“On paper, the economy is booming,” reports the Washington Post. Low unemployment, strong consumer spending, steady corporate investments, it’s amazing. The U.S. economy grew at an annual rate of 4.4% in the third quarter of 2025.

On paper.

I’ll let Diane Swonk’s words do the talking: “There are one-legged stools everywhere you look, and yet when you put it all together, we’re still standing. The question is, how long can we keep ourselves upright?” She’s the chief economist at KPMG, so I’m sure she knows what she’s talking about.

So, like Potemkin’s famous villages (an impressive facade with nothing behind it), America’s economic strength is an optical illusion. And the single beam holding up the entire structure? That would be your sector.

What’s crazier is that healthcare is the only sector growing. Not that it’s outpacing other sectors, no, it’s single-handedly holding up the economy. Everything else is treading water or actively sinking.

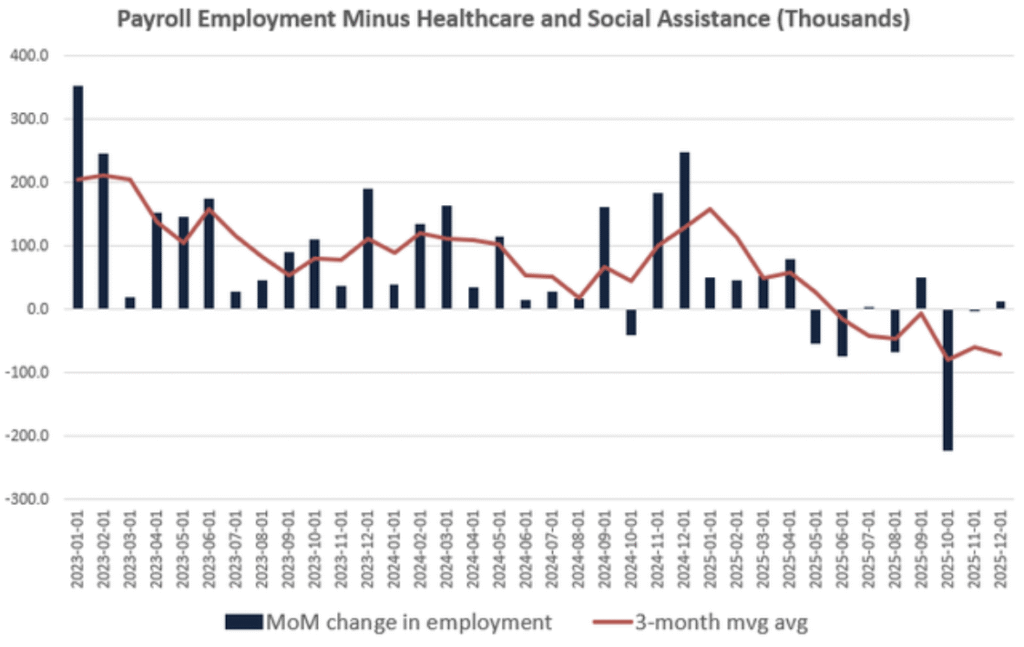

Strip out healthcare and social assistance jobs, and America’s employment growth is negative. As in, we’d be in a recession right now. The kind where people start hoarding canned goods and arguing about whether it’s technically a recession or just “two consecutive quarters of economic contraction.”

In case you missed it: Why I’m Not Worried About a Weaker Dollar

The Numbers Are Absolutely Bonkers

Over three years, healthcare employment and social assistance grew 12.5%, according to the Wall Street Journal.

Every other job category? Under 2%.

According to the Washington Post, health care and social assistance positions accounted for 97% of the 733,000 private-sector jobs created across the economy last year. That train has only sped up in 2026, with healthcare jobs making up 95% of January’s overall gains.

Read that again. If you got a new job in America last year, and you’re not in healthcare, you’re a statistical anomaly.

Daniel Zhao, chief economist at Glassdoor, told the Post that “It’s really impressive how much job growth has been driven by health care and social assistance. It’s the last remaining pillar of growth.”

Not one of several pillars. The only one still standing.

Healthcare makes up less than 15% of total U.S. employment but accounts for the majority of net job growth. If this were your portfolio, any advisor would tell you it’s dangerously concentrated. But apparently it’s fine for an entire economy.

