With ten years of real-world experience as a physician anesthesiologist, there are a few things I wish I would have known as a young buck just starting out.

Presenting, The Top 5 Things I’d Tell My Younger Self

1. You don’t need to build a 4,000 square foot home.

There’s a reason really nice homes are called “dream homes.” We long to own one someday. We can’t wait to be able to afford the home we’ve dreamed of for years. When you sign your first contract as a physician, the dream home can be yours.

“Don’t do it, younger self!”

Hindsight is 20 / 20 in this case, but I am one of many young physicians who made the mistake of building or buying too much home too soon.

Renting is not “throwing money away,” but that is a common misconception. While you don’t have to be a renter for life like Jim Collins or Jeremy, you’re not obligated to sign up for a mortgage two or three times your salary as soon as you can afford it.

You can buy a house. But wait until you’re settled and satisfied in your first job. Wait until you’ve made partner. Wait until you know the neighborhoods, the schools, and the local real estate market. Take your time. There will always be homes for sale. Even dream homes.

2. Take some time off.

For the first five years of my career, I was paid as an independent contractor, with a daily and sometimes hourly rate. Such an arrangement presents as a bit of a double-edged sword. On one hand, I was rewarded for every day worked, and long days often meant extra pay.

On the other hand, a day off was a day without pay. I found myself refusing to take a day off here and there. I’d ask the question, “Would I pay X number of dollars for a day off?” Of course not.

What I failed to realize is that a long weekend to rest and recuperate is worth every penny. Not earning money for a day isn’t the same as spending. Financially, I did well in those early years. What I failed to realize is that my free time was more limited than my future earning power.

3. There’s a site called Bogleheads. Become familiar.

Less than a year after I finished residency, Bogleheads.org was created and populated by members of the Morningstar Vanguard Diehards forum. If I would have discovered the site back then, I would have been off to a very advantageous head start in my personal finance knowledge.

Fortunately, thanks to books like The Only Investment Guide You’ll Ever Need, I avoided most of the major investing mistakes that are common among young professionals.

By the time I discovered Bogleheads, and really got my financial house in order, the site had been around for six or seven years. On the plus side, there was now a wealth of information, and most questions I could dream up had been asked and answered time and time again.

4. It’s OK to say No and “regretfully decline” invitations to serve the hospital’s administration.

In my first full-time job, I never said No. I served on the medical staff quality committee, the medical executive committee, and eventually served as the medical staff president-elect which came with a position on the Board of Trustees.

I spent many hours in committee meetings on post-call days, evenings, and even weekends. How was I compensated? An occasional free meal, usually catered by the hospital cafeteria.

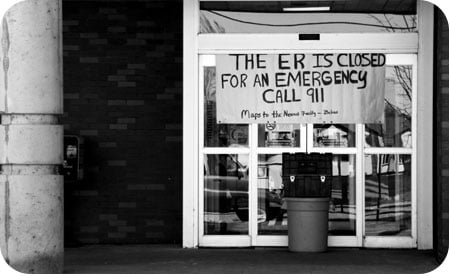

At the time, we were just starting a family at home, which gave me a much better place to be, but I felt I was obligated to say Yes when asked to serve. I was relieved of all my duties when the hospital was facing bankruptcy, and ultimately shut down. My involvement with the Board led to some future unpleasantness that included being personally sued for millions of dollars.

If I could go back to advise my younger self, I would recommend channeling my inner Nancy Reagan to Just Say No.

5. Buy AAPL. And the Giants will upset the undefeated Patriots.

It’s easy to look back at past performance with a woulda, coulda, shoulda. Seeing outsized gains and upset picks makes you wonder What If?

It would be tempting to give myself some hot stock tips or slip myself a Sports Almanac a la Marty McFly. Of course, that would give me a ridiculously unfair advantage. I might as just give my younger Self the winning powerball numbers.

Then again, lottery winners don’t end up all that happy, and even without the almanac I find myself in a rather enviable position 10 years later by taking the returns the market has given me. I won’t need to find a shortcut to financial independence. I can blaze my own trail.

If you could time travel back to the beginning of your career, what one thing would you tell your younger Self?

53 thoughts on “Top 5 Things I’d Tell My Younger Self”

A big house sure is a nice status symbol but it comes with big payments, and not just the mortgage. Taxes, maintenance HOA fees etc can easily be 10% of your mortgage payment. And as humans are wont to do, you WILL get used to your new digs and get the itch to look for a bigger house. This is one area of life where I would definitely caution people to be content.

