For nearly 25 years, Vanguard has offered exchange-traded funds (ETFs) to its investors as a share class for many of its mutual funds. With this structure, which also made their mutual funds equally tax-efficient to their ETFs, they were also able to offer Vanguard investors free conversions of their mutual funds to the ETF share class.

While I’ve been aware of this option for some time, I initially invested in mutual funds before ETFs became a thing, and I’m a creature of habit, so I’ve generally stuck with mutual funds. I’ve also been burned trying to tax loss harvest from a mutual fund to an ETF amidst the whipsaw market in March of 2020, so I’ve been a little gun-shy since then.

Over the years, though, I’ve come to understand that ETFs can have some advantages over mutual funds. While tax-efficiency is a non-issue for those of us who invest with Vanguard, the cost of holding the funds is an issue, and the expense ratio of every Vanguard ETF is either the same or lower than its corresponding mutual funds, with a discrepancy that ranges from 1 to 4 basis points (0.01 to 0.04% per year).

While that may not sound like much, when you have millions of dollars invested with Vanguard, the difference is hundreds of dollars per year. It was Vanguard founder John Bogle who proposed the Costs Matter Hypothesis, and if I can lower my costs with a few simple clicks of the mouse, why wouldn’t I?

Also read: Backdoor Roth IRA 2025: A Step by Step Guide with Vanguard

Why Convert Mutual Funds to ETFs?

Mutual funds and ETFs are not quite the same thing, but they’re awfully similar. They’re both “baskets” of many individual stocks packaged together. The ones I own are all considered passive index funds whose manager is replicating a stock index rather than trying to beat one.

I won’t make an exhaustive list of the similarities and differences — AI can do that for you — but I’ll briefly touch on those that matter to me.

As mentioned above, tax loss harvesting (TLH) differs between the two. With mutual funds, an exchange from one fund to another can only be executed at the end of the trading day, and the price will be the closing price of each mutual fund at that precise moment. With ETFs, you must sell one fund and use the proceeds to buy another. In some cases, it can take time for the money to “settle” and become available, which can be problematic.

As an actual retiree now, I haven’t been an active buyer of either mutual funds or ETFs in my brokerage account for some time, and everything I own is up nearly 30% or much more, and the likelihood of having significant tax loss harvesting opportunities continues to decrease, so I’m not particularly concerned about TLH anymore. Some people prefer to tax loss harvest with ETFs because they can trade at any time of day, giving the investor more control over the actual price at which they sell.

Another difference is the cost to purchase an ETF. It fluctuates by the minute, and there is a (usually tiny) bid/ask spread that is the difference between the cost to purchase and the actual net asset value. For high-volume ETFs like Vanguard’s big index funds, the spread will be minimal, like a penny per share or one or two basis points. It’s not nothing, and if you’re buying millions of dollars’ worth, it could cost you hundreds. Fortunately, you pay no bid/ask spread when converting a Vanguard mutual fund to its corresponding ETF, as I’m showing you how to do today.

ETFs are generally more portable. You can transfer them to different brokerages “in kind” without issue or tax consequences. The same isn’t necessarily true of mutual funds.

I should point out that this conversion is not taxable. However, if you change your mind for some reason and you want to “convert” an ETF back to a mutual fund, that would be a taxable event.

The final difference I’ll highlight is the difference in expense ratios, or the annual cost of owning the fund. With a savings of 4 basis points in a couple of international funds, 2 basis points in the small-cap and mid-cap funds, and 1 basis point in the US large cap funds, I came up with about $470 in annual savings from making the switch, which was more than I had anticipated. That’s about $40 a month or enough to pay for Netflix, Max, and Peacock.

That $470 in savings is based on the current value of my now-converted Vanguard mutual funds. If the market chugs along and returns 7% to 10%, I can expect the value of my savings and my Vanguard portfolio to double every 7 to 10 years. We know this thanks to the Rule of 72, which is mathematically closer to the rule of 70, but we use 72 because 72 has more common denominators. Anyway, before I go too far off on another tangent, let’s get to the step-by-step instructions.

