It’s amazing what you can do with a little knowledge and a spreadsheet.

And for many projects, that sort of approach is sufficient. But when it comes to quitting your job and depending on your wealth to live on, do you feel knowledgeable enough to be confident you have examined every angle? Do you understand all of the laws, regulations, and scenarios that could affect you, your money, how you access it, and how much you have to turn over to the feds and, if applicable, your state and local municipalities?

Sometimes a little professional advice–someone who’s seen a lot, been through it before, and knows all of the ins and outs–is definitely warranted, especially if you have doubts yourself.

As Government Worker FI describes in this guest post, the result can be reassuring, and even open up additional opportunities.

Let me tell you a secret.

I have major imposter syndrome when it comes to the FIRE movement.

Yes, I write a financial independence blog.

But honestly, I feel much more confident writing about finance than I do about our own finances. There are just so many people promoting financial advice on the internet that I sometimes doubt my own decisions.

So I decided to spend the money to meet with a tax professional to discuss FIRE. And we had the best conversation about tax strategies, early retirement, and college savings plans.

Not only was it worth every penny, but it got me so fired up that I needed to write an emergency blog post to process everything. (I understand the world and my life through writing about it.)

Where Are We in Our FIRE Journey?

Before I tell you what I learned from the CPA, you need to know where we are in our FIRE journey.

(If I want to tell you how to get somewhere, I need to know where you are now. Not sure why so many people spout off financial advice financial content like it’s universal.)

Assets

My wife and I are lucky enough to be close to “basic financial independence,” where our total liquid assets are 25x our annual expenses (i.e. 4% safe withdrawal rate), and we live in a paid-off house. While we’ve been chasing that milestone for a while, it’s not “retire early” money in my mind because:

- Our 25x doesn’t account for taxes

- We have subsidized healthcare through our jobs

- The 25x doesn’t have a lot of wiggle room for a major emergency (like a new roof on the house).

That being said, I think we’re in a great spot for one or both of us to walk away from our jobs if we needed to do so. If we earned even a small amount of money each month, I’m pretty sure we could live off of our assets forever.

(People like Financial Panther and Stop Ironing Shirts have made me confident we could get by in the Gig Economy with the amount of assets we have if we needed to.)

Asset Allocation

Almost all of our money is in stocks or tied up in our primary residence. We have a small amount in bonds. We don’t intend to hold cash, but every time I total up our net worth, I’m shocked by how much cash we have sitting in different savings accounts strewn about.

Our liquid assets are comprised of 50% in tax-deferred accounts, 36% in Roth accounts and 14% in after-tax accounts. The tax-deferred pool includes my wife’s 457(b) plan, which we can tap before age 59.5. (457(b) plans are wild.) I also did not include our HSA in these numbers since it is a small percentage of our net worth.

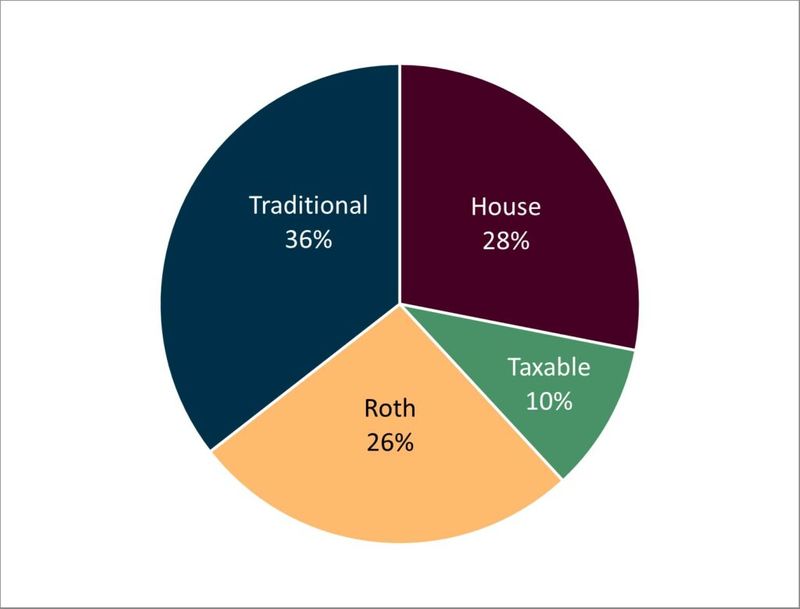

Here is how our liquid net worth is split among different types of accounts.

