Being a physician means that working long hours, keeping complex details in your head, and making big decisions on the fly all come with the territory.

Which is great because the U.S. tax code certainly makes us put those skills to good use. Even so, taxes can still sometimes feel like solving a puzzle with the corner pieces missing.

On the upside, as complicated as physician taxes can be, they’re also packed with opportunities to keep more of what you earn. The key is knowing which deductions and credits apply to you, when to use them, and how to stack them strategically.

The right deductions aren’t always the flashy ones. Sometimes they’re hiding in plain sight, able to quietly trim chunks off your tax bill. Once you know where to look, there’s no going back.

Table of Contents

ToggleLearn about Tax Strategies for High-Income Professionals

Universal Deductions Every Physician Should Know

There’s a core set of deductions that almost every doctor in the United States can take advantage of, regardless of whether you’re working as a hospital-employed W-2 physician, juggling multiple 1099 contracts, or running your private practice.

These are the building blocks of your tax strategy that will quietly work in the background year after year to lower your taxable income.

Retirement Plan Contributions

Retirement accounts are more than just a way to save for a life after medicine. They’re one of the most effective legal tax shelters available.

By contributing pre-tax dollars to certain retirement plans, you reduce your current taxable income, which means you pay less tax now. That money then grows tax-deferred until you withdraw it in retirement, ideally when you’re in a lower tax bracket.

Physicians often have access to more than one retirement vehicle. If you work for a large hospital or academic center, you may have a 401(k) or 403(b). These plans allow you to defer up to $23,500 in 2025, with an additional $7,500 catch-up contribution if you’re age 50 or older.

Self-employed physicians can go a step further with a SEP IRA, which allows contributions of up to 25% of net earnings from self-employment, capped at $69,000 for 2025.

Health Savings Accounts (HSAs)

If you’re enrolled in a qualifying high-deductible health plan, an HSA is arguably the most tax-advantaged account you can use.

Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free, which culminates in a rare “triple tax advantage”.

The IRS has announced the new contribution limits are for 2026 (PDF), showing a slight increase from 2025. For individuals, the annual limit will be $4,400, a 2.3% increase from the $4,300 limit in 2025. For families, the limit will jump to $8,750 in 2026, up 2.4% from $8,550 in 2025.

While HSAs are often viewed as short-term healthcare savings tools, physicians can take a more strategic approach by paying current medical costs out of pocket and letting the HSA balance grow untouched for decades.

Later, you can reimburse yourself tax-free for those old expenses, using the account as a stealth retirement fund.

Continuing Medical Education and Licensing Costs

Medicine doesn’t stand still, and neither can your education. For self-employed physicians or those earning 1099 income, the IRS allows deductions for CME expenses that maintain or improve your professional skills.

This includes conference registration fees, online courses, required specialty board renewals, and even travel and lodging costs directly tied to the CME event.

If you’re strictly a W-2 employee, the picture is different. The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated unreimbursed employee business expenses for most taxpayers.

That means CME costs can only be deducted if your employer reimburses them under an accountable plan, which is essentially a formal arrangement where you submit receipts and are paid back without the reimbursement being counted as income.