How to Convert Vanguard Mutual Funds to ETFs

This was easy. Almost too easy when you consider that the conversion is irreversible.

Apparently, up until the fall of 2024, in order to make the conversion, you had to call and speak to someone at Vanguard. Inevitably, that would mean time on hold, agreeing to have the call recorded for training purposes, and probably filling out some paper forms. It wouldn’t surprise me if a fax machine was involved at some point; Vanguard tends to trail its competitors in terms of customer service.

Fortunately, it can be done online now, and it’s easy to do once you find the right link. Here’s that link: Convert Vanguard Mutual Funds to ETFs.

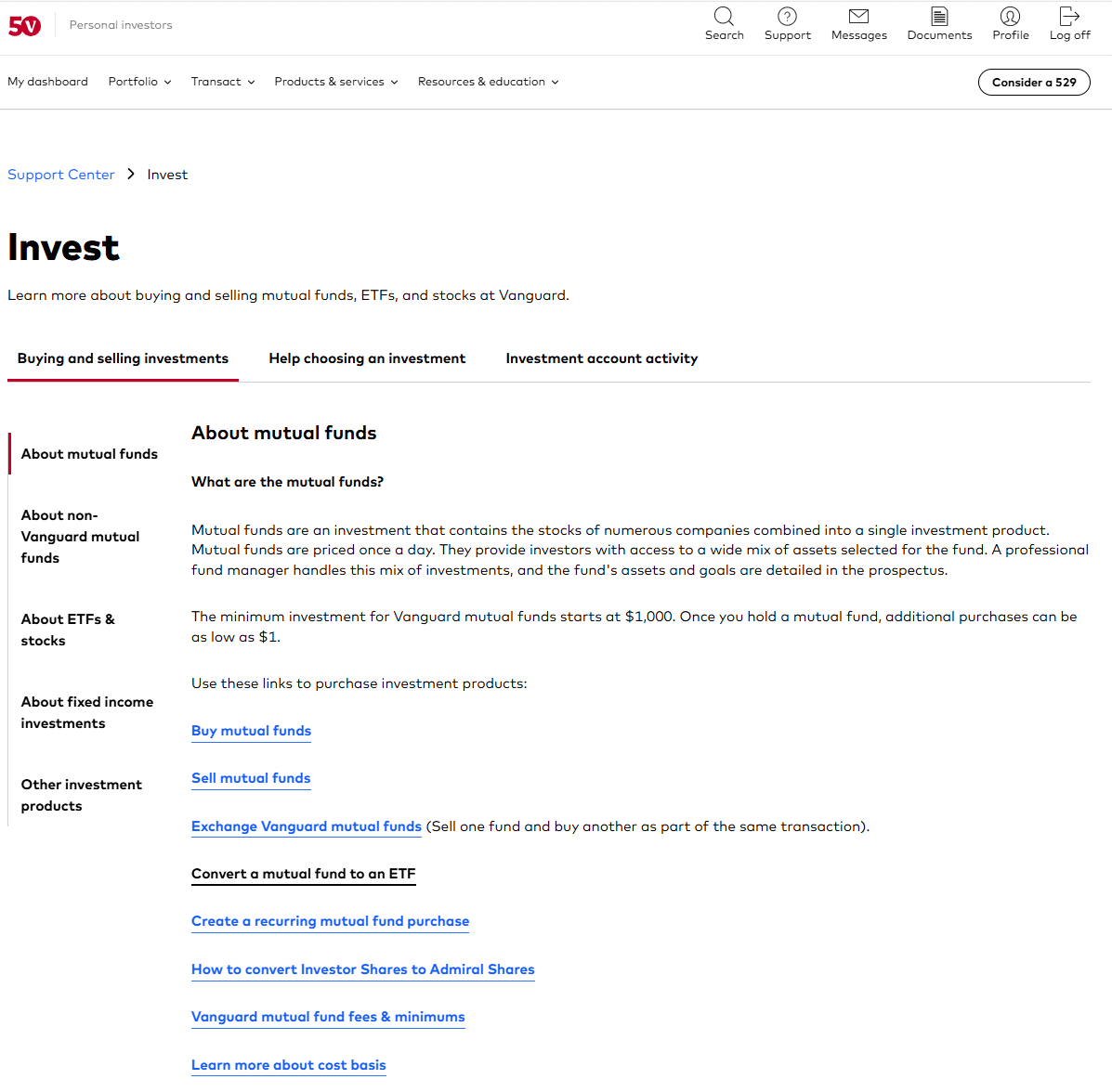

I struggled to find it myself, but eventually got there via a Support search.

