The good doctor is a radiologist married to a pediatrician. They’ve got two young human children and another of the canine variety. He started a blog of his own several months ago to explore his curiosities on life, money, and more in a two-physician household. If you enjoy this post, be sure to check out more thoughtful and curious posts at his site My Curiosity Lab.

Dr. Curious, tell us more about this ultimate hedge against future uncertainty.

Let me tell you about my Uncle Jack

For over 40 years, he worked as a research assistant in a lab at the local university, mostly in X-ray crystallography —a field which made possible the discovery of the double-helix structure of DNA. He was an intelligent man who enjoyed life’s simple pleasures; camping and trainspotting were among his most cherished hobbies. He planned to do them much more, and travel the world with his wife, during retirement.

He was in otherwise great shape when, while still working at age 63, he was diagnosed with Alzheimer’s disease. Four years later—following a slow, steady decline in physical and mental health—he was gone.

The future is uncertain

All of us will encounter a tragedy like Uncle Jack at some point in our lives—most of us more than once. As I write this, in fact, a close family member of mine is dealing with a possible cancer diagnosis. These types of events should not surprise us, yet so often they do. Thoughts about death, illness, and injury are not pleasant, and they tend to reside in the furthest corners of our minds until we are forced to confront them.

- Life is not all bad. This dog with sunglasses is good, right?

By definition, our future is unknown. Even if you believe that free will is an illusion, and that our future choices have already been determined, we still don’t know what those choices will be.

How do we deal with this uncertainty? Before answering this question, let’s explore some different types of future uncertainty.

Financial uncertainty

The fact that our collective financial future is uncertain should surprise exactly none of you. Oh, we can plan and project to our heart’s content but, as 2001 and 2008 have shown us, the global economy may have something else in mind for our retirement accounts. We can take advantage of temporary dips in the market—tax-loss harvesting and rebalancing, for example—but no one really enjoys tax-loss harvesting enough to hope for a financial crisis, do they?

A costly lawsuit, a desperate family member, an unexpected hospital bill—there seems no end to the ways we and our Benjamins might part. That’s what emergency funds are for, right? Although the financially savvy may be prepared to absorb unexpected expenses, they nonetheless present road bumps along the path toward a stable financial future.

Health uncertainty

A few weeks ago, I was chatting with my psychiatrist neighbor about his long-awaited move to California for semi-retirement. The very next day, I learned he had a stroke the evening prior and would be convalescing for months at a local hospital, his move on the back burner for the indefinite future.

Illness and injury is not uncommon, especially as we age, and it can cause havoc to our future life plans.

Life uncertainty

As a wise man once said, problems are inevitable and temporary. Unfortunately, some problems are temporary because they end in death. In our day-to-day lives, most of us take the advice of Blue Oyster Cult and don’t fear (or really think about) the Reaper.

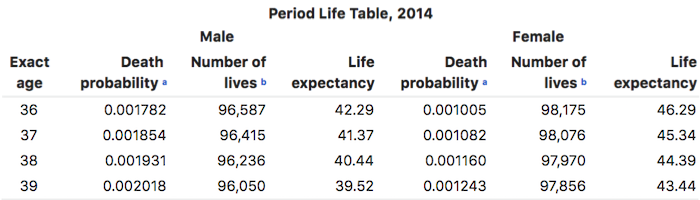

Ever wonder how much longer you have to live? The Social Security Administration has, and here is a selection from their actuarial life tables for someone around my age (38).

Looking at the annual death probability column, I have ~0.2% chance of dying this year; two out of every thousand 38-year-olds will meet their makers. By no means high, but not as low as I would like. Let’s scroll a little further down the table, closer to what will be my full retirement age.

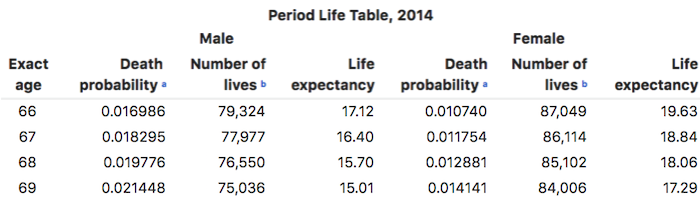

Lo, the Reaper has drawn closer. Nearly 2% of 67-year-olds can expect to die within the year.

According to the table, a 119-year-old has an 88% chance of kicking the bucket in a year; with only one American ever reaching that age, I’m calling BS on the data for that row.

