We spend a lot of time on this site thinking about saving: putting a lot of money away, making sure we put it away in the right places, figuring out how much risk we’re willing to take with that savings, and more.

But when the retirement rubber meets the road, there are a lot of mechanics to figuring out how you’ll actually draw off of those savings that have hopefully compounded over time.

Questions abound. How much do you withdraw? From what account do you take it? How do you pay only as much tax as you need to, without leaving a tip?

In this post, originally from The Retirement Manifesto, we examine with the author how well his carefully constructed drawdown strategy fared after three years of retirement, and plan for the future as well.

A year before I retired, I wrote Our Retirement Investment Drawdown Strategy as our plan for how we were going to manage the transition from Accumulation Phase to Drawdown Stage in retirement. That post was written on June 20, 2017.

I retired one year later.

In today’s post, a look back at how that strategy has actually worked over the past 4.5 years. Below, I’ll review each section of our original drawdown strategy as well as give our performance a grade. Just like in school, an A is excellent and an F is a failure. Fortunately, we’ve scored pretty well.

In addition, we’ll review our strategy to see what changes we should consider now that we’re 3.5 years into retirement.

- How has it worked thus far?

- What changes should we make going forward?

I enjoyed writing this post and updating the original charts from our drawdown strategy. I hope you enjoy reading it and trust you’ll learn some things that you can apply to your situation.

Revisiting Our Retirement Drawdown Strategy

Developing a strategy for managing your transition from accumulation to drawdown is critical. It’s a huge shift in your investment strategy, and it’s not something you should approach without a plan. Today, we’ll revisit our original retirement drawdown strategy and analyze how it’s worked since our retirement in 2018.

For consistency, I’ll present each of the charts from the original drawdown strategy, with updates showing our current status as of 12/31/21 for each. I’ll also summarize our original strategy, then provide an update with actions taken to date. Each of the elements will be presented in the same sequence as the original drawdown strategy, which means we’ll start with asset allocation.

Asset Allocation: Increase Stock Exposure

From the original drawdown strategy, I mentioned we were planning on increasing our stock exposure. From June 2017:

“When there’s a market correction, we’ll likely rebalance a bit back into equities”

Grade: A

We have increased our stock exposure from 48% to 57%, which is in line with what we were targeting. We took advantage of the COVID downturn to buy during the bear market, with our biggest move into equities coming on March 23, 2020. The S&P 500 hit 2,237 that day, which represented the low point in the market.

I outlined the steps we were taking in my post at the time, A Strategy For Buying Into A Bear Market, which included the following chart representing February to April 2020 (red circles are dates we moved money from cash/bonds into stocks, and the percentage is what percentage of our net worth we moved):

In addition to growing our equities, we’ve also increased our alternative asset class from 6% to 15%. This reflects our shift out of bonds and into real estate when we purchased a second home near our daughter in Alabama. Since we expect we’ll sell that home at some point in the future, we’re continuing to “count it” in our investment holdings, unlike our primary home, which is excluded.

Tax Allocation: Convert Before-Tax Into Roth

Like many Baby Boomers, we have too much money in our tax-advantaged accounts, a legacy of the Roth not being an option in our 401(k) during many of our working years. To rectify that and minimize our chances of getting punished by the required minimum distributions when we turn 72, we planned on doing annual Roth conversions from our tax-advantaged accounts.

From the original strategy: “this will provide an ideal opportunity to pull heavily from our tax-advantaged funds and convert them into after-tax and/or Roth at the lowest possible tax rate.”

Grade: B

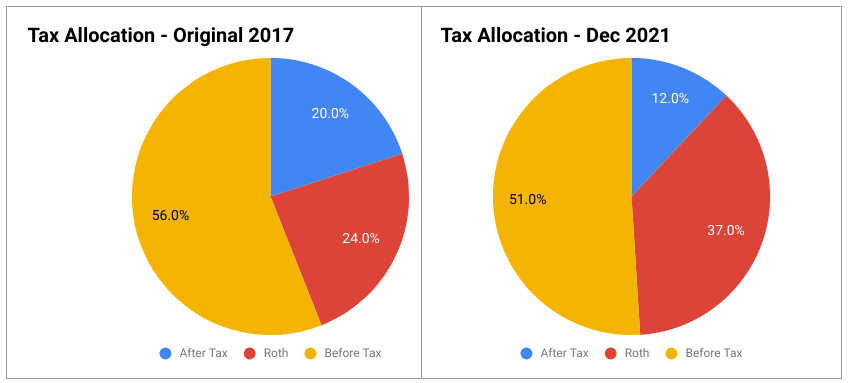

As I wrote in How (And Why) To Execute A Before-Tax Rollover Into A Roth, we’ve done Roth conversions every year since 2018. You can see the impact in the pie charts above, summarized below:

- Roth increased from 24% to 37% of our investment portfolio.

