2016 saw its share of highs and lows.

We dealt with the lingering threat of raising interest rates from historic lows. There was the Brexit vote, which rocked the markets for about a week, then completely blew over. We had a vote of our own in November that had profound effects on the markets. After it looked like the bottom was falling out in the overnight futures, the markets recovered and major indices have seen record highs in the closing weeks of the year.

PoF Portfolio Summary

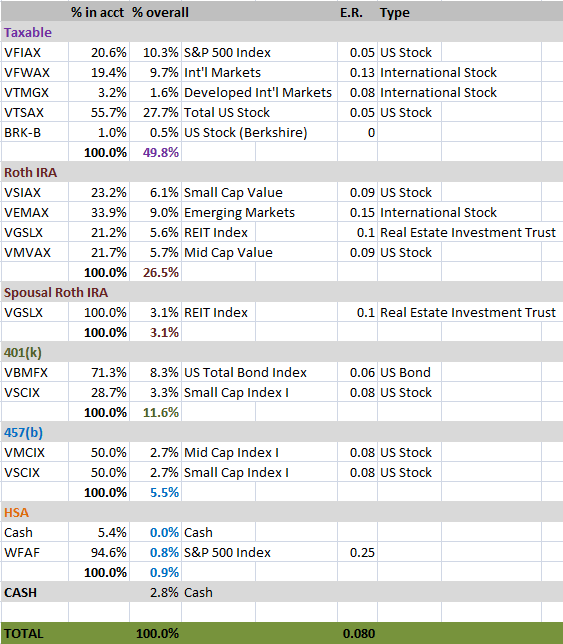

I’ll start with a review of the retirement portfolio, since it’s been the better part of a year since I first shared it with you. The following spreadsheet tracks our balances in percentages and is current as of the end of the calendar year, 2016.

This retirement spreadsheet includes our taxable account, Roth IRAs, HSA, and two retirement accounts. What you don’t see are the 529 accounts, our donor advised funds, or our microbrewery investments. I don’t plan on using those in retirement, save for the perks as owner and lender to the breweries. #freebeer

Our first and second home are not included above, although I do add them in when we calculate our net worth.

The portfolio is right where I want it to be in terms of asset allocation. We’re a little cash heavy as I am about to invest $10,000 to the 529 accounts, $5,500 each to two Roth IRAs via the “backdoor,” and will be making my monthly taxable account investment. Furthermore, my first few paychecks of 2017 will be on the small side as I front load my 457(b), so it’s nice to have built up a cash reserve.

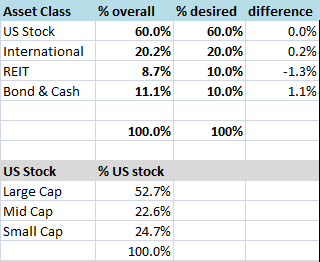

Here’s the spreadsheet’s breakdown of my current and desired asset allocation. REIT is a bit deceptive, as there is some overlap between small-cap US stocks and REIT. While I look underweight, Empower reminds me that I’m actually a little overweight.

You’ll notice a tilt to mid and small cap stocks. Based on market capitalization alone, large cap stocks would be closer to 80% of the total. I don’t have it broken down in the spreadsheet, but I also tilt to value stocks within the mid and small caps, with the index funds in my Roth account being value funds.

I also tilt to emerging markets within my international holdings, and shoot for a 50% / 50% split between developed and emerging markets.

2016 Returns for the PoF Portfolio

Let’s take a look at the You IndexTM representing my entire portfolio, provided by Empower, which is plotted against the S&P 500.

Hooray, I win! 11.52% up in 2016, compared to 9.54% for the S&P 500.

Not so fast.

Empower likes to make you feel good about yourself by apparently reporting the S&P 500 returns without dividends reinvested. With dividends reinvested, the S&P 500 actually returned 11.96%. So we didn’t win, but came pretty darned close. Considering we were well diversified with a 10% bond allocation and 20% international, I’d say we did well to approach the returns of the S&P 500.

Here’s how our S&P 500 index fund, VFIAX (in orange), charts out.

