Welcome back to Physician on FIRE’s Monday Markets review!

The upcoming Christmas week may seem quiet but don’t underestimate the market-shaking potential of short squeezes, impending shutdown theatrics, and the Fed’s tightening grip on liquidity. Our Week Ahead & Implications section cuts through the calm to reveal how these undercurrents could spark fresh volatility and, more importantly, where the best opportunities lie for both protecting profits and scoring last-minute wins as 2024 winds down.

Market Overview

All four major U.S. equity benchmarks ended the week in negative territory, with small caps hit especially hard. The Russell 2000 (–4.45%) lagged, while the Nasdaq 100 (–2.25%), Dow Jones (–2.25%), and S&P 500 (–1.99%) also posted losses. Markets initially tumbled midweek when the Federal Reserve cut rates but signaled fewer 2025 reductions than investors had hoped, sparking concerns about higher-for-longer borrowing costs.

Sentiment was further weakened by looming government shutdown risks, fresh tariff threats by President-elect Donald Trump, and disappointment around select corporate earnings and guidance.

Nevertheless, a powerful rally on Friday helped indices pare some of their losses, buoyed by below-consensus inflation numbers that renewed optimism for continued monetary easing—albeit at a more measured pace. Heavy trading volume suggested high conviction behind the rebound, as many traders appeared eager to buy the dip heading into the holiday-shortened week.

Last Week’s Highlights

- Fed Cuts Rates, Cautions on 2025: The Fed trimmed rates by 0.25% but signaled fewer next-year cuts, rattling markets midweek.

- PCE Surprises Lower: Core inflation rose 2.8% y/y in November, slightly below forecasts and fueling cautious optimism on inflation.

- High-Volume Friday: Over 21.7 billion shares traded—nearly double the daily average—amid heavy options flow.

- Government Shutdown Fears Emerge: Several funding measures failed in Congress, sparking fears of a potential federal shutdown.

- Upward GDP Revision: Q3 U.S. growth upgraded to 3.1% (from 2.8%), driven by robust consumer spending.

- Retail Sales Climb: November data jumped 0.7% after October’s 0.5%, shrugging off headwinds from higher interest rates.

- Labor Market Stays Strong: Initial jobless claims dipped to 220,000, with continuing claims down to 1.87 million.

- BoE Holds Rate: The Bank of England kept its key rate at 4.75%, though three officials voted for a cut.

- Nordic Rate Divergence: Sweden’s Riksbank trimmed its benchmark to 2.50%, while Norway held at 4.50%.

- Eurozone Contraction Eases: Slower declines in manufacturing and services signaled mild improvement.

- Germany Sets Early Election: Chancellor Scholz lost a confidence vote, scheduling February 23 polls.

- Japan’s Inflation Pressures: Core CPI jumped to 2.7% in November, intensifying BoJ rate-hike debates.

- Mixed Chinese Data: Retail sales slowed to 3% y/y, but industrial production jumped 5.4%, boosted by strong auto and solar demand.

Week Ahead & Implications

Consumer Confidence & Durable Goods: A Combined Force

Despite the pre-holiday slowdown, Monday’s consumer confidence print and Tuesday’s durable goods data will combine to underscore the market’s resilience heading into 2024.

A strong confidence reading will confirm steady household spending, providing a year-end tailwind for retailers and travel-related stocks. Meanwhile, an upbeat durable goods report – especially if aircraft orders and core measures beat the muted consensus – reinforces the bullish view on business investment.

Together, these signals should support cyclical manufacturing, industrials and discretionary names alike as traders position for a robust first quarter driven by solid consumer demand and an improving business spending climate. Expect portfolios tilted toward retail leaders, machinery manufacturers, and experience-driven service providers to gain traction, with stronger holiday season metrics fueling both near-term rallies and sustainable Q1 momentum.