- Before Tax reduced from 56% to 51%

- After Tax reduced from 20% to 12%

In addition, the overall size of the pie has increased over the same timeframe, with our net worth increasing 45% from 2017 to 2021 (thanks, bull market), in spite of the fact that we’re no longer contributing to our investments. I suspect we’ve lost a bit of ground since 12/31/21 with the market’s current volatility, but I haven’t bothered to check. #NoWorries.

I’ve found it surprising to realize how difficult it’s been to reduce our tax-advantaged allocation. Due to the strong market, and the fact that most of our tax-advantaged money is invested in equities, the total value of our tax-advantaged accounts has actually increased in spite of our Roth conversions! I never expected that, and that’s the reason I’ve graded this section with a B. In essence, the growth has been bigger than the amount we’re converting to Roth.

For example, say we convert $50,000 in a given year, but the actual value of the tax-advantaged investments increases by $75,000. In spite of a $50,000 conversion, the tax-advantaged amount actually increases by a net of $25,000 due to investment performance. The only reason the percentage has reduced from 56% to 51% is that the total pie is growing faster than the tax-advantaged slice. We may have to get more aggressive on the amount we convert every year, perhaps to the top of the 24% marginal tax bracket as outlined in The New Tax Law Loophole That Benefits Retirees.

Paying those taxes requires after-tax funds, which we’re also using to live on in retirement. You’ll notice that the after-tax slice has been reduced from 20% to 12%, which makes sense given that those are the funds we’re using to pay for our retirement expenses and Roth conversion taxes. At some point in the near future, we’ll have to determine when to move to either tax-advantaged or Roth withdrawals to fund a portion of our retirement expenses. I’m thankful the after-tax funds have proven sufficient to “cover the gap”, and I’m fine with beginning to tap into those retirement accounts when required (I’ll turn 59 1/2 this year, though I could have tapped the 401k earlier if necessary given that I retired at age 55).

Delaying The Pension

In our original strategy, I was considering delaying my pension to allow for continued growth (similar to Social Security, the payout increases if you defer). Ultimately, we decided against doing that.

Why?

Unlike Social Security, our pension payments are NOT inflation-adjusted. Once they start, they remain at a fixed payout for the balance of my life, at which point my wife will get a reduced payout for the balance of her life. Since we would have had to withdraw from our investments to fund our retirement during the delay, we decided against it. By NOT withdrawing those investments, we’ll allow them to continue to grow, which will allow longer-term inflation protection than increasing our non-inflation adjusted pension. I find that paragraph a bit confusing, but hope you understand the logic.

Bottom line: we did the math, and are convinced that our decision to NOT delay the pension was our best long-term decision to maximize the amount of money we’ll be able to spend during our retirement.

Grade: A

Implement the Bucket Strategy

I’ve written extensively about this one, and the Bucket Strategy Series has been my most-read series. In summary, we’ve created three buckets and fund our retirement spending as a “monthly paycheck” from the first bucket, which we refill three to four times a year with whatever assets have best performed. It’s worked more smoothly than I envisioned, and I couldn’t be happier with the approach. If you’re interested in reading more about it, below are links to the three articles I’ve written on the strategy:

The Bucket Strategy Series:

- How To Build A Retirement Paycheck (Setting up the structure prior to retirement)

- How To Manage The Bucket Strategy (How I maintain the bucket system in retirement)

- Your Bucket Strategy Questions, Answered! (Q&A regarding the management of the buckets in retirement)

Grade: A

A quick note, given the market’s decline as of this writing. As mentioned above, I strive to keep Bucket 1 full to provide maximum protection against a bear market. In fact, I sold several months’ worth of spending in early January to top off Bucket 1 as part of our Annual Financial Review. In hindsight, it was good timing, but that’s not the point. Rather, I’m simply following our pre-determined methodology for managing the buckets. At this point, we have three years of cash to ride out the stormy weather, and I’ve not lost any sleep over the recent market volatility. If the stock portion of our asset allocation falls below 50%, I’ll be rebalancing any funds in excess of our Bucket 1 and 2 limits from bonds into stocks. I’ll likely skip refills on Bucket 1 for a while, allowing it to draw down as intended to avoid selling any stocks during a downturn. Stay tuned…

Figure Out Health Insurance

At the time of our original drawdown strategy, we hadn’t resolved how we were going to manage health insurance during our early retirement years. We ultimately decided to use COBRA for the first 18 months, then migrated to an Aetna group plan my employer had previously established for retirees. Historically, my employer offered retiree health insurance, and the group plan was established for that purpose. My employer has discontinued that benefit, but the group plan remains available (fully paid by the retiree) and has slightly lower premiums than I was able to find through private individual plans. Given the increased ACA subsidies in 2021 and 2022, it’s possible we could have reduced our cost slightly for these two years, but we elected to remain in the group plan to ensure it was still available to us until we join Medicare in 7 years. Because of this voluntary “sub-optimization”, I’m grading this one a B-.

