Loath as we are to admit it, money is often a major cause of conflict among couples. Money and marriage are inextricably linked, and if you screw up one, you’re likely to damage the other.

Two households, both alike in income, can have wildly different outcomes depending on how they handle their finances together.

24% of divorcees say financial stress was the leading cause of conflict during their marriage and the main reason they ultimately split up.

And in a longitudinal study of married women spanning more than 25 years, women who reported arguing “often” about money were nearly three times more likely to divorce compared to those who “sometimes” or “hardly ever” argued about it.

What’s more is that the relationship between money and marriage runs both ways. Sound financial management strengthens marriages, and strong marriages lead to better financial outcomes.

If your marriage is rock solid (built on trust, open communication, and shared goals) having a sound financial plan makes it even stronger. You weather storms together. You celebrate wins together. You build wealth together.

But if your marriage is already shaky, no amount of financial wizardry will save it. In fact, money conflicts are more intense and problematic than disagreements about other topics, and they recur more frequently because, unlike disagreements about, say, whose turn it is to do the dishes, financial issues have external consequences.

Bills don’t care if you’re mad at each other.

Since Physician on FIRE isn’t a marriage counseling website, we aren’t going to suggest that getting your budget right will fix deep relationship dysfunction. But what we can tell you is that most couples (yes, even smart, high-earning couples) make preventable money mistakes that slowly poison their relationships.

Table of Contents

ToggleAlso read: Financial Planning for Dual-Physician Households: Optimizing Your Wealth for Success

The Emotional Gaps

Money, finances, investments…they’re all a lot more emotional than we’re willing to believe. And sometimes, it’s the emotional gaps that bring you down.

Don’t miss out on Shirtsleeves to Shirtless: How to Lose Any Amount of Money

His And Hers

Financial infidelity, meaning hiding debt, secret accounts, and undisclosed purchases, may not always carry legal consequences, but it does corrode trust.

In a 2025 Debt.com survey, 38% of respondents said a spouse hiding debt is a “damn good reason to file for divorce.” Not surprisingly, 37% of respondents report that they had hidden, or were hiding from, their spouse.

Look, nobody’s financial past is perfect. Maybe you have student loans you’re embarrassed about, or you made some questionable purchases early in your career.

But keeping it secret doesn’t make it disappear; it just ensures that when the truth inevitably surfaces, your partner will feel blindsided and betrayed.

The fix: Have a full financial disclosure conversation early. Share your debts, your credit score, and your money baggage. Yes, it’s uncomfortable. Yes, it requires vulnerability. But marriage is built on knowing each other fully — financial warts and all.

When you got married, the officiant pronounced you “as one.” That means one income, one set of debts, one financial future. Hiding things fractures that unity from the start.

You, Me, and Our Extended Family Make Three

Disagreements about how much money to give or spend on extended family members and kids are sneaky little cracks that wriggle their way into the bedrock of your marriage.

Maybe one partner’s parents need financial help. Maybe your spouse wants to fund their sibling’s business venture. Maybe you can’t agree on how much to spend on your own children’s extracurriculars, college, or weddings.

Also read: How to Set Money Boundaries with Family (It’s Okay to Be “Mean”)

Like Gatsby throwing lavish parties to impress, sometimes we spend beyond our means to prove our love or loyalty, but…the green light at the end of the dock keeps getting further away.

These disagreements are particularly toxic because they’re rarely just about the money.

When one partner feels their family is being shortchanged compared to the other’s, or when parents disagree about “what’s best” for their kids, resentment builds fast. According to research on family financial conflicts, 39% of married couples cite finances as a primary source of conflict, and extended family obligations are a major driver.

One partner sees their aging parent struggling and wants to help financially. The other partner sees their long-term retirement goals getting derailed. Or one parent wants to pay for an expensive private school while the other thinks public school is fine and the money should go toward retirement.

Comments like “Your mom doesn’t even need the money” or “We’re spoiling the kids” can easily be misunderstood as attacks on what someone values most.

The fix: Sit down together and map out all the potential financial needs from both extended families and your kids. Separate immediate needs from things that can wait.

Then agree on a maximum amount that either of you can give to family members without consulting the other. For amounts above that threshold, you discuss it together first. This arrangement gives you some financial flexibility while protecting your relationship and your shared goals.