Source: BLS

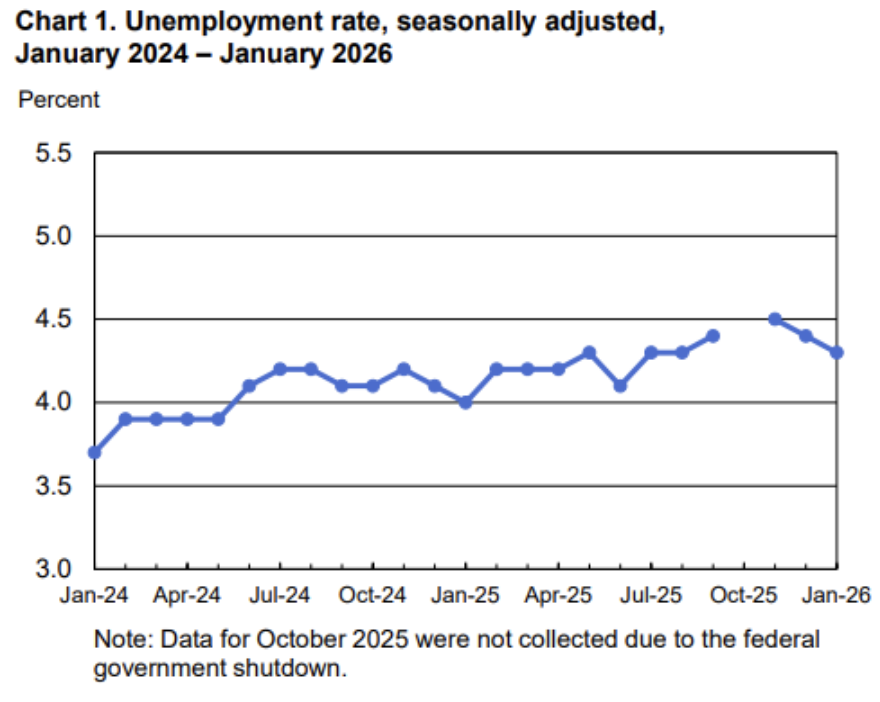

December’s numbers showed year-over-year payroll growth outside healthcare went negative for the first time since the last recession. Then January came in hot with 130,000 new jobs (the strongest month in over a year), unemployment dropped to 4.3%, and everyone’s acting like everything’s fine.

It isn’t.

The 2026 Employment Reality Check

The healthcare hiring boom is already slowing down.

Healthcare employment drove most job growth last year, increasing by an average of 33,000 jobs per month in 2025, according to the Bureau of Labor Statistics. But that’s down from 57,000 per month in 2024.

Employers added more than 400,000 health care and social assistance jobs in the first half of 2025. In the second half? 353,000.

Healthcare hiring has already dropped by 40% from its peak, and it’s still the only thing keeping the economy afloat.

“Having nearly all job growth concentrated in one sector is risky for the economy,” Zhao warns. “It would be much better if gains were spread across a variety of industries.”

Meanwhile, JPMorgan economists predict that the first half of 2026 will deliver “uncomfortably slow growth” in the labor market, with unemployment peaking at 4.5% in early 2026. The average monthly payroll growth in 2025 sat at just 50,000 jobs, and that too dropped to 29,000 per month from June to August.

Why Healthcare? Because America Is Weird, That’s Why

Sure, demographics matter. Record numbers of people turned 65 last year. More old people means more Medicare, more chronic disease management, more procedures, more everything.

But every developed country is dealing with aging populations. Japan’s demographic situation makes ours look like a retirement community in Boca. Europe isn’t exactly teeming with young workers either.

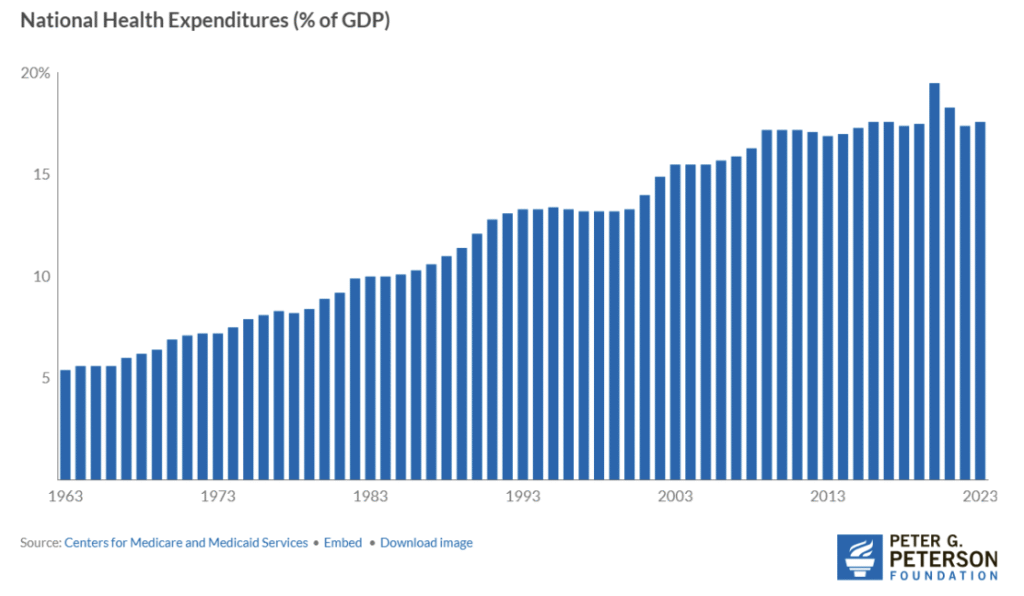

The difference? We spend twice as much per capita on healthcare as Britain or Japan. Because we’re healthier? Nope, we’re objectively not. Because our outcomes are better? Well, in many cases, they’re worse.

