I think the popularity of the Paramount show Yellowstone speaks volumes about the underlying yearning many of us have for the vast and magnificent landscapes of the American West.

While watching the show, I constantly found myself stunned by the majesty on screen. The sky-stretching vistas and rugged terrain make it seem as though the land itself is sacred. The camera might try its best to capture the glory of it all, but it never quite can.

It’s no wonder people still talk about “the frontier” with a kind of reverence, especially when you consider the fact that the American West contains most of our national parks and public lands.

Table of Contents

ToggleBut (and there’s always a but), this promise of space and freedom has turned into a housing bottleneck.

For anyone who has long fantasized about trading coasts or carving out a home near the Pacific or the Rockies, that dream has a number. And it’s getting higher.

Even those buyers who earn well and are responsible with money (e.g. physicians) may feel that the down payment on a modest home feels more like a ransom note.

Median prices have outpaced incomes in a way that defies national trends, with entire regions now effectively closed to even upper-middle-class buyers unless they’re already holding equity or large down payments.

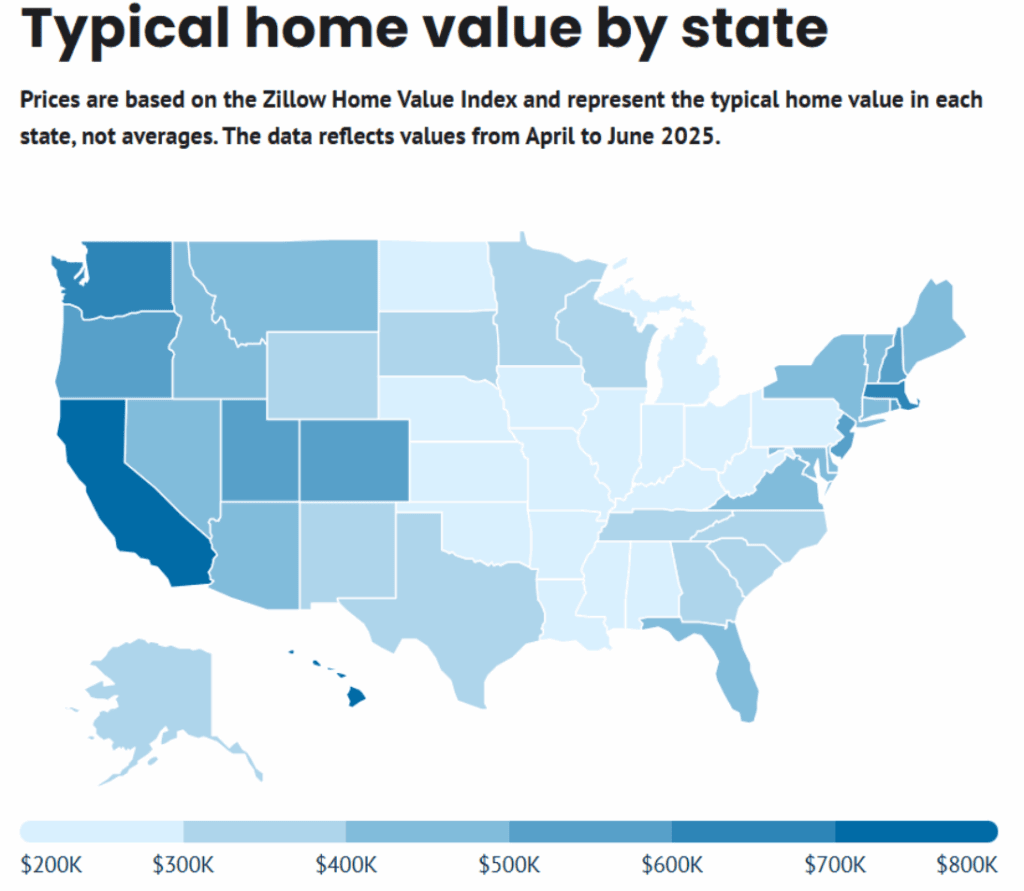

According to Zillow, the average home value in California has crossed the $780,000 mark (no surprise there), but even in Colorado and Utah, the prices hover above $500,000.

And no, these are not penthouse condos or oceanfront estates; they’re modest homes, sometimes many miles from major job centers.

(Side note: While different sources provide different figures on home prices and values, for this particular article, I’ll try to stick to data provided by Zillow.)

This is the story of basic supply and demand economics being twisted by geography, regulation, and demographic pressure. It’s about housing deserts in places that aren’t poor, and why even physicians, with their healthy six-figure incomes, are increasingly priced out or forced into tough tradeoffs.