Is Your Name Credit? Because You’ve Got My Interest

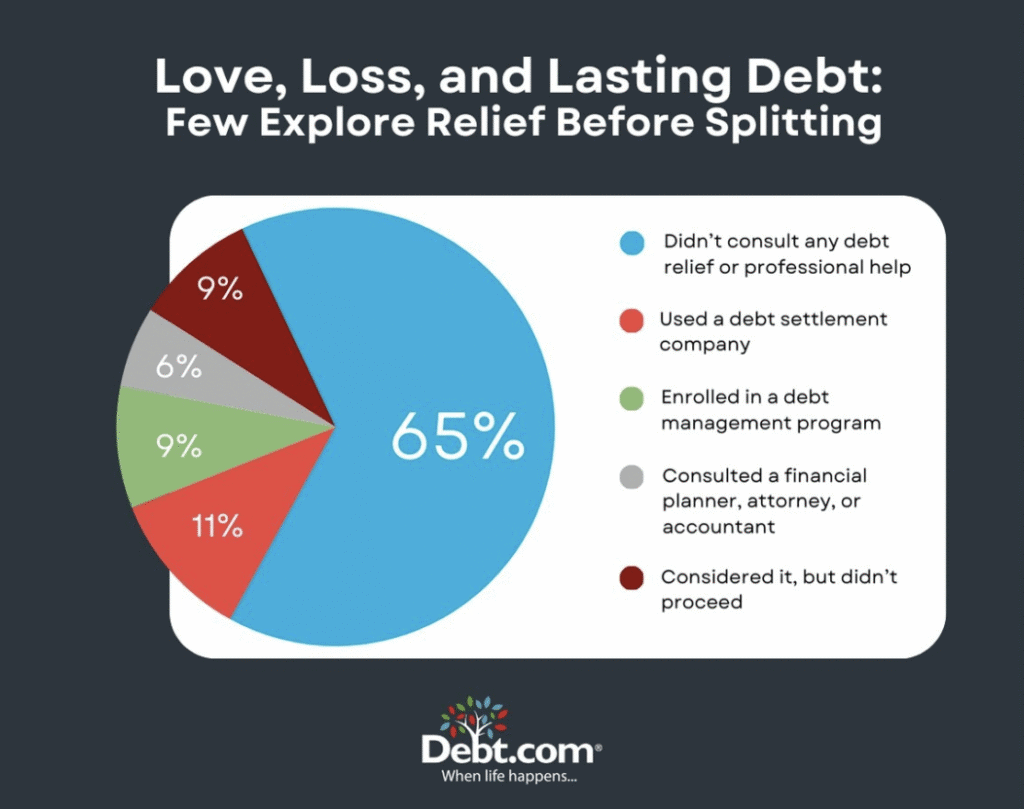

Debt doesn’t automatically doom a marriage, but ignoring it sure does. The majority of couples who divorced (65%) never sought any help for their debt problems.

They just…ignored it. Pretended it would resolve itself. Let it fester until the relationship imploded.

Credit card debt is especially insidious. With rates around 21%, that balance multiplies like bacteria.

And 42% of divorcees in 2025 said credit card debt played a role in their split, up from 34% in 2024 and 29% in 2023. The trend makes one thing clear: this problem is only getting worse, not better.

Try as we might, money conflicts create a self-defeating cycle. You try to fix it, but the negativity and defensiveness increase because the issues keep resurfacing in the shape of monthly bills, collection calls, and financial penalties.

Unlike other arguments that you can agree to disagree on, debt problems demand action and create external consequences that you can’t ignore.

The fix: Treat debt like a medical diagnosis. Identify it, create a treatment plan, and execute it together. If you’re overwhelmed, get help from an NFCC-certified credit counselor who can walk you through options like Debt Management Plans.

The important thing is to tackle it together rather than letting one person carry the burden while the other looks the other way.

It’s Not You, It’s Me… Handling Everything

Another common trend among many couples is that one spouse handles all the bills and financial accounts, and the other is essentially in the dark.

It seems practical to let the math wiz, the one who’s “better with money” take charge. But this creates a serious imbalance. The “CFO” feels burdened by a thankless job, while the other feels shut out and untrusted.