We spend more because our system is designed to spend more. It’s a feature, really. And that feature has created millions of jobs.

Look at the largest employer in each state. It’s either a hospital system or Walmart. Those are basically your options. In some states, the hospital system employs more people than the next five employers combined.

Yet, we’re still facing a shortage of physicians and nurses.

Read: How States Are Tackling America’s Physician Shortage

Wealth and Wishful Thinking Are Here To Help

While healthcare props up employment, the economy’s other supports are even more precarious.

The Gilded Age 2.0

The top 10% of Americans (those earning $275,000 or more) now account for a record 45% of all spending, up from about 39% before the pandemic.

Let that sink in. Nearly half of all consumer spending comes from one-tenth of the population.

“There’s been a dramatic narrowing: The folks at the top account for a much higher share of spending than the folks in the bottom 80 percent, and that gap is widening,” Mark Zandi, chief economist at Moody’s Analytics, told the Post.

“It very clearly shows that the economy is dependent on spending by the folks at the top.”

After adjusting for inflation, spending by lower- and middle-income Americans has stayed essentially flat since the pandemic. The top 20%? Their spending is up more than 4% per year since 2020, according to Moody’s.

This is the economic equivalent of loading all your weight on one side of a canoe. It works until it doesn’t.

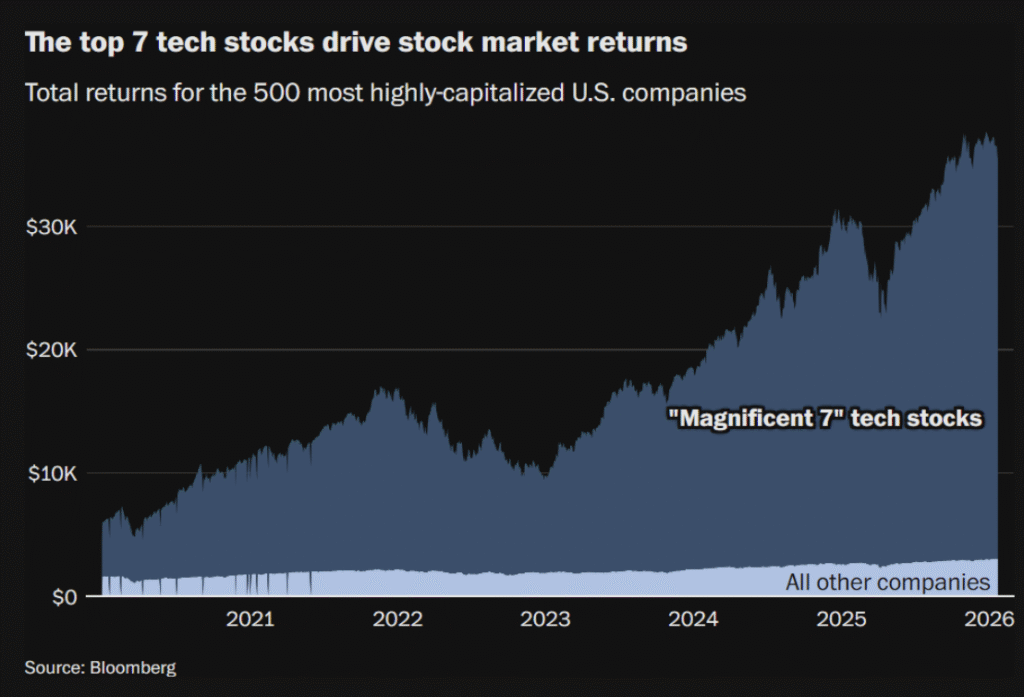

“Surging stock prices have made the wealthy even wealthier, giving them the willingness to spend,” Zandi explains. “But what happens if something were to disrupt that equity party? That source of growth would go away, and it would be enough to send the economy into a recession, or darn close to one.”

Consumer spending accounts for nearly 70% of GDP. If wealthy Americans stop spending (either because their portfolios tank or they get nervous), the whole economy collapses. It’s an ill-fated game of Jenga.

