The dollar continues falling, now down around 11% from January 2025 levels:

This is a big move by currency standards, especially the global reserve currency.

When you see a move this big in something as important as the dollar people get nervous. Just look at the headlines:

Until they crashed last week, we also saw the price of gold and silver going parabolic.

The concern here is that all of our government spending, high deficits and trade war policies are causing a retreat from the dollar. This is the debasement trade everyone has been talking about.

Anything is possible but I’m not all that concerned about the dollar for the time being. Here’s why:

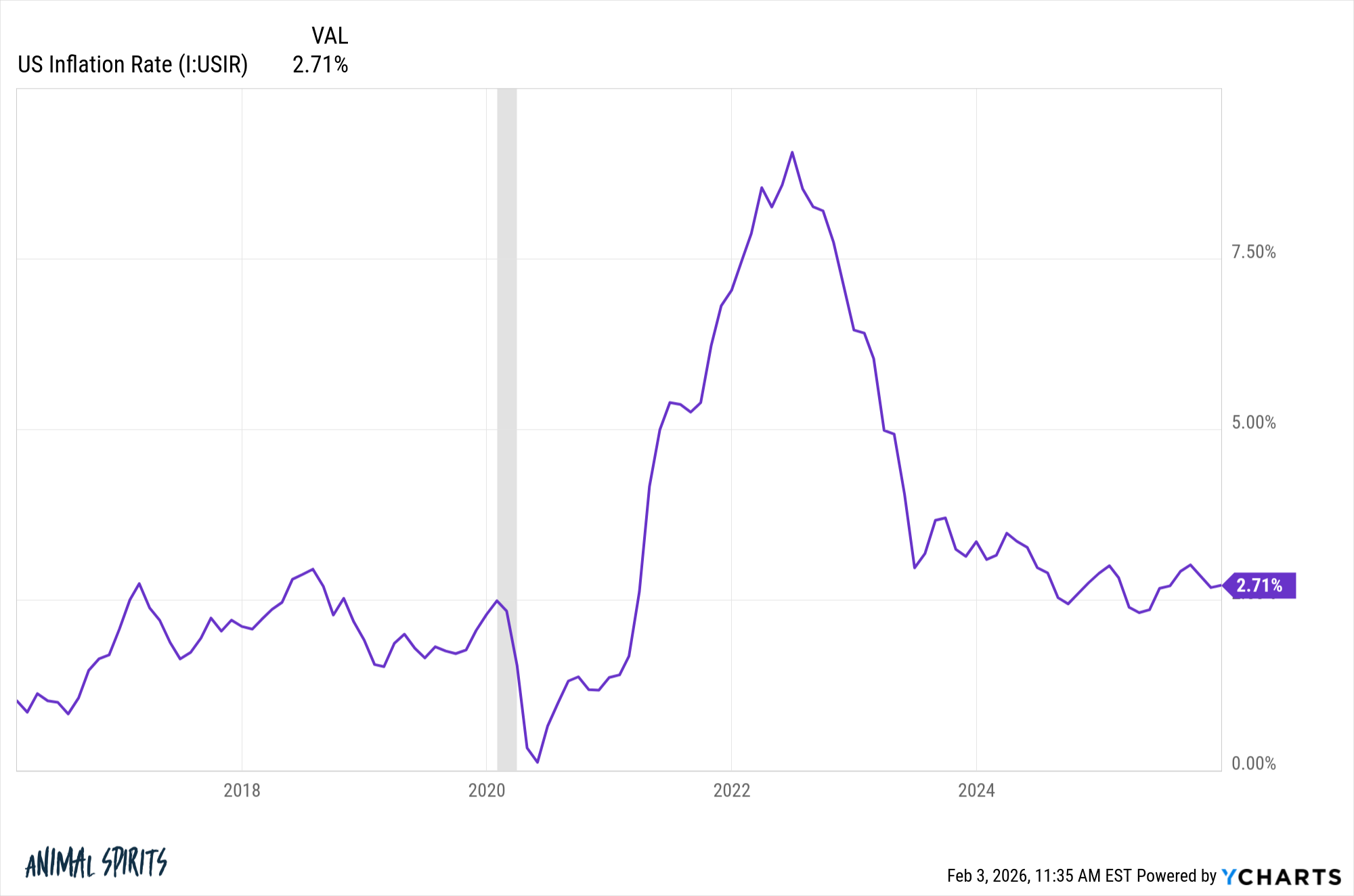

Inflation is under control. The long run average inflation rate over the past 100 years or so in the United States is 3.5%. We’ve now been below that figure since October 2023:

