Remember 2022? The world had shaken itself out of the COVID stupor, a slap at the Oscars reverberated out to even those who stopped caring about award shows years ago, “A Negroni… Sbagliato… with Prosecco in it” suddenly became the perfect drink, and a tune from 1985 became the soundtrack of the year.

But while we were distracted by all of that, Wall Street was living on a prayer. The VIX (Wall Street’s so-called “fear gauge”) regularly spiked above 30 throughout the year. If, at that time, your portfolio consisted of the classic 60% stocks, 40% bonds split, you know what I’m talking about.

Traditional balanced portfolios got absolutely hammered, losing around 16% for the year. Both stocks and bonds tanked together, breaking the fundamental promise that’s kept this strategy alive since your parents’ retirement planning days.

But, instead of declaring the 60/40 dead and moving on to the next hot investment trend (looking at you, crypto), some of the world’s smartest institutional investors started asking “What if we’re thinking about portfolio construction all wrong?”

Enter the Total Portfolio Approach.

Sounds like another buzzword destined for the investment graveyard alongside “target-date funds” and “smart beta”?

Probably not since back in November 2025, CalPERS, the $556 billion pension fund, became the first U.S. pension to ditch strategic asset allocation in favor of this framework (effective July 1, 2026). Their CIO believes it could add 50–60 basis points annually to returns. Imagine that compounded over decades.

In case you missed it: From Residency to Retirement: A Doctor’s Guide to Investing in Crypto Responsibly

The 2022 Wake-Up Call

To understand why the Total Portfolio Approach gained traction, we need to talk about what actually went wrong in 2022.

The 60/40 portfolio works on a simple premise that when stocks zig, bonds zag. This negative correlation has been its superpower for decades. During the dotcom crash, 2008 financial crisis, and the COVID panic of 2020, bonds rallied when stocks tanked, providing the ballast that kept investors from selling at the bottom.

Then 2022 happened. Inflation spiked to 40-year highs, forcing the Federal Reserve to jack up interest rates faster than they had since the Volcker era. The result? Stocks dropped 19.4% while bonds had their worst year in history, down 13%.

For the first time since 1980, both asset classes posted negative calendar-year returns simultaneously.

The correlation between stocks and bonds, which had averaged around negative 0.12 over 20 years, suddenly jumped to positive 0.51. To our collective horror, diversification stopped working exactly when we needed it most.

Now, does this mean the 60/40 is dead?

Well, not quite. It bounced back nicely in 2023 and 2024, and Vanguard’s analysis shows the 10-year trailing return through 2024 was still 6.9% — basically matching its long-term average. So, as Mark Twain might say, reports of its death were greatly exaggerated.

2022 did help expose a fundamental flaw. When inflation becomes the dominant macro variable rather than growth concerns, the traditional portfolio construction playbook isn’t as ironclad as we used to think.

The Total Portfolio Approach

Think of traditional portfolio management like filling buckets. You’ve got your stock bucket (60%), your bond bucket (40%), and you rebalance religiously back to those targets every quarter or year, regardless of what’s happening in the world.

Each bucket has its own benchmark, its own team managing it, and its own little fiefdom within your portfolio.

Total Portfolio Approach throws out the buckets entirely.

Instead of asking “how much should I allocate to stocks versus bonds?”, TPA asks “what combination of investments will best achieve my actual goals while managing total portfolio risk?”

It’s the difference between following a recipe down to the letter versus actually tasting your food and adjusting seasoning as you go.

Here’s what’s different:

- Dynamic vs. Static: Traditional portfolios reset to fixed percentages. TPA allows significant shifts based on market conditions and opportunities. When Australia’s Future Fund pivoted quickly during 2020–21, they could because they weren’t handcuffed to predetermined allocation ranges.

- Goal-Focused vs. Benchmark-Focused: Traditional investing obsesses over beating the S&P 500 or the Bloomberg Aggregate Bond Index. TPA cares about meeting your actual objectives — whether that’s funding retirement, maintaining purchasing power, or generating specific income levels. A March 2025 survey found that funds using TPA outperformed those using strategic asset allocation by 1.3% annually over a 10-year period.