And thank you so much for mentioning the giants beating the patriots. As a die hard Giants fan, I’m overjoyed when I meet Patriots fans because we are the only fan base who they have nothing to say to. Tom Brady will always have nightmares of Eli Manning.

Start your taxable account sooner. Having 100,000+ sitting in a (“high yield”) bank account for years allowed me to FEEL like I was doing the right thing, but I missed out on many years of returns and I’m kicking myself for it. Now I’m sitting here in my mid-30s, having discovered FIRE in the last year or two, looking at a longer horizon to FI than I would have had if I had made ALL my money work for me sooner. Start early, kids!

Just seeing this post now, but I think it is an important one to share. Though you can’t go back and share wisdom you have learned as you get older with your younger self, being able to accept, and acknowledge, this growth is important for your future. Thanks for bringing this up and I enjoyed reading your list!

Thank you, David. I can’t change the past, but a younger person in a similar situation CAN change his future.

Cheers!

-PoF

I would tell my younger self to get a Roth asap. And to not stressing over job changes.

Love this article, PoF, you share some great wisdom here! Funny coincidence, I wrote a guest post for another blog earlier this week, should be out sometime today. The original title was 3 LESSONS FOR MY YOUNGER SELF, and I also made reference to the “Just Say No” ad campaign, lol. I ended up changing the title, and unfortunately for the blog I wrote for, my post wasn’t nearly as good as yours, but I had to chuckle when I saw this. : )

Oh, don’t sell yourself short. And never miss an opportunity to link! What post was it?

Cheers!

-PoF

Hah, thanks! Here’s the link. Frugal PhD just released it on her blog today 🙂

Thankfully, right after dental school & residency I found MMM & let me say What a life changer it was for my husband & I.

We trade our high-cost living style to moved back home to be closer to the his family &mine. What started out as a temporary living arrangement with his parents, became a permanent solution for 4 yrs . That’s how long it took me to pay off $200k federal loan debt at 7% interest rate. We’re not FI yet, but our working arrangements rock. We’re not burnt out in our profession like others. Frugal living help us kept more $ we make & enjoying life without high interest debts ( we have 280k mortgage debt at 2.99% ). Most of my friends said I’m quite lucky to be able to work whenever i want. But i feel like the lucky part was discovering MMM & FI blogs like POF, madfienist, retire at 40 etc. – long time lurker / fan

.. Ironically, when I try to preach frugal living to my peers, all i hear is denials, ” i can’t live like that because [insert excuse here]”

I cant believe that there are people out there buying new phone every 2 yrs & paying month to month protection plan (because it’s an expensive phone/note/ipad/gadgets) ; or life insurance is good retirement plan.

These are great tips. I recognize the importance of taking time off and rejuvenating, which is why I place a lot of value on my sleep and have to make sure I get an average of 8 hours per day throughout the week. Have to pay off my sleep debt!

I would give the exact same advice to my younger self. I took on way too much responsibilities and had almost no time for social events (I think I saw my close friend once a month) and now I’m constantly trying to allocate my time to the highest value adding activities and the lowest value adding activities go to the lower end of my schedule planning. Have to make sure to maximize my time!

and what about advising our young selves- the scut monkeys- to take it easy? How much angst, frustration, disbelief, self doubt and self deprecation do we go thru in our intern years? (in addition to the physical exhaustion, hah hah). This too shall pass, say older and wiser ourselves.

Indeed, Sergey.

“Life moves pretty fast. If you don’t stop and look around once in awhile, you could miss it.” -Ferris Bueller

I would tell my 18-22yo self to get much better grades in undergrad so I could have been competitive for my state med schools, instead of having to go private with a 60k/yr COA (or wish someone had told me that was a terrible idea, although I do have great friends and memories from med school). Thankfully in residency I stumbled upon Tobias’s book, then Millionaire next door, random walk, bogleheads, and WCI. So saving for retirement, paying a hefty chunk of take home pay every month to student loans and having 2 young kids has made #1 a non-issue for now! I’m just 2 years out of residency, had a couple years between undergrad and Med school. I’m hoping to be debt free by 40, then back in debt by 41 with a reasonable home for the family.

Strong advice. I was fortunate to be able to stay on for another four years at my in-state public university. The transition was super easy. My student ID number didn’t change and it was used when test scores were printed and posted on the bulletin board. I still remember that number; I expect I always will.

Your path of discovery is remarkably similar to mine. I also had (and realized) the goal of being debt-free by 40.

CHeers!

-PoF

Great ideas to tell your younger sellf PoF.

The biggest financial mistakes we can make are usually around debt. I noticed you didn’t have any of those in your list (unless the ‘too much’ house included a mortgage?)