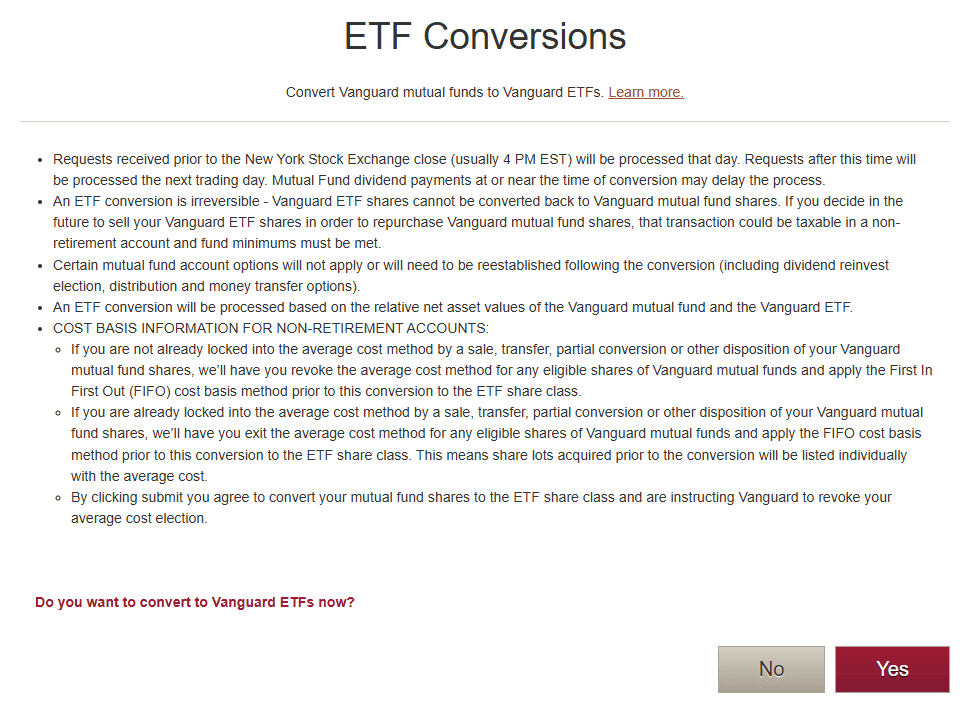

When you click on “Convert a mutual fund to an ETF“, you’ll get the following disclaimer:

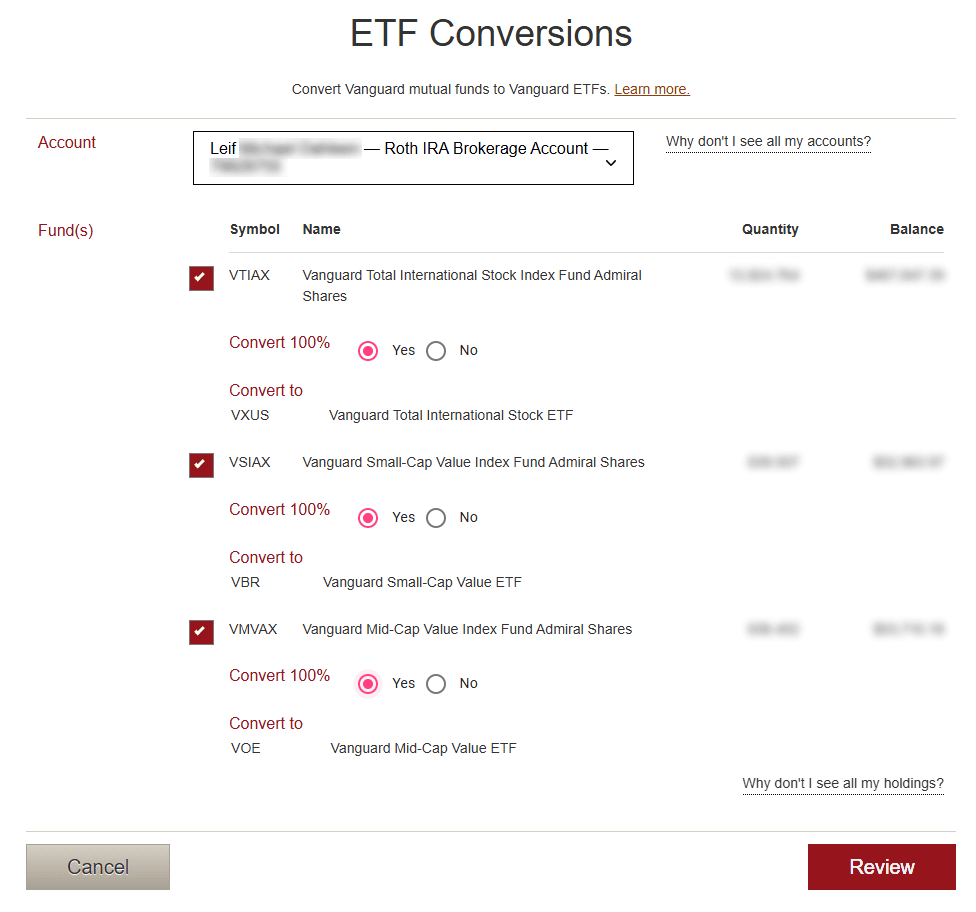

Select “Yes“, and you’ll be guided to a conversion page in which you’ll choose an account. I’ve got both a joint brokerage account and a Roth IRA, so I’ll do one at a time, starting with the Roth IRA.