Government Shutdown Fears

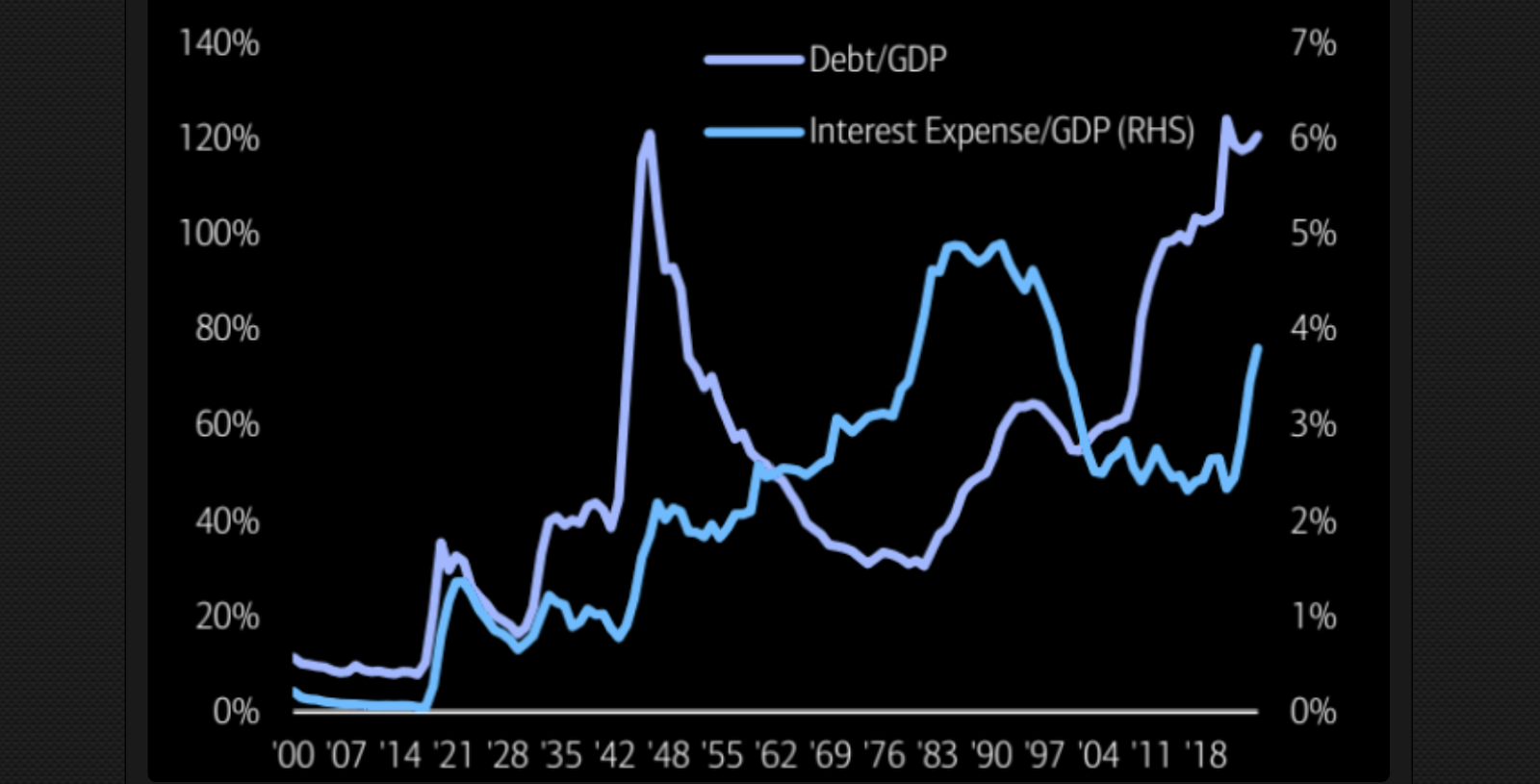

As the chart below illustrates, U.S. debt and interest expense relative to GDP are pushing into uncharted territory, a situation made more precarious by the rising yields that accompany political standoffs and persistent deficits.

Against this backdrop, the imminent threat of a US government shutdown, far from being uniformly bearish, may paradoxically reinforce expectations of a more dovish Fed policy. Shutdown fears tend to be deflationary in the short term, which has already led some investors to reprice the likelihood of fewer future rate cuts. This dynamic is even more important now, as markets are still digesting the Fed’s temporary hawkish pivot.

This interplay between shutdown news and rising debt-servicing costs should provide a near-term boost to Treasuries – especially at the long end, as traders see the government standoff as a drag on growth and support for a more dovish stance later in 2025. In practice, this suggests a defensive tilt in portfolios, with a focus on safe-haven assets and sectors that are resilient to reduced government spending.

