The Sunday Best is a collection of articles I’ve curated from the furthest reaches of the internet for your reading pleasure.

Every week, I scan hundreds of headlines, read dozens of posts, and bring you the best of the best to save you time and mental energy.

Financial Independence (FI) is a primary focus, but it’s an awfully broad topic. I tend to approach FI and early retirement from a fatFIRE perspective and through the lens of a physician, so expect to see those biases in the selected articles.

Related topics that have become recurrent themes include early retirement, selective frugality, tax issues, travel, physician issues, and of course, investing.

For more great articles, take a peek at The Sunday Best Archives. Now let’s get to the best… The Sunday Best!

The Sunday Best

Are you looking for a way to track your net worth that you can manage yourself (i.e. a Empower <- referral link alternative)? Mike Pearson of Credit Takeoff has a slick answer for you using Google Sheets and Google Data Studio. Check out his free Net Worth Tracker Dashboard ( <- not a referral link).

A healthy retirement can be better realized with a proper simulation. Edith from Cracking Retirement has learned that a healthy retirement also benefits from proper stimulation. The same could be said of many activities, not all of them PG. Retirement Needs Stimulation.

Big ERN at Early Retirement Now is The King of Stimulation Simulation, and I somehow neglected to feature the last eight posts in his long-running retirement simulation series. Today, I rectify the situation. Here’s a great Guide for First Time Readers of the series and the most recent 8 parts.

- Part 31: The Yield Illusion (or Delusion?): Another Follow-Up!

- Part 32: You are a Pension Fund of One (or Two)

- Part 33: How to Calculate Your Safe Withdrawal Rate without using Simulations

- Part 34: Using Gold as a Hedge against Sequence Risk

- Part 35: Asset Location: Do Bonds Really Belong in Retirement Accounts?

- Part 36: Safe Withdrawal Math with Real Estate Investments

- Part 37: Dealing with a Bear Market in Retirement

- Part 38: When Can We Stop Worrying about Sequence Risk?

After writing about financial independence for the better part of six years, “Stockbeard” at How to Retire Early has reached that glorious pinnacle. What will the father of three do now? Suddenly, FI.

Will he retire? Maybe just slow down? Cubert from Abandoned Cubicle peers into the Blue Zones for inspiration and discusses the benefits of both. Do We Need to Retire, or Just Slow Down?

I imagine he’ll do whatever makes him happy. In a world where every word has been verbed (see “women who money“), Jonathan Clements of The Humble Dollar delivers 15 Ways to Happy.

It’s Christmas in July with this thought-provoking post from XRAYVSN. In Pursuit Of FIRE, Don’t Recreate The Gift Of The Magi.

You can reach FI by saving up to a lump sum, by creating cash flow streams, or any combination thereof. I focused on the former but ended up with quite a bit of the latter. My 4 Current and 4 Future Passive Income Streams.

I guess that leaves me with extra cash flow. What to do? The Physician Philosopher has some ideas, 5 of them to be exact. 5 Ways to Use Extra Cash Flow

For me, becoming a doctor was well worth it, but I can’t say I ever did a cost-benefit analysis beforehand. BeMo Academic Consulting did. Cost vs. Reward of Becoming a Doctor or a Dentist.

On the rewards side, plenty of dentists and doctors become millionaires. Here’s another 5 millionaire interviews from ESI Money to peruse.

- Millionaire Interview #181

- Millionaire Interview #182

- Millionaire Interview #183

- Millionaire Interview #184

- Millionaire Interview #185

Dr. Dennis Bethel of Nest Egg Rx weighed the costs versus rewards of continuing a career in emergency medicine when he was excelling as a real estate investor. Hanging Up the White Coat.

Dr. Peter Kim of Passive Income MD and Passive Real Estate Academy is in a similar situation, but the anesthesiologist is not hanging up the white coat just yet. What he is doing sounds irresponsible at face value, but things are not always as they seem. Create Massive Leverage Through Passive Real Estate Investing.

- Dr. Kim’s signature course opens for enrollment in a couple of weeks. Join the waitlist to be offered a substantial discount, and you’ll be under no obligation to buy (but you’ll get a deal if you do!).

Education, Exercise, and Ethanol

Did you know I created this website to enlighten, educate, and entertain? It’s true; the 3 E’s are right there in my mission statement on the About Me page.

Mission Statement

Physician on FIRE is a personal finance website created to inform and inspire both physicians and our patients with insightful writing from a physician who has attained financial independence and the ability to retire early. The site has a triple aim to leave visitors enlightened, educated, and entertained.

In my personal life, I’ve been focusing on a different set of 3 E’s. That’s just a happy accident, and one of them is the same, but let’s roll with it.