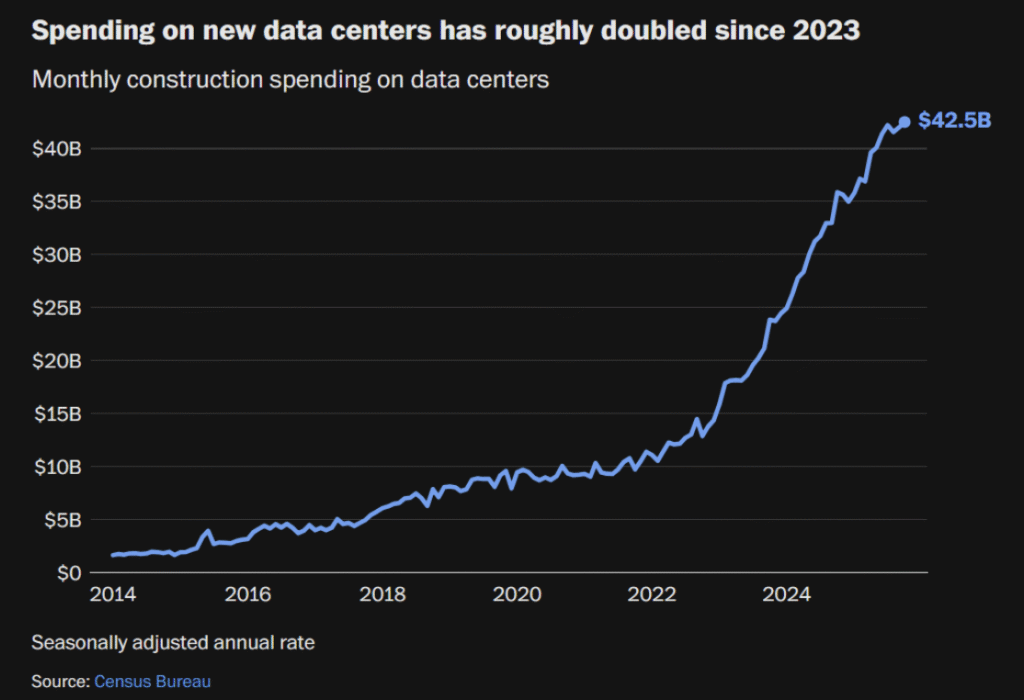

The AI Gold Rush

If healthcare is Atlas, then investments in artificial intelligence are Hercules. Stepping in to assist…but gone too soon.

Microsoft, Google, Amazon, and Meta spent roughly $360 billion combined on AI-related projects in the 12 months ending November 2025, according to the New York Times. Data centers, computer chips, software, equipment — the spending is insane.

“There is one horse drawing the carriage right now, and that’s AI,” says Mark Muro, a senior fellow at the Brookings Institution. “But it’s not necessarily a reassuring source of growth. There are worries about a bubble and a lot of questions about what happens next.”

The “Magnificent Seven” tech stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) have seen their share prices balloon by nearly 20% in the past year, translating to trillions in value.

Like Don Quixote charging at windmills, convinced they’re giants, we’re throwing hundreds of billions at AI infrastructure with uncertain returns. The difference? Quixote was only risking his own neck (and lance). This gamble risks the entire economy.

Richmond Fed President Tom Barkin sums it up like so: “The two engines of today’s economy are the AI ecosystem and wealthy consumers.” The two, he noted, are inextricably linked.

“AI has been supporting virtually all of the growth in business investment. And any drop in valuations of the Magnificent Seven would surely flow through to net worth and, in turn, to consumption.”

So we have an economy propped up by healthcare jobs, wealthy people spending stock market gains, and AI hype that may or may not deliver actual productivity gains.

That isn’t exactly reassuring.

Also read: The Total Portfolio Approach That Made CalPERS Ditch $556 Billion in Old-School Investing

The Policy Guillotine Is Already Falling

The One Big Beautiful Bill Act slashed over $900 billion from Medicaid over the next decade. In fiscal year 2026 alone, $17 billion in cuts go into effect. By 2034, that number will hit $165 billion annually.

Hospitals and nursing homes that rely on Medicaid are already wary of increasing payrolls. The Federal Reserve’s Beige Book reported that community leaders “anticipated that upcoming changes to Medicaid may cause reductions in health care services more broadly, including hospital closures.”

And it’s already happening. Alameda Health System in Oakland announced layoffs of 247 employees, including clinicians, citing an expected $100 million annual loss by 2030 from Medicaid cuts.

Revere Health, Utah’s largest physician-owned system, laid off 177 employees in September, citing AI automation of claims processing.

This is happening right now, while you’re reading this.

Don’t miss: The Hippocratic Divide: How the “Beautiful Bill” Fractures American Healthcare

The AI Double-Edged Scalpel

Speaking of AI…

According to JPMorgan’s analysis, AI investment has gone toward equipment, software, and data centers, not job creation. Jobs with more AI exposure have seen slower job growth, especially among younger workers.