This arrangement may work for roommates, but it doesn’t work for couples. At least not in the long term.

When you change your language from ‘mine’ to ‘ours,’ it forces you to set goals together, dream together, and carry the weight together. It creates a level of unity that nothing else will achieve.

The danger of disunity extends beyond feelings. If the financially savvy partner dies or you divorce, the less-involved spouse is suddenly exposed to massive financial risks they’re completely unprepared to handle. That’s terrifying.

The fix: Both partners must be active participants. Try taking turns managing the checking account each month, or schedule regular financial check-ins so everyone knows what’s happening.

Both partners should attend meetings with financial advisors. Research shows that shared financial decision-making power is associated with higher marital satisfaction. The endgame is for both partners to be equally informed and equally responsible.

Going All In

Financial experts who work with couples say that marriages are always growing together or they’re growing apart. There’s no in-between.

And one of the fastest ways to grow apart is to maintain separate financial lives after you’ve committed to a shared life.

This doesn’t mean you can’t have any personal spending money. But it does mean that the fundamental approach needs to be unified. Some advisors advocate combining everything. When one partner earns significantly more, it doesn’t matter — tthe income belongs to both of you, spiritually, morally, and legally.

Beyond philosophical reasons, research confirms that couples with joint financial accounts report better relationship quality across multiple dimensions, i.e., less conflict, better communication, and higher satisfaction.

Collectivist, shared money systems appear most beneficial to relationship quality, especially for women.

The fix: Make financial decisions together. If you’re currently operating separate systems, have a conversation about moving toward unity. Start small if needed, maybe one joint account for shared expenses while you transition.

But the goal should be full financial integration, because that’s what marriage is. A full-on merger of two lives into one shared future.

The Fiscal Faults

Are We on a Date? Because I Can’t Afford to Be Here

How many times have you justified a fancy date night “just because?” How often do you blow past your budget for gifts or experiences because you “deserve it?” Look, romance is important. But when you’re constantly overspending to maintain connection, you’re actually creating the very financial stress that kills romance.

It is a truth universally acknowledged that a couple in possession of good credit must be in want of financial boundaries. (I really hope someone gets the Jane Austen reference here).

Many people’s primary love language is “receiving gifts,” but being able to afford those gifts isn’t always possible. Racking up debt to impress your partner doesn’t demonstrate love; it demonstrates poor judgment that will eventually become a source of conflict and resentment.

The fix: Talk about a gift-giving and date-night strategy together. Agree on a budget for birthdays, holidays, and spontaneous experiences. I’m not asking you to live without joy or fun.

You just need to be more intentional instead of impulsive.

Some of the best things in life are free — hiking together, cooking at home, exploring your city. Save the splurges for when you can genuinely afford them without stress.

Are You My 401(k)? Because I’m Not Giving You Enough Attention

Some couples max out one person’s retirement plan and completely ignore the other. They think, “Well, we hit the contribution limit and got the full employer match, so we’re good!”

But if both partners have access to employer plans, you’re leaving money on the table by not capturing both matches.

Over the years, even a 3% unclaimed match compounds into a significant amount. It’s literally free money you’re refusing to pick up.

The fix: Research both retirement plans and contribute enough to each to capture the full employer match. E

ach plan is unique, so take time to understand what you’re working with. After securing both matches, decide how to allocate additional savings based on your overall strategy.

Learn more: Max Out Your 401k

Are You a Portfolio? Because You’re All Over the Place

If you’re both managing retirement accounts separately without coordination, your collective nest egg could be overloaded in one asset class or sector, which could lead to limited gains or exposure to outsized losses.

Two risk-averse partners who separately load up on bonds may not generate the growth needed for retirement. Or maybe you’re both heavy in healthcare stocks because, well, you work in healthcare, but that concentration is risky.

The fix: Take a big-picture view of your investments together. Establish an overall asset allocation appropriate for your ages and goals.

Then coordinate your individual account choices. If one plan has superior bond options, lean into that. If the other has excellent growth funds, balance it out there. Think of your retirement savings as one portfolio managed across multiple accounts.

