The post-election rally has rekindled investor optimism, but with the S&P 500’s lofty relative valuations, the road ahead isn’t without risk.

Next week could reveal whether this bullish momentum can withstand scrutiny or faces a recalibration as markets prepare for inflation data, tariff speculation and potential profit-taking. Will the enthusiasm continue or is a reality check on the horizon?

Market Overview

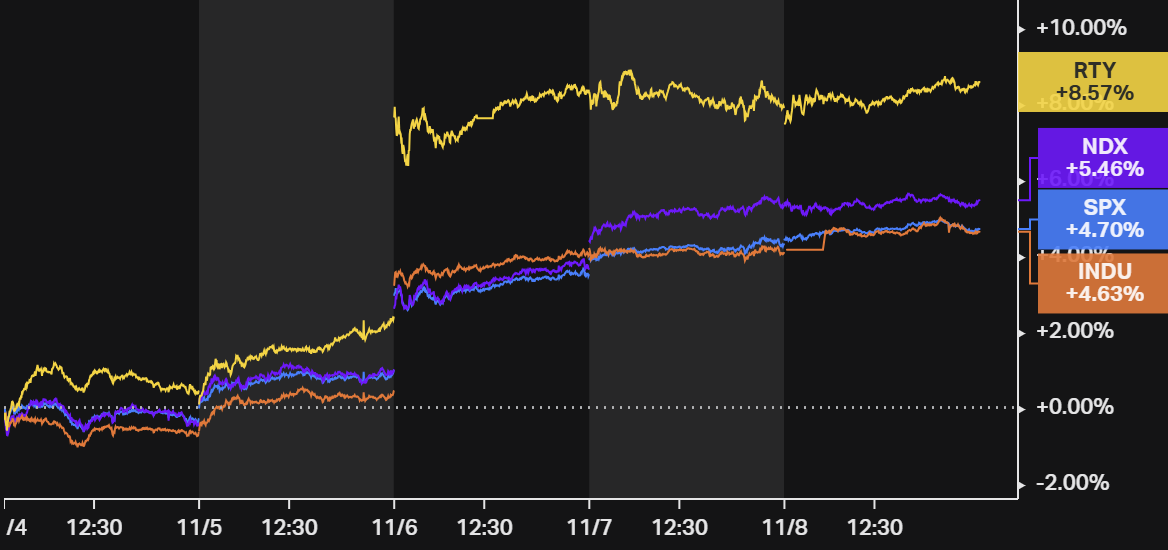

The U.S. stock market experienced a resounding rally last week, driven primarily by the decisive results of the U.S. presidential election.

The Russell 2000 led the gains among the major benchmarks with an impressive 8.57% weekly gain, reflecting renewed optimism in small-cap stocks on expectations of lower corporate taxes and deregulation under President-elect Trump’s administration.

The tech-heavy Nasdaq followed closely with a 5.46% gain, while the S&P 500 and Dow Jones posted their best weeks of the year with gains of 4.70% and 4.63%, respectively.

This broad-based bullish momentum was further bolstered by the Fed’s expected 25 basis point rate cut.

Investors were reassured as election uncertainty was replaced by clear expectations of fiscal easing and corporate-friendly policies.

However, while enthusiasm surged across the board, particularly among cyclical sectors and small-caps, caution was noted in discussions about valuation.

The S&P 500’s current P/E ratio of 22.2 times forward earnings indicates that while the relief rally was strong, it came with a backdrop of high valuation multiples.

Analysts pointed to the stark contrast between today’s elevated expectations and the more restrained investor sentiment before Trump’s first term in 2016, which could temper future gains as market participants weigh the benefits against possible overpricing.

Last Week’s Highlights

- Trump’s Election Win Drives Market Surge: A Republican red sweep sparked investor hopes for deregulation and tax cuts.

- Fed Rate Cut Supports Optimism: The Fed cut the federal funds rate by 25 basis points to 4.50%-4.75%.

- VIX Sees Steep Drop: The CBOE Volatility Index fell 32% to 14.93, marking its sharpest weekly decline since December 2021.