At the end of the year, the orange line does come out on top. For much of the fall, my portfolio was ahead by 3% or more, but that all changed on the second Tuesday in November. US stocks have solidly outperformed other classes since then.

Winners in the PoF Portfolio

Small cap value stocks had a banner year, with VSIAX ending the year up nearly 25%. The fund had outperformed large caps by a few percentage points, and really took off after the election. It’s easy to see the launch point towards the end of the year.

Mid cap value stocks followed a similar pattern but to a lesser extent, with VMVAX finishing up just over 15% on the year.

Losers in the PoF Portfolio

Impressively, no asset class lost money for me this year. There were a couple that underperformed, though. Which were the bums that only returned a few percent or less?

Developed international markets were not terribly exciting this year, unless you found the Brexit scare exciting. In hindsight, it was but a blip. Just a drop in the Thames when looking at the broader picture. Can you even spot it?

After a series of ups and downs, my developed markets fund, VTMGX, finished up 2.43%. International stocks are trading at much lower P/E ratios compared to their US counterparts. Time will tell if this proves to be a buying opportunity, but it is fair to say that developed market stocks look relatively cheap right now.

What about Bonds?

The 10% bond allocation in my portfolio is held entirely in the Vanguard Total Bond Market index fund, VBTIX. It eked out a 0.14% gain this year, after being a top performer for the first 5 months or so, slowly gaining in value while stocks lost around ten percent early in the year. The graph certainly demonstrates how a bond allocation acts to “smooth” your returns compared to more volatile investments.

The Others

Speaking of volatility, a couple classes didn’t perform particularly good or bad on the whole, but took me for quite a ride over the course of the year.

Let’s look at emerging markets first. Recall that half of my international allocation, or 10% of my portfolio is invested in this asset class. Yes, I do enjoy rollercoasters.

My emerging markets fund, VEMAX, ended the year up 11.72% but for about four months looked quite dominant. When did it change course abruptly? Right after that election. Are you seeing a theme yet?

One more class that also comprises approximately 10% of my portfolio is REIT. These are interest rate sensitive. They gained when rate increases were postponed, and fell when rates were on track for an increase.

Vanguard’s REIT index fund, VGSLX gained 8.47% for me by year’s end, but over the summer was outpacing stock funds by about 10%. It will be interesting to see the performance in the coming years as interest rates presumably rise.

2016 PoF Portfolio Performance Summary

I’d say it was a great year. Returns of 11.5% in the portfolio were enough to cover our annual spending (post coming soon!) three to four times over. Returns were slightly ahead of long-term averages and well ahead of what most forecasts predict for the years and decades ahead.

The tilts served me well last year. Having a higher proportion of mid cap and small cap value stocks compared to their market capitalization worked out in my favor as the year came to a close.

My tilt to emerging markets within the international allocation also served to boost my return in 2016. Despite a downturn at year’s end, emerging markets ended the year with returns nearly identical to that of the S&P 500, while developed markets lagged behind significantly.Let’s take one more look at the portfolio’s performance (blue), going way back to 1/1/2000, plotted against VFIAX (the S&P 500 index fund) in orange.

Blue for the win! Taking all my funds into account, along with the percentage I have in each shows a long-term advantage over the S&P 500 (145% versus 130%) if you consider 16 years to be long-term. Note that there were brief periods after each of the two big downturns where blue dips below orange. In other words, this is not the best asset allocation to be holding in a bear market, but it has performed well when the markets are rising.

Do I need this many funds?

I could have similar returns with a simpler portfolio, without a doubt. Some of the complexity comes from tax loss harvesting, which results in me holding four funds in the taxable account, rather than two. Also, I added Berkshire Hathaway stock for its no-dividend feature, and for the “free” tickets to the annual stockholder’s meeting in April.

Additionally, only certain funds are available to me in my 401(k) and 457(b). In both of these accounts and in my Roth accounts, I intentionally avoid holding substantially identical funds to those which I hold in the taxable account, so as to avoid a potential wash sale when dividends in the tax advantage accounts are reinvested, or when automatic investments are made.