But AI isn’t just failing to create jobs. It’s actively eliminating them in healthcare. Administrative roles are getting automated first. Research published in PMC warns that healthcare workers could face job displacement as AI assumes greater responsibilities, with some expressing concerns that AI technologies could devalue years of professional training.

A study of healthcare workers found deep anxiety about job security, with one physician stating, “I wonder if my years of training and expertise will be devalued by machines.”

While AI automates away healthcare admin jobs, it’s simultaneously driving massive economic growth in data centers and chip manufacturing — industries that create almost no jobs relative to their capital investment.

A $10 billion data center might employ 200 people. A $10 billion hospital system employs 50,000.

One Wrong Step and We’re Toast

The U.S. economy is walking a tightrope right now, and healthcare is the only thing keeping us balanced.

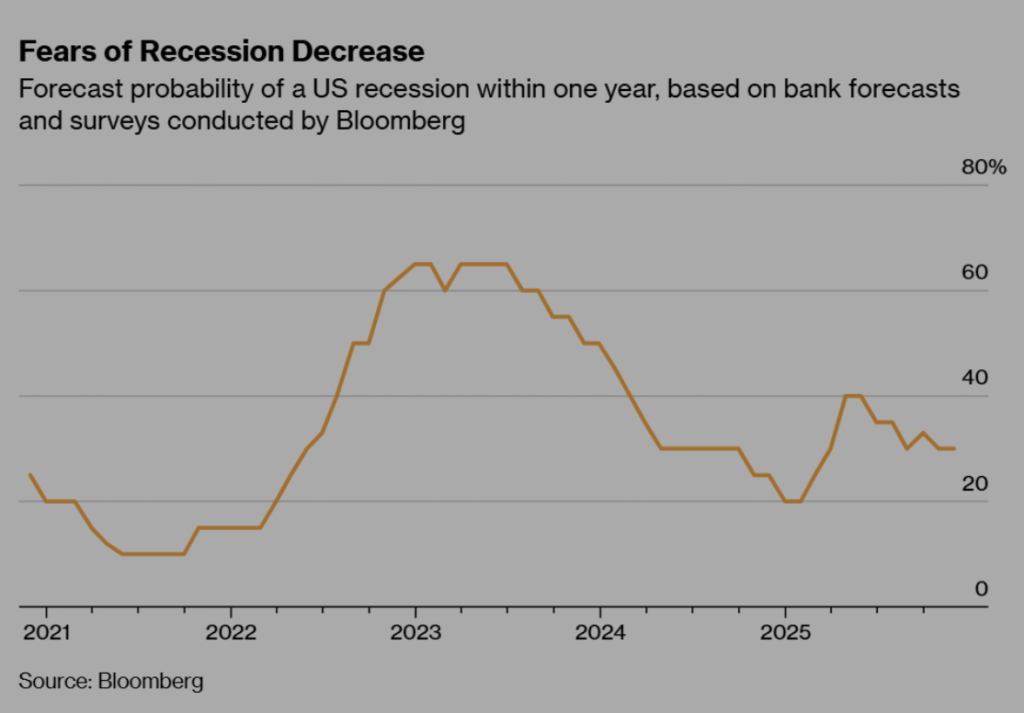

Most economists surveyed by Bloomberg put recession odds at around 30% for 2026. Moody’s Analytics pegs it higher at 42%. Chief economist Mark Zandi says, “I think we’ll most likely get through 2026 without a downturn. But nothing else can go wrong. Like, nothing. We’re pretty much on the edge.”

Goldman Sachs is more optimistic, lowering their recession probability from 30% to 20%, but even they acknowledge that “the outlook for the labor market is more uncertain — we expect it to stabilize but see the possibility of further softening as the key risk for 2026.”

Here’s what the economic outlook looks like:

- GDP growth: Projected at 1.8% to 2.3%, depending on which forecast you believe (JPMorgan, Goldman Sachs)

- Unemployment: Expected to hit 4.5% in early 2026, up from 4.3% now (JPMorgan)

- Monthly job growth: Averaging just 50,000–70,000, down from 130,000 in January. (JP Morgan, Goldman Sachs)

- Inflation: Stuck at 2.7%, higher than the Fed’s 2% target (JPMorgan)

Remember, these projections assume healthcare keeps hiring. If healthcare employment drops, all bets are off.

The Catch-22 Nobody Wants to Talk About

Healthcare costs are genuinely killing American competitiveness. Businesses pay more for employee health benefits than their foreign rivals. Families go bankrupt over medical bills. Government spending on Medicare and Medicaid is eating the budget alive.

Something has to change. Everyone agrees on that.