Student Loan Interest Deduction

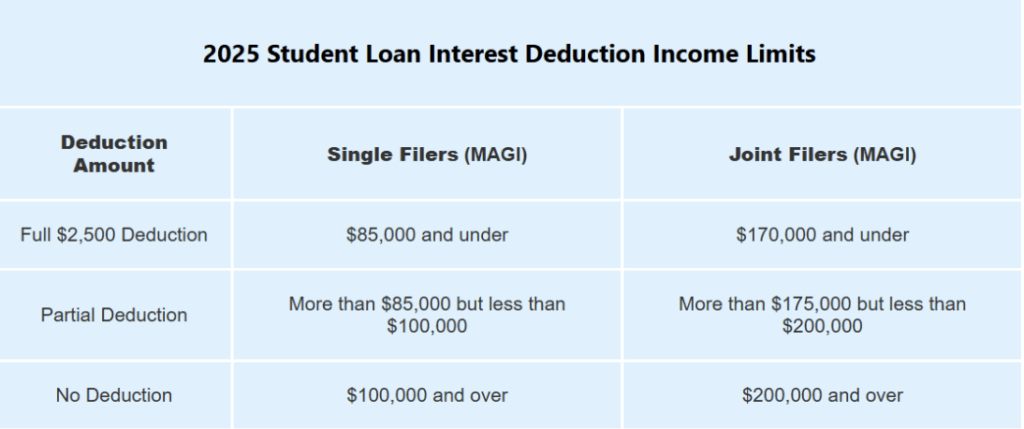

If you’re still carrying medical school debt, you may be eligible to deduct up to $2,500 of student loan interest each year. However, this deduction phases out at higher incomes.

In 2025, the phase-out begins at a modified adjusted gross income (MAGI) of $85,000 for single filers and $170,000 for joint filers. Many attending physicians exceed these thresholds quickly, but residents or those in fellowship may still benefit.

Source: Smart Asset

Charitable Contributions

Physicians are often generous donors, whether to medical charities, religious institutions, or alma maters.

In 2025, you can deduct cash contributions up to 60% of your adjusted gross income. Non-cash donations, such as used medical textbooks or equipment, require you to determine the fair market value and may need an appraisal if over certain thresholds.

Donating appreciated securities instead of cash can allow you to deduct the full market value while avoiding capital gains tax, which means a double benefit for the charitably inclined

Under the One Big Beautiful Bill Act (OBBBA), physicians who take the standard deduction get a small but notable new perk: the ability to deduct charitable contributions up to $1,000 (single) or $2,000 (married filing jointly). This provision was previously unavailable unless you itemized.

Conversely, charitable contribution deductions also face a new hurdle. You can only deduct amounts exceeding 0.5% of your Adjusted Gross Income (AGI), starting in 2026. For example, with a $500,000 AGI, you’d need to give more than $2,500 before deductions kick in.

Physician-Specific Deductions

While the aforementioned deductions are broadly available, there are others that are much more tailored to the way physicians work and earn.

This is where the tax strategy starts to get interesting, because two doctors in the same specialty could have completely different opportunities depending on their employment arrangement.

The Home Office Deduction

Despite the stereotype that doctors always work in hospitals or clinics, many now spend significant time on telemedicine, administrative tasks, or research from home.