These efforts go back to when I was still gainfully employed but mentally preparing for this semi-retirement lifestyle I’m now living. Leaving my job and now living the lockdown life emphasized the importance of education, exercise, and ethanol in my life.

Like Edith (a 4th E!) says, retirement needs stimulation.

Education

The brain needs new stimuli, and I continue to feed it daily. Even though I don’t go to work or school anymore, I treat every day like it’s a school day.

I learn a lot by just reading financial news, books, and blog posts as I put together this weekly Sunday Best series.

I continue to expand my Spanish vocabulary on a daily basis with DuoLingo and the Drops app. Ellos hacen el aprendizaje divertido. I use Google Translate to fill in the gaps when I’m not sure how to best say something (as I did just now — I would have used “aprender”).

I’m also learning how inappropriate some episodes of The Office can be for boys who are 9 and 11 years old. They, in turn, are expanding their vocabulary as we make our way through the series. Spoiler alert! We’re on Season 4 and it’s good to see Jim & Pam finally get together.

Exercise

Back in the good ol’ days when we could travel, we were putting miles and miles on our feet most days as we explored the cities we temporarily called home. We didn’t need a formal exercise routine.

We did do some bodyweight exercises in Mexico, and my wife and I trained for and ran a half marathon in Barcelona during our two months in Spain earlier this year.

Now we’re back in the States, and gyms, if open, are not the best place to be. I started doing daily pushups and situps in mid-March, and I’ve been doing 100 of each every single day since mid-April, closing in on 100 days of that routine.

We’re also training for another half marathon, and yesterday morning, we ran 10 km with our boys. It was their third consecutive summer training for and running a 10k. We’re very proud of them!

Ethanol

I like drinking. A good beer buzz one of my favorite ways “to happy,” as Jonathan Clements might put it.

I also recognize that, especially when it comes to the consumption of ethanol, too much of a good thing can be a very bad, bad thing. Without a doctor job and the responsibilities that go with it, I have fewer reasons not to drink, so I have to be cognizant of where I’m at with that.

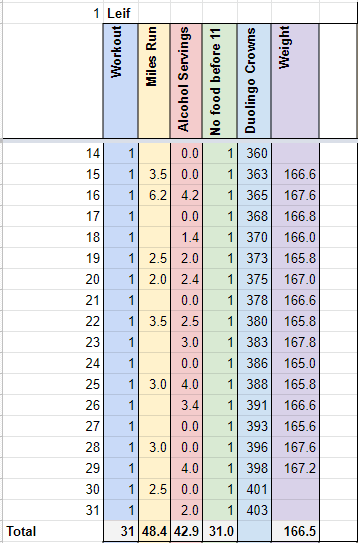

Like any personal finance nerd would (and I know a couple of others that do), I started tracking my consumption on a spreadsheet, along with a number of other daily habits (like education and exercise) in early 2018.

One serving is equal 60 ABV*ounce units. A “standard” beer is 12 oz. at 5% ABV. A serving of wine is 5 oz. at 12% ABV, and a serving of liquor is 1.5 oz. of 40% (80 proof) ABV rum, vodka, etc… 60 is the magic multiple. So a 16 oz. craft beer at 6% ABV is 1.6 servings of alcohol (6*16 = 96, and 96/60 = 1.6).

Yes, I’m that precise with it. I mean, it’s a spreadsheet, after all. We can’t be rounding off and fudging numbers.

Each of the last two years, my wife and I had a Sober October, and we plan to do so again in 2020. There was talk of an aburrido Abril in 2020, but with everything shut down and few entertainment options, we opted not to follow through with that. We also take a full week off from drinking each month.

Last year, I had a soft goal of averaging 2 drinks per day, and having so many built-in alcohol-free days helped, but I ended the year at 2.15. Summer and celebrating this newfound freedom put that initial goal out of reach.

This year, I went with a more restrictive goal of no more than 60 drinks in any month. I’m 6 for 6 so far, averaging a healthy (for me) 1.7 servings a day. I’m far from perfect, but happy with where I’m at.

Cheers to being semi-sober in semi-retirement! 🍻

A Featured Financial Advisor

For those of you who would rather not DIY, I maintain a shortlist of recommended financial advisors. Among the good guys and gals who work frequently with physicians, only the lowest cost, fee-only fiduciary advisors were invited to be on this shortlist. Among them is RFK Capital Management.

RFK Capital Management

RFK Capital Management – Application for Financial Advisory Listing

RFK Capital Management specializes in supporting DIY investors with their financial and investment planning. Led by a CFP Professional with more than 10 years of experience in investment management, we are a fee-only, advice-only firm.