- ISM Services PMI Surpasses Forecasts: October’s ISM services PMI reached 56.0, the highest since August 2022.

- U.S. Jobless Claims Increase: Initial jobless claims rose by 3,000 to 221,000, showing a slight uptick amid broader labor market strength.

- Treasury Yields Dip Post-Cut: Treasury yields fell with the Fed’s rate cut, while short-term yields edged up.

- Earnings Season Shows Mixed Results: 90% of S&P 500 companies reported Q3 earnings, with 75% beating expectations, below the 5-year average of 77%.

- China’s Debt Plan Boosts Markets: China announced a RMB 10 trillion ($1.4 trillion) debt refinancing plan for local governments.

- Chinese Exports Surge: October exports jumped 12.7% year-over-year, the fastest pace since July 2022.

- Rate Cuts in the UK and Sweden: The Bank of England and Sweden’s Riksbank each cut rates to address slowing inflation.

- Japan’s Markets Climb: The Nikkei 225 rose 3.8%, driven by U.S. election results and the Fed rate cut, despite yen strength.

- Crude Oil Rises Slightly: Crude oil prices rose 1.2% to $70.4 per barrel.

- Gold Price Slides: Gold dropped 2.0% to $2,684 as investors shifted to equities and riskier assets.

Week Ahead & Implications

Post-Election Market Dynamics: Sustained Momentum or Cautious Retracement?

The significant rally across US equities following Trump’s election win has set the stage for continued bullish sentiment into next week. Investors have been reinvigorated by expectations of tax cuts, deregulation, and potential pro-business policies reminiscent of his first term.

