Benjamin Franklin famously wrote that “in this world nothing can be said to be certain, except death and taxes.” He might have added a third certainty for modern retirees. The government will get its cut of your tax-deferred retirement savings, one way or another.

Most of us know that the IRS gives us two choices. You can take your Required Minimum Distributions on your own terms, paying taxes on the money you withdraw at your ordinary income rate. Or you can forget…and pay a penalty of up to 25% on top of those taxes.

In 2024, 585,000 Vanguard clients chose option two. Not intentionally, of course. They simply forgot. And it cost them, collectively, somewhere between $678 million and $1.7 billion in penalties that even the most aggressive tax accountant couldn’t write off.

The funny thing is, more than half of them will do it again this year. Don’t be one of them.

In case you missed it: The Physician’s Guide to a Regret-Free Retirement: Three Steps to Financial Freedom

The Numbers Are Worse Than You Think

In 2024, 6.7% of Vanguard clients who were supposed to take an RMD simply didn’t. That’s roughly 585,000 people at Vanguard alone, so before someone calls it an obscure edge case affecting a handful of confused retirees, know that it’s not.

We’re talking about hundreds of thousands of people, many of whom are otherwise financially sophisticated, getting hammered with penalties.

The average RMD that went untaken? About $11,600. The penalty for missing it ranges from 10% to 25% of that amount, depending on how quickly you fix the mistake.

Doing some quick math reveals that this amounts to $1,160 to $2,900 per person, per year, going straight to the IRS for nothing more than forgetting to hit ‘withdraw’ on your brokerage account.

But that’s not all. Another 24% of Vanguard clients took withdrawals that were below the required minimum. So we’re also shining the light on people who remembered but screwed up the calculation. Only 69% of people actually got it right.

Aaron Goodman, Vanguard’s Senior Investment Strategist, wasn’t mincing words when he called missed RMDs “a billion-dollar mistake.”

When Vanguard extrapolated their data to the estimated 8.7 million Americans who should be taking RMDs, they calculated that the collective penalties could reach up to $1.7 billion in a single year.

Why Smart Keep Making the Same Mistake

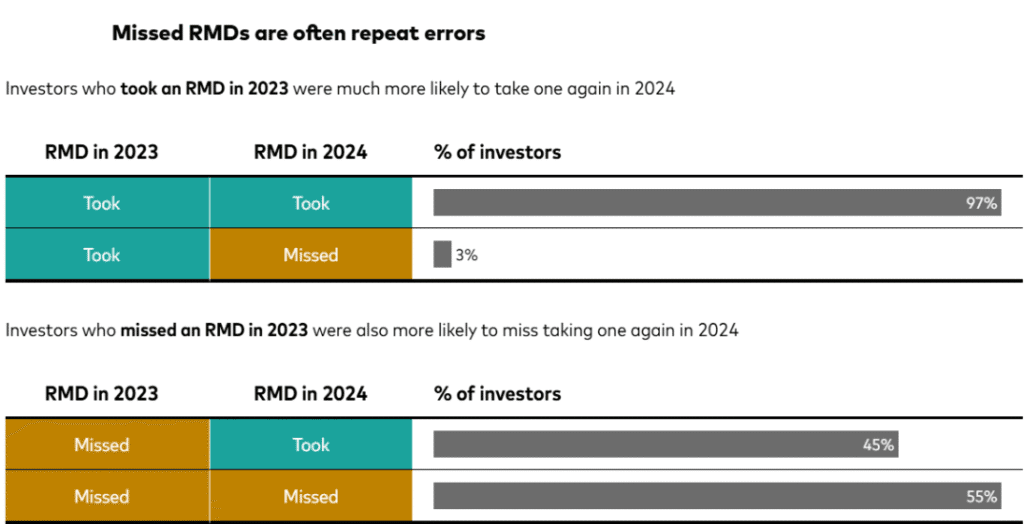

Andy Reed, head of behavioral economics research at Vanguard, found that 55% of people who missed their RMD in one year missed it again the next year.

Reed’s assessment cuts to the heart of the problem.

“Most investors seem to make RMDs a routine, but rather than ‘set and forget,’ many simply ‘forget and forget,'” he said in the report. “Reducing the rate of missed RMDs by even a modest amount could save investors hundreds of millions of dollars each year”.

Source: Vanguard

Think about how many times you’ve changed jobs during your career. The average American changes jobs roughly 12 times. Each job change might have meant a new 401(k), maybe a rollover IRA, perhaps a SEP-IRA from a side gig.

Fast forward to your 70s, and you’re sitting on multiple retirement accounts scattered across different institutions. It’s a recipe for disaster if ever there was one.