So what’s really going on? Why is the West so brutally expensive to buy into, especially compared to the rest of the country? (The national average home value is not even $400,000.)

Let’s look at what’s really driving these regional price disparities and what states are now the most cost-prohibitive for new buyers.

Curious about The Reality of Changing U.S. Real Estate Prices? Click to learn more.

The American West Is Expensive

A generation ago, the western U.S. wasn’t cheap, but it was manageable.

California was already pricey, but places like Arizona, Idaho, and Oregon were seen as affordable escapes from coastal congestion.

That story is over.

The average home value in the Western U.S. now routinely exceeds $400,000, with Wyoming, New Mexico, and Alaska being the outliers of this trend.

Image Source: Motley Fool Money

In certain counties like Santa Clara (CA), Routt (CO), and Summit (UT), the average home value is near or well above $1 million.

For comparison, the U.S. national median home sale price is close to $446,000 as of June 2025.

This disparity isn’t simply about HCOL or luxury preferences. The real issue is the mismatch between how many people want to live in these areas and how few homes are being built.

It’s Not Just the Demand

The Western housing crisis often gets chalked up to rising demand, especially during and after the COVID-era migration booms.

And yes, the lifestyle appeal of tech jobs, climate, and outdoorsy culture plays a huge role. But demand alone doesn’t create permanently high prices. In well-functioning markets, supply typically follows.

Except in much of the West, it doesn’t.

Federal and local governments across the western region have enacted strict land-use policies, zoning limitations, and environmental review processes that delay or prevent new housing development.

Even rural counties with vast stretches of land often fail to keep up, due to limited infrastructure, low builder competition, or restrictive building codes.

While reform seems to be on the horizon, the current picture means that these restrictions cause delay, which in turn compounds both cost and scarcity.

Moreover, many Western counties are geographically constrained by mountains, forests, or deserts. It’s tough to build subdivisions on rough terrain, and many towns were never designed to accommodate large populations.

According to Ray Delahanty (CityNerd), an overwhelming number of the NIMBYest (Not In My Back Yard) cities in the U.S. are found in California. While we don’t need to go into the details of its effect on the economy, NIMBYism has certainly played a role in aggravating the housing crisis.

Rural Doesn’t Mean Affordable

A common misconception is that rural counties in the West offer a cheaper alternative. That may have been true in 2000. But in 2025, many of these rural areas are now more expensive than urban counties elsewhere in the country.

Why?

Because supply is even less elastic in these places.

Small-town builders often lack access to capital and labor. A local contractor can only build so many homes per year. Financing large-scale development is risky and often unprofitable in low-density markets. As a result, even modest upticks in demand can send prices surging, and then they stay high.

This problem is particularly evident in counties with tourism-driven economies like Wasatch County, Utah, and Eagle County, Colorado, where out-of-state buyers and retirees drive up prices without expanding the labor force or housing stock.

In these markets, it’s not uncommon for physicians, despite earning in the top 5% of local incomes, to find themselves competing with cash buyers for homes that need hundreds of thousands in renovations. A high income means very little when there’s nothing to buy.

Thinking about renting instead of buying? Learn about Renting Advantages: Why Renting is the Superior Choice.

How Expensive Is the American West?

So we’ve established that the prices of homes in western states are touching the sky, but which states are costlier and which ones don’t seem quite so outrageous? Here’s a table:

| State | Average Home Value (2025) (Zillow) | Median Home Sale Price (2024) | Price-to-Income Ratio (2024) |

| Hawaii | $833,984 | $760,000 | 9.1 |

| Califronia | $786,107 | $825,000 | 8.4 |

| Washington | $611,096 | $621,000 | 6.3 |

| Colorado | $554,708 | $543,000 | 6.0 |

| Utah | $537,109 | $562,000 | 5.7 |

| Oregon | $507,256 | $480,000 | 6.4 |

| Idaho | $474,766 | $471,000 | 6.1 |

| Montana | $465,421 | $495,000 | 6.6 |

| Nevada | $454,444 | $469,000 | 5.9 |

| Arizona | $430,710 | $435,000 | 5.7 |

| Alaska | $377,447 | $383,000 | 4.0 |

| Wyoming | $368,358 | $467,000 | 4.8 |

| New Mexico | $315,386 | $369,000 | 4.9 |

It’s no surprise that California and Hawaii top the list, but what may be less obvious is how the prices have surged in Colorado and Utah. These are not coastal behemoths, but they are lifestyle states, increasingly flooded with remote workers and retirees.

This happened in Boise, ID, where the median home price had surged to almost 10x the local median income back in 2021.