Existential uncertainty

A rogue asteroid, rogue virus, or rogue nuclear weapon could end life as we know it. Should we throw caution to the wind and party like it’s 1999?

Who knows? According to The Doomsday Clock—a metaphor to how close humanity is to global destruction—we are two and a half minutes until “midnight,” i.e. the end of the world. So never say never, and hope those are long minutes.

How do we hedge against an uncertain future?

Hedge /hej/ (verb): protect oneself against loss on by making balancing or compensating transactions.

In 1949, Alfred Winslow Jones launched the world’s first hedge fund when he acted to compensate for the risk of his long-term stock holdings by short selling other stocks, i.e., hedging his bets. If the stock market crashed, he would lose some money, but not all of it. His hedge cost him money in the short-term but protected him from monetary loss.

We can also hedge against uncertainty about the future with a “purchase” of sorts: buying more time.

Our time on this earth is constantly decreasing, and we don’t know when it will run out; we can only hope that we have a good deal of it left. The only way to absolutely guarantee an experience is to do it now, not later. Later may never come.

I would argue that the best way to mitigate against future uncertainty is early retirement. You start doing exactly what you want, when and how you want to do it. A health crisis or asteroid may derail your plans at some point, but until that time you will have lived your life exactly as you pleased.

What about financial uncertainty?

Early retirement can solve many problems, but admittedly it may not be an ideal hedge against financial uncertainty. The ability to continue to work and earn money can be advantageous when faced with financial adversity. Does this mean our plans for early retirement are ruined?

Nah. To address our financial uncertainty, we need only pay a visit to early retirement’s rich uncle—financial independence. Savvy readers of personal finance websites (yes, you) take it as gospel that financial independence and early retirement go hand in hand.

If one achieves financial independence — i.e. possesses sufficient wealth to survive without needing to earn income — that sizable nest egg or sweet pension can help to buffer market instability or unexpected costs. Of course, nothing can completely eliminate the possibility of financial disaster, but this is a fact of life whether one is financially independent or not.

The sky is not falling

If this post seems like fearmongering, or I come across as the world’s biggest worrywart, I apologize: that was not my aim nor my personality. I’m actually quite optimistic about my own life and the world in general.

I accept that the future is uncertain. While attaining financial independence and early retirement will not guarantee success and happiness in that future, it will guarantee more time to pursue those goals. Yes, FIRE is our ultimate hedge against an uncertain future.

PoF: Thank you for your article, Dr. Curious. I’ve often had similar thoughts, but have never put them in writing so eloquently. The future is unknowable, and I remain optimistic that mine will consist of a lengthy, healthy, fulfilled life. But it might not be.

If I don’t take advantage of the opportunity I’ve got to start living a life less ordinary, the possibility could be taken away by an unfortunate twist of fate. Why not take a shot at an early retirement? After all, we could always return to a more ordinary life.

26 thoughts on “The Ultimate Hedge Against Future Uncertainty”

There is a Greek philosopher born in 539 BC , in Ephesus (eastern Turkey) names Heraclitus. He is famous for the notion you can “never step into the same river twice” On it’s face two things are in tension. Some aspects of the river are same, like you occupy the same GPS co-ordinate, but other aspects have under gone a flux namely the water has changed.

I FIRE’d a couple months ago and was enjoying the peace involved with no longer pulling the train. Today I’m looking down the throat of a cat 5 crossfire hurricane. All things being equal, if I was still working I’d be looking down the throat of a cat 5 crossfire hurricane, but now I will have the time to deal with the aftermath and not be bothered with pulling the train.

The thing that got me to FIRE was I looked at my SSA earnings. My first return was when I was 16, and my last working return will be this year. I realized working another 4-5 years would make little difference in my NW, (single digits), but a huge difference in how I spend my remaining time. I understood you can’t make all the money so why try? All you need is enough and not a dollar more.

We work to grow wealth but at some point our ability grow the wealth becomes asymptotic and the value of time on its own, over takes and rapidly exceeds the value of trading it for wealth generation.

UPS just came. They delivered my new generator.

Congrats on pulling the FIRE trigger and no longer pulling the train!

I completely agree with the concept of knowing when you have Enough and the relative futility once your net worth reaches the point of diminishing returns. I am starting to work a reduced schedule for less pay for that reason.