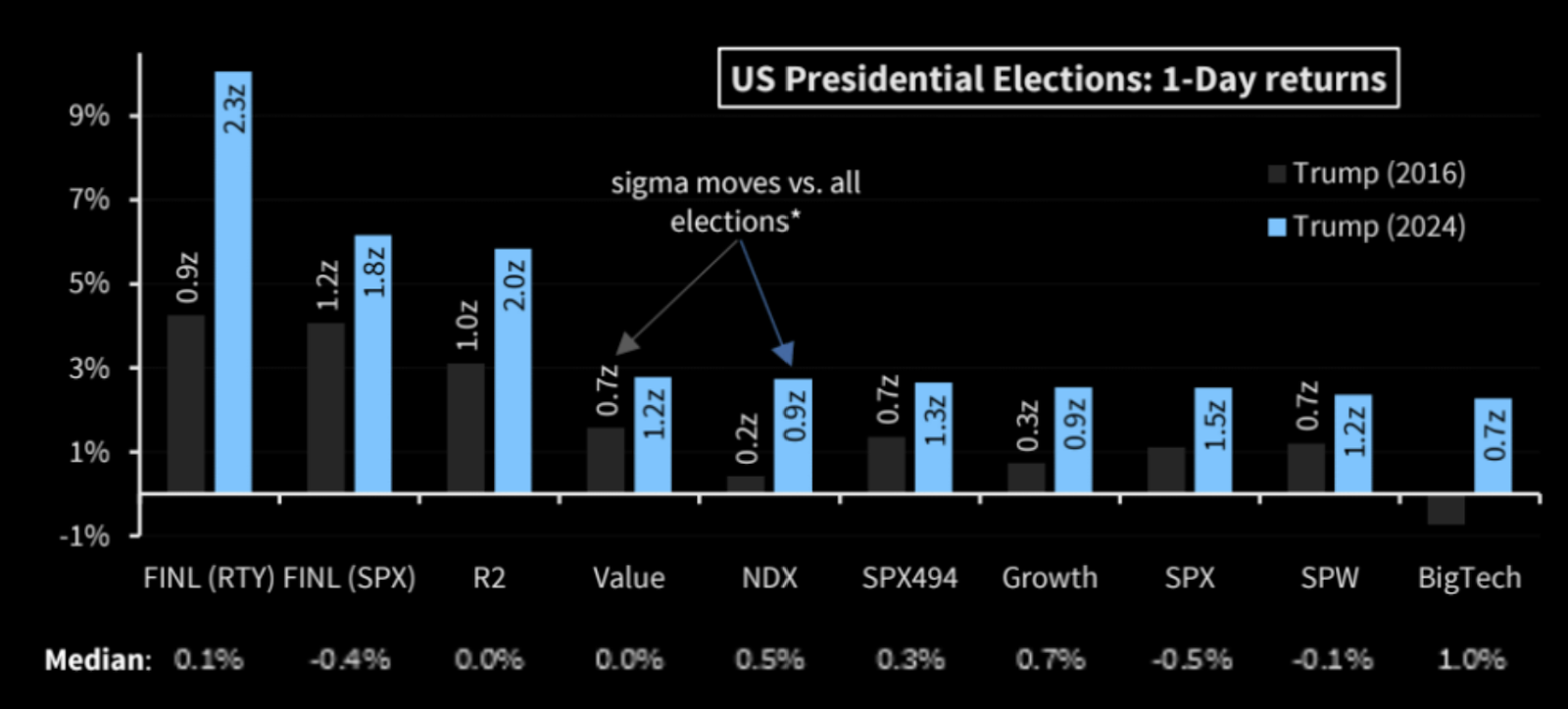

The graph below highlights the scale of this reaction, comparing 1-day returns from Trump’s 2016 and 2024 election victories.

As seen, the recent surge shows a more pronounced movement across financials and other key sectors compared to 2016, underscoring heightened investor enthusiasm.

However, this surge comes with a risk: elevated valuations. With the S&P 500 now trading at over 22 times forward earnings and indices at record highs, markets may face a reality check if sentiment becomes overly exuberant.

Next week could see sustained momentum as hedge funds and institutional investors continue reallocating capital after having trimmed exposure in October.

Yet, caution is warranted as profit-taking or recalibration could lead to pockets of retracement. Investors should remain vigilant, possibly diversifying their equity exposure with sectors that offer value relative to growth, such as financials and industrials, while maintaining a balanced approach to risk.

US CPI: Key Moment for Inflation Trajectory

The US Consumer Price Index (CPI) release on Wednesday is set to be the most crucial market-moving event next week.

Forecasts anticipate a +0.2% month-over-month increase for the headline CPI and a steady 0.3% for the core measure. The inflation data carries significant weight as it aligns with Federal Reserve Chair Jerome Powell’s recent comments, emphasizing that inflation, though easing, remains elevated.

The chart below, showing inflation swap rates at levels where the Fed typically intervened in the past but currently staying hands-off, reinforces this view.

A higher-than-expected reading would not only solidify market expectations that the Fed will keep rates steady but may push investors to reprice potential rate cuts in 2025, effectively keeping bond yields elevated and pressuring equities.

The Impact of Potential Tariffs on Global Trade

President-elect Trump’s clear intent to reintroduce tariffs could begin influencing market sentiment ahead of any formal policy announcements.

The focus on tariffs, particularly targeting China and Europe, has historical precedence for unsettling markets due to implications on global supply chains and inflation.

Sectors with high international exposure, including technology and consumer discretionary, may come under pressure as investors pre-emptively adjust for a more protectionist trade environment.

This risk-off sentiment translates into renewed strength for the US dollar as traders seek safe-haven assets, creating headwinds for emerging markets and commodity prices.

US private sector financial assets as a percentage of GDP are currently at record levels, indicating that the financial landscape is getting hot.

This elevated state underscores the vulnerability of markets to significant policy changes such as tariffs, which could disrupt the upward trend and lead to volatility.

For the weeks ahead, investors should consider hedging strategies or shifting exposure towards domestic-facing sectors less vulnerable to trade disruptions.

China’s Economic Data: Evaluating Recovery Strength

Friday’s release of China’s industrial production, retail sales, and fixed asset investment (FAI) data will offer a comprehensive view of whether Beijing’s recent stimulus measures are taking hold.

With industrial production forecasted to hold steady at 5.4% and retail sales expected to show a modest rise from 3.2% to 3.8%, markets will scrutinize these numbers for signs of demand recovery.

