Investing

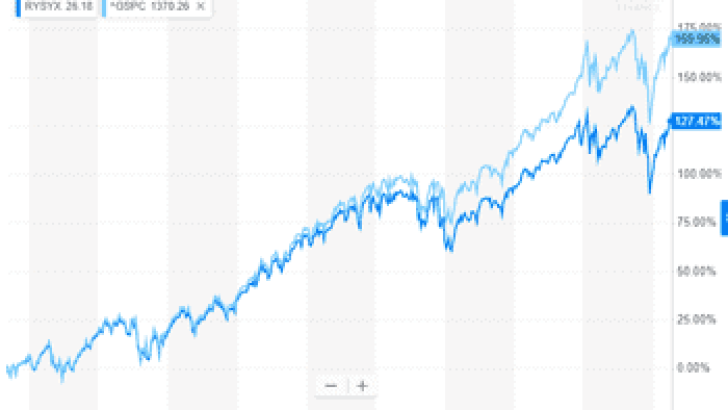

Not all index funds are created equally. While they may follow similar indices in a similar manner, the costs involved

If you’d like to create a comprehensive financial plan, I can think of three good options. One: Work with a

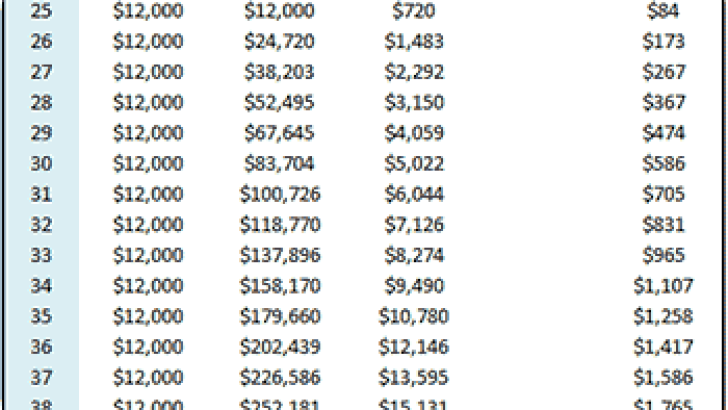

A cash balance plan, if you have one available, is unlike any other retirement account you might have. The others,

With all this FOMO talk lately, you might mistake me for a millennial. FOMO! YOLO! See you at the Fyre

I know some intelligent people who invest in only one asset class. The VTSAX portfolio is well diversified, but is

What’s the first thing that comes to mind when you hear the question “How do you get rich?” You might

Today’s Saturday Selection from Dr. Peter Kim is one of my favorites. It speaks to the truth about passive income,

You’ve decided on the perfect asset allocation for you. It matches your risk tolerance, preference for domestic versus international equities,

Students of personal finance are familiar the concept of a ladder. So are roofers and firefighters, but that’s another matter,

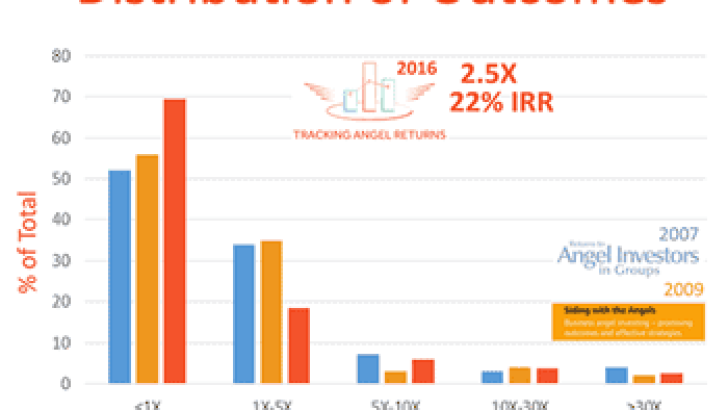

Real Estate is often touted as an optimal path to wealth. Many people have done very, very well by investing

I’ve personally invested in a handful of crowdfunded real estate deals. I wouldn’t want to recommend investments to my readers

I recently published a detailed article questioning the Marginal Value of the Backdoor Roth. I wanted to answer a simple

Today’s post comes from my WCI Network partner Passive Income MD. I think he’s pretty good with money, but he

When investing, it’s important to think about your objective. It’s tough to answer the question “Where should I invest my

Investing advice is not difficult to come by. It’s everywhere. Sound investment advice? Now, that can be a little more

Regular readers know I’m not a big fan of dividend-focused investing. While I like the concept of “mailbox money” and

While there’s no surefire way to become something you’re not, one effective method is to study the people you want

I like investing in index funds. They give me great diversification, market returns, and don’t cost much. It’s a lot

Wouldn’t it be nice to be able to lock in your “winnings,” particularly at the end of a long bull

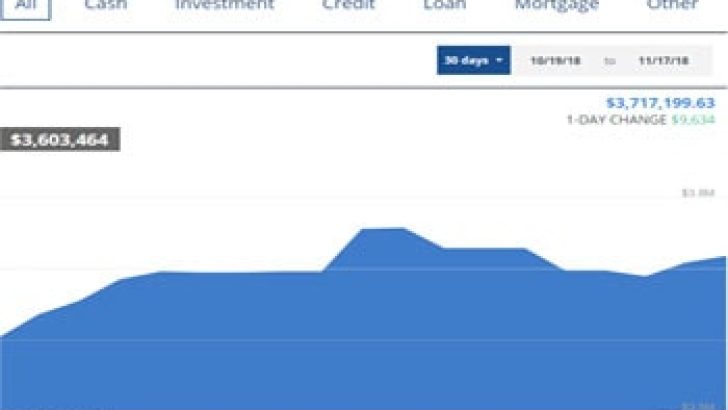

Well, should you? I first calculated our household net worth a few years after residency. Although much of our net