My pal Dr. James Turner at The Physician Philosopher likes to write about the 20% you need to know to achieve 80% of the results in personal finance. He even wrote a book detailing that 20%; I recently read it on vacation and I highly recommend it.

Here at Physician on FIRE, we spend a fair amount of time exploring the other 80% you might want to understand to eke out the most optimal results. Today, we’ve got one such post, and it deals with asset location for a model early retiree.

Note that asset location and asset allocation are not the same thing, and our author explains that difference. Today’s post was written by Dr. David Graham, who shared with me the following bio:

David Graham, MD, is a practicing Infectious Disease physician and blogs at FiPhysician.com. After discovering his passion for personal finance, he started a Registered Investment Advisory to promote his mission of “Financial Literacy for Physicians.” For personal enjoyment, he recently sat for and passed the CFP exam.

Asset Location and Making Your Money Last in Early Retirement

The debate rages on: Bonds go in your taxable!

Or is it: “bond fund(s) are tax-inefficient… and belong in a tax-deferred account.”

The White Coat Investor and Physician on FIRE don’t agree on everything.

For those pursuing early retirement, who are we to believe?

Does asset LOCATION, how you distribute your desired asset allocation in your always taxable (IRA and 401k), sometimes taxable (brokerage), and never taxable accounts (Roth), influence your net worth in early retirement, or is it much ado about nothing?

Bogleheads has a nice Wiki on asset location, but one may be left slightly confused after a thorough reading. “It is best to understand the basic principles and then apply them to your situation.”

Another quote from the Wiki is revealing:

“The situation may change in retirement, when the funds are withdrawn for income (decumulation phase). It is possible under some combination of lifetime investing results and lifetime individual tax situations to be better off doing the opposite of the strategy recommended here.”

Well, that helps.

What would PoF do in early retirement? Let’s look at his portfolio and find out!

The PoF Portfolio

When asked, PoF suggested a solid asset allocation for early retirement. His actual portfolio is more complex and nuanced (as is real life), but he suggested the following (and I’ve added expected future returns):

- 50% US Total Stock Market (7%)

- 10% Developed International Stocks (7%)

- 10% Emerging Markets (8%)

- 10% REIT (8%)

- 20% Total US Bond Fund (3.5%)

Of course, if the expected future returns of asset classes were known, we would all be rich and not need to worry about asset location. Generally, however, over long periods of time, you might have higher average returns from Emerging Markets and REITs than from US and International funds, which all usually have higher average returns than bonds.

REITs kick out K-1 income, which is taxed as ordinary income rather than at the more favorable capital gains or qualified dividends rate–more on this below including the 20% QBI deduction. Interest from bonds is also taxed as ordinary income. REITs and bonds share a tax disadvantage and portfolio placement should be carefully planned.

In addition, PoF has three types of accounts to consider: he suggests we distribute his portfolio 50% in brokerage, and 25% each in an IRA and a Roth IRA. (Excellent retirement tax diversification).

So, how should an early retiree locate or distribute his funds in his different accounts?

The Scenario for Early Retirement

Assume the early retiree is 44, married, and working for 5 more years. After retirement, let’s follow the portfolios for 15 years to see the effect of asset location on net worth in early retirement. Retirement income is taken from the brokerage account, and the IRAs grow in the background for future use.

At 44, they have $2,000,000 in assets with 50% in their brokerage account, 25% in a rollover IRA, and 25% in their Roth account after aggressive (and perhaps ill-timed) conversions.

Working part-time, they earn $120,000 for the next 5 years and then will retire and live off of the accumulated nest egg. They spend about $80,000 a year, approaching a 4% withdrawal rate.

Income increases 2% per year, and inflation sits at 2.5% overall and 5% for healthcare.

Asset Location Models

Let’s look at the next 20 years for this couple given three different asset location models. (Download the spreadsheet to enter your own info)

Figure 1 (Good location model)

The first model named “Good” asset location has bonds and REITS in the tax-deferred accounts and invests most aggressively in the Roth account.

Figure 2 (Even location model)

The second model “Even” has even asset location between the three account types

Figure 3 (Poor location model)

The third model dubbed “Poor” has the least tax efficient funds (bonds and REITs) in the brokerage account.