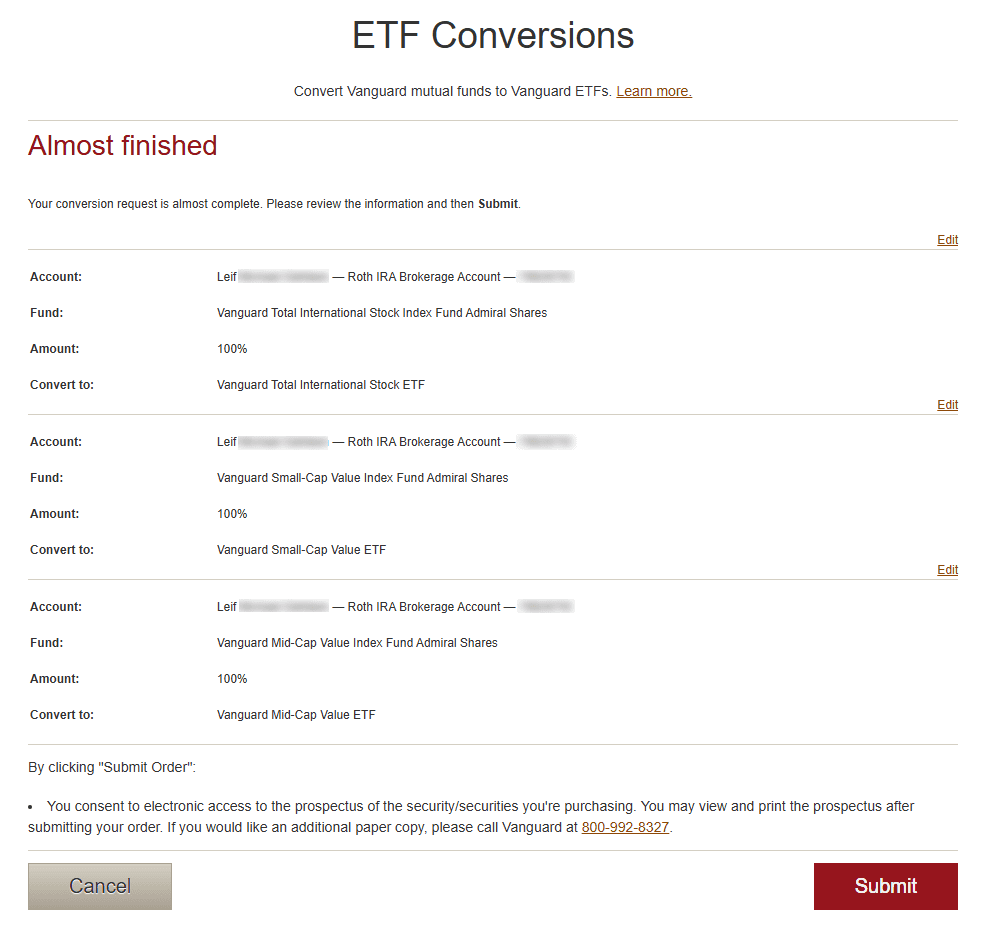

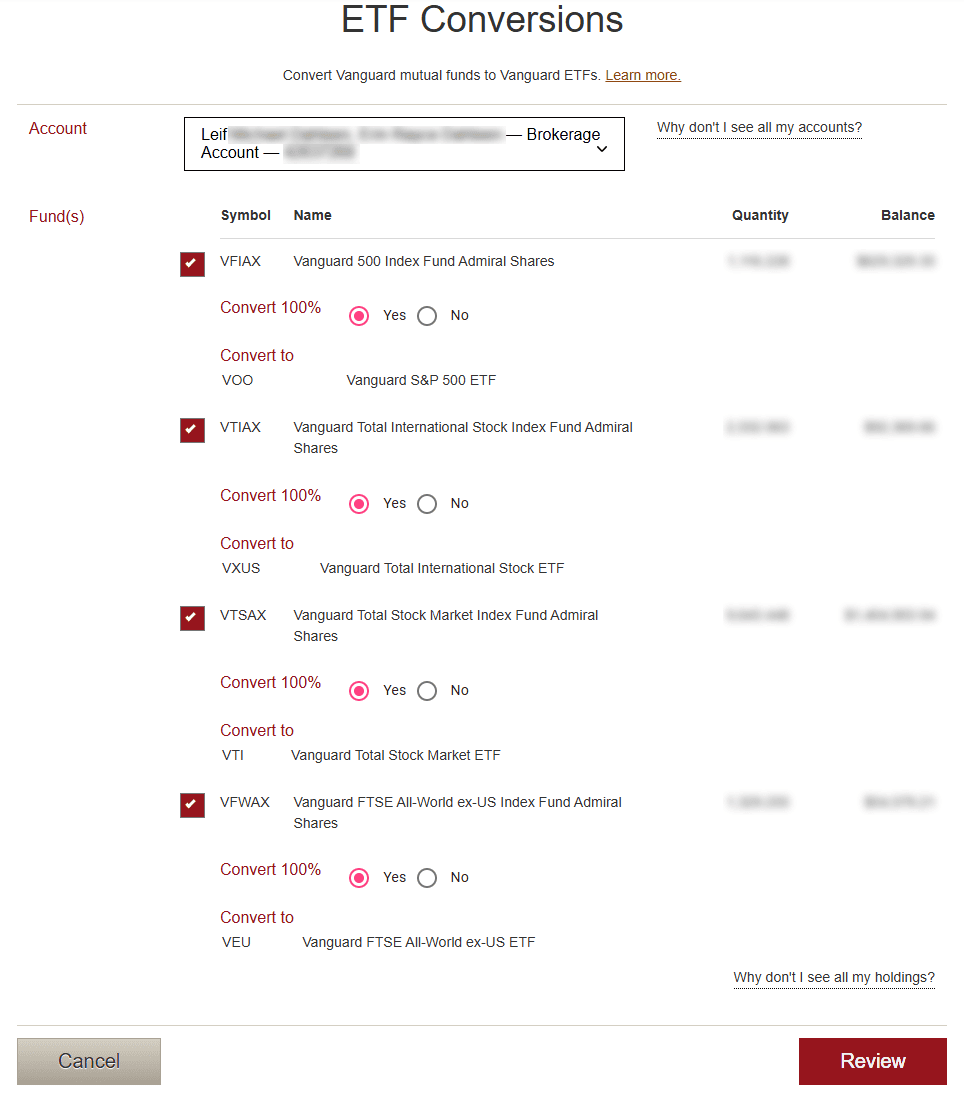

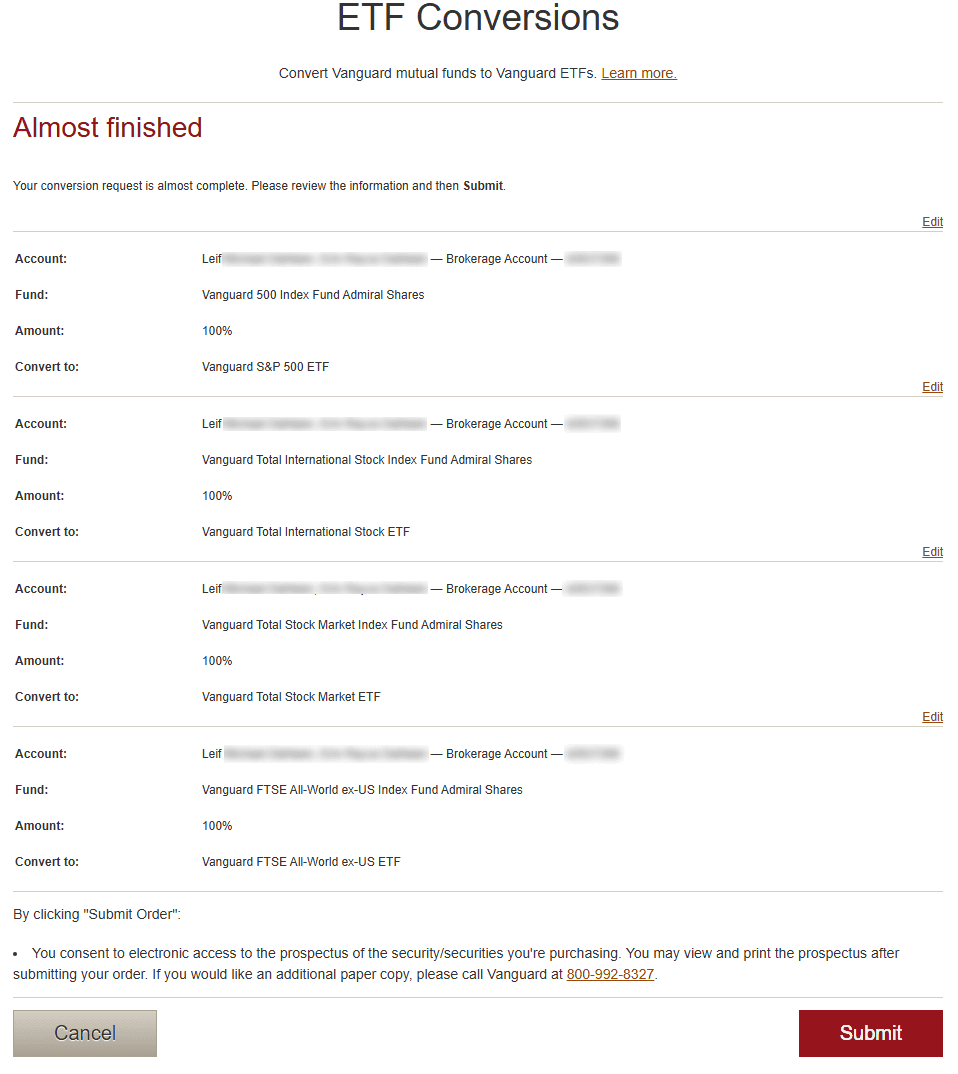

I check the 3 boxes to convert 100% of the mutual funds to their corresponding ETFs. In the lower right, I select “Review“.