Goodman explained the challenge this way, “With investors changing jobs nine times or more in their working careers, it’s tough to keep tabs on all retirement accounts,” he wrote. “Combining IRAs and putting RMDs on autopilot takes forgetting out of the equation”.

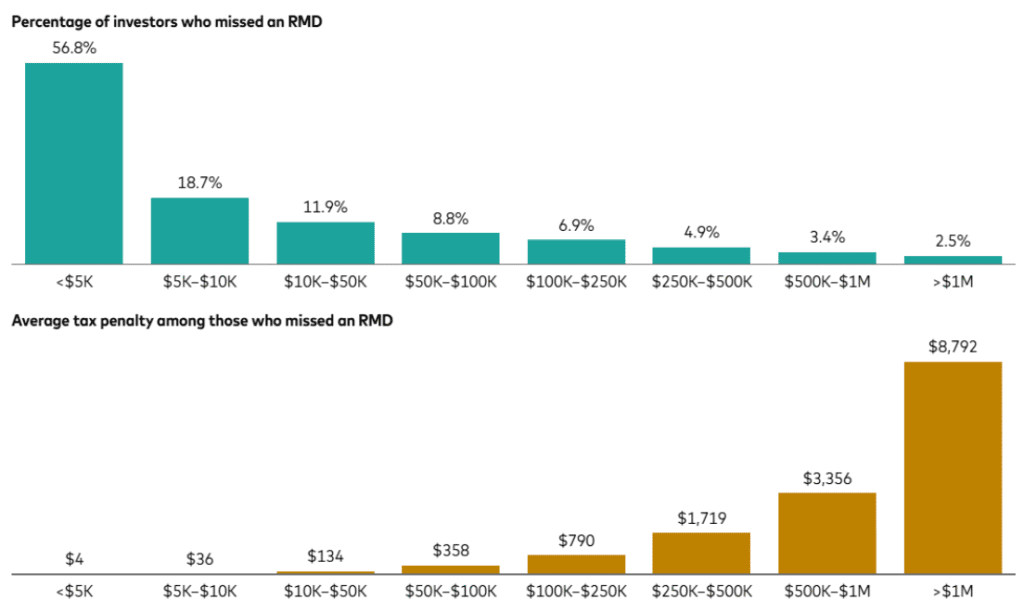

The data shows that investors with smaller balances struggle the most. Among Vanguard clients with account balances under $5,000, a staggering 56.8% failed to meet their withdrawal requirements. But this isn’t just a problem for people with modest savings.

Even among those with $250,000 to $500,000 saved, nearly 5% didn’t hit their requirements.

Source: Vanguard

And if you’re sitting on serious wealth? The penalty scales with your account balance. For investors with at least $1 million in their accounts, the average penalty was $8,792. I, for one, wouldn’t categorize that as chump change, even in this economy — even for high-net-worth individuals.

Also read: Building Retirement Income Streams as a Physician: Strategies and Tactics

RMD Rules: A Quick Refresher

Let’s get the basics straight. Once you hit 73 (for those born before 1960) or 75 (for those born after 1960), the IRS wants its cut of all that tax-deferred growth you’ve been enjoying in your traditional IRA, 401(k), and other non-Roth retirement accounts.

They calculate how much you need to withdraw based on your account balance at the end of the previous year and your life expectancy.

You’ve got until December 31 each year to take your RMD. With the one exception that in the year you turn 73, you get until April 1 of the following year for your first distribution. The hitch is, if you wait until April 1, you’ll need to take two RMDs in the same calendar year (your first one by April 1, and your second one by December 31).

That could bump you into a higher tax bracket and result in a bigger tax bill than if you’d just taken your first distribution before year-end.

The penalty for missing an RMD used to be a brutal 50% of the amount you should have withdrawn. The SECURE Act 2.0, passed in 2023, lowered it to 25%. If you catch the mistake and correct it within two years (and file IRS Form 5329 showing you fixed it) you can potentially reduce the penalty to 10%.

There’s some flexibility in how you handle multiple accounts. If you have several traditional IRAs, you can calculate the total RMD across all of them and then take the entire withdrawal from just one account if you want.

Same goes for 403(b) accounts — you can aggregate them all together. But you can’t mix and match different types of accounts. Traditional IRAs and 403(b)s need to be handled separately.

401(k) accounts are the exception. Each 401(k) has its own RMD requirement that must be satisfied separately.

And if you’re still working at 73 and participating in your current employer’s 401(k), you might be able to delay RMDs from that specific account until you retire, but only if you don’t own 5% or more of the company and your plan allows it.

The Simplest Fix: Automate and Actually Forget It

The good news is that this is one of the most solvable financial problems you’ll face in retirement. Vanguard’s data shows that among clients who automated their RMDs, the rate of missed distributions is 0%. Zero. Zilch. Nada.