I fully anticipate having a simpler portfolio in early retirement. Maybe not three fund portfolio simple, but I should be able to whittle down the number of funds a fair amount.

Was 2016 good to you? Do you know your total return? Do you want to?

If you sign up for Empower via any links on the page, I receive a commission that will help support the site’s charitable mission. I appreciate your role in making it happen!

59 thoughts on “PoF Portfolio Returns: How Did We Fare in 2016?”

I follow a few blogs and just read this post about your portfolio. I was really surprised on how heavy you are in equity mutual funds and how low in bonds. What is your strategy in a bear market like 2000 and 2008? I don’t understand where you could pull out money each year to pay expenses without selling at some large losses if there is another bad streak in the market like 2000 and 2008.

I’ve got a few things going for me in 2020 that I didn’t in 2016.

One is having a portfolio large enough to give me about a 2% withdrawal rate at our current rate of spending.

Two is about 5 years worth of spending in cash / bonds (although it’s higher now as we are in the market for a new home and wanting to spend cash).

Three is blog income which keeps me from withdrawing anything at all.

I think we’re in good shape to withstand a big drawdown, and March of 2020 was a bit of a test, even if short-lived. We did lose a million dollars and I pretty much shrugged it off as being inevitable, although it happened sooner than I had anticipated.

Cheers!

-PoF

Newb question:

You don’t include your home value in your net worth (as an asset), but (assuming one has a mortgage) you would include that as a liability?

Thanks

When calculating net worth, I would include both the value of the home as an asset and a mortgage as a liability.

When considering my retirement portfolio, I don’t consider the home as part of that portfolio, but it could be used in a reverse mortgage situation, so if that’s potentially part of your plan, you could include it.

It really just depends on what you’re trying to track. It’s the same with 529 Plans. I count them in our net worth, but they’re earmarked for a specific purpose, so I don’t consider them part of our retirement savings.

Best,

-PoF

I use essentially a three-fund portfolio, so I underperformed the S&P 500 and Total Stock Market indices because of the poor performance of international stocks (or conversely, strong performance of U.S. stocks) this year. Congratulations on your 2016 investment returns PoF!

Great job POF. When I totaled all the figures (lot of dividends to add up), I ended the year at 12.05% return. Dividends once again exceeded our living expenses but they were all reinvested to accelerate the compounding – achieved 12.8% dividend growth over last year. You are right that PC doesn’t include all dividends in their return calculation so best to do this manually using starting and ending balances to get correct figure. Sounds like 100% equities was the right strategy last year, lets see this year. Other than some targeted stock buys when they hit my value range, I intend not to touch my portfolio. All the best for another great year!

Thanks for sharing the insights into your portfolio. 2016 was a surprisingly good year. I was not doom and gloom like many, but did not expect double digit returns in the market. I ended the year right around 14% per Personal Capital. Berkshire is the most significant individual stock I hold. With a return of 23%, they helped boost my returns. I also have very little bond allocation, and my foreign allocation is just at about 10%.

Whoa, those are some nice returns PoF! I love all the separate graphs too, even though that must have been tedious to put together, thanks!

We haven’t totalled up our 2016 returns yet, but have started compiling how much we saved or didn’t… Quadrupling our cash on hand expecting simultaneous layoffs meant our “outside the 401k” investments were less than usual. We still did well on our 401k and 529 investments though. We now have that pile of cash to dump into the market, so it’s not like it’s a loss, except for that run at the end of the year. Could’ve been some nice gains, oh well…

Woulda coulda shoulda. I wouldn’t worry about it one bit, Mr. SSC. The good news is you didn’t experience simultaneous layoffs!

Best,

-PoF

An outstanding year, PoF! Congrats!

And I agree with your thoughts on developed market international equities – they look relatively attractive. But maybe that’s all the imported beer talking. Cheers!

It was, wasn’t it?

I won’t be increasing my international allocation, but will continue to rebalance into it as appropriate. That’s the beauty of rebalancing — forces you to sell high and buy low.

Cheers!

-PoF

Congrats on a great year. Wishing you continued success in 2017 and hoping that the market continues to treat you well.

Thank you, Dennis. Many happy returns to you, as well.