Post-Fed Short Squeeze and Options Hangover

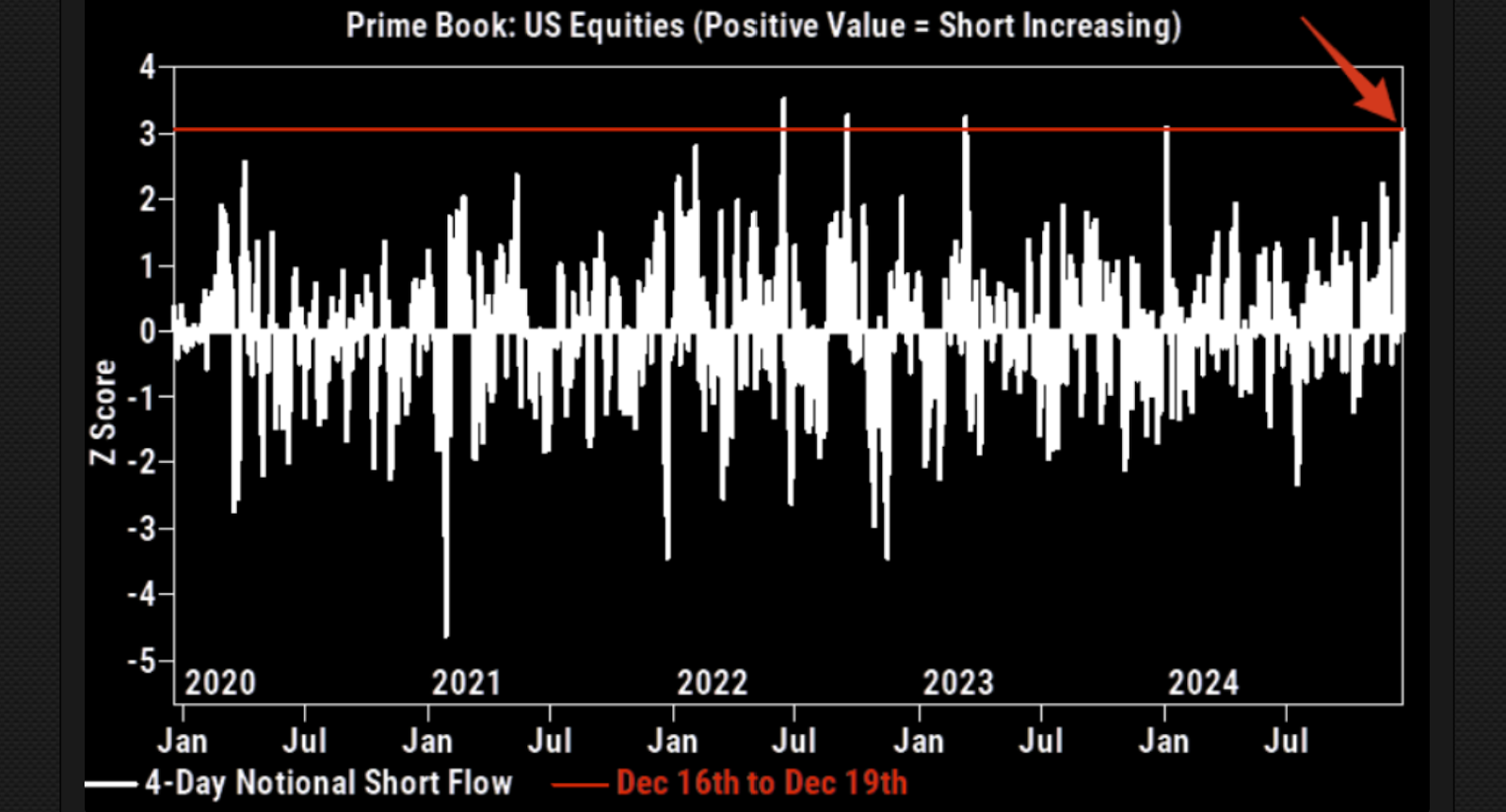

As the Goldman Prime Book chart illustrates, short selling in U.S. equities reached the 100th percentile on a five-year lookback during the four sessions leading up to Friday’s massive triple-witching option expirations.

That frenzy set the stage for a violent short squeeze once markets rebounded. The residual hangover will likely surface early next week as dealers reset hedges in a thinly traded environment, prompting exaggerated intraday swings that reward nimble traders over long-term buy-and-hold approaches.

Momentum-driven tech and crypto-related names — already vulnerable to sentiment shifts — could see large price moves, especially if the shutdown narrative evolves or macro data reshape the Fed debate. A prudent stance now is to trim high-beta exposure, raise cash, and be ready to pounce on potential forced selling when volatility reasserts itself.