But healthcare is now so central to employment that changing it means triggering massive job losses. We’re damned if we do, damned if we don’t. Cut healthcare spending by 20% and you’re not just affecting hospitals. You’re cascading through:

- Medical device companies

- Pharmaceutical companies

- Medical office real estate (and the regional banks that financed it)

- Health IT vendors

- Billing companies

- Medical equipment manufacturers

- Clinical labs

- Imaging centers

- Home health agencies

- Nursing homes

- Rehabilitation facilities

And all their suppliers. And all their employees’ spending. And the businesses that depend on that spending.

It’s dominoes all the way down, except the dominoes employ millions of people and if they fall, there’s nothing to catch them because the rest of the economy is barely treading water.

According to Stanford SIEPR analysis, “sweeping tariffs do more harm than good” and “undermine the administration’s goal of reversing the decline in manufacturing employment, which continued last year, with the sector dropping 68,000 jobs.”

We’re addicted to healthcare spending. And like any addiction, quitting gradually is hard, and quitting suddenly might kill us.

Zandi’s warning means we’re one crisis away from watching the whole house of cards collapse.

What This Means If You’re Trying to FIRE

If you think it’s reassuring that the economy is running on healthcare while you build your path to financial independence, think again.

The “Stable Career” Might Not Be

You probably went into medicine partly because it’s supposed to be recession-proof, which it has been for the most part.

Healthcare jobs survived 2008. They survived COVID. They’ve survived every economic hiccup in recent memory. But that was when healthcare was one strong sector among several.

According to surveys of healthcare workers, 55% intend to search for, interview for, or switch jobs in 2026. 84% feel underappreciated. The Health Resources and Services Administration projects a shortage of nearly 700,000 physicians, registered nurses, and licensed practical nurses by 2037, according to Reuters.

But shortages don’t guarantee job security when reimbursements get slashed.

Reimbursement cuts, scope of practice changes, AI replacing diagnostic work — any one of these could shift faster than you think. And if you’re planning to coast for another five years before pulling the trigger on retirement, those five years might be when everything changes.

Learn more: Planning for Retirement at any Age

Your Portfolio Probably Has More Healthcare Exposure Than You Think

A lot of physicians invest heavily in healthcare stocks because they “know the sector.”

But you’re also seeing the sector at peak political and economic vulnerability. Policy risk in healthcare right now is off the charts. One bill, one regulatory change, one major insurer exiting a market, any of these could crater specific stocks or entire subsectors.

Apart from healthcare stocks, if healthcare employment collapses, it ripples everywhere. Medical office REITs, health IT companies, pharmaceutical distributors, medical device manufacturers…healthcare could be all over half your portfolio, even if you think you’re diversified.

Also read: How Physicians Think About Investing

The 4% Rule Was Built for a Different Economy

The Trinity Study that gave us the 4% safe withdrawal rate studied historical periods where the economy had multiple strong sectors. Manufacturing, services, finance, retail, the employment was distributed.

We’ve never tested retirement strategies against an economy where one sector does everything and that sector is facing massive political pressure to shrink.

According to Indeed, we’re in a “low-hire, low-fire” labor market where employers are unsettled enough to punt hiring decisions but not concerned enough to make significant layoffs.

It’s the best of times for wealthy Americans and AI companies, the worst of times for everyone else.

EY’s forecast confirms this. “Consumer spending is likely to remain uneven, with high-income households continuing to drive outlays while lower-income families remain under pressure.”

Maybe the 4% rule still works. Maybe it doesn’t. We’re going to find out, which is a terrible sentence to read when you’re planning to live off your portfolio for 40+ years.

If you’re retiring early, you might want to stress-test your plans with a 3% or even 2.5% withdrawal rate. Am I being conservative? Maybe, but we genuinely don’t know what happens when the healthcare employment bubble pops while AI creates economic growth that doesn’t require workers.

Check out: How to Beat the 4% Rule

Sequence of Returns Risk Just Got Stranger

Traditional sequence of returns risk assumes a relationship between employment, consumer spending, and market returns. When unemployment goes up, consumer spending drops, corporate earnings fall, markets decline.

But what if unemployment rises while GDP grows? What if corporate earnings soar while fewer people get paychecks?

Deloitte warns that “much of the economy remains vulnerable to any faltering” of AI-related spending, noting that “just maintaining current spending levels for consumers and businesses would create a significant drag on GDP growth.”

The historical correlations your retirement calculator uses don’t account for this scenario because it’s never really happened before.

If you retire right as this transition hits, you could face market behavior that none of the models predicted. Your diversification strategy might not diversify the way you expected.

The Immigration Wild Card

To no one’s surprise, immigration policy directly affects healthcare staffing.

Recent visa restrictions jeopardized hundreds of international doctors ahead of their residencies. Home health aide positions are heavily reliant on immigrant workers. Workforce trend analysis warns of “heightened uncertainty for international healthcare specialists due to a perfect storm of geopolitical tensions, evolving immigration policies, and domestic protectionist pressures.”

