Global population trends have been worrisome for many years now. Countries like South Korea, Japan, Italy, Spain, and Germany are dealing with plummeting birth rates that are reshaping their societies and economies.

Take South Korea, for example, where the recorded fertility rate was just 0.72 in 2023, despite the government spending billions to address the issue. The consequence? Aging populations, shrinking workforces, and economic models that no longer line up with the number of people available to support them.

Table of Contents

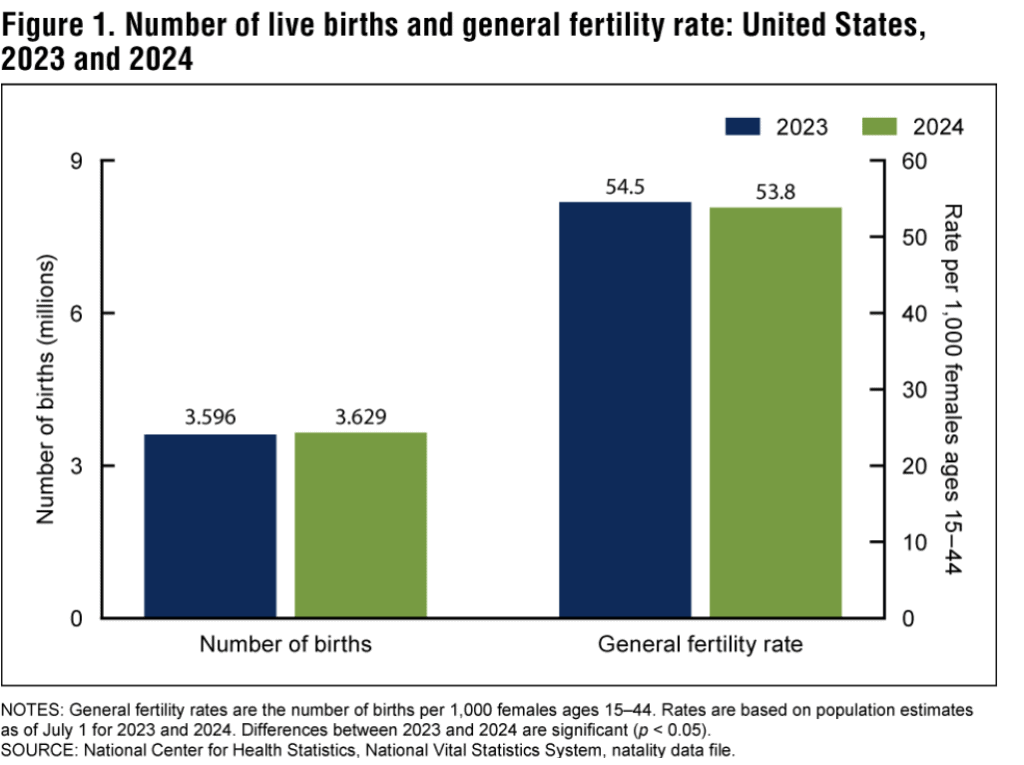

ToggleFor the U.S., things haven’t been so dire, thanks to a relatively stable birthrate and steady immigration. But that’s changing fast. The CDC reports that the U.S. birth rate hit a record low of 1.59 in 2024, down from 1.621 in 2023. That means 53.8 births per 1,000 females ages 15–44.

Source: CDC

That’s well below the 2.1 births per woman we need to keep the population stable without immigration. Fewer children means fewer future workers, which puts pressure on everything from social safety nets to economic growth.

So what’s our government doing about it? Enter the One Big Beautiful Bill Act (OBBBA), signed into law on the 4th of July, 2025.

We’ve covered many other aspects of this bill here before, but the buzz around the “Baby Bonus” or Trump Accounts, as they’re formally known, has been undeniable.

The House Committee on Ways and Means calls it a “pro-family policy” that gives kids “a strong start at life” and says these accounts will “grow alongside the economic revival that President Trump’s policies will deliver.”

The gist: Every kid born between 2025 and 2028 gets a $1,000 government seed deposit in an investment account. Families and employers can then add up to $5,000 a year. The money’s invested in a low-cost U.S. stock index fund and turns into a traditional IRA when the child hits 18.

The idea isn’t novel; baby bonds and similar child allowances have been floated before. But this one was touted as a silver bullet, promising free money just for having a kid. But the question remains: Will $1,000 make Americans want to have a baby? Or is this another case of “if it sounds too good to be true, it probably is…”?

Curious about How the One Big Beautiful Bill Act Affects High-Income Individuals and Taxpayers? Click to find out.

All That Glitters Is Not Gold

As mentioned earlier, a Trump account is an investment account automatically created by the federal government for every U.S.-born child with a work-eligible Social Security number, starting with those born between 2025 and 2028.