- Risk Factor-Based vs. Asset Class-Based: TPA looks at underlying risk drivers like inflation sensitivity, interest rate exposure, economic growth dependency, rather than just asset class labels.

High-yield bonds might sit in your “bond bucket,” but during market stress, they behave like stocks. They fall when stocks fall. Same with emerging market debt, leveraged loans, and private credit.

If you think you’re diversified because you own “different asset classes,” you might actually be concentrated in equity-like risk without realizing it.

TPA would move those credit-sensitive bonds into a “Growth” sleeve alongside stocks, leaving only genuinely defensive assets in the “Stability” sleeve. This means it’s actually honest about what’s actually providing diversification versus what just has a different name.

The Private Markets Component

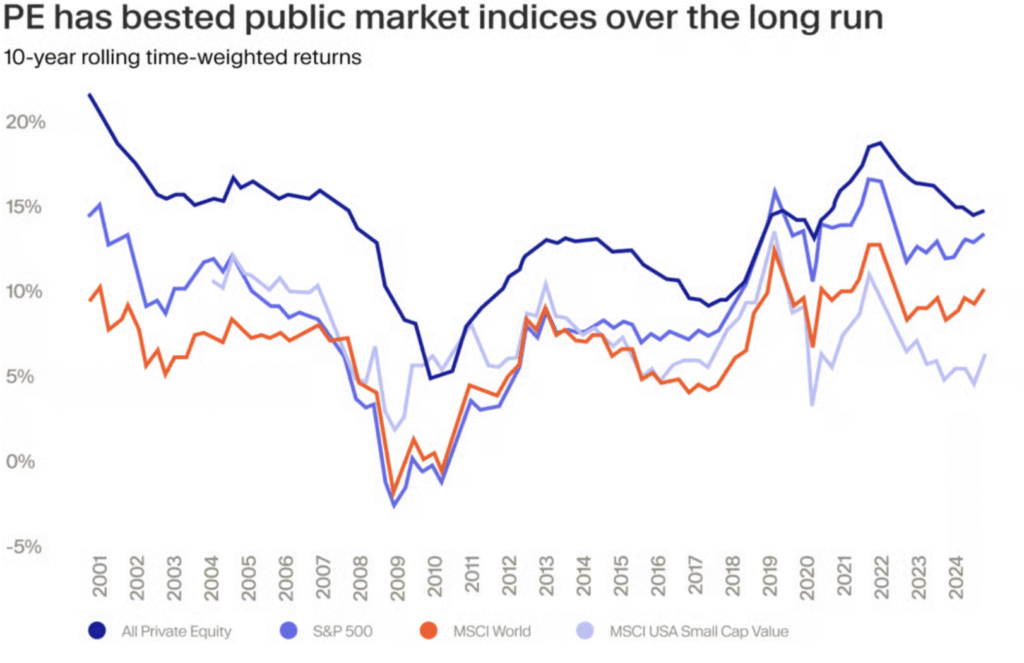

One of TPA’s key features is that public stocks and bonds aren’t the only game in town. Private markets (private equity, private credit, infrastructure, real estate) have exploded in size and sophistication over the past two decades.

Since 2000, private equity has generated a net annualized return of 13% compared to public equities’ 8%. Hamilton Lane estimates that $1 invested in private equity in 2015 would have grown to $3.96 by 2024, outpacing the S&P 500’s $3.51 and MSCI World’s $2.61.

More importantly, private markets often provide true diversification. Private credit has shown lower correlation to public markets than traditional bonds (or stocks for that matter), with institutional investors specifically seeking it out for “portfolio diversification, low correlation to public markets, and relatively high returns.”

During the COVID selloff in Q1 2020, private credit declined only 7.6% versus 15% for high yield bonds and 19.6% for the S&P 500 which is a testament to its defensive characteristics.

The downside is that private markets require patience, higher minimums, and you can’t panic-sell at 3 AM when you’re reading scary headlines. UK private capital funds delivered a 15.8% annualized return over 10 years through 2024, but you can’t achieve those returns if you need liquidity next month.

For most individual investors, accessing quality private investments has historically been tough.