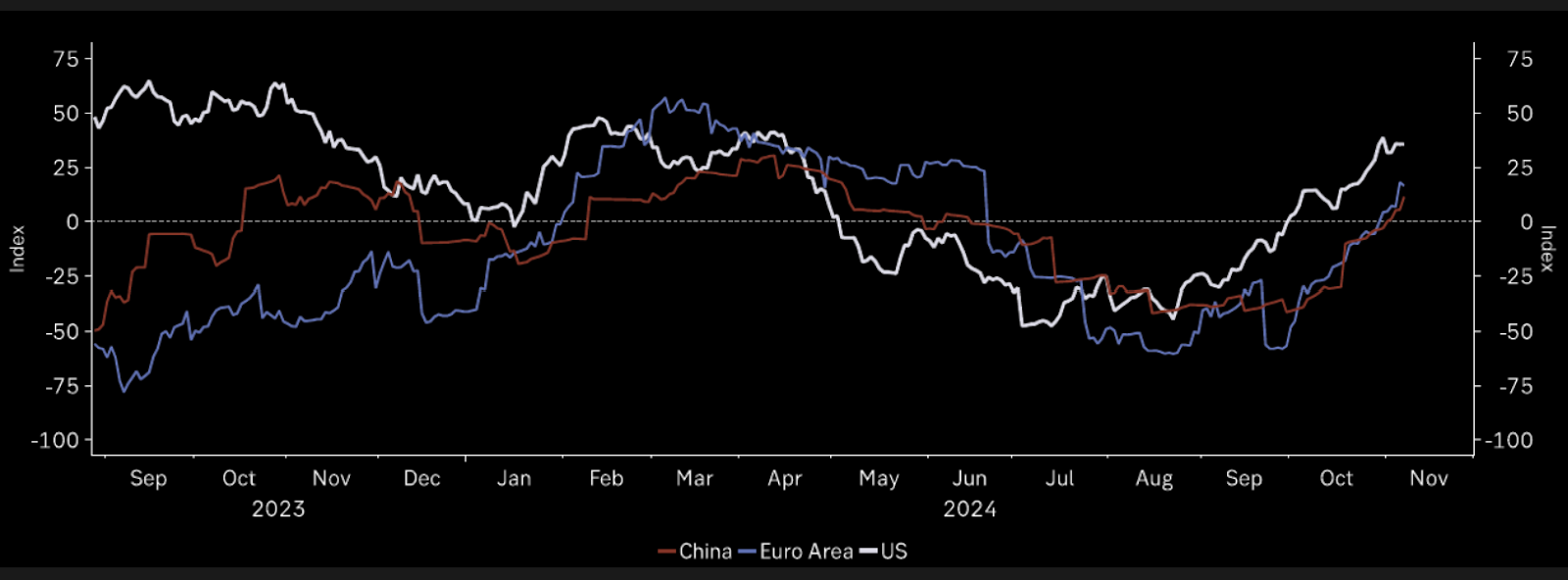

The recent PMI uptick hinted at stabilizing demand, as illustrated by the chart below, which shows macro surprises slowly turning positive for China and Europe. This week’s reports will need to confirm that narrative for continued optimism. A robust set of figures would reassure global investors and could strengthen risk assets.

Germany’s Political Crisis: Economic Repercussions Beyond Borders

Germany’s coalition government collapse, triggered by Chancellor Olaf Scholz’s dismissal of Finance Minister Christian Lindner, has sent shockwaves through the European political landscape.

This political instability exacerbates existing economic woes in Europe’s largest economy, which is already grappling with energy costs, slowing growth, and weakened industrial output.

The potential for early elections and further political fragmentation will likely weigh on investor confidence in European markets over the next weeks. The Euro may face further downside pressure as capital rotates to safer assets or more stable regions.

UK Outlook: Labor Market Strength and Growth Prospects

Next week, two critical economic data points—the UK jobs report on Tuesday and the Q3 GDP estimate on Friday—are set to shape UK sentiment and policy expectations.

The labor market, expected to show a slight uptick in the unemployment rate to 4.1% from 4.0%, and average earnings growth of 3.9%, will signal whether the employment landscape is maintaining enough momentum to support consumer spending.

This report is crucial for gauging wage inflation pressures, which can influence the Bank of England’s (BoE) rate decisions amid its cautious stance.