“Automating it takes memory out of the equation,” says Reed. “Among those clients, the odds of missing RMDs is 0%. It’s the most surefire way to avoid forgetting, to avoid penalties and avoid a surprise tax bill if you have to take a bunch of RMDs at once”.

More than one-third of Vanguard’s self-directed IRA customers have already automated their RMDs, and it’s completely free at most providers.

You set it up once, and the system handles it from there. No remembering, no calculating, no stress.

Most major brokerage firms and retirement account custodians now offer automated RMD services. Fidelity has it. Schwab has it. Vanguard obviously has it.

The setup process typically takes less than 10 minutes, and you can usually specify exactly when during the year you want the distribution taken and where you want the money sent.

If you’re not tech-savvy or prefer a more hands-on approach, at minimum put a recurring calendar reminder on your phone for October every year. IRA custodians are required by law to send you RMD notices by January 31, and many send courtesy reminders in October and throughout the fall. But relying on memory or paper notices is exactly what gets people in trouble.

Another step to take is to consolidate your retirement accounts. If you’ve got IRAs scattered across three or four different brokerages from previous employers, consolidating them into one or two accounts makes the whole process infinitely more manageable.

Already Missed One? Here’s What to Do

If you’re reading this and just realized you missed your 2025 RMD, don’t panic. You’ve got options.

First, take the distribution immediately. The sooner you correct the mistake, the better your case for penalty relief.

Second, file IRS Form 5329 with your tax return. This form lets you make a “timely voluntary correction” of a missed RMD. Critically, it also gives you the opportunity to explain that the mistake was “due to reasonable error and you are taking reasonable steps to remedy the shortfall.” The IRS has the authority to waive penalties in cases of reasonable error, and they do grant waivers.

Is it a guarantee? No. But it’s absolutely worth trying. The worst they can say is no, and you’re in the same position you’d be in anyway.

Many tax professionals and CPAs have successfully gotten RMD penalties waived for clients, especially first-time offenders who can demonstrate they’ve put systems in place to prevent future violations.

Third — and this is crucial — don’t make the same mistake twice. Remember, 55% of people who miss one RMD miss the next one too. Set up automatic distributions right now, today, before you get distracted by something else.

The True Cost of Missing an RMD

Paying thousands of dollars in RMD penalties isn’t the result of bad luck. It’s poor management. And which of us can stand by that?

A market downturn can be waited out, or a temporary setback can be recovered from. But incurring an RMD penalty? That’s just money walking out the door to the Treasury Department.

For high earners with substantial retirement savings, this is particularly galling. You likely have a higher-than-average retirement account balance thanks to years of high income and disciplined saving.

That means your RMD (along with the potential penalty for missing it) is probably higher than the average retiree. If your RMD is $19,000 instead of the Vanguard average of $11,600, you’re looking at penalties between $1,900 and $4,750. Oh boy.

And let’s talk about the tax implications of doubling up on RMDs if you’re forced to take multiple years’ worth of distributions at once.

That extra income could push you into a higher tax bracket, trigger higher Medicare premiums through IRMAA surcharges, affect the taxation of your Social Security benefits, and potentially increase your net investment income tax. The ripple effects can cost you even more than the penalty itself.

But remember, this is completely preventable. Unlike market volatility, sequence of returns risk, or healthcare costs in retirement, all of which are things you actually should be worried about, RMD compliance is a purely mechanical problem with a purely mechanical solution.

So, if you’re 73 or older, log into your brokerage accounts right now and set up automated RMDs. Not tomorrow. Not next week. Now. It takes 10 minutes and could save you thousands of dollars.

If you’re approaching 73, put “Set up automatic RMDs” on your calendar for the year you turn 73. Better yet, consolidate your retirement accounts now while you’re thinking about it. Future you will thank the present you.

If you have aging parents who are in the RMD zone, have the conversation with them. 6 to 7% of retirees are missing their RMDs, and odds are someone in your family could be in that group.

Have you or someone you know missed an RMD? What happened? Did you catch it in time? Did the IRS waive the penalty? Share your experience in the comments below, it might just help another reader avoid the same mistake.

In case you missed it: Backdoor Roth vs Taxable Investing for High Earners

Frequently Asked Questions

What is a Required Minimum Distribution (RMD)?

An RMD is the minimum amount you must withdraw annually from tax-deferred retirement accounts like traditional IRAs, 401(k)s, 403(b)s, and similar accounts once you reach age 73. The IRS calculates this amount based on your account balance and life expectancy to ensure you eventually pay taxes on money that grew tax-deferred.

At what age do I have to start taking RMDs?