JPMorgan economists attribute the labor market slowdown partly to “increased deportations, an aging population, and fewer visas for workers and students.”

If immigration restrictions tighten further, healthcare’s ability to fill positions takes another hit — right when policy is pushing for cost cuts.

What You Can Actually Do About This

We could certainly use a Nostradamus right now. A tidy little prophecy about where healthcare policy and the labor market land five years from now would make planning a lot easier.

Unfortunately, crystal balls are in short supply, and economic forecasts age like milk. And since none of us can see the future, the only rational move is to hope for the best while preparing for the worst.

Diversify Your Income Before You Need To

Don’t wait until reimbursement gets cut to figure out alternative income streams. Real estate, consulting, businesses that have nothing to do with healthcare. Start building them now while you still have a stable W-2.

The time to build the lifeboat is before you see the iceberg.

Stress-Test Your FIRE Plan Against Worst-Case Scenarios

Run the numbers assuming:

- Your income gets cut 30% in the next five years

- Healthcare stocks underperform for a decade

- Economic growth continues, but employment doesn’t

- Safe withdrawal rates need to be 3% instead of 4%

- A 30–42% chance of recession actually materializes

If your plan still works under those scenarios, great. If it doesn’t, you’ve got time to adjust. Maybe that means working a few more years. Maybe it means cutting planned retirement spending. Maybe it means both.

In case you missed it: Why Is Real Estate America’s Favorite Investment?

Watch Policy Like Your Retirement Depends On It (Because It Does)

Medicare reimbursement changes, Medicaid block grants, scope of practice legislation, AI diagnostic approvals, these may well be potential earthquakes for your career and your portfolio.

According to Healthcare Dive, “As margins improve, providers will use this year to bolster efficiency initiatives to prepare for impending hits to their bottom line.”

Translation: your hospital is already preparing for the cuts. Are you?

You don’t need to become a healthcare policy wonk, but you should probably know when major changes are coming.

Also read: What Do Higher Social Security Payments Mean For Millions of Americans

Don’t Double-Down on Healthcare Investments

If you’re a physician with 40% of your portfolio in healthcare stocks and healthcare REITs, you’re making a massive concentrated bet. Your human capital is already 100% exposed to healthcare. Why expose your financial capital the same way?

Diversify away from what you know. It feels wrong, but it’s probably right.

Build Bigger Margins Than You Think You Need

Whatever your FI number is, add 25%. Whatever withdrawal rate you planned, drop it by a point. Whatever timeline you set, extend it by a couple years.

Sounds harsh and pessimistic, I know. I hate it too. But it has been acknowledged that we’re sailing into uncharted waters, and the old maps might not work anymore.

Goldman Sachs expects GDP growth of 2.8% in 2026 but acknowledges significant downside risks. Moody’s maintains a 42% recession probability despite recent optimism.

Bankrate’s economist survey states that trying to get ahead in this economy “can feel like playing a real-life game of dodgeball, where you’re constantly ducking obstacles and unsure if you’ll be able to remain standing.”

The Uncomfortable Truth

The U.S. economy is being held together by one sector, and you work in it.

That should feel good, because hey, job security! recession-proof! essential workers!

But it should also terrify you, because nothing this unbalanced stays balanced forever.

We’re running an experiment in real-time. Can an economy grow when employment doesn’t? Can markets keep climbing when consumers stop spending? Can retirement planning models built on historical patterns work when the patterns break?

Nobody knows the answers. We’re going to find out together.

The January jobs report bought us some breathing room. But look closer and you see an economy running on fumes and prayer, held together by one sector that everyone agrees costs too much and needs to shrink.

For physicians planning early retirement, this signifies the ground shifting under your feet. The assumptions you’ve built your plans on (stable employment, predictable markets, reliable withdrawal rates) might not hold.

Indeed’s comprehensive 2026 forecast says that “Economic and labor market uncertainty is everywhere. The longest federal government shutdown in history has only recently ended, tariff policy remains unsettled, immigration continues to decline, monetary policy is in flux, and the labor market feels distressingly stuck in place.”

You’ve got time to adjust. But probably less time than you think. Plan accordingly.

Also read: Tapping Out: When Should Physicians Retire?

Frequently Asked Questions

Is healthcare the only sector creating jobs in 2025?

According to the Washington Post, healthcare and social assistance positions accounted for 97% of the 733,000 private-sector jobs created in 2025. Strip out healthcare jobs, and America’s employment growth would be negative.

Healthcare employment grew 12.5% over three years while every other job category stayed under 2%. This concentration makes the economy dangerously dependent on a single sector that’s facing massive political pressure to cut costs.

How does the healthcare job boom affect physician FIRE plans?

