Taxes

Tax Loss Harvesting is a great tool for generating tax alpha and lowering your annual tax bill, but it only

Depreciation is the relatively simple fundamental concept that as new things incur wear and tear, they become worth less and

It’s often said that there are only two absolutely certain things in life: death and taxes. But many folks don’t

When the stock market hiccups, as it is known to do from time to time, you may have one of

I’m excited to share a tax planning tool that I’m thrilled to have discovered a year ago. I’m not one

We wish you a Merry Checklist, we wish you a Merry Checklist, we wish you… you get the idea. It’s

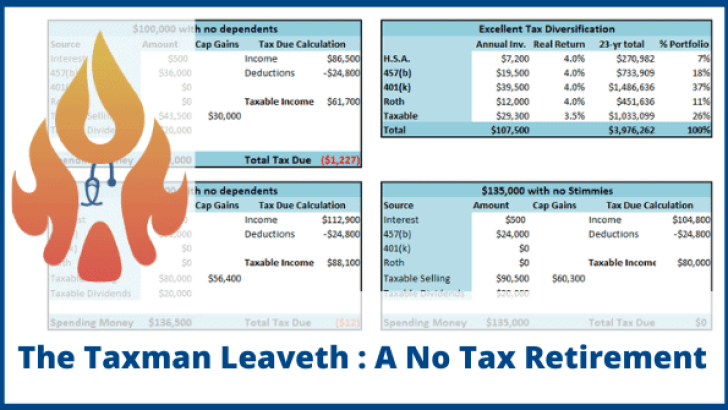

If you’ve spent any time learning the U.S. tax code, you’ve learned that taxes are due when you earn income.

There are, actually, several ways to avoid paying capital gains taxes. It’s just that most of them are things people

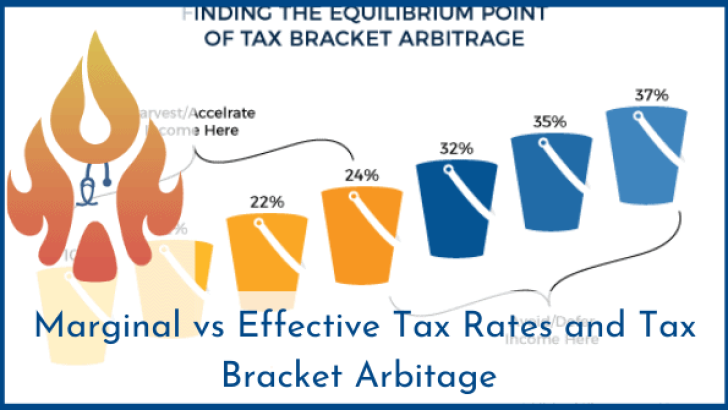

I’ve been known to take advantage of arbitrage opportunities like the geographic arbitrage somewhat unique to the medical field where

Whatever your circumstances, if you bought a home and are thinking about moving, I implore you to live in your

I’ve shown you how easy it can be to pay no federal income tax in retirement. In fact, it’s not

During our years of wealth accumulation, a.k.a. working, we pay a pretty penny in taxes. We become accustomed to knowing

I don’t make the rules. I just try to play by them. And the rules tend to favor those who

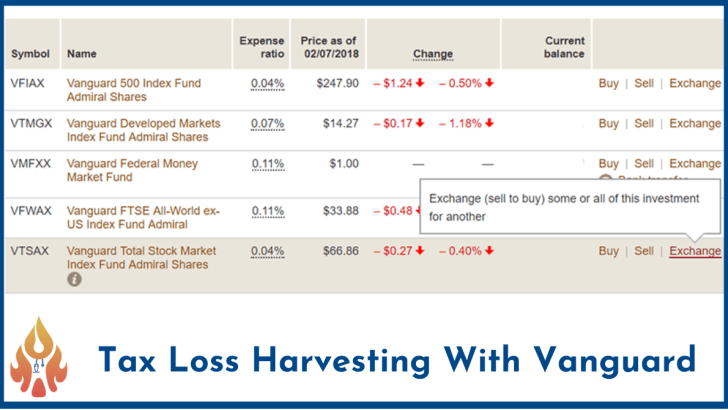

Vanguard, my preferred brokerage, has taken strides in recent years to make it very easy to donate appreciated assets. In

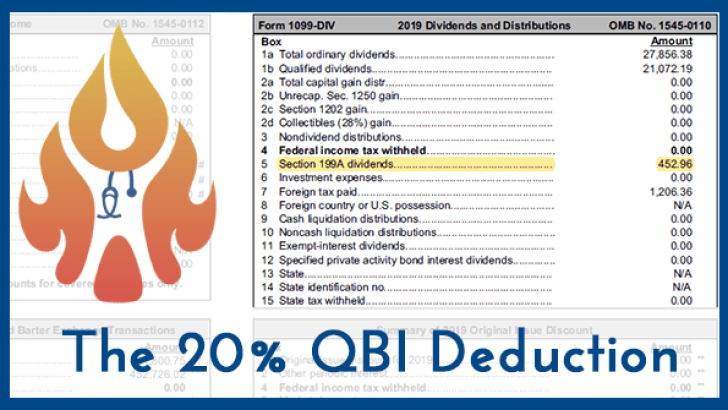

2021 is the fourth year in which I’ll be eligible to receive a QBI deduction, that is, a tax deduction

It is commonly understood that muni bond taxation is favorable. Typically, an investor will not owe federal income tax on

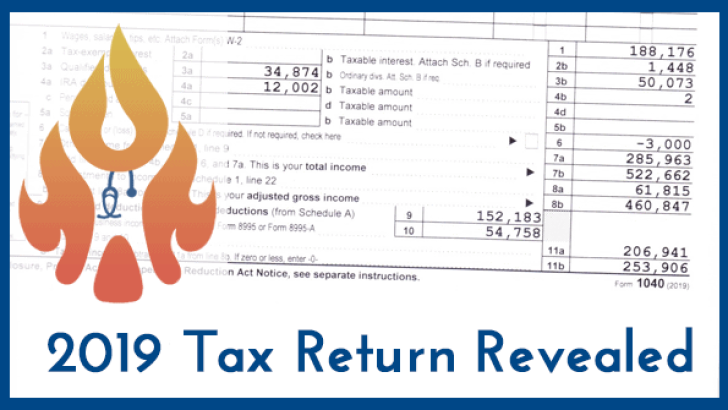

I’ve not done a tax return reveal before, but 2019 was an interesting year from a tax perspective, and I’d

A long-time reader recently reached out with an intriguing idea; he wanted to share his passive income tax rate as

High-income professionals should focus not only the returns from their investments, but also the after-tax returns. The difference can be