Investing

It’s one of the more hotly contested debates there is in investing. Income, or cash flow, vs. total return investing.

William J. Bernstein wrote in his short but highly useful book If You Can to beware of financial professionals. “Act

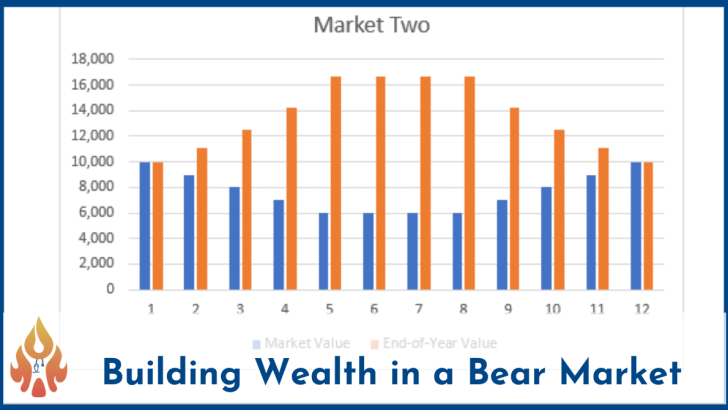

Investing in a bear market sure is exciting, isn’t it? My first day on the job was July 3, 2006.

Bond. James Bond. Bonds. The ballast of a robust, stable portfolio. The dramamine for those sick from the market’s ocean

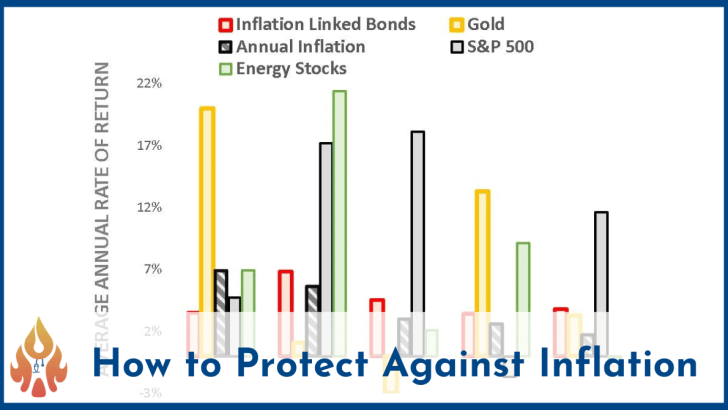

Each month, the U.S. Bureau of Labor and Statistics updates inflation numbers by publishing data for the Consumer Price Index,

Do you have a “play money” allocation in your investment portfolio? Investing can be quite simple. Mike Piper has a

You’ve undoubtedly heard about the price of Bitcoin, that mysterious electronic money, and its roller-coaster ride over the past decade.

In 2013, I opened my first Donor Advised Fund (DAF), and 2022 is my 10th year using them. They’re a

At this point, I think we’ve moved on from the notion that the inflation we’re seeing could be considered “transitory.”

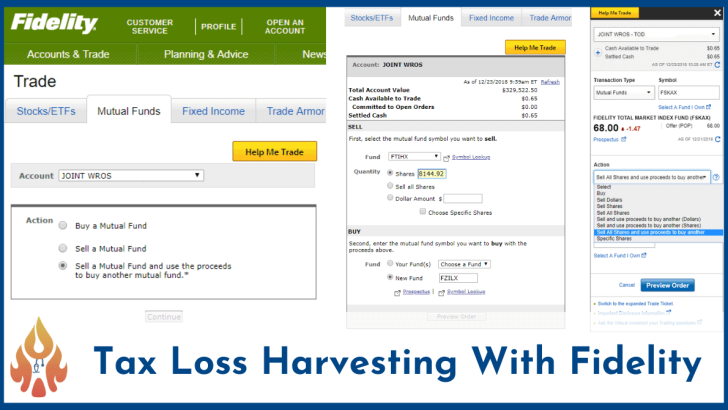

When the stock market gives you lemons, make lemonade. In December of 2018, the markets delivered lemons by the truckload.

I’ve been using and recommending Empower for longer than I’ve been a blogger. I’ve watched my net worth grow and

As a teenager, I stumbled upon the fact that money is fungible while working in a grocery store. I didn’t

Dr. Peter Kim wears many hats. Anesthesiologist. Husband and Father. Blogger, podcaster, conference organizer, and course creator. Did you know

Rising inflation means I’ll pay more for things, and the money I’ve got parked in a “high-yield” savings account is

How many income streams do you have? I’ve got six — the five passive streams mentioned here and the active

Decisions have outcomes. Some of our decisions have well-known outcomes with limited downside and limited upside. Other choices we make

My path to financial independence took about 10 years from the time I was broke, but if I hadn’t saved

How does one build generational wealth? Step one is to build some wealth of your own. Steps two and beyond

In an era of extremely low interest rates, is paying off the mortgage early a mistake? Or could it be

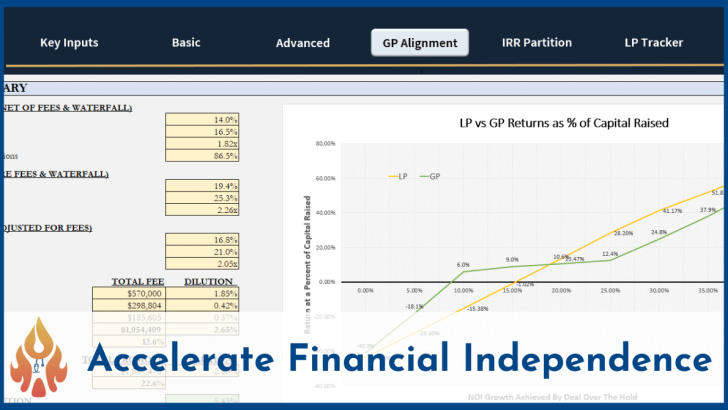

Several years after opportunity zone investments were incentivized by the federal government, new opportunities to invest in these areas to