The Results Are In

Let’s see how these plans perform over time.

Figure 4 (Asset simulation)

Figure 4 shows simulated assets with confidence levels over our 20-year investing timeline. Results from all three models are similar, so the Even asset location model is shown.

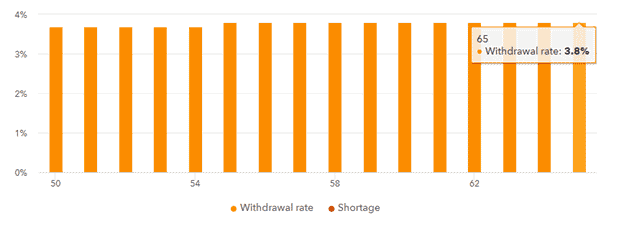

Figure 5 (Withdrawal rate)

Withdrawal rate (again shown for the Even asset location model) in figure 5 starts at 3.7% and increases with inflation. It is 3.8% after 20 years.

Cash Flow Analysis

So how do our plans perform in the first decade? First, let’s look at tax efficiency via cash flows from the Good and Poor asset location plans.

Figure 6 (Cash flows for Good asset location)

Figure 7 (Cash flows for Poor asset location)

As we can see in Figures 6 and 7, income and expenses are the same (expenses go up in retirement to account for health insurance starting at $10,000 a year).

Tax payments are quite different between the two models. In the first 5 years, taxes cost $178,606 for the Good (tax-efficient) portfolio and $215,243 for the Poor (tax-inefficient) portfolio. The Even asset location plan (data not shown) splits the middle and pays $198,403 in taxes.

Net flows initially are positive for the Good plan and negative for the Poor, but note they are very similar by 2030. Tax payments are also similar by then. We will see why later.

Account Balance and Net Worth After 20 Years

So how do the plans do after 20 years? Let’s find out.

Figure 8 (Good, Even, and Poor asset location model account balances)

| Year | Age | Brokerage | IRA | Roth | Total | ||

| 2025 | 50 | 1,424,140 | 639,995 | 784,662 | 2,848,797 | ||

| Good | 2030 | 55 | 1,323,716 | 786,167 | 1,142,290 | 3,252,173 | |

| 2035 | 60 | 1,008,188 | 965,725 | 1,662,915 | 3,708,828 | ||

| 2040 | 65 | 621,207 | 1,186,293 | 2,420,828 | 4,228,328 | ||

| Year | Age | Brokerage | IRA | Roth | Total | ||

| 2025 | 50 | 1,357,460 | 729,571 | 729,571 | 2,816,602 | ||

| Even | 2030 | 55 | 1,189,776 | 999,576 | 999,576 | 3,118,928 | |

| 2035 | 60 | 867,531 | 1,369,505 | 1,369,505 | 3,606,541 | ||

| 2040 | 65 | 317,723 | 1,876,341 | 1,876,341 | 4,070,405 | ||

| Year | Age | Brokerage | IRA | Roth | Total | ||

| 2025 | 50 | 1,278,657 | 750,365 | 767,354 | 2,796,051 | ||

| Poor | 2030 | 55 | 1,030,131 | 1,052,426 | 1,096,521 | 3,179,078 | |

| 2035 | 60 | 618,253 | 1,476,082 | 1,566,890 | 3,661,225 | ||

| 2040 | 65 | 0 | 2,041,098 | 2,239,030 | 4,280,128 |

As seen above, the balance in the brokerage account grows more at retirement in 2025 in the Good and Even plan than in the Poor plan. It is then spent down in all plans, all the way to zero in the Poor plan.

The IRAs grow in the background. They grow equally in the Even plan. In the Good plan, however, the Roth IRA is invested much more aggressively and grows substantially more. Make note of this, as further discussion follows.After 20 years, the total balance is ~$4.2M in both the Good and Poor plan, and $4.0M in the Even plan.

We can now see why the tax liabilities are the same in the Good and Poor asset location plans by 2030. The brokerage account in the Poor plan not only suffers from higher initial taxes, but also lower yields from the bonds. By 2030, asset levels are low enough that despite ordinary income liability, taxes are equal to the higher, more efficient, Good asset location plan.