If my investments earn 8% to 10%, I gain nearly as much as I would working full time with 0 investment returns. The tax treatment of investment returns tends to much more favorable than earned income.

Cheers!

-PoF

p.s. Care to write a guest post? I’d love to hear and share your story.

I didn’t know about the PoF sight and thank you for this post and invitation. Your investment style is quite similar to my own. I have more in post tax than pre-tax accounts and pretty much quit contributing to pre-tax once I realized RMD would kill any chance of controlling my post retirement tax bill. I also harvest tax loss and the market over the past 20 years has given me a lot of it.

I recently built myself a “homebrew annuity” selling 600K of post tax stock, matching my cap gains with cap loss and plowing the cash into VWSUX a muni fund. My tax bill was zero. I will live off this for the next 5 years while while I back door unload some of my IRA into Roths. The idea is to move the IRA money into the Roth with only a 15% tax bite, and reduce my RMD as much as I can before Uncle Sam forces me to pull that trigger. This move, moves me into a pretty bond heavy position (58:42) for 5 years, but as I spend down my “annuity” my stock:bond mix will increase and re-balance automatically towards a higher equity stake (70:30) as my longevity also automatically decreases. In 5 years I’ll re-evaluate and in the mean time have a nice life. The higher bond ratio is also desirable to portfolio longevity in early retirement.

I would love to see some writing on looking at accumulation from a distribution point of view. Distribution is a whole ‘nother thing very different but not entirely dissimilar from accumulation. A clear understanding of distribution AND the ultimate asymptotic limit of your particular accumulation is what is needed to know when enough is enough.

I’ll do something on this once Irma quits messing with my ADD.

Best

Thanks for giving us a nice daily dose of perspective Doc! Last October, Mr. Wow was hit by a car while riding his bicycle and he lost his memory for a night. He had no recollection of who I was, let alone our quest for FI. Luckily, there were no long term affects, but it proved that the future is uncertain. Ultimately, it solidified the FIRE mindset for me and actually made me want to achieve it even sooner.

Glad to hear Mr. Wow had not long-term effects! You’re right: it’s not only the “old” who become seriously ill; young folks can be devastatingly struck down in the prime of their lives too.

I try not to dwell on the potential disasters that could befall us all, but ignoring the fact that they happen sometimes doesn’t do me any favors either. I think FIRE is a great way to focus on the positive and mitigate against these potential negatives.

Thanks!

Early retirement the sooner the better!

I retired in June at 48 years old. Here I am a little more than 2 months later, now 49, and I have been diagnosed with Coronary Artery Disease and I am scheduled for Heart Bypass surgery next week. Trust me, anything can happen at any time.

My prognosis is good and I plan to live a long happy life but for now, I must deal with this issue before I can fully enjoy my early retirement.

Sorry to hear that, Troy, but glad they caught it in time. I just heard an interview with Dana Carvey, who had similar issues around your same age. You just never know.

Good luck with surgery, and I hope you have a long and happy early retirement!

Great post – thank you.

A close relative passed away quite suddenly a few years ago. He’d just gone to deposit a check, had a heart attack and was gone before the ambulance could get there. He was 60. All his life, he’d put off the “fun stuff” like travel because there was always time for it once he retired.

That experience set a few things in motion for me, one of which was to get financially independent (and free) – so that I at least get to do some of the things I want to do before I can’t any more.

Most (all?) of us go through an experience like this at some point in our lives. If you are “lucky,” it might happen when you are young, and alter your perspective on the time each of us is allotted.

Striking the right balance between working hard toward FIRE (assuming you want that) and enjoying life while you are young is a most tricky and personal decision. Many don’t confront it until it’s too late.

Thanks for reading!

My uncle also in his 60s recently got diagnosed with early dementia. Brutal for everyone in the family. I try to fin balance. The only regret I have now is distance from my family but the trade off is we are closer to my wife’s family. Hopefully in the future as I go part time I can make more trips down south to see my folks.

An partner in my practice is currently building a mother-in-law carriage house on his property to take care of his mother, who is also suffering from dementia. These kinds of thoughts weigh heavily on the minds of my wife and I when we talk about a cross-country move or long-term international travel. Family becomes more important to me the older I get.

Thanks DDD!

I think moving away from my family is my biggest hang up when planning for the future. I fortunately live about 30 minutes from my parents which is awesome and a 2 hour flight from my sister. I really want to spend some time slow-traveling internationally, but thinking about being away from family isn’t easy, especially when planning on being gone for months at a time.