Grade: B-

Longer-Term Strategy Items

Our original strategy had a bullet list of various other long-term issues we were considering. A brief update on each follows:

- Delay Social Security: I’m still planning on delaying my SS until age 70, though we may elect to have my wife start claiming at full retirement age based on my reading of Wade Pfau’s latest book. We have plenty of time before having to make any decisions on this one.

- Protect the Roth: To date, we’ve only added to our Roth through conversions from our tax-advantaged accounts. When our after-tax funds are nearing depletion, we’ll evaluate the optimal mix of withdrawals from Roth vs. tax-advantaged accounts. I assume this will be driven by tax optimization, but more work is required before finalizing our decision. In general, it’s best to protect your Roth as long as possible, and we suspect the majority of any legacy we leave our daughter will be in the Roth account

- Life Insurance: At age 52, we purchased a $200k term policy that expires when I reach age 72 as a bit of hedge for my wife in the event I die on the early side. My pension survivor benefit drops to 67% upon my death, so this was a cheap insurance hedge if that happens before I turn 72. We’ll continue to carry it until it expires in 13 years.

- HSA: We’ve contributed the max every year since retirement and spent from the account as medical bills arise. For simplicity, we use it to “pay as we go” rather than intentionally pursuing a longer-term tax strategy. We plan on continuing with this approach until we start Medicare and lose the ability to contribute to the HSA.

- Part-Time Work: We had talked about some potential short-term seasonal employment opportunities in our original strategy, but have elected not to pursue them. In reality, having four dogs makes a seasonal job in a National Park impractical, and we don’t need the extra money. The Board of Directors’ work was not a part of my original strategy and has been an enjoyable experience to date.

- Long Term Care: As stated earlier, we elected to self-insure against LTC risks, and continue to be comfortable with that decision.

What We’re Changing In Our Drawdown Strategy

As we approach our fourth year in retirement, we’re pleased with how well our initial drawdown strategy has worked. Going forward, the basics of the plan will remain intact. Following is a summary of how we’re approaching each of the key elements in our original plan and the minor tweaks we’ll be making:

- Asset Allocation: In the original strategy, we were planning to increase our stock exposure from the 48% allocation at the time. Mission accomplished. Going forward, we expect to maintain a stock exposure of 50 – 60%, with 20 – 30% in bonds/cash and 15% in alternatives. We’ll watch that 50% floor given the current market downturn as a potential trigger for rebalancing, though we’ll only rebalance funds from cash/bonds to stocks in excess of our Bucket 1 and 2 limits.

- Tax Allocation: We’ll continue to make annual Roth conversions, though we’ll consider implementing them to the top of the 24% marginal tax bracket due to the reality that our tax-advantaged accounts are still larger than we would prefer.

- Donor-Advised Funds: This is an addition to our original drawdown strategy. Before the new (favorable) tax law took effect, we pre-funded around five years of charitable donations into a Vanguard Charitable Fund account. This fund has been drawn down, and we’ll likely look at doing another “big” funding in the next year or two to make the deduction worthwhile versus the standard deduction of $24,000.

- Bucket Strategy: We’ll continue to utilize our bucket strategy, though I expect our quarterly refilling process will be put on hold (as designed) if the current market correction continues. It’ll be interesting to see how the strategy works in a more volatile market, but I’m convinced it’ll be the best way to manage our retirement paycheck regardless of market conditions

- Roth vs. Tax-Advantaged: The biggest change from our original strategy will be to determine which funds we utilize to fund our retirement expenses once our after-tax funds are depleted. I expect we still have three years before we face this decision. If I had to answer this one today, I’d lean toward using the tax-advantaged accounts to fund our expenses and reduce our annual Roth conversions by a like amount. We’ll likely move toward a combination of tax-advantaged account withdrawals and Roth conversions to optimize within our chosen tax bracket.

Conclusion

As we approach our fourth anniversary of retirement, I’m pleased to report that our original drawdown strategy was effective in managing our transition from the accumulation phase to the withdrawal phase.

Overall Score: A- (mathematically calculated from the above scores)

The primary shortfall lies in the reality that converting the tax-advantaged funds into Roth is a bigger challenge than originally envisioned, especially given the strong market growth in our first 4 years of retirement. Also, each conversion triggers a tax bill, which accelerates the depletion of those valuable after-tax funds. I’m fine with that “problem” and am confident that we’ll continue to navigate the challenges of optimizing the withdrawals from our portfolio for the foreseeable future.