Does Asset Location Matter in Early Retirement?

So, what can we learn about asset location in early retirement?

If you have other income, tax liability increases when the brokerage account is loaded with tax-inefficient funds. In this example, this amount is $36,637 over 5 years. Over 20 years, however, there is no difference in the size of the retirement assets. An even distribution of portfolio allocation leads to a ~5% decrease in retirement assets compared to the other plans.

While taxes need to be considered in proper asset location, higher expected returns drive the truly important results. Returns matter–and returns compound over time. Especially consider expected returns in your tax-deferred and tax-free accounts, but note that stuffing your Roth is not a free lunch.

As an example of the difference due to higher expected returns, revisit figures 1 and 8. The Roth IRA in the Good asset location plan compounds to more than two times the traditional IRA, thanks to the fact that 80% of funds pay 8% vs 80% bonds paying 3.5%. This 4.5% spread doubles in 16 years (using the rule of 72), which accounts for the large difference. Again, returns matter.

Bonds and REITs

Let’s look more closely at a few obvious fund choices when considering asset location.

Bond interest is tax inefficient and taxed as ordinary income. Bonds also have low rates of return compared to other asset classes. So why have bonds? Bonds offer portfolio diversification and dampen volatility. Especially peri-retirement, bonds decrease sequence of return risk and may allow better sleep. You invest in bonds because they are part of your planned asset allocation, and you locate them where they do the least harm vis-à-vis their low expected returns.

REITs are tax inefficient as well, but are expected to have higher returns over time than bonds. REITs pay K-1 income, which is taxed as ordinary income. Prior to the Tax Cut and Jobs Act of 2017, it made a lot of sense to own REITs in tax-sheltered accounts to avoid ordinary income. Section 199A (the Qualified Business Income 20% pass-through deduction) changed the math for REITs, however, as you can deduct up to 20% of the K-1 income from your brokerage account as QBI. All in all, still, REITs belong in tax-sheltered accounts.

Other examples of potentially tax inefficient funds are actively managed funds with short term capital gains, commodity funds, target date funds, and small cap value funds.

Additional Early Retirement Considerations

A few other issues must be addressed. Obviously, this simplified scenario doesn’t consider partial Roth Conversions, capital gain harvesting (or the 0% tax rate for qualified dividends in the bottom two tax brackets), or the standard deduction. If adjusted gross income is less than the $24,000 standard deduction for married filing jointly, no tax is paid regardless of the income source.

Additional issues with asset location depend on your mix of taxable vs tax-deferred accounts, FIRE maneuvers like the 72(t) SEPP or Roth conversion ladder, and, of course, when the money is needed.

Real life circumstances, such as limited investment selections in 401k, 403b or 457 plans, affect all portfolios. In addition, consider the rebalancing challenges if you only have certain asset types in specified accounts. For instance, with small cap value in a Roth and the total market index and bonds in a brokerage account, how does one rebalance after a 10-year bull market?

Should I Worry About Asset Location?

Asset allocation trumps asset location for the retire early crowd, as savings rate trump both when you are just starting out.

So, what should someone planning early retirement do?

The big picture: start with asset allocation. What percentage of bonds are you comfortable with? What tilts may potentially juice your returns? REITs and emerging market index funds are tilts in this scenario, but other considerations are small caps, value funds, sector funds, etc.

Then consider asset location. First, place your high-return tax-inefficient assets in your tax-deferred accounts. Next, place your high-return tax-efficient assets in your brokerage accounts. Finally, low return assets (like bonds) fill in the remaining voids.

Sounds like WCI and PoF both got it right. As seen after 20 years of PoF’s fictional portfolio above, where you put bonds doesn’t much matter if you get the big picture right.

[PoF: Well, I’m relieved to here I was right. Or not wrong, at least.

One thing I’d like to point out that Dr. Graham alluded to is the fact that the “poor” model does leave you with a similar amount of total money as the “good” model. However, there is a heck of a lot more still in the tax-deferred IRA (by ~ $850,000) and a lot less in the Roth IRA (~ $200,000 less) and the taxable account in the “poor” model is depleted.

Taxes will continue to affect the “poor” model much more than the “good.”