The GDP estimate for Q3 is projected at a modest 0.2% month-over-month growth for September, indicating a fragile expansion.

This release will be a focal point in determining whether the UK economy can sustain its current trajectory, especially as broader European concerns add pressure.

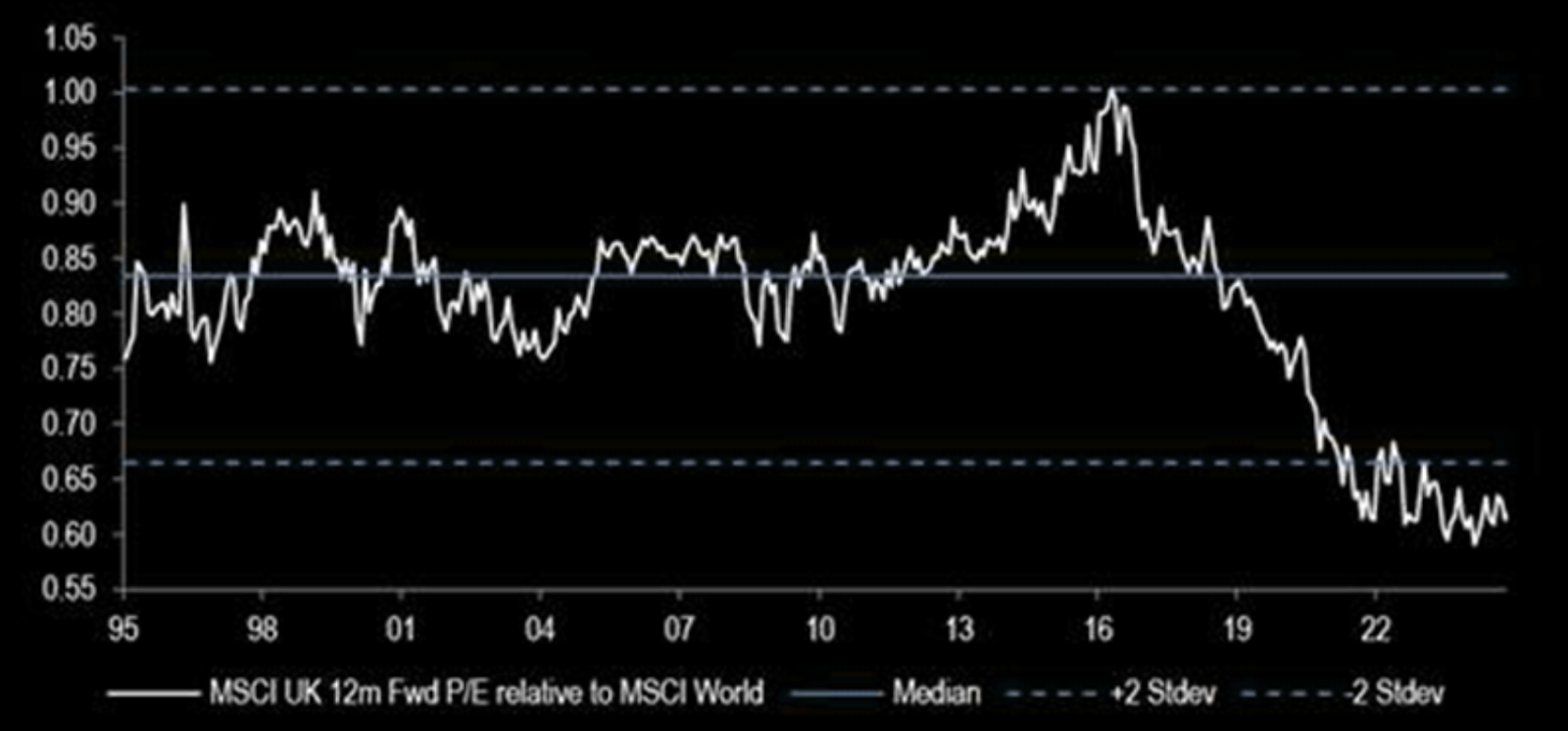

The chart below underscores that UK equities, as shown by their relative P/E ratio to the MSCI World, remain undervalued compared to global peers. Staying on the sidelines for now makes the most sense to us.