Going forward, our biggest challenges will be to transition from using after-tax funds to beginning to withdraw from our tax-advantaged accounts. It’s a reality we’ll all face, and it’s the reason we built those tax-sheltered retirement funds in the first place. As for the recent market volatility, I’m not too worried about it yet given the cushion provided by Bucket 1 and 2, but I’ll be monitoring for potential rebalancing actions if it turns into a full bear market

Finally, health insurance continues to be a nagging (and expensive) concern. I’m looking forward to the day we’re eligible for Medicare and can put the problems of private health insurance behind us. It’s a problem we can live with until then.

Your Turn: What have been your biggest challenges as you made the transition from accumulation to withdrawal? Does your withdrawal strategy provide protection against the current market downturn? Let’s chat in the comments…

10 thoughts on “Drawdown Strategy Revisited After 3 Years of Retirement”

I’m loving these posts on drawdown. It is all more complicated than the accumulation that we normally focus on.

I’m following Fritz’s lead and setting up my buckets. Even though I still earn a paycheck, it would be good to see how I can replace that paycheck from passive and portfolio income if needed.

Great article!

My husband and I are also challenged to convert some of our large tax advantaged accounts into Roths. He retired in 2018 with a disability and is receiving disability insurance and SSDI (as required by disability provider) and I retired in 2019. He had an excellent plan and current checks equal his prior take home pay so no drawdown is required. This will be reduced by the amount of his pension l in 7 years once he has to begin taking his pension at full retirement age. The drawback is any withdrawals from his 401k trigger a reduction in his disability income equal to the withdrawal amount so we don’t want to touch his.. We could move mine but at this point that will trigger IRMAA increases in Medicare and RX rates. So far we have not made any moves but continue to look for options or our tax rate at age 72 will be quite high.

Thanks for the excellent update, Fritz. i’ve been thinking a lot about Roth conversions these days. I’m not surprised it’s been hard to lower your pre-tax accounts given the lengthy bull run… until this year.

What’s even better, you can practically feel how relaxed and not worried you are in the post! That’s a huge win.

Fritz,

Thanks for this update – and, more importantly, thanks for encouraging other bloggers to develop their drawdown plan prior to retirement. It was probably the most beneficial exercise I did during my blogging career (using “career” loosely!). I retired in 2016 at age 51.

The most important element of my plan was to fund my spending from investment sales when my invested net worth is within 90% of it’s high and from cash when it has fallen below that 90% threshold. I carry about 7 years of expenses in small CD’s and high interest bank accounts. I have stuck with that with one slight change. For the last few years, the market has felt frothy in January so I’ve sold stock to fund the entire year’s spending in January. These January sales mean I haven’t had to fund spending with cash since I retired.

You and I were extraordinarily lucky with the timing of our retirement and the subsequent run up in the markets. I still look at my net worth monthly and the recent sell off has been rough. But I only need to take this year’s losses against my gains since retirement and I’m way ahead of where I expected to be.

Life is good, I’m healthy and happy. Glad to see you are the same!

I am financially ready to retire, but I still like working. Having cash flowing in that we don’t need means I don’t have to sweat anything financial at all. No optimization is needed because we have way more than we need. And I suspect with a few more years of work, it will always be that way, for life.

I kind of like it this way. At the moment, I am likely going to continue working, at least part time, for another 4.5 years.

Ziggy,

There are very good benefits to not sweating the small stuff. The only problem is the small stuff still has to be done. Might as well figure out your basic plan. Small example, didn’t see how the Social Security strategy was developed. For both PoF and yourself, opensocialsecurity dot com makes sense.Sounds like you won’t sweat the big stuff either. Nice plan.

Be sure to do Roth conversion 2-3 years before starting medicare . Otherwise, you will get a medicare premium surprise. It is not easy to get it reduced even after retirement and your income is reduced. Wish I had known

Hi, what do you mean it’s not easy to get the Medicare surcharge reduced? I thought it was recalculated each year based on tax return two years back. I.e. 2022 premium was based on 2020 income. I’m expecting a large capital gains income this year.

How much of your annual spending does the pension cover? With so few getting pensions these days, that has to be very helpful especially during a bear market.

I enjoy this question for the chance to place some planning numbers to the % of expenses covered by income source at a certain age. The assumptions make all the difference. For this reply, I assume 5% increase in cost of living and lifestyle creep. The 5% assumption allows me to reduce lifestyle creep when inflation is high and spend more when inflation is low (at least on paper).

At my current age, a pension covers 97% of expenses; age 60 the pension covers 94%; and age 70 covering 64%.

Implied are the additional income sources required to meet all expense requirements. For example, dividends and interest income. Tracking those numbers by the percentage of expenses covered has provided some value in planning the lifestyle creep in these golden years.