In my most recent portfolio update, I had about 48% in taxable brokerage, 18% in tax-deferred, 23% in Roth, a smidge in an HSA, and about 11% in crowdfunded and other investment real estate (also taxable investments).

With the tax-deferred portion representing under 20% of my retirement nest egg, I can safely say to most people, “My Money Is Worth More Than Your Money.“]

Where do you keep your bond allocation? How important do you think asset location is to your overall investment and retirement plan?

28 thoughts on “Asset Location and Making Your Money Last in Early Retirement”

This does not seem to account for spendable dollars after taxes, specially if you cash out. Your taxes depend on several things, including state taxes, but if you assume 10% less taxes on taxable/brokerage account, and 35% less taxes on the Roth, then at age 65, you are 7% ahead with the good location. If you cash out and die, with cost basis step-up and no marginal tax on taxable/brokerage, then still 7% better with good location. Not a huge amount after 20 years, but could be a few years of expenses for you or your beneficiaries.

FIPhysician,

My situation: 43yo, retiring FIRE-style in 5 years with a pension (w/COLA) of roughly $70K/year in today’s dollars, and roughly $1.3M in a Bogleheads-style 3-fund portfolio invested in a tax-smart asset location manner across our Roth IRAs, Roth 401k, and brokerage accounts. In addition to my pension, we’ll need to pull out roughly $40K/year from my brokerage account in order to meet our expenses–which are many due to having five kids, paying for some college, and we’ll have a new mortgage (b/c we never owned a house while in military).

My question: for purposes of drawing off the $40K/yr from the brokerage account (since I won’t tap into retirement accounts until a decade later), which type of bond or other asset works best in the taxable brokerage account? Our tax bracket is low enough to where municipal bonds don’t make sense (or so I’ve been told), yet a Total Bond Market Index Fund is not tax-smart either. If I’m not as concerned about the long-term eventual returns but rather the provision of something more like “Bucket 2” during the first FIRE decade, what’s the best avenue? Hopefully I’m asking this the right way. Many thanks!

“REIT’s kick out K-1 income”

Don’t think so.

Maybe I’m lazy but is it worth the mental space for optimizations to eke out 4.2M$ vs 4M$?

I’ve recently been working on the point of view that the time something is floating around in my head might as well be time spent working. Its a little aggressive but it has helped me to clear away some of my mental clutter.

My wife is happier too with me droning on about weird financial schemes less often now 😛

Well, that 0.2 looks better when you write it out as $200,000.00.

And it is a 5% difference, which is enough for me to take notice. Either way, you’re wealthy, but if it’s a matter of putting all the right funds in all the right places, it seems worth doing.

Cheers!

The other Leif

I’m with you, Leif. Especially when it’s all hypothetical in the first place. I’m not against hypothetical discussions (I actually like them), but agree, 4M vs 4.2M isn’t worth sweating.

I’m a bit confused by figure one. The article discussed putting REITs in your tax deferred account, but the ‘good’ portfolio in figure one seems to have that allocation in the Roth account instead.

Interesting writeup though, appreciate it.

I worked from the other direction. I moved my risky TIRA assets into a Roth first and paid the taxes. I left the least risky assets in the TIRA. Money from the TIRA comes out as ordinary income. Money from SS comes out as ordinary income and income tax is based on ordinary income. I whittled down the TIRA so only about 500K of low risk was left and moved the rest of the TIRA to a Roth. Upon RMD you won’t pull money out at some number like 3.5% but at the RMD schedule which starts at 3.56% is over 5% by year 10 and over 8% at year 20. As the RMD goes up taxes go up and as SS goes up taxes go up and you want the assent to be orderly and predictable. While you stay in the 12% bracket LTCG is 0% so it’s good to control growth starting in the middle of the 12% before you actually move to 22% Bonds pay in ordinary income so bonds are the obvious choice for the TIRA.