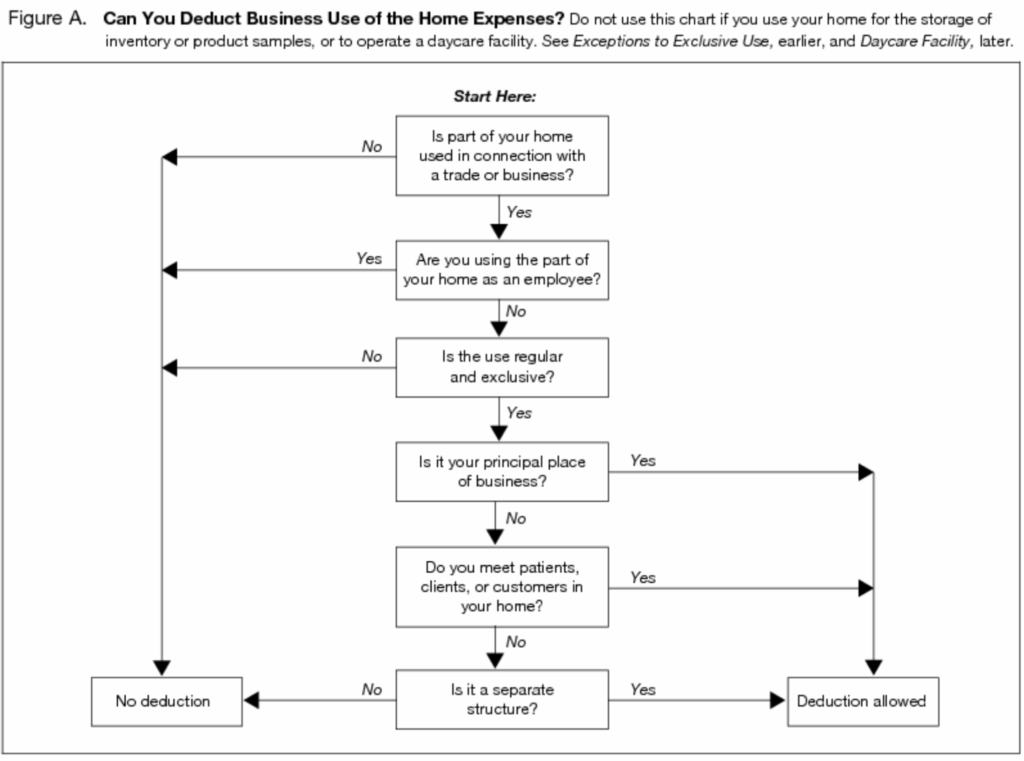

If you use a space in your home exclusively and regularly for work, you may qualify for the home office deduction. But keep in mind that exclusivity is key, so a laptop on the kitchen counter doesn’t count.

The IRS offers two calculation methods. The simplified method gives you a deduction of $5 per square foot, up to a maximum of 300 square feet.

Source: IRS

On the other hand, you’ve got the actual expense method, which requires more tracking, but can yield a larger deduction if your home costs are high.

It allows you to prorate mortgage interest, rent, utilities, insurance, and certain repairs based on the percentage of your home used for business.

| Expense | Description | Deductibility |

| Direct | Expenses only for the business part of your home.

Examples: Painting or repairs only in the area used for business. |

Deductible in full.*

Exception: May be only partially deductible in a daycare facility. |

| Indirect | Expenses for keeping up

and running your entire home.

Examples: Insurance, utilities, and general repairs. |

Deductible based on the percentage of your home used for business.* |

| Unrelated | Expenses only for the parts of your home not used for business.

Examples: Lawn care or painting a room not used for business. |

Not deductible. |

| *Subject to the IRS’s deduction limit. | ||

Source: IRS

Professional Dues and Subscriptions

Annual dues to organizations like the AMA, specialty societies, or subspecialty boards are deductible if they’re directly related to your profession. The same applies to medical journal subscriptions and online databases that you use to stay current in your field. These costs can add up quickly.

Malpractice Insurance Premiums

For self-employed physicians, malpractice insurance premiums are fully deductible as a business expense. For employed physicians, it depends on whether the premium is paid by the employer and whether there’s an accountable plan in place for any portion you pay yourself.

Medical Equipment and Supplies

If you purchase your own equipment, anything from diagnostic tools to EMR software, you can often deduct the full cost in the year of purchase under Section 179. This applies whether you’re buying a $300 otoscope or a $30,000 ultrasound machine, as long as it’s used for your practice.

Travel for Locum Tenens or Multiple Practice Sites

Physicians working locum tenens assignments or splitting time between different practice locations may be able to deduct travel expenses if the work site is considered “temporary” and outside their tax home.

Eligible costs include airfare, lodging, and 50% of meals while traveling for business. The rules for defining a tax home and determining whether a location is temporary are strict, so this is an area where many physicians rely on a CPA’s guidance.

OBBBA 2025

The One Big Beautiful Bill Act (OBBBA), signed into law back in July, brought with it a sweeping set of tax and financial changes. While the law spans more than 1,000 pages, most physician households will notice only modest differences in day-to-day tax planning. Here are some important shifts worth noting.

