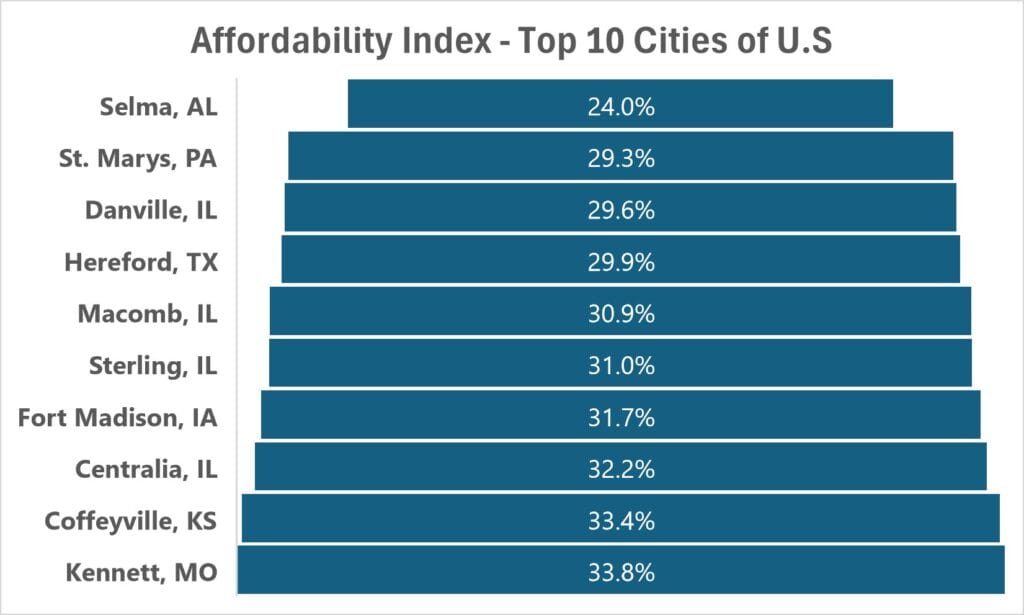

The new research conducted by Physicians on Fire has revealed 10 affordable cities in the U.S. where you can easily buy a home. The data source has been collected from Zillow. This analysis will give details about the home prices in 10 cities in the U.S.

The monthly mortgage rate is calculated with a 6.4% mortgage rate repaid over 30 years. Collected the average price of utilities and council tax for each area. By combining the monthly mortgage rate, utility cost, and property tax, we can calculate the total monthly cost of homeownership in each town. Further, by comparing the results with the median monthly salary, we will find out which area houses are affordable.

With inflation, home prices and mortgage interest rates are increasing. Day by day, the dream of owning a house has become a challenging task for the first-time homebuyer. Keeping the affordability ratio and calculations in mind, this research will help you make a wise decision.

The 10 Affordable Cities in the U.S

- Selma, AL

- Hereford

- St. Marys

- Danville

- Macomb

- Sterling

- Fort Madison

- Centralia

- Coffeyville

- Kennett

1. Selma

Selma is a city located on the river banks of Alabama State in the U.S. According to research, Selma is one of the most affordable cities in which to buy a home. The median home price in Selma city is about $74,450.

When you buy a home, you take a loan, which is a mortgage rate that is about 6.4%. The utility cost is about $350 in this area. Furthermore, the monthly mortgage payment is $466.18, and the total monthly homeownership cost is about $816.18.

However, keeping the average monthly salary in mind, which is $3,500, the affordability ratio would be 24.57%. This means that after buying a home, about a quarter of your monthly salary goes towards housing expenses.

2. Hereford

Hereford is a beautiful town in Texas. Where you can enjoy the scenery of natural beauty. According to the research, this is the second most affordable place for homebuyers. In Hereford, the median home rate is about $120,000. The average mortgage rate is approximately 6.4%. The monthly utility costs about $310. Moreover, the monthly mortgage payment is $734.91 and the total monthly homeownership cost is about $1,024.91. The study reveals that the average monthly salary is about $3,600. Now, if we sum up the mortgage rate and utility rates, the affordability ratio would be 29.90%.

3. St. Marys

St. Marys is a small city located in Pennsylvania. People call it the city full of love and life. St. Marys comes in third among the affordable cities in the U.S. The Median home rate is $117,000. Keeping in mind the average mortgage rate which is 6.4%, and utility cost, which is $290, we can calculate the affordability ratio.

However, The monthly mortgage payment is $676.96, and the total monthly homeownership cost is about $976.96. The average salary in St. Mary’s City is about $3,500, and the affordability ratio is 30.08%.

4. Danville

Danville is the fourth number in the list of affordable cities located in Illinois U.S. With the median home price of $108,000, the average mortgage rate is 6.5% The utility costs are about $300.

In Danville, the monthly mortgage payment is $765.60, and the total monthly homeownership cost is about $1,075.60. The average salary is $3,300, and if we calculate it, then we will get an affordability ratio that is 30.65%.

5. Macomb

Macomb, in the state of Illinois, is also considered an affordable city. The median home rate is about $113,000. The average mortgage rate is approximately 6.4%. The monthly utility costs about $280.

The research reveals that the monthly mortgage payment is $708.30, and the total monthly homeownership cost is about $988.30. The average monthly salary is about $3,200. After summing up, the affordability ratio would be 31.54%.

6. Sterling

Sterling is also one of the most affordable cities in Illinois. Here, the median home rate is $124,950. The average mortgage rate is 6.4%. The monthly utility costs about $300. The monthly mortgage payment is $783.21, and the total monthly homeownership cost is about $1,083.21. The average monthly salary is about $3,500. The affordability ratio would be 32.08%.

7. Fort Madison

It’s a city in Iowa that comes at the seventh number. The median home rate is $124,900. The mortgage rate is 6.4%, and utility costs are $290. The monthly mortgage payment is $786.99, and the total monthly homeownership cost is about $1,076.99. As the average salary is $3,400 then the affordability ratio would be 32.23%.

8. Centralia

Centralia is at the number eight. The median home rate is $125,000. The mortgage rate is 6.4%, and utility costs are $280. The monthly mortgage payment is about $783.52, and the total monthly homeownership cost is about $1,062.52.In Centralia, the average salary is $3,300, and the affordability ratio is calculated at about 33.43%.

9. Coffeyville

Coffeyville in Kansas is considered a five-star city. It’s a small town with modern facilities. Compared to Selma, Coffeyville is a bit expensive and comes in ninth place. But it’s worth buying a home here.

The median home rate is about $123,950. The average mortgage rate is approximately 6.4%. The monthly utility costs about $270. The monthly mortgage payment is approx $798.18, and the total monthly homeownership cost is about $1,068.18.According to the research, the average monthly salary is about $3,200. After calculation, the affordability ratio would be 33.69%.

10. Kennett

Kennett, Missouri, is famous for its agricultural history. Kennett is tenth among the affordable cities in the U.S. It is known as one of the peaceful towns. You will find a friendly environment here.

The Median home rate is $126,450. The average mortgage rate is 6.4%, and the utility cost is $270. The monthly mortgage payment is $811.76, and the total monthly homeownership cost is about $1081.76. The average salary is about $3,200, and the affordability ratio is 34.20%.

No doubt, living on rent and paying bills and rent every month is challenging. You own nothing, but you lose a lot of your money.

Therefore, this research gives valuable insight for first-time homebuyers. If you can afford the budget, it is better to buy your own house. Owning a home is everyone’s dream, a place where you create memories and decorate it according to your wishes. It’s not just a dream but a wise decision, as it builds equity, which means your property will be your saving or investment, giving you a sense of security.