It also depends how much your like your family and your in-laws 😉

As DDD mentioned, it’s not only spending quality time with them, it’s also how to deal with a significant or debilitating illness when you are on the other side of the world.

Working in a role where the mandate is to discover and develop new drugs in areas of high unmet medical need has been a passion for >20 years, albeit with varying levels of intensity. I am thankful my work as part of that mission has provided our family with a great life and a financial base to avoid worrying about money.

The opportunity to discover new things, with even greater freedom and autonomy, when I no longer have a paycheck is just as powerful, if not more.

It is not completely clear to me what those new areas of discovery in our FIRE life will exactly look like. If we knew exactly what we were doing, it would not be called discovery…..

I like the idea of “discovery” as part of FIRE. I get the sense that most of us who aspire to FIRE do so with another life in mind, not just a lazy continuation of the previous one.

A lack of worry about money, or at least lack of reliance on a paycheck, is certainly one of the greatest benefits of financial independence.

Thanks!

Nice recap of all the risks we face, Doc. I especially like this line:

It may appear counter-intuitive at first glance, but there is profound truth behind your point. It’s an offshoot of an old classic, Don’t count the years left, make the years count! Enjoyed reading this post doc.

Exactly! Both positive (having children) and negative (death of a loved one) events can bring the importance of “making the years count” into stark clarity.

Thanks!

I totally agree with this. Sadly I also get this clarity every time I read/hear about some terrible event in the news.

Nice post!

Great analysis of uncertainty and “life hedging”.

Confidently calculating how close one is to financial independence is too difficult. I found I was getting more stressed out by the question of “do I have enough?” than I was working my 60+ hours/week full-time job.

I hedged by quitting full-time work, but also downsizing, moving to another location and becoming an independent consultant.

I like the flexibility and balance of work/freedom this affords.

Excellent discussion about the future, value of time, and what is important in life. I am also a rad (52), and one thing that I have learned (and continue to learn) is that as a person, we are all constantly changing, in our needs, our values, and our aspirations. And our world is changing around us.

I am a different person now than I was 10 years ago, and I expect that I will be different again in 10 years. Projecting my psychic, family, and financial needs is a constantly moving target.

Financial independence (FI) certainly allows you to grow into the new you, at least where there are financial concerns, but if the new you (or your personal orbit) has additional, unprotected monetary needs, the early retirement (RE) could be limiting. In that way, continuing to work might be the hedge against the changes that occur with you (in addition to changes in health, unexpected family needs, etc.).

IMO, the compromise is to craft a sustainable work model where work seems less of a chore, and you still have the income to live the life the way you want now and in the future and hedge future financial uncertainties. I guess if we knew in advance when our last day would be (and how we would get there), we could make a more discrete plan. We don’t and we can’t.

As PoF illustrated in his last post, long-term plans can change in the blink of an eye, so a willingness to be flexible is a huge asset. As you say, I can hardly identify at all with the me of 15 years ago, and I’m still changing.

I envision working part-time for a while before full retirement, and thankfully that is possible in radiology. For those who truly hate their jobs or don’t have great part-time options, FIRE might be the best (only?) option.

Thanks!

While there’s no true way to know what’s going to happen or to prevent it, like you said, the ability to buy time is beneficial. Most of the bloggers in the FIRE community are simply looking to take back their time. For me, the ability to spend that time on something more meaningful to me is the goal. So I readily identify with your analysis. Thanks for sharing!

Concerns about an uncertain future are implicit but rarely explicit in most financial and life decisions. For me, having children and updating our wills really brought these considerations to the forefront. It’s easy to get lost in the nitty-gritty details of life and money, and forget about what is truly important.

Thank you for taking the time to read!

It’s definitely a balancing act but this is why you have to both enjoy today a plan for tomorrow. Tomorrow may never come so you have to enjoy today, but if tomorrow comes badly the better you’ve prepared especially financially the more you will be able to at least mitigate. Financial independence is the ultimate available mitigator imho. A life well lived is the best protection against a surprise shortened life.

The holy grail would be a fulfilling, enjoyable, and meaningful career, with great pay and plenty of time off to spend with friends and family. Like the holy grail, that’s exceedingly difficult to find. The second best option for many is to achieve FI and start doing exactly what they want to, all day long.

Thanks for reading!