The healthcare employment boom creates a dangerous paradox for physicians planning early retirement. While your job appears secure now, healthcare is the sole pillar holding up the economy, making it a massive political target for cost-cutting.

Policy changes like the $900 billion Medicaid cuts over the next decade could trigger hospital closures and job losses. Physicians should stress-test FIRE plans assuming 30% income cuts, lower safe withdrawal rates (3% instead of 4%), and potential healthcare stock underperformance.

What is the 4% safe withdrawal rate, and does it still work?

The 4% rule suggests retirees can safely withdraw 4% of their portfolio annually, adjusted for inflation. It’s based on the Trinity Study analyzing historical periods when the economy had multiple strong sectors.

We’ve never tested this rule against an economy where one sector (healthcare) does everything while facing political pressure to shrink. Given current economic concentration and uncertainty, physicians planning early retirement should consider more conservative withdrawal rates of 3% or even 2.5%.

How is AI affecting healthcare jobs and the economy?

AI is creating a double-edged effect. While tech companies spent $360 billion on AI infrastructure in 2025, this investment creates almost no jobs — a $10 billion data center employs 200 people, while a $10 billion hospital system employs 50,000.

AI is actively eliminating healthcare administrative roles through automation while failing to create replacement jobs. According to JPMorgan, jobs with more AI exposure have seen slower growth, especially among younger workers. Healthcare workers express deep anxiety about AI devaluing years of professional training.

What are the recession odds for 2026?

Most economists surveyed by Bloomberg put 2026 recession odds at 30%, while Moody’s Analytics estimates 42%. Mark Zandi, chief economist at Moody’s, warns: “I think we’ll most likely get through 2026 without a downturn. But nothing else can go wrong. Like, nothing. We’re pretty much on the edge.”

The economy is held together by healthcare jobs (now slowing), wealthy consumer spending (dependent on stock market gains), and AI investment hype (unproven returns). Goldman Sachs projects GDP growth of only 1.8–2.3% with unemployment hitting 4.5%.

Should physicians invest in healthcare stocks?

Physicians should avoid concentrating investments in healthcare stocks. Your human capital (earning potential) is already 100% exposed to healthcare. Adding heavy healthcare stock positions creates dangerous concentration risk — if policy changes hurt the sector, both your income and portfolio suffer simultaneously.

Policy risk in healthcare is currently extreme, with Medicaid cuts, reimbursement changes, and AI disruption all threatening sector performance. Diversify away from what you know, even though it feels counterintuitive.

How are Medicaid cuts affecting healthcare jobs?

The One Big Beautiful Bill Act slashed over $900 billion from Medicaid over the next decade, with $17 billion in cuts hitting 2026 alone, rising to $165 billion annually by 2034. Hospitals are already responding — Alameda Health System laid off 247 employees, citing expected $100 million annual losses by 2030.

The Federal Reserve’s Beige Book reports community leaders “anticipated that upcoming changes to Medicaid may cause reductions in health care services more broadly, including hospital closures.” These cuts are happening now while healthcare is the only sector keeping the economy afloat.

What does “economic concentration risk” mean for physicians?

Economic concentration risk means the entire U.S. economy depends on two things: healthcare jobs and wealthy consumers spending stock market gains. Healthcare represents less than 15% of total employment but accounts for the majority of net job growth.

The top 10% of Americans now account for 45% of all consumer spending, up from 39% pre-pandemic. This is like loading all your weight on one side of a canoe — it works until it doesn’t. For physicians, this means both your career security and retirement portfolio are exposed to the same systemic risks.

What happens to physician retirement plans if healthcare spending gets cut significantly?

Cutting healthcare spending by 20% would cascade through the entire economy, affecting far more than hospitals. It would impact medical device companies, pharmaceutical firms, medical office real estate (and the regional banks financing it), health IT vendors, billing companies, clinical labs, imaging centers, home health agencies, and nursing homes — plus all their suppliers and employees.

For physicians planning FIRE, this creates a catch-22: healthcare costs are genuinely killing American competitiveness, but healthcare is now so central to employment that fixing the cost problem triggers massive job losses. There’s no soft landing scenario when one sector employs this many people and the rest of the economy is barely treading water.

How does wealth inequality affect physician retirement security?

The top 10% of Americans (earning $275,000+) now account for 45% of all consumer spending, while spending by lower- and middle-income Americans has stayed flat since the pandemic. Consumer spending represents nearly 70% of GDP, meaning the entire economy depends on wealthy people continuing to spend stock market gains.

For physicians planning early retirement, this creates sequence of returns risk you can’t model: if wealthy Americans stop spending because portfolios tank, the economy collapses — but your historical retirement calculators assume employment, spending, and market returns move together. We’ve never had unemployment rise while GDP grows, or corporate earnings soar while fewer people get paychecks. Your diversification strategy might not diversify the way traditional models predict.