My income supplements from brokerage sale of stock. I just let the stock reinvest and don’t worry about using it to produce a dividend income stream. I want some money I sell some stock. I therefore have very good control over the tax picture with a slow and steady growth in ordinary income in the 12% bracket supplemented and it comes out a whatever the RMD rate dictates. Any extra fun money comes from a large Roth which provides me self insurance plus a new car once in a while. It’s simple strait forward and predictable. I built inflation into my model as well. I have a yearly readout on taxes. I don’t care about asset mix anymore only that my portfolio lives on the efficient frontier which tells you the amount of risk you are taking. A saying is the amount of risk you take is equal to the amount of income you can afford to loose. It changes the picture on risk tolerance. If you’re all stock your income can vary as much as 15%. If you’re REIT closer to 20%. Screw that. So my AA is devised around 9% and as time goes on I may reduce that more as I get closer to death. I was able to calculate my retirement need over the next 20 years it’s 2.6M. I tracked my expenses for 2 years to come up with a real budget and then stress tested my budget to see what “cutting out the fat” felt like so I have a good handle on that tied to reality. I have plenty of money more than the 2.6M I’m slated to need. Point being all of this can be quantified and optimized actually quite precisely.

Nice article! From a tax perspective, wouldn’t you always want your INTL allocation to be in your brokerage (taxable) account, so that you can take advantage of the foreign income tax credit? I realize it generally doesn’t amount to much, but if we’re talking about “optimal” here…

I’m with you there, Adam.

I have had my total international and developed markets in taxable only from day one, and I just recently indirectly “migrated” my emerging markets from Roth to taxable.

I plan to write a post about that at some point this summer. I’ll be getting a 4-figure foreign tax credit for the foreseeable future, so it’s not an insignificant point for me.

Cheers!

-PoF

If you are putting higher risk/return investments into the roth it is raising your overall risk. There is no free lunch. This scenario puts the REITs and Emerging in Roth and they are being predicted by the author to outperform over this time frame. All that roth money is yours but a portion of the IRA and Taxable account will go to the taxman. We are comparing apples to oranges here.

Also bonds are paying low interest now. If interest rates rise then they become way more tax unfriendly. That was the point of the WCI post mentioned.

I think these issues make the spread between the good and bad portfolio more pronounced .

Yep — the asset allocations look the same, but they’re really not, since your after-tax balance of the assets in the tax-deferred accounts are effectively smaller, just as the Roth allocations are effectively higher.

To me, the conclusion is still that asset location does matter. But it’s not likely to make or break your plan. We’re pretty thick in the weeks of the 80% that makes the final 20% of a difference.

Thank you for the keen observation.

-PoF

My take on the numbers was it doesn’t matter which you do. All continued to grow from about 2.8M to over 4M. All had great results. So don’t sweat the small stuff.

Dr. Cory S. Fawcett

Prescription for Financial Success

There’s some Pareto Principle wisdom right there.

Cheers!

-PoF

Good discussion. Tax efficiency is the easiest form of “alpha” and everyone can do it.

In the discussion where bonds belong, I’m squarely in the PoF camp: bonds don’t belong in the taxable account. Period. The WCI post referenced here has a pretty obvious logical flaw: comparing apples and oranges because the stock/bond allocation deviates so dramatically over time in that numerical example. If you were to compare apples to apples and keep the overall stock allocation the same over time then, indeed, you find again you do better with stocks in the taxable account and bonds in the Roth. Conventional wisdom confirmed!

Big ERN,

Thanks for the comment. Have you thought about any ways to model asset location during de-accumulation? I would love to hear your thoughts on SWRs and asset location.

Nothing too formal. For us personally, we’ll withdraw from taxable accounts and do Roth conversions until age 59.5. Then withdraw from the 401k. We’d make sure we always have enough in the 401k/IRA to have a lifetime supply of withdrawals to fill up the standard deduction (0% tax bracket). Then use the taxable accounts and Roth to finance the rest. We shall see how the tax landscape looks like 20-30 years down the road. A lot can change!

Hey ERN, always respect your high-level expertise. I can’t quite wrap my head around a related concept. At the drawdown stage, not necessarily during EARLY retirement and given > $5 million in mutual fund/bond funds total assets in all 3 tax-treated account types, plus enough passive commercial real estate investments generating $100,000 cash distributions, generally one would do Roth conversions in the lower income years before SS and RMD’s (depreciation is still offsetting the RE cash) between, say, 65-70 and initially draw from the taxable account to live on.