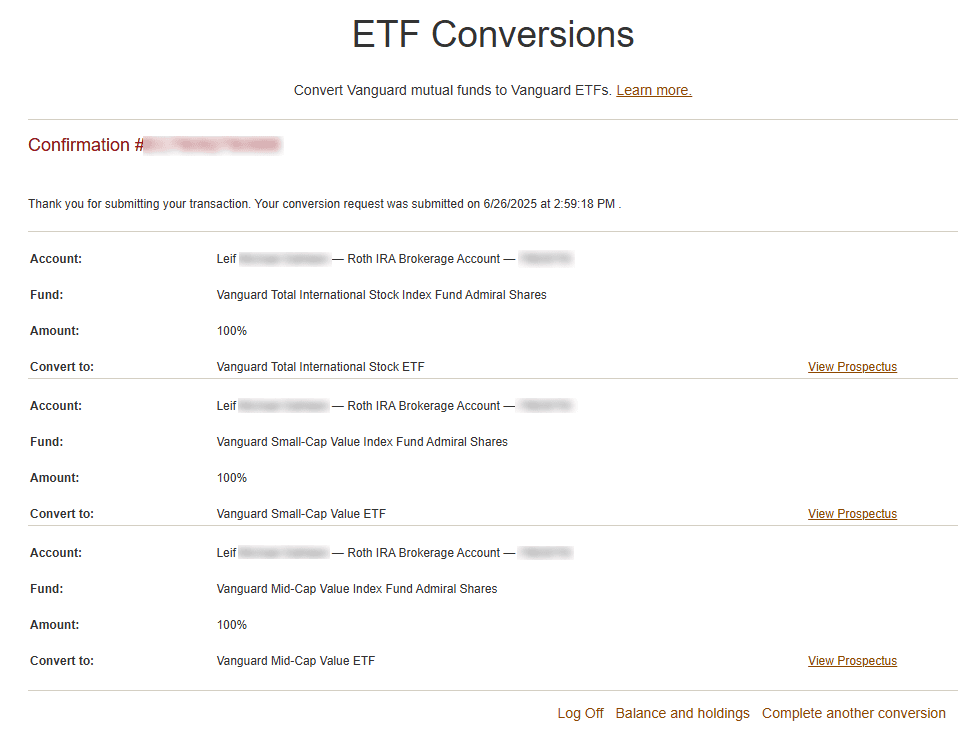

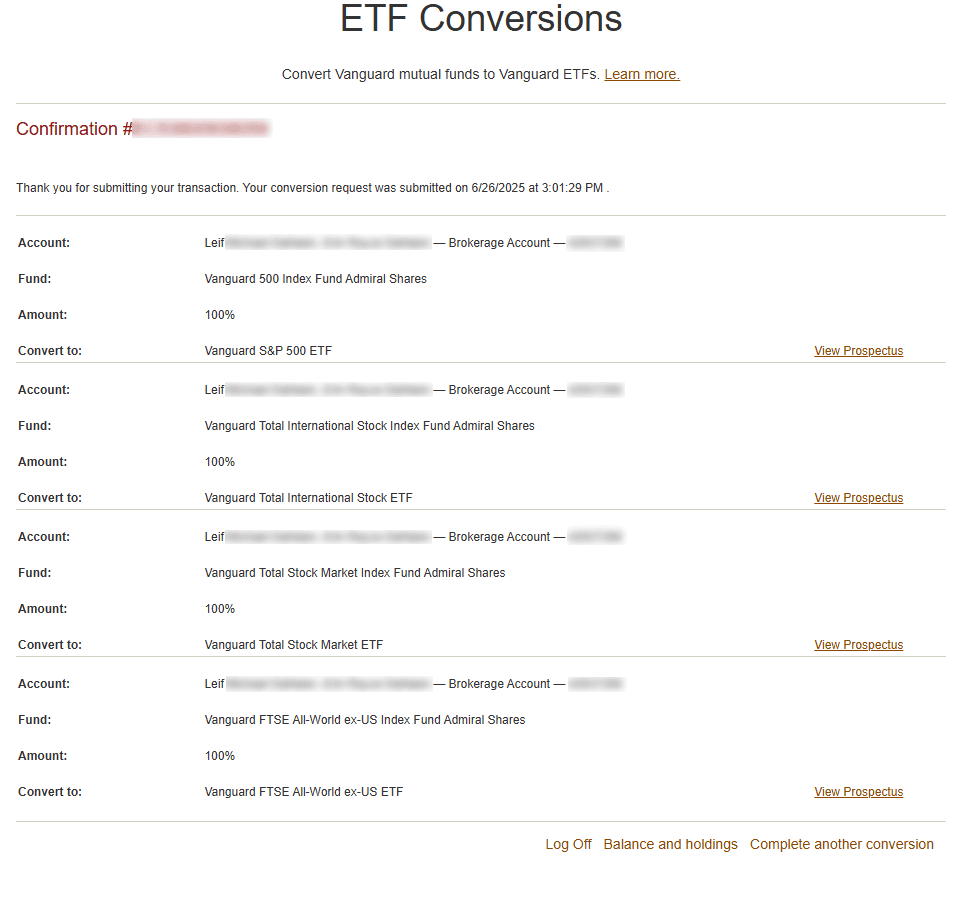

Note that in the lower right hand corner, there’s an option to “Complete another conversion“, which is something I need to do. Our taxable brokerage account is up next, and I do the same steps there.

And…. we’re done.

We chose not to make the conversion in my wife’s IRA because the one mutual fund it holds, Vanguard’s Real Estate Index Fund (VGSLX) has the same 0.13% expense ratio as the REIT, VNQ. This is actually true of a majority of mutual fund / pairs at Vanguard, but there are 18 in which the ETF equivalent is indeed cheaper.

By converting the six funds (seven conversions with VFIAX in both accounts) that I transitioned, I’ll save nearly $500 a year, and as the portfolio grows, so do the savings.

Had I been paying closer attention, I would have known that the expense ratios of the mutual funds are double in some cases (VFWAX and VTIAX at 0.08% as compared to VEU and VXUS at 0.04%), and I would have made the conversions more of a priority.

The only potential downside I can see is the possibility that tax loss harvesting becomes slightly more complicated. I can live with that, especially given the fact that I’m unlikely to harvest any losses with the lots I just converted.

Do you prefer mutual funds or ETFs? Why? Have you converted Vanguard mutual funds to ETFs yet? Is anything holding you back?

Frequently Asked Questions

1. Is converting a Vanguard mutual fund to an ETF a taxable event?

Answer: No. As long as you’re converting within Vanguard from a mutual fund to its ETF share class, the conversion is not a taxable event.

2. Can I convert any Vanguard mutual fund to an ETF?