One of the biggest headlines for high earners: the Tax Cuts and Jobs Act (TCJA) tax brackets are now permanent. That means the top bracket will remain at 37% indefinitely, rather than reverting to 39.6% in 2026. For many physicians, that’s a welcome bit of stability in planning projected tax liabilities.

The TCJA’s higher standard deduction was also made permanent, meaning $15,750 for single filers and $31,500 for married couples filing jointly, with annual inflation adjustments baked in.

For those who itemize deductions, there are some updates as well. The State and Local Tax (SALT) deduction cap has temporarily doubled, to $20,000 for single filers and $40,000 for joint filers, through 2030. However, the higher limit phases out starting at $250,000 (single) or $500,000 (joint), which will limit its usefulness for many physicians in high-tax states.

OBBBA also made some smaller, targeted tweaks, like a new car loan interest deduction (up to $10,000) that applies to qualifying loans on U.S.-assembled vehicles, though income phaseouts mean this will mostly help residents and early-career physicians.

The child tax credit has increased to $2,200 per child and is now permanent, with inflation indexing. Dependent care FSA contribution limits will rise from $5,000 to $7,500 starting in 2026, potentially saving physician families hundreds per year in taxes.

Education funding also gets a boost starting in 2026. Annual withdrawals from 529 plans for K–12 expenses will double from $10,000 to $20,000 and cover a broader range of costs, including tutoring, testing fees, and curriculum materials.

Finally, the lifetime estate and gift tax exemption (previously set to halve in 2026) has instead been increased to $15 million per person (indexed for inflation) indefinitely. For physicians with substantial assets, this higher threshold offers more room for lifetime gifting and estate transfer strategies without triggering the federal estate tax.

Curious about How the One Big Beautiful Bill Act Affect High-Income Individuals and Taxpayers? Click to find out.

The Bottom Line

The reality is that most physicians won’t use every single deduction here. The right approach is to understand which ones fit your specific situation, track your expenses carefully, and coordinate your tax strategy with your financial goals.

A hospital-employed cardiologist and a self-employed dermatologist will have very different opportunities, even if they’re earning similar incomes. So, while the tax code may not be designed with simplicity in mind, it does reward those who learn how to optimize their finances accordingly.

Which change brought about by the OBBBA will impact you the most? And how do you plan to adjust? Share your thoughts, and let’s compare notes.

FAQs

Q: What tax deductions can physicians claim in 2025?

A: Physicians in 2025 can deduct retirement plan contributions, malpractice insurance premiums, CME expenses (if self-employed), Health Savings Account contributions, charitable donations, mortgage interest, and certain state and local taxes.

Q: Do doctors qualify for the home office tax deduction?

A: Yes, doctors qualify for the home office deduction if part of their home is used exclusively and regularly for business, such as telemedicine or administrative work. This applies mainly to self-employed or 1099 physicians.

Q: Can physicians deduct CME expenses in 2025?

A: Self-employed physicians can deduct CME expenses, including conferences, courses, and related travel. W-2 physicians can only deduct them if reimbursed under an accountable plan.

Q: How does the Health Savings Account help physicians save on taxes?

A: An HSA offers triple tax benefits: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. Physicians can also use HSAs as a long-term retirement savings vehicle.

Q: What is the SALT deduction limit for high-income physicians in 2025?

A: The SALT deduction cap is $20,000 for single filers and $40,000 for married filing jointly through 2030. However, the higher cap phases out at $250,000 for single filers and $500,000 for joint filers.

Q: Can doctors deduct charitable donations without itemizing in 2025?

A: Yes. Under OBBBA, physicians taking the standard deduction can deduct up to $1,000 (single) or $2,000 (married filing jointly) in charitable donations.

Q: What OBBBA 2025 tax changes affect physicians the most?

A: OBBBA made TCJA tax brackets permanent, expanded SALT deduction caps temporarily, increased the child tax credit, introduced new deductions for charitable contributions, dependent care FSAs, and expanded 529 plan withdrawals.