Cheers!

-PoF

did you pick the funds in your four fund strategy?

If so how did you come to pick them?

Yes, e. More detail in my rationale in this post.

Cheers!

-PoF

Nice work! What a good feeling it must be to know that your gains far exceeded your expenses. So how much longer are you working again? haha…

You have a pretty high risk portfolio. Only 10% bonds and stocks with a value/international shift. Yikes. It is rationally ideal as long as you can psychologically handle a major crash. I learned in 2008 that I’m not as mentally tough as I thought I was.

True. It’s a diverse portfolio, but rather aggressive for a 41-year old man. I justify it by:

a) having exceeded my FI number

b) still adding to the pile while gainfully employed

c) I treated 2008 as a great buying opportunity

d) greed

Cheers!

-PoF

Not too shabby there PoF, especially considering 40% of your assets were either in international, REITs, or bonds/cash.

That’s interesting that Personal Capital doesn’t include reinvested dividends for the S&P500 , yet your own portfolio numbers do (I’m assuming).

That 2%-ish advantage must make most investors feel pretty good…and unfair advantage that I’m sure Personal Capital likes to keep around. In the software world we used to call that a “won’t fix” bug.

Yeah, I go to a lot of trouble to almost match the returns of the market, don’t I?

And yes, I don’t know why it’s calculated that way. It looks like VFIAX destroys the index, which makes no sense. Here’s an explanation of the difference.

Best,

-PoF

Thanks for sharing! I love reading how like-minded people use different methods to get to the promised land… it’s all about spawning ideas. I use a far more focused strategy than you do (probably due to my personal quirks and psyche)… My results would be more volatile by definition. Last year was a down year, this year a great year… I posted about it here:

63% of your portfolio in a single stock! BRK is about as diversified as you can get with one stock, but you are a braver man than me.

Buffett and Munger aren’t getting any younger.

Best,

-PoF

Oh yea! There are times that I’ve been 100% in BRK. I’ve owned it since 1998 and during that time I’ve seen it drop ~50% at least twice… Charlie Munger likes to say that “Three stocks is plenty of diversification” but I wouldn’t do that with too many stocks other than Berkshire and a handful of others. I focus like a maniac on the stocks I own so I know everything humanly possible about them. That said, I don’t worry about Buffett/Munger leaving… They have great people to step in… If the price drops a lot I’ll just buy like crazy. That said, as time passes I’ve been slowly accumulating Vanguard funds (VFIAX, VHDYX) – now about 25% of portfolio. I do take to heart what Buffett directed for his widow’s portfolio: 90% VFIAX and 10% short term treasury fund.

(whistling and cat calling as you go down the street) “Nice returns PoF!”.

The latter part of 2016 was a fun year to be in the market. 2017, you have big shoes to fill, so step up.

I’ve never tax loss harvested yet. 2017 is when I plan to cull the herd. Are you listening herd? This is the year of perform or die.

2016 was a good year for TLH due to the early drop and another opportunity in the brief nadir after the Brexit.

It wouldn’t bother me if no good opportunities arise in 2017, but for your sake, Mrs. BITA, I’ll allow one brief drop.

Cheers!

-PoF

Sounds like a pretty great year, PoF.

Not only is PC not including dividend reinvestment on the index, but It’s also my understanding that PersonalCapital just backdates today’s allocation for the You Index, you can test this by changing the start date to some date before they started monitoring your portfolio…I’m not aware to look at my actual return within PersonalCapital. It’s great for not having to individually log in to all my accounts though.

I actually like that latter feature, TJ. It lets me backtrack my current allocation, as I did above with a 16-year look-back.

Also, since I don’t plan on making significant changes to the allocation, the number should be very close to my actual return. If you’re making changes throughout the year to the extent that the MyIndex number is meaningless, you’re probably making too many changes! Not you in particular, but in general. 😉

Cheers!

-PoF

You know, from that perspective, I would agree with you, and it’s not like it adds or detracts any value to know that I was smart or dumb in my buy or sell decisions. I guess I’m just curious to know. I know that maxing out my IRA on the first trading day of January last year was not optimal vs. waiting a few weeks, but 20-30 years from now it probably doesn’t matter.