You must begin taking RMDs the year you turn 73. Your first RMD can be delayed until April 1 of the following year, but this means you’ll need to take two distributions in one calendar year (potentially pushing you into a higher tax bracket). After your first RMD, the deadline is December 31 each year.

What happens if I miss my RMD?

If you miss an RMD, the IRS imposes a penalty of 25% of the amount you should have withdrawn. However, if you correct the mistake within two years and file IRS Form 5329, the penalty can be reduced to 10%. The IRS may also waive the penalty entirely if you can demonstrate the error was due to reasonable cause.

Do I need to take an RMD from every retirement account I own?

No. For traditional IRAs, you can aggregate the total RMD amount and withdraw it from any one or combination of your IRAs. The same applies to 403(b) accounts. However, 401(k) accounts must be handled separately — each 401(k) has its own RMD requirement that cannot be aggregated with other account types.

Can I avoid RMDs by keeping my money in a Roth IRA?

Yes. Roth IRAs are not subject to RMDs during the account owner’s lifetime. This makes Roth conversions an attractive strategy for some retirees looking to minimize required distributions and maintain more control over their retirement income.

What if I’m still working at age 73?

If you’re still working at 73 and participating in your current employer’s 401(k), you may be able to delay RMDs from that specific account until you retire — but only if you don’t own 5% or more of the company and your plan allows the delay. RMDs from IRAs and previous employers’ 401(k)s still apply.

How is my RMD amount calculated?

Your RMD is calculated by dividing your account balance as of December 31 of the previous year by a life expectancy factor from IRS tables. Most brokerage firms will calculate this for you and provide the exact amount you need to withdraw. The IRS also provides worksheets in Publication 590-B.

Can I automate my RMDs?

Yes, and you absolutely should. Most major brokerage firms (Vanguard, Fidelity, Schwab, etc.) offer free automated RMD services. You set it up once, specify when and where you want the money sent, and the system handles it automatically each year. Vanguard’s data shows that clients who automate have a 0% miss rate.

What if I take more than my RMD amount?

That’s perfectly fine. The RMD is the minimum you must withdraw, not the maximum. You can withdraw more if you need the income or want to reduce your account balance. However, excess withdrawals in one year do not count toward future years’ RMDs.

Can I donate my RMD to charity instead of taking it as income?

Yes, through a Qualified Charitable Distribution (QCD). If you’re 70½ or older, you can direct up to $100,000 per year from your IRA directly to qualified charities. The distribution counts toward your RMD but isn’t included in your taxable income, which can provide significant tax benefits.

Does the SECURE Act 2.0 change RMD rules?

Yes. The SECURE Act 2.0 raised the RMD starting age from 72 to 73 (effective 2023) and will raise it to 75 in 2033. It also reduced the penalty for missed RMDs from 50% to 25%, with a further reduction to 10% if corrected within two years.

What happens to my RMDs if I inherit a retirement account?

Inherited retirement accounts have different RMD rules depending on your relationship to the deceased and when they passed away. The SECURE Act eliminated the “stretch IRA” for most non-spouse beneficiaries, requiring the account to be emptied within 10 years. Consult with a tax professional about inherited account rules.

Will my RMD affect my Social Security benefits or Medicare premiums?

RMDs count as ordinary income, which can affect the taxation of Social Security benefits (up to 85% may become taxable) and can trigger higher Medicare Part B and Part D premiums through Income-Related Monthly Adjustment Amounts (IRMAA). Strategic planning around RMD timing and amounts can help minimize these impacts.

Can I put my RMD back into a retirement account?

Generally, no. Once you take an RMD, it cannot be rolled over into another tax-deferred retirement account. The only exception is if you take a distribution before your required beginning date and then decide to roll it back within 60 days — but once RMDs begin, they cannot be rolled over.

What’s the best time of year to take my RMD?

There’s no universally “best” time — it depends on your situation. Some people take it early in the year to get it done, others wait until December to keep money growing tax-deferred as long as possible. If you have fluctuating income or are managing tax brackets, mid-year might allow you to assess your tax situation and decide on timing. The key is not forgetting the December 31 deadline.

6 thoughts on “The $3,000 Mistake 585,000 Retirees Made Last Year (And the 10-Minute Fix)”

Rather than $100,000 I believe that in 2026, you can donate up to $111,000 per individual from your IRA as a Qualified Charitable Distribution (QCD) to satisfy all or part of your Required Minimum Distribution (RMD). For 2025, $108,000.

Thank you for sharing basketball stars

This makes a complex retirement topic much easier to understand.

This makes a complex retirement topic much easier to understand.

calculate your reverse tax with this tool free:https://reversesalestaxcalc.123projectlab.com/

For those born in 1960, RMD age is 75. You need to correct that.