Fed Balance Sheet Runoff: Liquidity Pressures Finally Stick

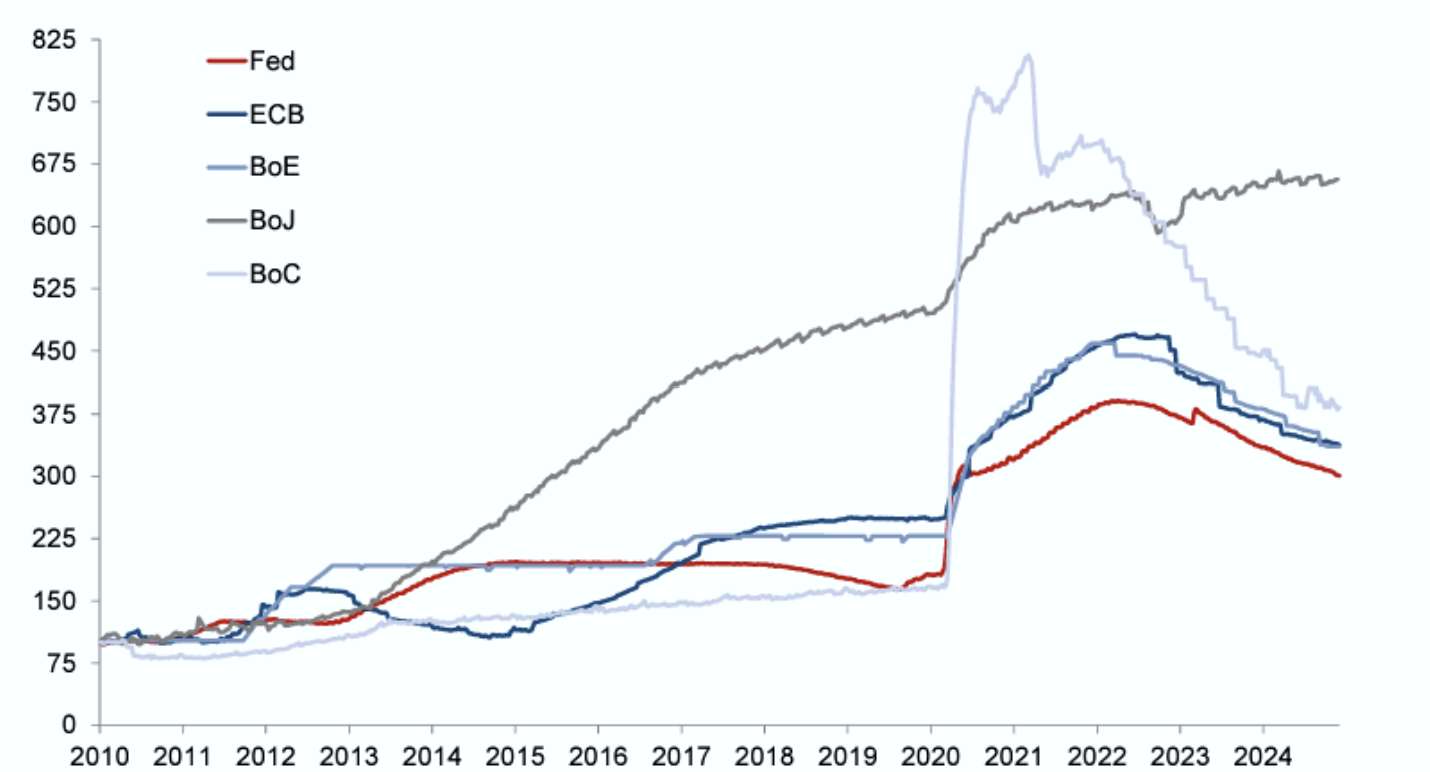

As the following chart shows, most G10 central banks have continued quantitative tightening, while the Fed has slowed its pace of balance-sheet shrinkage but is expected to end QT in Q2 2025.

After months of reserves staying surprisingly steady, the Fed’s efforts are about to bite hard, with the Reverse Repo Program balance dwindling and little room left to buffer. As liquidity finally shrinks, the stock market might face a genuine headwind that could intensify early next year.

With fewer backstops in place, investors should expect renewed volatility in momentum names and heightened sensitivity to any negative news on growth or policy. The best move is to rotate toward large-cap defensive plays and ensure portfolios aren’t overly reliant on liquidity-driven rallies.

Stay cautious on high-flyers with stretched valuations, as tighter liquidity often triggers swift re-pricing in those corners of the market.

Most Impactful Events to Watch Next Week