You’re So Fine, You Make Social Security Want to Wait Until 70

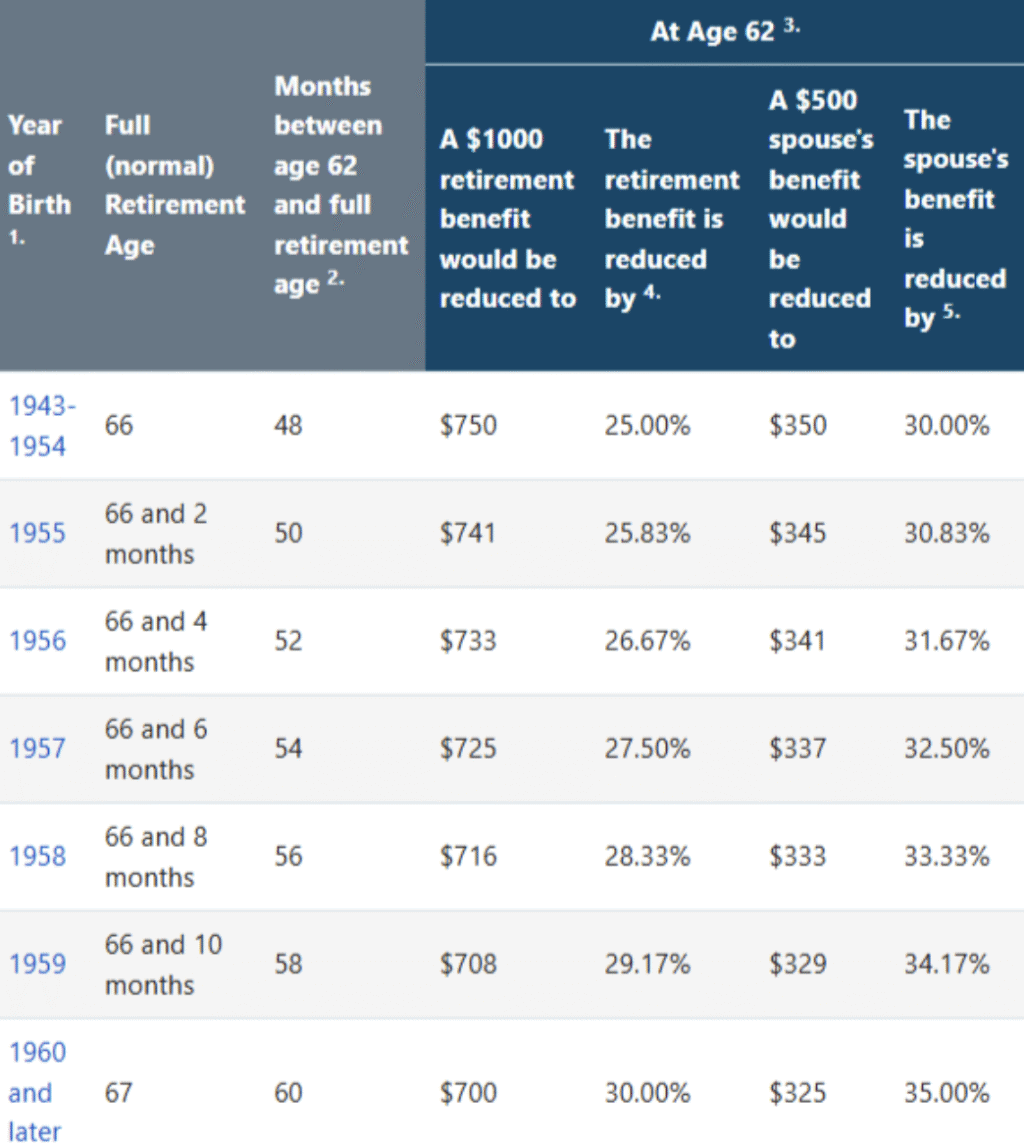

You can claim Social Security at 62, but your benefit will be permanently reduced by a fraction of a percent for each month you claim before full retirement age. Claim at 62, and you’ll lose 25% compared to waiting until 66.

For married couples, delaying benefits (especially for the higher earner) is often smart.

You earn an 8% delayed-retirement credit for each year past full retirement age that you wait, up to age 70. That’s $2,000/month at 66 versus $2,640/month at 70.