The hook is a one-time tax-free $1,000 deposit from the government at birth. Parents, relatives, and friends can add their own after-tax contributions, and employers can pitch in tax-free funds as well.

The annual combined limit is $5,000, with employer contributions seemingly capped at $2,500 a year. (I say, seemingly, because of a slight wrinkle in the language that could be interpreted as a $2,500 lifetime contribution cap for employers, though that may not have been the intention.)

Within the year in which the child turns 17, state and local governments, along with charitable organizations, can also make tax-free deposits without counting toward the $5,000 limit. (If they do so, they have to distribute the funds evenly across all eligible children in a defined year or region.)

Contributions can be made through the year the child turns 17, but no withdrawals are allowed before age 18, except in case of the child’s death.

In the meantime, all the money must sit in one or more low-cost, diversified stock index funds.

In the year of the child’s 18th birthday, the account morphs into a traditional IRA. From that point on, standard IRA rules apply, meaning the beneficiary can make withdrawals anytime for any reason, but early withdrawals (before age 59 1⁄2) mean a 10% penalty unless they meet one of the penalty exceptions.

Required minimum distributions work the same as they do for any other traditional IRA. Withdrawals are taxed as ordinary income when they come from employer, government, or charity contributions and investment gains. Only the after-tax deposits from family and friends come out tax-free.

All of this comes with strings attached: Contributions can’t start before July 4, 2026 (not January 1, as some sources claimed), and the $2,500/$5,000 caps will begin adjusting for inflation in 2028, not 2027. And while the citizenship status of the parents doesn’t matter, the child’s citizenship does — at least for receiving the federal $1,000 seed deposit.

In theory, parents might open a Trump account to grab the federal deposit, employer match, or any state/local/ charity contributions. But as financial analysts have pointed out, putting your own money in might not be the smartest move in many cases, as other types of tax-advantaged accounts could deliver better long-term benefits.

The Upside

The idea, of course, is not without merit, and there is certainly nothing inherently bad about having another investment option for proactive parents. Let’s look at what works in the Trump accounts:

- Automatic and universal enrollment means that there are no initial hoops to jump through. The account is opened automatically for every qualifying newborn. Parents don’t have to do anything to get that initial $1,000.

- That $1,000 is real money that every child born during the program years will get. It’s a financial head start, and for many kids, it might be the first or only nest egg they acquire.

- Because the money’s invested in the stock market, there’s a chance it will grow well over 18 years. The starting point may be small, but steady and meaningful contributions, coupled with the magic of compound interest, can lead to a nice little pot of gold at the end of the rainbow.

- Employers of the beneficiary’s parents can add up to $2,500 per child without it counting as taxable income for employees. For some families, this could be a meaningful workplace perk.

But Here’s Where It Gets Messy

Nice perks are all well and good, but if the cons outweigh the pros, the question usually shifts from “if” to “why”. Here are some of the reasons financial experts decried the provision:

- Let’s be real, $1,000 isn’t going to move the needle. Even invested over 18 years, that amount isn’t going to buy a down payment on a house or cover tuition. Opinions in online forums were pretty mixed on the idea, with one user calling it “a useless idea for its purpose- to encourage more babies to be born. It might be worth a month’s rent when the kid turns 18, so it might help a teeny amount for the young adult.”

- Families with the means can add the full $5,000 a year (or more if the employer chips in), potentially growing the account enough to be meaningful. Low-income families struggling to get by may never contribute, meaning their child only gets the initial $1,000. This policy actually risks widening the wealth gap rather than closing it.

- Unlike 529 college savings plans or IRAs, contributions to Trump Accounts aren’t tax-deductible. Withdrawals are taxed based on the child’s income bracket, and there’s a 10% penalty if the money isn’t used for approved expenses.

- As it stands, the Trump accounts proposal leaves big gaps in clarity. CPA Evan Morgan points out that although the money is meant to grow tax-deferred, the IRS will probably have to publish an approved list of “qualifying” index funds before anyone knows exactly where those dollars go. Even the tax treatment of contributions isn’t fully clear, including whether certain family gifts might trigger gift tax rules.

- Finally, beneficiaries can’t just take the money and spend it whenever. It’s locked until age 18, and even then, it’s only penalty-free if used for certain expenses like college, a first home, or childbirth.

Trump Accounts and the 529

To me, the Trump accounts feel like a patchwork quilt cobbled together from older ideas but missing the full design or fortitude.

It’s hard not to compare them to the “baby bonds” or other child-centric investment vehicles.