Answer: Not all Vanguard mutual funds have ETF equivalents. Only mutual funds that share the ETF share class structure can be converted. Vanguard currently offers about 18 where the ETF version has a lower expense ratio.

3. What are the main advantages of ETFs over mutual funds?

Answer: Key advantages include:

-

Lower expense ratios

-

Intra-day tradability

-

Greater portability between brokerages

-

Potentially tighter tax control (especially for tax-loss harvesting)

4. Can I convert my ETF back to a mutual fund later?

Answer: No. Converting back is not supported — you’d have to sell the ETF and buy the mutual fund, which would be a taxable event in a taxable account.

5 thoughts on “How to Easily Convert Vanguard Mutual Funds to ETFs (and Why)”

Hi Leif, thank you so much for this step by step guide on how to convert the mutual fund to an ETF. I have been wanting to do this for the past few years and now I can without having to call Vanguard. Win!

It’s been on my radar, too, and I’m glad to have finally pulled that ETF trigger.

Cheers!

Leif

Thanks so much for checking!

Leif,

Thank you for this helpful guide. I noticed in the disclaimer that Vanguard makes you change the cost basis method to FIFO before conversion. I currently use SpecID for tax loss harvesting purposes. Do the ETFs convert with the same cost basis lots as the mutual funds formerly had, or do they use some other method? Thanks so much for your help.

I guess you read the disclaimer more carefully than I did, Matt, but I can tell you that I had everything set to SpecID beforehand and did not change it prior to the conversion.

I just checked post-conversion, and the ETFs had a “Not established” cost basis method which I was able to change back to SpecID just as they were before. All the lot information is preserved from my numerous prior lot purchases.

Cheers!

-Leif