The fix: Coordinate when each spouse claims benefits to maximize lifetime payouts. Understand spousal and survivor benefits, and create a strategy together. If you need help, consult a financial advisor specializing in Social Security planning.

I Promise to Love You in Sickness and in Wealth

Losing even one income source can jeopardize your ability to pay bills and meet savings goals. Yet many couples skip disability insurance, assuming “it won’t happen to us.”

Disability insurance replaces a portion of your income if illness or accident prevents you from working.

Disability insurance isn’t a safety net for your sake; it’s meant to help your family while they deal with the aftermath of a breadwinner’s disability.

The fix: If you’re self-employed, buy a policy. If your employer coverage is inadequate, get a supplemental plan. This is non-negotiable protection for your family’s financial future.

Learn more: Own Occupation Disability Insurance: Your Shield Against Career Disruption

Money and Marriage Live And Die Together

So, it’s clear that the relationship between your marriage and your money is symbiotic.

Strong marriages lead to better financial outcomes. Couples with stable relationships accumulate greater wealth over time and better weather financial storms. But the reverse is also true. Sound financial management strengthens marriages.

Proper financial planning has a direct positive influence on relationship happiness and buffers against economic pressure.

You simply can’t treat these as separate domains. If your marriage is solid but your finances are a disaster, the stress will eventually crack even a strong foundation.

If your finances are perfect but your marriage is dysfunctional, all the money in the world won’t save it. You need both.

Fascinatingly, couples who discuss mundane everyday expenses and spending (even when they disagree) report more positive relationship outcomes. The more time you spend discussing day-to-day financial issues, the better you’ll handle high-stakes decisions and the healthier your relationship overall.

Small conflicts about money can actually strengthen your relationship by forcing necessary conversations.

Your Action Plan

Schedule regular “money dates” – Set a monthly (or weekly, if needed) meeting to discuss finances. Make it enjoyable. Cook together, open wine, and create an atmosphere where you’re connecting, instead of just crunching numbers.

Research shows that couples should have quarterly financial meetings at a minimum; more if you’re facing challenges.

Only discuss money when you’re calm – If emotions are running high, postpone the conversation. Statistics indicate that in 96% of cases, the outcome of a conversation can be predicted based on the first three minutes. A harsh start-up almost inevitably leads to a negative outcome. Set yourselves up for success by choosing the right time and tone.

Get professional help when needed – If financial stress or debt is harming your relationship, bring in a third party. A financial advisor, credit counselor, or money coach can help you communicate more effectively in a non-judgmental environment. Don’t wait until things are catastrophic.

Strong couples know that handling money together means communicating openly about their values and finding their way onto the same page. If you commit to facing the real issues together, you’re building a foundation that can weather any financial storm.

Frequently Asked Questions

What percentage of divorces are caused by money problems?

About 24% of divorcees cite financial stress as the leading cause of their divorce. Research shows that women who argue “often” about money are nearly three times more likely to divorce compared to those who “sometimes” or “hardly ever” argue about finances.

Should married couples combine their finances?

Research shows that couples with joint financial accounts report better relationship quality, including less conflict, better communication, and higher satisfaction. While you can maintain some personal spending money, financial experts recommend working toward a unified fundamental approach where both partners are equally informed and responsible.

What is financial infidelity in marriage?

Financial infidelity involves hiding debt, maintaining secret accounts, or making undisclosed purchases from your spouse. In a 2025 survey, 38% of respondents said a spouse hiding debt is grounds for divorce, and 37% admitted they had hidden financial information from their partner.

How can couples avoid fighting about money?

Schedule regular “money dates” to discuss finances when you’re both calm. Both partners should be active participants in financial decisions and attend advisor meetings together. Set clear boundaries around extended family spending and establish a unified approach to budgeting and saving.

What’s the biggest money mistake couples make with retirement accounts?

Many couples max out only one person’s retirement plan and ignore the other, leaving employer match money on the table. Both partners should contribute enough to their respective plans to capture full employer matches, then coordinate investments to avoid overconcentration in specific asset classes.

How much should couples give to extended family members?

Couples should agree on a maximum amount either partner can give to family members without consulting the other. For amounts above that threshold, discuss together first. This protects both your relationship and shared financial goals while maintaining some flexibility.