But if the market crashes (SORR) as in 2008 where pretty much ALL equity subsectors took a significant hit, don’t you need some uncorrelated assets like bonds in the taxable account to last as long as the recovery time to avoid selling very low, even if you take some tax hit? I.E., isn’t the loss from selling very low often greater than the tax hit of maintaing bonds in a market crash in the taxable account?

…or is the answer that bonds are taxed in taxable the same way as if withdrawn from tIRA, thus no need to leave them in taxable? And thus would need to withdraw from tIRA first in this case, not taxable acct at all…?

I think you answered your own question.

You can effectively spend bonds that are tucked away in a tax-protected account by selling stocks from taxable and exchanging bonds for stocks in the IRA / 401(k), etc…

You don’t even need to withdraw any money from the tax-advantaged account. You’re just shifting money around to maintain or alter your overall asset allocation as desired.

Cheers!

-Pof

Yup, the answer is that simple. Money is fungible!

I had another thought re: bond funds in taxable acct. Yes, taxation of bond interest in one’s taxable acct is identical to tax-deferred accts, thus the conventional wisdom to avoid putting bonds in one’s taxable acct. BUT, in the taxable acct, one is taxed on the INTEREST only whereas in the tax-deferred, on interest and principal upon withdrawals. So, I am concerned that, with no more personal human capital in 1-1.5 years, I will enter a poor SORR as we do have the present ridiculously high Schiller Cape 10 stat and P/E ratios, etc. So perhaps I paid tax on, say, 50% interest on the bonds over some years in my taxable acct. After retirement I would need to access that bond money in a precipitous stock market decline to avoid selling equities low, which translates to having paid tax at the income rate on 1/3 of my bonds withdrawal (2/3 principal, 1/3 interest). But if instead, those bonds were in my tax-deferred acct, that would translate to paying tax on 100% (vs 33.33%) of the withdrawal. Again, I don’t want to touch the crashed equities in my taxable. So, I guess I am asking shouldn’t one NEAR RETIREMENT have some bond $ (or other non-correlated, ‘safe’ $) in taxable acct? Otherwise it seems in a very depressed stock market, one is forced to pay the inevitable higher tax proportions of, e.g., tIRA withdrawal in their earlier retirement years instead of delaying this. Not to mention the decreased space now for Roth conversions. And sure, the price I paid is paying income rates vs cap gains rates on that segment of bond $ in the taxable, but this doesn’t approach the potential tax liability for having to withdraw from tax-deferred accts in early retirement years and with less Roth conversion $. Assume I am in the 24% income bracket at retirement as I will do large Roth conversions. What am I missing?

Sequence of Risk at retirement is paramount

Can you afford a major loss of 50% equity

I think the answer depends on the retiree’s multiple of expenses / withdrawal rate.

At $2M in invested assets, probably not, but this is a hypothetical.

With a withdrawal rate of under 3% and / or additional passive (or active) income streams, then a 50% drop in equity values would not doom one’s retirement.

Best,

-PoF

First an outstanding guest post on WCI and now a great follow up on POF’s site. Color me impressed.

I love your level of detailed analysis and I was a bit surprised to learn that the good and poor portfolios were similar in value in the end (although POF does make a great point in his commentary that it still is better overall with the good portfolio). What is shocking is the hybrid compromise didn’t do as well as either.

I am not sure if you are going down the list of WCI network members but looking forward to your next guest post.

Thanks for the compliments! There are other guest posts in the works as you have guessed!

Yes, it is funny how the Good portfolio turns out the be better than the Poor portfolio on a post-tax basis. Almost like that was planned…

I was also surprised that the Even portfolio didn’t do as well. I’m not sure if that will have implications in my own portfolio or not.

Thanks for the shout out, POF.

I would love to hear the author’s opinion on municipal bond funds that avoid some of the tax issues and still allow for some bond location to be placed in a taxable account. Best of both worlds? Or not a good idea?

TPP,

That is another 80% type question and difficult to generalize. In the above scenario, the couple was in 22% tax bracket or less so municipal bonds likely don’t make sense.

Folks in the (say) 32% tax bracket, especially if they live in a high tax state (and even city) may want to consider munis, but they should do the math see if it makes sense.