There are, actually, several ways to avoid paying capital gains taxes. It’s just that most of them are things people don’t want to do, like die, give away money, or have a relatively low income.

Not all hope is lost, though. Dr. Peter Kim gives us a couple of examples involving real estate that can help you defer capital gains taxes or avoid them completely, regardless of your income, charitable aspirations, or status as among the living!

Note that several proposals have been made to alter how capital gains taxes are collected. If gains push your income over $1 Million, you could soon pay ordinary income tax rates on those gains. There’s also been talk of eliminating the step-up in cost basis upon death, meaning that your heirs could face sizable tax bills upon receiving an inheritance. Time will tell if either of these proposals will become a reality.

This post was originally published on Passive Income MD.

I firmly believe that real estate investing is one of the most effective strategies for building wealth. Not only that, but wealth through passive income. And as you might have guessed, I’m a big fan of making income as passive as possible.

Unfortunately, there is one big downside, and it comes around every April. Yes, it’s taxes.

Of course, taxes aren’t unique to real estate investing, but they can certainly be more intimidating. This is especially true of the dreaded capital gains tax.

For today’s post, we’ll be taking a look at what capital gains tax is, when it applies, and how it can be handled. Let’s get right to it.

What is Capital Gains Tax?

Put simply, if you sell a property for more than what you paid for it, you’ll have to pay taxes on the profit you made. But figuring out how much you have to pay–well, that’s the tricky part.

First, it’s important to note that there are two main categories of capital gains tax: short-term and long-term.

Any investment that was held for a year or less is considered short-term, and it will be taxed at the same rate as your regular income.

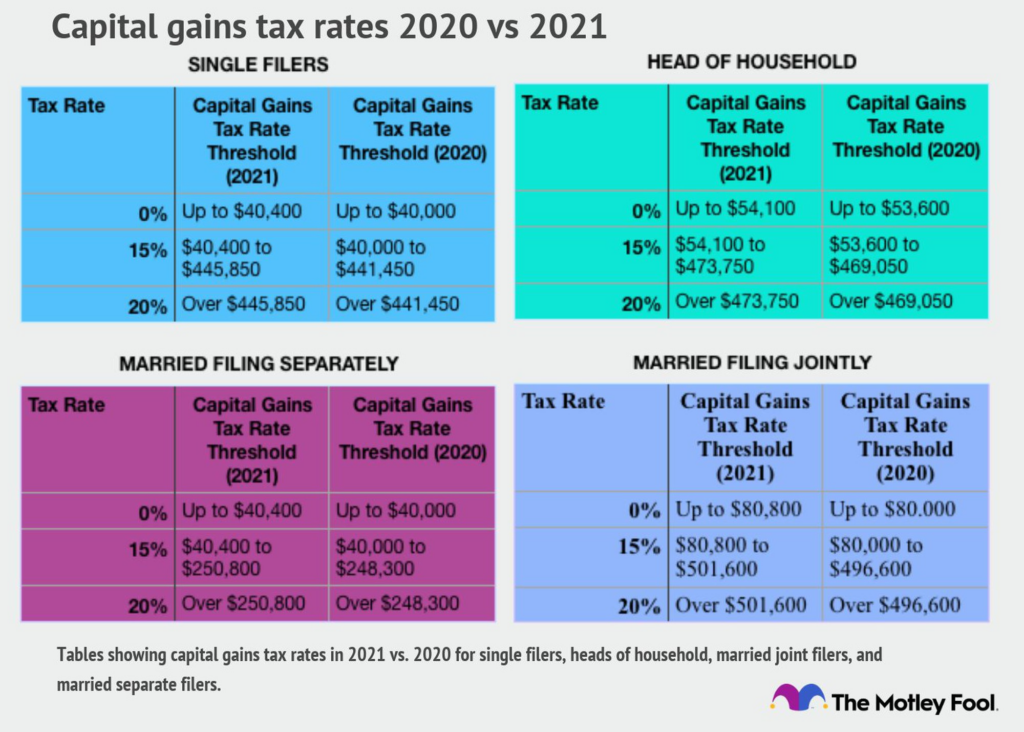

If you hold it for longer than a year, though, it’s considered long-term. Here’s where things change quite a bit. Here’s a table that compares the percentage the IRS will take based on how much capital you gained, depending on your tax filing status:

[PoF: This table ignores the 3.8% NIIT, a tax levied on investment income (i.e. capital gains) for individuals with income over $200,000 and couples with income of over $250,000. State income taxes, which are generally applied to all income including capital gains, are also left out.]

Those are the basics of capital gains taxes, compressed in a nutshell. Now the question is: are there any situations where you don’t have to pay those taxes?

Exclusions to the Capital Gains Tax

While there are likely quite a few exclusions on loopholes to paying taxes on capital gains, we’ll just be looking at the most common and most effective ones.

First, there’s the home exclusion benefit. Basically, if you sell a property, you can avoid paying capital gains tax if you:

- Lived in the home for 2 of the last 5 years

- Make less than $250,000 (or $500,000 if married and filing jointly) in gains from the sale

That’s pretty much it. You don’t even have to live in the home for two years in a row–as long as you’ve lived in the home for a total of two years within the last five, you’ll qualify.

1031 Exchange

The other great way to handle capital gains is by utilizing a 1031 exchange. I talk much more in-depth about this here, but I should point out that this isn’t exclusion, per se. Instead, it’s a way to defer taxes–sometimes indefinitely.

If you sell a property for a profit and then use the gain in capital to purchase another rental property, the capital gains tax is deferred until the sale of the next property. That is, unless you also use the profit from that property to buy the next one… you get the idea.

With the current rules in place, if you pass the property on to your children when you pass away, they’re able to take over the property with what’s called a “stepped-up basis.” They essentially gain the property at the current market value and the accumulated appreciation (and therefore deferred taxes) gets wiped.

This can be a very powerful tool for generational wealth creation.

There are a few qualifications you’ll need to meet in order to take advantage of a 1031 exchange, so be sure to check out the link above for some more info.

In general, a 1031 exchange is great for two reasons: Not only can you avoid paying capital gains taxes now, but if you buy and sell properties often, this deferring of taxes can push your rate from short-term to long-term.

Of course, because there’s so much to tax law (especially in the case of real estate), it’s best to speak with a tax professional before making any decisions based on this knowledge.

[PoF: You can also avoid taxes on capital gains if your taxable income is on the low side (see table above), if you donate generously, or if you pass away and your heirs inherit your assets with a stepped-up cost basis. For more info on all of these, see the Top 5 Ways to Pay No Tax on Capital Gains & Dividends.]

The Bottom Line

Capital gains tax is an unavoidable reality for most, especially when the time comes to sell an investment property. Still, there are a couple of ways you can defer or eliminate that amount entirely. But the most important thing you can do is be proactive.

Learning about taxes isn’t necessarily the most fun thing in the world, but the more you know about them, the more you can reduce the income you have to share with good old Uncle Sam, and the closer you can come to achieving true financial independence.

5 thoughts on “Capital Gains Tax: A (Mostly) Unavoidable Reality”

[…] the most compelling tax benefits of after-tax investment accounts is the favorable long-term capital gains tax rates. If you hold an investment in an after-tax account for more than a year before […]

[…] the most compelling tax benefits of after-tax investment accounts is the favorable long-term capital gains tax rates. If you hold an investment in an after-tax account for more than a year before […]

Why do you leave out investing in Qualified Opportunity Zones as a way of addressing capital gains taxes?

Excellent question for Dr. Kim. Several non-real-estate strategies were also left out, but I’ve got them covered in another post.

I have written about the QOZ option here and in other places.

Best,

-PoF