RFK Capital Management specializes in supporting DIY investors with their financial and investment planning. Led by a CFP Professional with more than 10 years of experience in investment management, we are a fee-only, advice-only firm.

We believe most investors can manage their own investment portfolios using index funds if they receive and follow good advice. Our main service offering is our DIY Investing Service. You will receive a personalized financial plan, an investment policy statement, a review of your insurance policies, and support and guidance in becoming an effective investor using low-cost index funds.

Fees:

DIY Investing Service: Onetime fee of $1,400

Hourly Charge: $125 per hour

Introductory Call: 15 to 30 minutes, free

Contact Info:

9425 S. Union Square Suite #102

Sandy, Utah, 84070

801-372-1446

ryan.kelly@rfkcap.com

Have an outstanding week!

-Physician on FIRE

16 thoughts on “The Sunday Best (7/19/2020)”

Hi PoF. As you probably know, I’m one of the few non-drinkers in the FIRE community. I’ve been stone cold sober for 7 years now (even longer than my blog has existed). You know what? I don’t miss it. Not one bit.

It’s great to see other people cutting back a little. Good on you guys! Keep at it!

Thanks for the SundayBest!

Good for you, Mr. Tako. I’m doing my best to find a healthy balance.

PoF,

1) I would not have guessed “el apprendizaje” in a million years, so it’s just a weird “queen’s grammar” term.

2) Our family discussions during watching ” the office” got most interesting when Todd Packer made appearance; it made explaining, “That’s what she said!” feel tame. Brace yourself.

Cheers,

CD

Oh, yeah. Todd’s already made an appearance. Jan had her augmentation procedure. I’m glad our kids have already had some sex education, because The Office is probably not the best place to hear about this stuff for the first time.

A lot of it still goes over their head, which is good.

Best,

-PoF

Thanks for a feature in the Sunday Best Leif.

I love the Office. It is quite the awkward moment when adult jokes that used to go above my daughter’s head no longer do (she’s 14 now). I often tell her “Hey! You’re not supposed to find that line funny!”. Lol

I think we’re still a few years away from all the jokes making sense, but my boys do love the pranks that go on all the time in that office.

Cheers!

-PoF

Curious! So, not eating before 11 – is that intermittent fasting, eating in an 8 hour window?

It’s a variation of intermittent fasting. If I consume no calories after 7pm, then it would be an 8-hour window with a 16-hour fast. But I usually have a snack or beverage in the evenings, so it ends up being a 13-14 hour daily fast.

I have found that I don’t miss breakfast and the empty calories that came with it, and I’ve been doing this for at least a year with rare exceptions (usually when traveling).

Cheers!

-PoF

PoF,

I like the spreadsheet. I do note it’s a little more tempting to partake in a beer when its homebrewed and sitting in a kegerator (speaking from experience). Is there such a thing as COVID brewing? I like your idea of dropping down on the quantity consumed as long as you don’t compromise on the quality…which I have no doubt. Cheers.

I hear you on that!

I don’t have a great place to ferment in the summertime (no basement or dedicated temp-controlled mini-fridge), so that will have to wait for the fall. I do have some beers on tap from a brewery in MN that gives me free beer for life, and I should be getting refills on that next month.

Cheers!

-PoF

Kinda OT, but the Gervais Principle essay series on the philosophy behind The Office is pretty mind-blowing. Permanently changed how I think about human relations:

https://www.ribbonfarm.com/2009/10/07/the-gervais-principle-or-the-office-according-to-the-office/

I’ll give it a read! I watched an episode or two of his original British version, but couldn’t get into it. I was already locked in to the American version of the characters, and it was hard to get used to “the replacements,” even if they were original.

Cheers!

-PoF

Did you and the fam finish watching the Marvel movies? My son and I watching them through as well. Watched Black Panther last night, so just a few more to watch. Hours of fun for both of us, and occasionally my husband too, who likes the Antman and the Guardians.

We’re at the same place, then! We just watched Black Panther on a rainy afternoon a few days ago.

We only see one every few weeks or so; it’s just too nice out in the summer. I’m guessing we’ll make our way to Endgame sometime this fall. If there’s no football, I imagine we’ll start on another series.

Cheers!

-PoF

A spreadsheet to track alcohol consumption? I think I’ve heard of everything now. What’s the number for Spreadsheeters Anonymous?

I may have a problem. 🙂

It’s more of a habits tracker with consumption being 1 of 6 things I record daily. I picked up the idea from a popular blogger at the first Camp FI. I believe you’re more likely to meet goals and continue good habits if you hold yourself accountable.

Cheers!

-PoF