We had the initial inflation spike from a combination of government spending, supply chain shocks and pandemic weirdness but now the inflation rate has settled in below 3%.

This is not the hyperinflation scenario the fear-mongers have been warning about.

Interest rates aren’t spiking. The yield curve is steepening but that’s a more normal environment for bond yields where long-term yields are higher than short-term yields.

The 10 year Treasury has been range-bound for a few years now. If faith in America was waning you would expect yields to scream higher because investors would require a premium to invest in Treasuries.

That’s not happening.

The stock market remains near all-time highs. We had 39 new all-time highs on the S&P 500 last year:

There have already be 4 new highs in 2026.

Investors still have plenty of faith in U.S. financial markets.

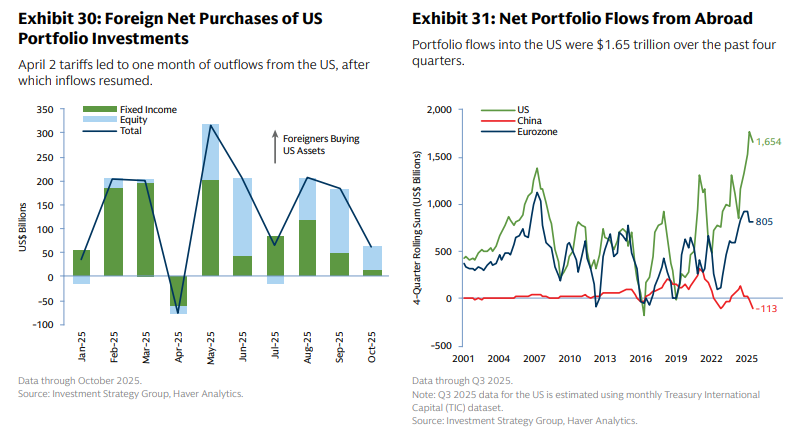

Foreigners are still investing. Goldman Sachs shows foreigners did slow their purchase of U.S. assets in April when the Liberation Day stuff happened:

But then they picked right up where they left off, buying U.S. financial assets.

We still have the biggest, most liquid financial markets.

Zoom out — currencies fluctuate. This is the dollar versus a basket of other currencies going back to the early-1970s:

There has been a lot of volatility in the dollar over these 5+ decades, but the net result is that it’s essentially unchanged over the long run. All of the ups and downs cancelled each other out.

In fact, the dollar was just lower than it is today not all that long ago. It’s been strong since the end of the Great Financial Crisis. These things are cyclical.

Don’t get me wrong — there are legitimate reasons the dollar is selling off.

Countries around the world are hoarding stuff — gold, commodities, important supply chain materials, etc. because of the trade war. That’s certainly impacting the dollar and is a big reason it has fallen.

But what is the alternative to the dollar?

Most of the world’s debt is still priced in dollars. Commodities are priced in dollars. Treasuries remain one of the largest, most liquid bond markets on the planet. The U.S. stock market makes up ~65% of the world’s total market cap.

This isn’t exactly a ringing endorsement but there are no clear alternatives at the moment. Gold and bitcoin are far too volatile. The Yen, the Euro and the Yuan aren’t up to the challenge.

I can see a situation where the dollar slowly but surely loses its stronghold but it’s hard to envision a situation where it happens overnight.

And if you’re really concerned with the dollar’s place in the global hierarchy, buy international stocks. Buy hard assets. Buy real estate.

But don’t freak out every time the dollar goes up or down.

These things are cyclical.