But that’s changing. Interval funds, tender offer funds, and other semi-liquid vehicles are making private markets more accessible to high-net-worth individuals who can meet the suitability requirements and handle reduced liquidity.

Also read: Backdoor Roth vs Taxable Investing for High Earners

The Valuation Advantage of Thinking Long-Term

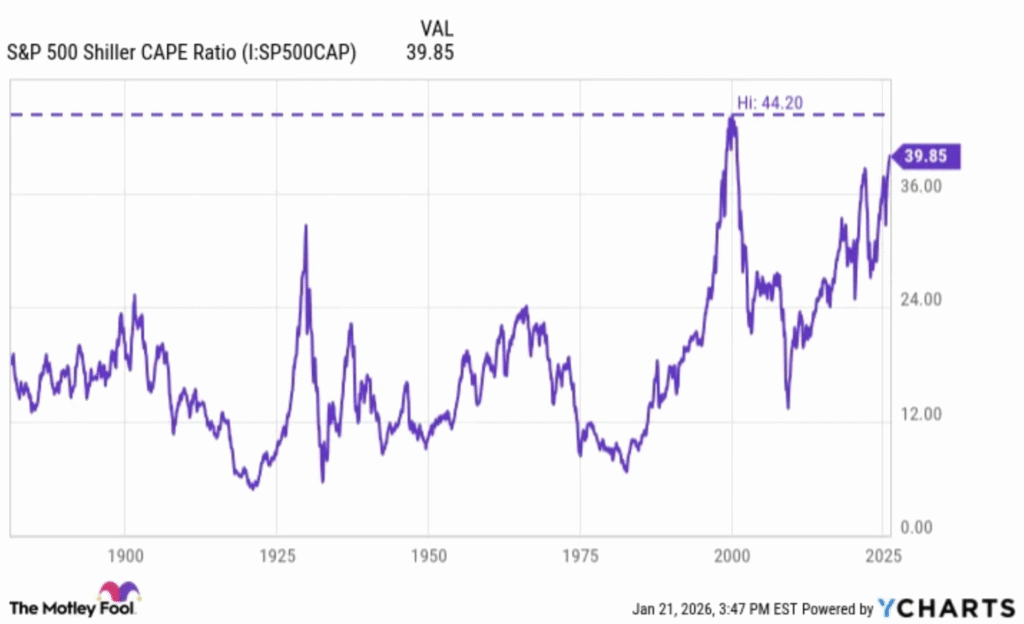

Public markets are expensive by historical standards, while private markets are relatively cheaper.

The CAPE (Cyclically Adjusted Price Earnings) ratio (a valuation metric that smooths out earnings cycles) sits at around 40 as of January 2026. The second-highest in history.

Historically, high CAPE ratios spell trouble for public equities. When CAPE exceeded 30 in the late 1990s and 2020–2021, subsequent 10-year returns were muted.

Meanwhile, private equity has been buying companies at an average EBITDA multiple of 9.6x over the past 25 years, compared to public market valuations of 12.1x. That spread has remained remarkably consistent across different market cycles.

A Total Portfolio Approach gives you the framework to actually act on this information. Instead of rigidly maintaining 60% exposure to richly-valued public equities because “that’s the policy,” you can incrementally shift toward private markets or other opportunities offering better risk-adjusted return prospects.

Real-World Implementation of the Total Portfolio Approach

To be clear, implementing TPA isn’t as simple as rearranging your Vanguard ETFs on a Saturday afternoon. This is complex stuff, which is why massive institutions hire teams of PhDs to manage it.

But the core principles can inform how individual investors think about their portfolios:

Risk Factors

Stop organizing your portfolio by “I have stocks, bonds, REITs, and gold.”

Instead assess your exposure to equity market risk, interest rate risk, inflation risk and economic growth dependency.

That high-yield bond fund you own for “fixed income diversification”? It probably has an 0.60+ correlation with stocks. It’s not providing the diversification you think it is. TPA would categorize it alongside equities in a Growth sleeve.

Meanwhile, that dividend aristocrat stock fund (companies with 25+ years of consecutive dividend increases) might actually behave more like a Stability asset during downturns than your junk bond fund.