The fact that you’re able to max out an IRA when the bell rings in early January means a lot, though. Having that ability means you should be in great shape.

I have to DCA the 401(k) or I won”t get the match until the following calendar year. The employer stops contributing when you stop contributing, even if you’ve stopped because you’ve put in the $18,000.

I do frontload the 457(b) in three pay periods.

We went through our net worth yesterday for 2016. It was a good year all in all with an increase in net worth by over $75K despite a big cross country move and a loss of approximately $20K on the sell of our house. Our net worth creeped to the positive range just to be thrown into the negative territory when we purchased our Cali house with fees, upgrades, furniture, etc that comes with home purchase.

As for stocks. We go with the KISS – keep it simple stupid. I am heavily invested in VTSAX.

Thanks for sharing.

Strong work, EJ. Amazing what a good job does for your net worth, sometimes in spite of our choices. I’ve done poorly with housing, but have more than overcome my mistakes by having a doctor’s salary for more than a decade.

Simple is good.

Cheers!

-PoF

Congrats on awesome overall return.

We came in at 8.5%. Our bond holdings are much larger than yours and that accounted for most of the differential I suspect. Although we hold some small cap value stocks, not as much as your portfolio. Most of our equities are in the SP 500 (VIIIX in my 401k and a similar fund in Mrs. PIE 401k) followed by VTSAX and VWIAX as next largest. Our biggest bond fund (JCBUX) still managed to eke out 2.7% return even after the bond meltdown in Q4. Our international funds were all poor performers – except VEMAX.

We take 2016 firmly as a big win overall.

8.5% is nothing to sneeze at, Dr. PIE.

More bonds will do that, but you’ll be glad to have them in Mr. Market’s down years.

Cheers!

-PoF

Such detail!

We have just a handful of index funds and balance our allocation by adding more to lower categories when we have the money, so we just track our total gain/loss for the year.

Your graphs and charts are interesting, though, so thanks for doing all the work for us!

Thanks, Julie! Like you, I rebalance with new additions.

It wasn’t much trouble, other than cropping the screen captures. Personal Capital makes looking at individual performance of the various portfolio holdings simple.

Cheers!

-PoF

Very impressive returns! Who would have thought that after the bumpy start??? Or the Brexit? The double-digit returns are the reward for not losing our nerves and staying in the market (reminds me of your excellent post “Don’t just do something. Stand there!“)

I came in pretty much exactly at the S&P500 annual return. Most of my assets are in it already and the allocation to the put option writing strategy couldn’t beat the index by much either. That’s because of the bond market meltdown after Nov 8. I use Muni bonds to hold the margin cash and to add another 2-3% p.a., but that didn’t work so well last year. Oh, well, try again this year!

I’m happy to take what the market gives me, ERN. Looks like 2017 is off to a good start, not that a day (or a week or a month) means anything.

Looking forward to seeing what you’ve got in store for us at Early Retirement Now! this year.

Cheers!

-PoF

Nice breakdown! 2016 was an excellent year for our portfolio as well. Lets hope the good times roll in 2017. But if they don’t that’s OK too, this market might need a breather, those dollars have been working hard 🙂

Yup, Mr. CK, we all know a bear market is lurking somewhere around a corner, it’s just impossible to know which one. I’d just as soon see its ugly face before I take a break from this career than after.

Best,

-PoF

Hey Doc! Fascinating to be voyeristic with your portfolio, thanks for the thrill (yeah, us PF folks are a bit wierd when it comes to what excites us). I came in slightly below S&P500, but I intentionally raised cash levels a bit over target, and hold more than you in bonds. Our Net Worth grew nicely, and it’s comforting to know we’re at a point where we can reduce risk a bit and still get the $ growth we need for FIRE in 2018. Our goal: conservative growth at this point, which we accomplished nicely in 2016.

I do expect a correction is looming, and tho all advise against timing the market, it feels good to have built up some “dry powder” in 2016, even if it came at the expense of some return. Thanks for sharing your numbers, great process.

Hey Fritz! Congrats on meeting your goals and building up your cash reserve.