Here’s a look at how the Trump account stacks up against the well-loved 529:

| Feature | Trump Accounts | 529 Plans |

| Universal Enrollment | Yes, automatically created for all U.S.-born children in 2025-2028 | No, it must be opened by a parent, guardian, or other adult |

| Initial Public Deposit | $1,000 from the federal government | None |

| Private Contributions | Allowed up to $5,000/year (plus up to $2,500 from employer) | No contribution cap, but account owners need to factor in state laws and gift tax exemptions |

| Tax Treatment | Tax-deferred growth; taxable on withdrawal; some contributions may be tax-free | Tax-free growth and withdrawals if used for qualified education expenses |

| Withdrawal Flexibility | Limited with penalties for non-qualified withdrawals before age 59½ | Education-only (or incur a 10 penalty) |

| Investment Options | Must remain in low-cost diversified index funds | Wide range of portfolios, age-based funds, and state-specific funds |

| Control of Funds | Child becomes owner at 18; can withdraw for any reason (penalties apply) | Account owners retain control indefinitely and the beneficiary can be changed |

In the end, while taking advantage of every savings and investment option available is rarely a bad move, 529 plans have a long track record, better tax benefits for education, more flexibility in contributions, and broader investment choices.

Trump accounts may appeal because of their “free money” hook, but without ongoing investment and with rigid restrictions, they’re far from the most effective tool for long-term financial planning.

For most families aiming to save for college or other education expenses, a well-funded 529 is still the stronger bet.

Click to read more about the 529 Plan

The Bottom Line

Back in 2023, Senators Cory Booker and Ayanna Pressley championed a similar yet different concept. The goal wasn’t just to help families save, it was to actively narrow the racial and generational wealth gaps by ensuring that every young adult entered the workforce or higher education with meaningful capital for wealth-building.

Trump accounts, on the other hand, are the stripped-down, patchwork cousin. The progressive design has been replaced by a one-size-fits-all starter deposit and heavy reliance on private contributions.

And sure, if you’ve got relatives who can max out $5k a year and maybe an employer willing to kick in too, these accounts can grow into something meaningful. But let’s be real, that only applies to a sliver of families and does not a universal wealth-builder make.

This isn’t a political left vs. right. It’s about how we, as a nation, imagine digging ourselves out of the blow-burn crises we can see coming: stagnant wages, rising costs, falling birth rates, and widening inequality. Do we take the hard road and petition for policies that actually shift the starting line for everyone? Or do we stick to flashy ideas that make good headlines but crumble under the weight of everyday reality?

If the stated aim is to boost the birth rate, Trump accounts may draw interest from some would-be parents, particularly those less aware of the full financial and logistical demands of raising a child. But the hard truth is that a one-time $1,000 deposit won’t even come close to covering the real costs of parenthood. From childcare and healthcare to housing and education, the economic realities dwarf this starter sum.

A policy that promises “free money” for having a baby might sound enticing in a headline, but in practice, it’s more of a talking point than a lifeline.

Check out 11 Ways to Invest in Your Child’s Future

FAQs

Q: What are Trump Accounts?

A: Investment accounts automatically created for every U.S.-born child between 2025 and 2028, seeded with a $1,000 federal deposit and eligible for additional private and employer contributions.

Q: How much can be contributed each year?

A: Families and others can contribute up to $5,000 annually, plus employers can add up to $2,500 (possibly lifetime, due to unclear language).

Q: How is the money invested?

A: Funds must remain in one or more low-cost, diversified U.S. stock index funds until the child turns 18.

Q: When can the money be accessed?

A: Withdrawals are locked until age 18, at which point the account becomes a traditional IRA with standard IRA withdrawal rules and penalties.

Q: Are contributions tax-deductible?

A: No. Growth is tax-deferred, but withdrawals are taxed as income unless they come from after-tax contributions by family or friends.

Q: Who benefits most from Trump Accounts?

A: Families with the means to contribute regularly and employers offering matches; lower-income families may only be able to benefit from the initial $1,000.

Q: How do Trump Accounts compare to 529 plans?

A: 529s offer tax-free growth for education expenses, more investment choices, and greater control; Trump Accounts have universal enrollment but more restrictions.

Q: Will Trump Accounts significantly boost the U.S. birth rate?

A: Unlikely. $1,000 is far below the real costs of raising a child and may only appeal to those unaware of the broader financial demands.

Q: What are the main criticisms of Trump Accounts?

A: The small starting deposit, unclear rules, potential to widen wealth gaps, lack of tax deductions, and rigid withdrawal restrictions.

1 thought on “Are Trump Accounts the Trump Card America Needs? OBBBA and the Baby Bonus”

Combined with cuts to Medicaid, SNAP, etc. etc. etc…. Net loss for poor kids.