Clear Goals

In the traditional approach, you are aware that you need to maintain the 60/40.

A TPA allows you to think: “I need $120,000 annually in retirement income with high confidence, adjusting for inflation, and I can tolerate a 15% maximum portfolio drawdown.”

See the difference? One is arbitrary. While the other gives you a real framework for making allocation decisions.

Allow Flexibility Within Guardrails

CalPERS set a 75/25 stocks/bonds reference portfolio with a 400-basis point active risk limit. This means they can move meaningfully away from that reference point, but not wildly.

For individual investors, this might mean that while your baseline is 60/40, you can range between 50/50 and 70/30 depending on valuation, market conditions, and opportunities, with total portfolio volatility not exceeding a certain percentage.

Incorporate Private Markets (If You Can Handle the Constraints)

If you’re an accredited investor and can stomach 5–10 year lockups, allocating 10–20% to quality private equity or private credit can meaningfully improve long-term returns and diversification.

But — and this is critical — only if you:

- Don’t need the money for a decade

- Have sufficient liquid reserves for emergencies

- Can afford the higher fees

- Have access to quality managers (this matters enormously; the dispersion between top-quartile and bottom-quartile private market funds is massive)

For many physicians with high incomes but lumpy cash flows, interval funds offering quarterly liquidity at slightly lower fees might be more appropriate than fully committed capital.

The Implementation Reality Check

Are you sold on the idea yet? Well hold your horses ’cause the bitter truth is that…TPA is hard to execute well.

CalPERS itself acknowledged that adopting TPA “poses a meaningful change to the investment governance model.” They spent over a year preparing, had to reorganize teams, upgrade analytics systems, and fundamentally change how they communicate with stakeholders.

For you and I — individual investors — the challenges include:

- Data and Tools: Assessing factor exposures across your entire portfolio requires sophisticated analytics. Your typical brokerage platform won’t cut it. You need portfolio construction software that can aggregate risk metrics across diverse holdings.

- Discipline: The flexibility of TPA can be a bug, not a feature, if it leads to excessive trading or performance-chasing. You need real conviction and a systematic process, not just permission to make tactical bets.

- Quality: Not all private market investments are created equal. The difference between top-quartile and median private equity funds is massive — often 5–10% annualized over a fund’s life. Getting into the best funds requires relationships, minimums, and timing that most individual investors lack.

- Liquidity Management: McKinsey’s 2025 private markets report noted that distributions finally exceeded contributions for the first time since 2015, but that came after years of capital calls with limited liquidity. You need a serious liquidity budget and discipline to avoid forced selling.

This is why TPA might be most valuable as a mindset rather than a complete overhaul. You don’t need to replicate CalPERS’ approach, but you can borrow its core. Think holistically about risk, focus on goals over benchmarks, and allow measured flexibility when opportunities arise.

What Should You Actually Do?

If you’re intrigued by TPA but not ready to blow up your entire portfolio strategy, there’s a sensible middle path.

Start with Factor Awareness

Audit your current holdings for hidden concentrations. That “diversified” portfolio of 8 different funds might all have 70%+ exposure to equity market beta. Understanding what you actually own is step one.

Create Liquidity Buckets

Separate money you’ll need in the next 1–3 years from money you’re investing for 10+ years. This gives you the psychological freedom to think long-term with the latter bucket.

Test the Waters with Alternatives

Before committing serious capital to private markets, consider allocating 5–10% to liquid alternatives that capture some of the diversification benefits like managed futures, market-neutral strategies, or real asset funds. See how you handle the different return patterns.

Reframe Your Benchmarking

Instead of obsessing over beating the S&P 500, define success as: “Am I on track to meet my financial goals with acceptable risk?” That’s a different (and arguably better) question.

Work with Advisors Who Get It

If you’re going down the TPA path seriously, you need advisors who can access institutional-quality private investments, build sophisticated risk models, and implement dynamic strategies without triggering excessive taxes. This is not robo-advisor territory

The Total Portfolio Approach isn’t magic, and it won’t prevent bad years when markets broadly decline. What it offers is a more honest, sophisticated framework for thinking about portfolio construction in a world where correlations between stocks and bonds aren’t fixed and valuations matter for future returns.