I would have told my younger self to pay off student debt before building a house.

Didn’t you have any debt coming out of medical school? That’s an enviable position to be in if it’s true.

I did take on some serious mortgage debt, that’s true, but never credit card or other consumer debt.

Attending my in-state flagship University with scholarships for undergrad and medical school kept my student loans lower than they could have been otherwise. I ended up with a high five-figure student loan balance. It would have been a low six-figure balance but when my physician Grandfather passed, the grandkids’ inheritance was set up to help pay for education.

Best,

-PoF

Nice! Beats the 50 grand in debt I had coming out of school.

I had a bit more than that, actually, but after 8 years of schooling. I was in the black after 4!

#1 is really good. #2 I’m still struggling with a little. I sometimes find myself working too much and not taking enough vacations, but my rationale (or rationalization, perhaps) is that I’m still in my prime/young working years and struggling to accumulate money as fast as possible to retire early, so it will pay back in the future with interest (literally and figuratively). Hard to tell whether I’m kidding myself or not.

The only thing I’d say about #1 is maybe don’t wait until you make partner before buying any home at all. But definitely don’t buy the big “I’m-a-hotshot-attorney” home before you make partner. Before I buy a property, I usually engage in a number-crunching exercise assuming I make about $30k less than I really do. That way I know I’m not pushing my budget too far. But at least I have a roof over my head that is also an investment (because it really is both, especially if you’re buying less house than you can afford). Plus, I think it’s easier to upgrade houses later than it is to come up with a huge down payment from scratch.

Excellent points, Yetisaurus. [I love typing that name!]

One argument against taking time off early in your career is the future value of that money earned. A week’s income at age 30 can grow to 2 weeks of income in 10 years, 4 weeks of income after 20 years, or 8 weeks’ worth after 30 years.* So if you plan on working 20 to 30 years (I don’t) you might rather work the week now to save yourself a month or two of work later.

* Many assumptions here, using the Rule of 72, assuming 7.2% interest, and more or less ignoring inflation and the possibility of higher earning power in later years (which isn’t much for most physicians — if anything, earning power may be shrinking in future years).

Best,

-PoF

Thanks, PoF! I’ve never had anyone react so positively to the name before. 😀 Yes, your point about future value is exactly what I meant. Hard to find a balance, though, too.

Number 4 is a game changer. The power of NO is immense, but we are conditioned by society, medical school, and residency to always say yes. Most of the time the things we say yes to serve others at the sacrifice of ourselves, and in the grand scheme of things don’t make a difference anyways.

And yeah, 4000sq ft is too many. I didn’t go that big, but definitely have more house than I need. But that’s OK because it is an ‘investment’ right? (sarcasm)

The Power of No, you say? Tell us more!

I would have responded sooner, but I was busy pushing my 40v electric lawnmower around my double lot. Fortunately, the 3-car garage and ranch home cover a lot of ground, so I can get it done on the charge of two batteries.

Cheers!

-PoF

p.s. Today is IPA Day. You’re welcome.

Haha! Good timing for my post today. I only have stouts on hand, so it looks like a bike trip to the store is in order 😉

Along with Bogleheads, I wish I’d found Mr. Money Mustache and Marie Kondo sooner and might have avoided the too-big house entirely.

Learning to say no to extra duties at work goes hand in hand with decluttering and living simply–it’s prioritizing your own values over the requests of others. Of course we all want to lend a helping hand and pay it forward, but there are plenty of other ways to do this besides sitting on hospital committees.

If I could go back only five years, I would bookmark MMM and WCI when they were in their infancy. I’m still figuring out the clutter issue. Decluttering takes time, at least the way I do it, hemming and hawing over every worthless thing.

Cheers!

-PoF

#4 is huge (HUGE!) and under appreciated. As a physician and career professional, you always want to move forward and upward and feel honored and flattered by fancy titles and such.

I played seven years in such a leadership role, and while my free dinners were apparently better than yours, they came with headaches and aggravation. Meetings became more numerous and complex.

One day, while in a contentious meeting, I looked around and realized that everyone else in the room, administrators and employed physicians with administrative stipends, was getting paid for putting up with this except me. Within a month, I started pulling pack on my administrative roles and within six months, I was out entirely.

All that time, everyone else is getting paid, and you were not? That is absurd. I have seen places that reimburse physicians for their time. I’ve actually been on the medical executive committee and chaired small departments at two different hospitals, and have never seen a dime.

If I’m going to volunteer, I’m going to do something more fulfilling and worthwhile than revising and renewing bylaws, and dealing with problem physicians.