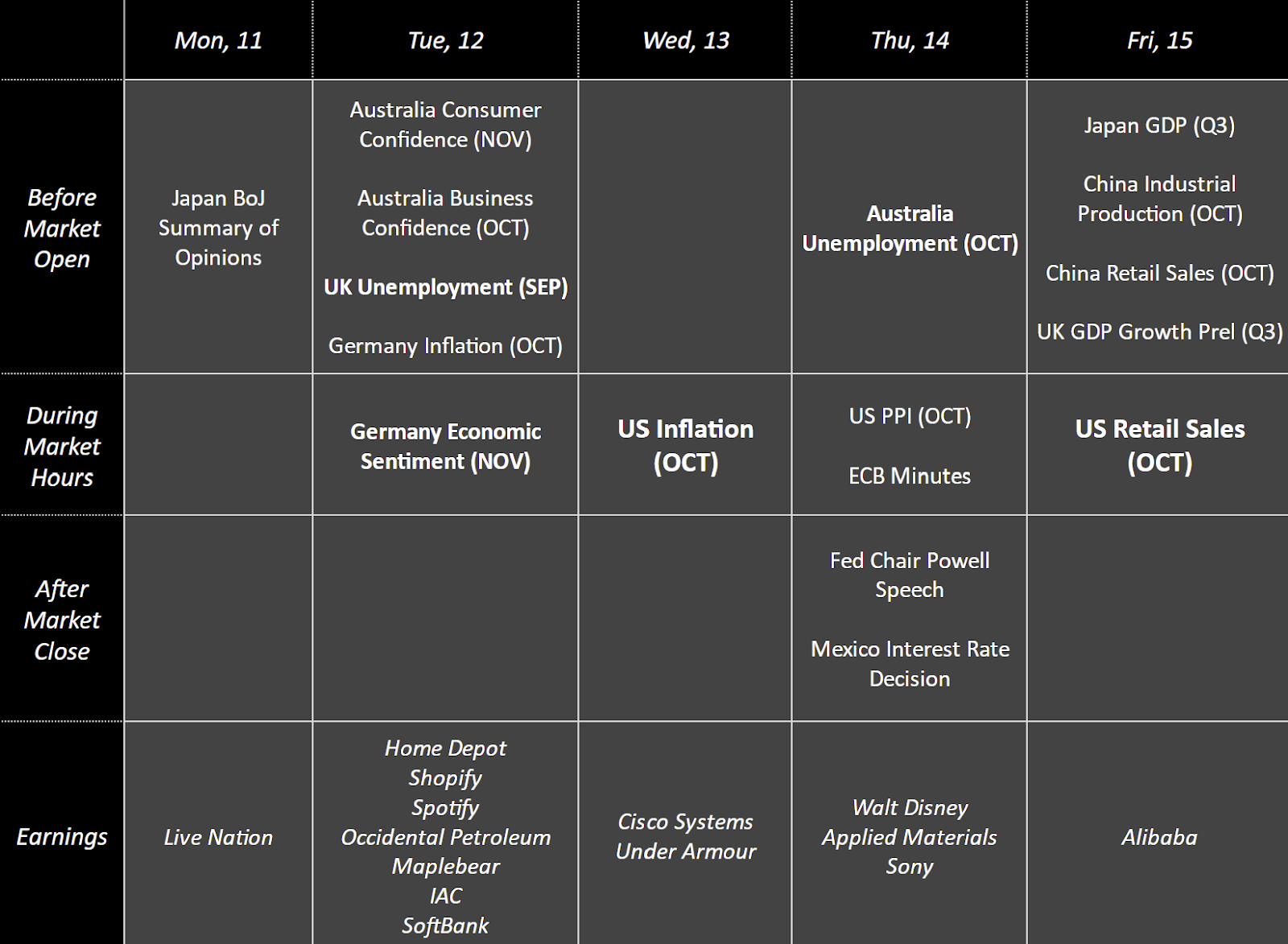

Most Impactful Events to Watch Next Week