The 60/40 portfolio served investors well for decades, and with some adjustments, it can continue to work for many people. But if 2022 taught us anything, it’s that we need to think more deeply about what we own, why we own it, and whether it’ll actually do what we need it to do when markets get weird.

CalPERS made headlines by formally adopting TPA, but they’re just catching up to sovereign wealth funds like GIC Singapore, New Zealand Super Fund, and Australia’s Future Fund that have been doing this for years.

For individual investors, fully implementing TPA might be overkill. But borrowing its soul is something worth considering. Holistic risk assessment, focus on achieving your goals, maintaining flexibility to exploit opportunities, and considering the full investment universe rather than just stocks and bonds can meaningfully improve outcomes.

The classic 60/40 isn’t dead. But it could use an upgrade. The Total Portfolio Approach might just be it.

Disclaimer: This article is for informational purposes only and should not be considered personalized investment advice. Private market investments involve substantial risk, including illiquidity, and may not be suitable for all investors. Always consult with qualified financial professionals before making significant changes to your investment strategy.

Also read: Income Investing: The Smart Way To Reach Financial Independence

Frequently Asked Questions

What is the Total Portfolio Approach (TPA)?

The Total Portfolio Approach is an investment framework that manages your entire portfolio as one unified strategy focused on your specific goals, rather than dividing assets into rigid buckets with fixed percentages. Instead of mechanically maintaining “60% stocks, 40% bonds,” TPA looks at underlying risk factors and allows dynamic allocation based on market conditions, valuations, and opportunities.

How does TPA differ from the traditional 60/40 portfolio?

Traditional 60/40 portfolios use fixed asset class percentages and rebalance back to those targets regardless of market conditions. TPA is flexible and goal-focused — it asks “what combination of investments best achieves my objectives?” rather than “am I maintaining my preset percentages?” TPA also incorporates a broader investment universe including private markets and uses risk factor analysis instead of just asset class labels.

Why did the 60/40 portfolio fail in 2022?

In 2022, both stocks and bonds fell simultaneously — stocks dropped 19% while bonds had their worst year ever at -13%. The negative correlation between stocks and bonds that normally provides diversification broke down when inflation became the dominant concern. When the Fed raised rates aggressively to fight inflation, it hurt both asset classes at once, causing traditional balanced portfolios to lose around 16% for the year.

Can individual investors actually use the Total Portfolio Approach?

Yes, but the implementation varies by sophistication level. You don’t need to replicate CalPERS’ complex system. Individual investors can adopt TPA principles by: thinking about risk factors rather than just asset classes, setting clear financial goals instead of chasing benchmarks, allowing flexibility within guardrails (like ranging between 50/50 and 70/30 instead of rigid 60/40), and potentially allocating 10–20% to alternative investments for true diversification.

What are the risks of Total Portfolio Approach?

TPA’s flexibility can become a weakness if it leads to excessive trading or performance-chasing. It requires sophisticated risk analytics that typical brokerage platforms don’t provide. Access to quality private market investments is limited for most individual investors, and the dispersion between top-quartile and bottom-quartile private funds is massive. TPA also demands strong discipline and a systematic process to avoid making emotional allocation changes.

Is the 60/40 portfolio dead?

No. The 60/40 bounced back strongly in 2023-2024, and Vanguard’s analysis shows its 10-year trailing return through 2024 was 6.9% — matching its long-term average. However, 2022 exposed vulnerabilities when inflation is the dominant macro factor. The 60/40 can still work for many investors, but TPA offers a more sophisticated framework for those willing to embrace additional complexity.

How much should I allocate to private markets in a TPA portfolio?

Most institutional investors using TPA allocate 10–20% to private markets (private equity, private credit, infrastructure, real estate). However, this only makes sense if you: don’t need the money for 5–10+ years, have sufficient liquid reserves for emergencies, can afford higher fees, and have access to quality managers. For many investors, starting with 5–10% in liquid alternatives (managed futures, market-neutral strategies) is a more practical first step.