If we include the house, our assets are 28% house, 10% after-tax, 26% Roth, and 36% Traditional.

I don’t understand why people include home equity in net worth calculations, but regardless, there are our numbers.

My Big Questions

- Do we have too much money in traditional accounts? Did we make a mistake by saving in tax-deferred accounts? Are we on a path to certain doom?

- Should we have more after-tax money? What are we going to live on during the Roth conversion ladder window?

- Is early retirement even in the cards for us? I have my own “theoretical” early retirement number in my head. But could we actually live on that? Are we taking too much risk?

Who is this CPA, Anyway?

About 34 years ago (plus or minus 2 years), I played tee ball. I was horrible at it.

Our tee ball team was coached by a small town CPA. My parents were looking for someone to help them with their taxes, which were complicated by some of the master limited partnerships in which he was invested. (What I learned from my dad: If you want a simple life, avoid investing in MLPs at all costs).

Since my tee ball days, my coach grew his business from a one-man operation in a tiny village to one of the biggest public accounting firms in the state. The founder is still nice enough to meet personally with my parents each year and do their taxes.

(I always chuckle that one of the biggest accountants in the region meets personally with my parents for an hour a year. But on the other hand, I guess they’ve worked together for a long time.)

I thought that if anybody could look over my plans for FIRE, it would be their firm. I filled out the “contact form” on their website and assumed I’d get a call back from a receptionist to book a time with their newest accountant.

Instead, I got an email back within a few hours from the tee ball coach! He said his firm would be happy to look at our FIRE strategy and suggested I set up a meeting with his son, who is now a partner at the firm.

Why did I write 300 words about tee ball?

I thought I should establish that I was meeting with an authoritative tax expert and not some random internet clown.

Takeaway 1: Don’t Sweat the Traditional Balance

My half-hour intake call was less a discussion and more of me trying to walk into a hurricane of advice being spouted in my direction. (To be fair, it was an awesome hurricane!)

Every time I opened my mouth to ask a question I could barely finish before the CPA was like, “I know what you’re thinking, and it’s smart, but we’re going to take care of it.”

I don’t think I ever verbalized my major question of if we have too much money in traditional accounts. Every time I started to ask, I was cut off and was told that it was a shrewd move to have 40-60% in a traditional account for many reasons.

The CPA told me several stories where he was limited in helping clients optimize their taxes in retirement because all of their money was in taxable accounts.

Apparently, he can’t work as much magic when all of the assets exist in non tax-favored accounts (which makes sense, I guess).

Here are some reasons tax-deferred accounts make sense for us:

-

- By maxing out my TSP and my wife’s 457(b) plan, we are able to bring our income below important IRS thresholds. (No, I’m not telling you which ones. Stop being so nosy.)

- Next year, I could direct a small percentage of my TSP contributions to Roth TSP instead of traditional TSP and still stay within the ideal income range.

- We live in a high tax state. If we move somewhere like South Dakota in early retirement, we can save 7% on Roth conversions as opposed to Roth contributions while we work.

- The CPA had a lot of ideas about when to convert these to Roth funds and minimize taxes in retirement and is willing to run the numbers and advise me on an optimized strategy when we get closer.

Too Good to Be True?

Honestly, if this were a financial advisor and not a CPA giving me this advice, I wouldn’t have trusted them. (I get creeped out by someone else’s potential conflicts of interests in handling my money).

Throughout the conversation, I kept asking myself if it was too good to be true.

Was he selling me something? Am I getting swindled?

As a finance blogger, I’m so jaded. Blogging showed me the dirty underbelly of the financial world. I now assume that whomever mentions a product or service gets a large commission.

But this CPA firm has helped my parents optimize their taxes for 30 years. I felt like I had a champion in my corner.

He doesn’t want to manage my assets. And I’m just paying him for his time and to do my taxes.

In return, he’s helping me answer some of the hardest decisions in the FIRE movement like when to pay taxes, what the best draw-down strategy is, and how to maximize ACA subsidies.

It seems well worth his hourly fee.

Takeaway 2: We Can Retire in Less Than 10 Years with No Worries

We didn’t set a date over the call. But he didn’t see any problems with retiring in 10 years (around age 50) or less. Compared to some of my blogger friends, retiring at age 50 seems ancient.

Actually, I think 50 would be a great age to retire. I’ll still have a kiddo in high school at age 50. FIRE with a high school junior in tow doesn’t seem glamorous. As long as we can retire when she graduates I will be happy. At that point, Mrs. Gov and I can travel the world together (or not travel and just sip coffee on our porch). In fact, retiring at age 50 gives us a decade or two of freedom more than most retirees.