Best,

-PoF

Stay fit. Better health means a better qualify of life, however long that life may be. cd :O)

I couldn’t agree more, Chris!

I am soooo glad we didn’t do #1! That is one of the big reasons we are FI. House is paid for and we’ll be selling to downsize even more next year. The space might have been nice – but we likely would have filled it with just more stuff. And #4 – ouch….yep, I said yes to almost everything! And once people find out you’ll say yes – they just wait you out and they are off the hook!

I hear you, Vicki. In my current job, I’ve said Yes to one project / committee with a limited timeframe, but I’ve made a point of saying No to everything else.

Best,

-PoF

Great advice PoF and I can particularly relate to #1. Coming out of a top b-school program several years ago, we got into our “dream” house. It’s not quite 4,000 s.f., but it’s pretty darn nice. If we had stayed in our more modest townhome, I would be FI right now.

On the other hand, I was down in the basement playing pool with my son the other day and I thought, “wow, this house is really nice.”

The struggle is real! lol!

I’ll admit I wasn’t unhappy there, but I completely overbuilt for the area, and sold the home years after we moved out for nearly a quarter million less than what we had into it.

Our current home isn’t that much smaller, but is 60 years old and cost less than half as much as the house we once built.

Best,

-PoF

p.s. We had a ppol table in the basement, too. Now, I could only fit a bumper pool table. Or maybe foosball. 🙂

My advice to my younger self would be “Live within your means, moron!” When I got out of school, I had about $64k of school loans, mostly taken to subsidize my lifestyle, not just for tuition, and about $16k or so of credit card debt. Again, coming from lack of discipline in spending and not saying NO when people asked me if I wanted to “go out.”

On the other hand, because we were throwing so much money towards my debt the first 2 years of our careers, when they were paid off, we were already living below our means, and used to not having big chunks of our pay, so they went into “not 401k” type of investments. That helped with our savings rate being so high early on.

It sounds like your debt turned into a valuable life lesson, Mr. SSC. The vast majority of us physicians start out with whopping debt levels, but that doesn’t stop most from living at or beyond our means anyway.

Best,

-PoF

I have an article scheduled with nearly exactly the same title! Wow super cool. I also have another article for my older self ?

I was inspired by mercy me’s song dear younger me!

I’m familiar with Marvin Gaye’s Mercy, Mercy Me, but not the band. I learn something every day. Advice to your older self… that will be interesting.

Best,

-PoF

Ooh, the Giants v Patrits comment put a dagger to my heart. Ouch.

I would also add a reminder to myself to send a note to Jim Collins to hurry along with his stock series. That, combined with Bogleheads forum is investor learning gold.

Well, the previous comment was actually Mr. PIE. The perils of Wordpress and not paying attention….

And he takes full responsibility for the typo also. Amazing what lack of coffee and not being fully awake does to you.

Brits are allowed (and expected) to have one typo apiece, and not expected to care about what we call football. It’s kinda cool that you do, actually.

Cheerio!

-PoF

The advice I’d give to my younger self is that when your roommate moves out of your two bedroom / two bathroom efficiency apartment right next to every major train, you should take over his room, drop your rent by a couple hundred dollars a month and rent out the other room on AirBNB. You’re never home anyway, you’ll easily make $150+ a night, you can block out times when you want the place all to yourself and you probably won’t have to pay rent again for the rest of your time in NYC.

That would have worked out very nicely, BigLaw. Did AirBNB exist back then? Pardon my ignorance. I used AirBNB (and Uber) for the first time last fall. I’ve become a late adopter in my oldish age 😉

Cheers!

-PoF

I agree with your self-assessment. Buying too much house is extremely common. Spending time on hospital committees is a thankless waste of time. I did buy some apple and I guess will be passing it on to my heirs one day. My own personal mistake was hiring an interior decorator.

As emasculating as it sounds (and is), I am the interior decorator in our household. Picture a Mad Men set on a local public access budget.

Cheers!

-PoF

Solid tips, PoF. I could see the struggle with not buying a nice big house right out of residency. You’ve just worked your tail off for years studying and residency, now you have your first big paycheck and it’s time to enjoy it. You worked hard and you earned it mindset. Easily justifiable and hard to have that discipline to wait a bit longer until your more settled.

Thanks for the post!

The term “delayed gratification” is repeated so often throughout our training, we feel compelled to overspend to complete our destiny, like it was written on a runestone or something. Turns out, it’s not mandatory after all. I learned that lesson the hard way.

Best,

-PoF