And we’re one year closer to 2018!

Best,

-PoF

I’ve yet to run our 2016 return numbers. Thanks for the reminder. It looks like you had a pretty good return. Personally I wouldn’t worry to much about the number of funds so long as you have a clear handle on what asset class is what. The reality is certain accounts have a limit on what you can invest in. As such I doubt a true three-four fund portfolio is possible.

True, FTF. I’m comfortable with what we’ve got, and it’s very simple to manage and track. I hope you experienced similar returns.

Cheers!

-PoF

Whoop! GREAT year PoF, appreciate the detail here. I didnt figure out my year % increase yet this year, but I at least know it is positive 🙂

#FreeBeer sounds pretty awesome, solid investment

Are you positive it’s positive, AE? 😉

It would have been somewhat difficult to lose money in this market unless you made bets on individual stocks. But I know you wouldn’t do that.

Cheers!

-PoF

Solid year, PoF! We slightly underperformed the S&P this year attributable to the 10% hold in my company stock which was up just a bit on the year and also international held me back some, similar to you. Not bad though. As long as I track closely to the market I’ll be just fine.

Thanks for the update!

Darn that company stock! Actually, I’ll bet you’ve done well with it, since you probably receive it at a discount compared to buying it on the open market.

Cheers to a similarly succesfull ’17!

-PoF

Impressive that you’re beating the S&P 500. I find that despite using broad index funds I typically lag a little bit due to bond holdings. Can’t complain at all about that 11.5% annual return IMHO. I’ll be looking to calculate my own ROR for the year, but I doubt it is that high.

Nothing to complain about, F40G, other than the fact that the S&P 500 actually did slightly better. That’s not surprising, since I’m holding 10% bonds and 20% international allocations.

Cheers!

-PoF

Given the size of your portfolio, this is a pretty huge gain in raw numbers. I’m really looking forward to the time when my investment gains are out-earning my own raw savings. Either way, at a certain point, you really start noticing that a good market year contributes a lot to your savings (for us, it’s almost as if we have another person in the relationship working and saving on our behalf).

True. It’s a wonderful thing when the portfolio kicks in as much as the worker. It makes one wonder why they’re still working full time 😉

Cheers!

-PoF

It sounds like 2016 was a great year for you, PoF! It’s all about those dividends, so congrats on that as well!

We’re currently getting out of student loan debt, so unforunately it doesn’t make sense for us to invest heavily quite yet. But we do make it a priority to contribute to 401ks and Roth IRAs while we’re young. I’ve seen a small positive return on my Roth this year, which is always great to see. I am considering exploring less conservative investing with my Roth, but we’ll see how the numbers work out.

Thank you, Mrs. Pincher!

Investing while in debt is challenging. You’ve got lots of years ahead of you before you touch your 401(k) and Roth, so I would not be afraid to be aggressive there.

Cheers!

-PoF

Well done PoF! I was doing great last year and spanking the indexes until post election when my bond and emerging market funds both took it in the shorts.

Still closed up 9.4% for the year, so I’m not complaining! Most of my funds are Vanguard, with my 401k in a generic Russell 3000 account. I’ll be writing up the details later. Through mid-year, my precious metals fund was pulling me way up over the indexes, but that one took a dive as well after the election.

Well done, yourself, Jon!

Anything in the neighborhood of 10% is great in the current environment. This bull has been running a long time… let’s hope the party lasts a bit longer!

Best,

-PoF

I’m looking forward to calculating my annual returns and net worth growth, hopefully this weekend once I get my statements. It’s kind of lousy that Personal Capital doesn’t include dividend reinvestments when calculating returns of the index. Seems that it’s not a useful comparison in that case.

It’s odd, CMO, but luckily it tracks VFIAX, the Vanguard S&P 500 fund, accurately. So I’m able to get an accurate comparison that way.

Cheers!

-PoF

Where can I find a man like this? Finance is so confusing… I dread looking at my online brokerage account.

You can sign up for Personal Capital here. If you’re looking for a financial advisor (man or woman), I’ve got a list of some excellent, low-cost advisors here.

Cheers!

-PoF