Buyers came in from out-of-state (primarily California), driving up prices. When this happens, local income can’t keep up, and that widens the affordability gap, causing long-term residents, including physicians, to rethink their housing dreams.

Why This Matters

Physicians relocating to the West are often drawn by lifestyle: mountains, biking trails, ski resorts, wine country, or simply the laid-back pace of smaller towns.

But many overlook the financial tradeoffs.

Housing is often the largest line item in a physician’s budget, particularly in the first decade of practice. For those entering their peak earning years, buying a million-dollar house in a high-property-tax county may erode their ability to invest, save aggressively, or pursue early retirement.

This is especially true in regions like California’s Bay Area, where the median prices require a minimum $320,000 income just to qualify for a conventional loan, and Bend, Oregon, where aging homeowners are holding tight, limiting availability for younger buyers.

If you’re part of a young, dual-income physician couple earning in the ballpark of $600,000 a year, these price tags may be manageable.

But if you’re paying off $450,000 in student loans combined, raising a family, maximizing savings, or looking to retire early, tying up a significant amount in a house could delay your FIRE plan by a decade.

Will Prices Fall?

In some Western metros, we’re starting to see price corrections, as is the case across the rest of the nation.

These corrections are particularly taking place in overbuilt suburban markets or those affected by rising interest rates. Las Vegas and Phoenix are already showing signs of slight decline, and experts say there’s more to come.

“Given that mortgage rates are likely to remain elevated around 7 percent through the end of the year, we anticipate price growth will continue to slow,” said Asad Khan, a senior economist at Redfin.

“For sellers, this means the latter half of 2025 may be a tougher market as demand slows further and more inventory piles up, leading to more price drops. We’ve already called Las Vegas a buyer’s market, and buyers will only have more negotiating power going forward.”

But in most desirable regions, prices are sticky. Homeowners aren’t selling, inventory is low, and new construction remains sluggish due to labor shortages, high material costs, and strict permitting.

Even if national housing prices cool, the West will likely remain structurally expensive for years to come. Unless major policy reforms open the door to denser development, affordability won’t return on its own.

What Prospective Buyers Can Do

If you’re a physician eyeing a Western state, consider:

- Expanding your radius: Look 45–60 minutes outside high-cost metros. In Washington, that might mean Wenatchee instead of Seattle. In Colorado, Pueblo instead of Boulder.

- Buying small and renovating: Older homes in need of work can provide entry into competitive markets, that is, if you have the time and risk tolerance.

- Waiting for seasonal dips: Many Western markets cool off in late fall and early winter. Use that to your advantage.

- Negotiating relocation packages: Some health systems offer housing stipends or closing cost assistance for in-demand specialties.

You don’t need to live in a million-dollar mountain town to enjoy the West. But you do need to approach housing like an investor, not a romantic.

Have you moved to a Western state recently, or left one because of housing costs? We’d love to hear from you. Where did you go? What surprised you most about the homebuying process? Would you do it again?

Drop your thoughts in the comments. Your insights may help someone else weigh their options in this complicated—and increasingly expensive—corner of the country.

In case you missed it: Home Upgrades That Are (and Aren’t) Worth the Money

FAQs

Q: Why is buying a home in the Western U.S. so difficult?

A: High demand, limited land, strict zoning laws, and an influx of remote workers and retirees have all driven prices up. Supply simply hasn’t kept pace.

Q: Which Western states are the most expensive?

A: As of mid-2025, top contenders include:

Hawaii ($833K), California ($786K), Washington ($611K), Colorado ($555K), and Utah ($537K). All of which are far above the U.S. median of ~$446K.

Q: What does the price-to-income ratio mean for buyers?

A: It shows how many years of income it would take to afford a median home. In parts of California and Hawaii, that ratio is 8x or more, well beyond the 3x affordability benchmark.

Q: Can physicians afford homes in the West?

A: Yes, but even high earners feel the pinch. In some areas, a $300K income barely qualifies you for a starter home, especially with student loans or early retirement plans.

Q: What strategies help buyers manage Western prices?

A: Widen your search radius, consider fixer-uppers, look off-season, or negotiate housing stipends in job contracts, especially in rural or underserved areas.

Q: Are prices expected to fall soon?

A: Some cities like Phoenix have seen slight dips, but most Western markets remain tight. Without major policy reform, broad declines are unlikely.

Q: Why is California so unaffordable?

A: It’s the perfect storm: tech jobs, coastline, mild weather, and some of the strictest housing policies in the country mean that demand far outpaces supply.

Q: What should I consider before relocating West?

A: Besides job perks and scenery, factor in home prices, commute times, cost of living, and whether ownership fits your long-term financial goals.