The CPA was full of confidence about my FIRE plan. In fact, he spent a lot of time talking about how to structure a donor advised fund to optimize taxes on our charitable gifts in retirement. I was relieved. Not only could we retire early, but we can retire early with abundance to give generously.

For someone with impostor syndrome about FIRE, having an expert look at my plan and tell me that it was sound was a giant relief.

Side note: I estimate we will reach our “early retirement” milestone in less than 10 years. However, I based my estimate off of assumed market returns. I agree that 10 years is a conservative timeline. And we get closer to that date, the CPA and I can adjust and tailor the plan to something that is solid

Takeaway 2.1: He Was Less Worried about Healthcare Costs Than I Am

One of my biggest fears about early retirement is what the heck are we going to do about healthcare. Giving up subsidized healthcare seems like a giant unknown.

When I brought this up on the call, the CPA was convinced that with the right strategy, we’d be able to get a large ACA subsidy.

He spoke from experience in helping other clients do this.

I still have no idea how we can possibly do this. Our family needs to eat. We only have so much money invested in after-tax accounts to live off of with no taxable income.

But perhaps there is a strategy where we make a giant conversion in some year, pay a ton of tax, and then live off of essentially no taxable income for several years?

Ultimately, I trust the CPA’s expertise from helping many other clients navigate ACA subsidies.

(And my wife and I are on a very conservative FIRE path. We’re not going to retire early unless we have enough capital to weather unexpected surprises.)

Takeaway 3: Invest More in My Business

This is definitely not financial advice or tax advice.

I have been very careful to run my business in the black.

Everything on the internet I read said that your business needs to make a profit in 3 of the past 5 years. Otherwise the IRS will audit you, declare your business a hobby, and fire and brimstone will rain down and you will be smote by the gods.

The CPA said that what I didn’t understand about the 3 out of 5 guidance was that I was trying to make a profitable business. I think he said something like,

“Sam. You’re trying to be the next Dave Ramsey*, right? So of course you’re going to need to spend money and invest to grow your business into something profitable.”

We went through my revenue numbers for the past couple of years, which are increasing, and what I was spending money on.

Needless to say, my expenses are very much tied to growing the blog. (I have not been following the “LLC Twitter” advice of forming an LLC and then writing my entire life off as a business expense.)

And I really didn’t need much convincing to invest more into the blog, which is growing a lot! Within a few hours of talking with him, I told my email subscribers that I wanted to hire a writer.

Let me tell you readers: I got some amazing applicants and I’m so excited about what we are going to do next year.

Takeaway 4: Our 529 Plan Strategy is Solid

The CPA and I briefly discussed our 529 plan. I wrote a while back that we have 529 plans for our kids, and we put a little bit of a money in them, but not a ton.

In my analysis, our plan gave us not only the advantages of not paying state income tax on the contributions, but also flexibility. The CPA said that putting a little bit of money in the 529 was good, but that he wouldn’t recommend going overboard.

Since we have three kids, we also have more flexibility to shift money around between them in case one of them gets an unexpected scholarship.

Again, it was worth the money to have an expert review our strategy and confirm we’re making good choices.

Summary: We are #blessed

Honestly, I started writing this post with imposter syndrome comparing myself to wealthy FIRE bloggers and now feel like my wife and I have an embarrassment of riches.

And it is true. My wife and I are healthy, employed, have great kids, and are still in love with each other.

How many people can say that? On top of that, we saved enough assets to retire decades before most Americans.

Hopefully you didn’t find this post about talking to the CPA too gauche. I didn’t write it to glorify avoiding taxes. Instead, I wrote it because I felt like too few finances bloggers talk about hiring a finance professional. In my mind, the CPA is a pilot who can help us steer through the sharpest bends and most dangerous currents of early retirement.

I am so happy to have someone to help us navigate our next few moves.

5 thoughts on “A CPA Dissects and Critiques a FIRE Plan”

Seems very risky.

If the house is bigger than will be needed, then the “too big” part could be an asset.

If you consider moving and a large fraction of your wealth is in pretax retirement plans and you will have social security, you may consider a state that does not tax retirement plans distributions, such as Pennsylvania.

Some parts of such an optimization have to be based on assumptions about future tax rates, which are only partially predictable.

QCD would be very good for that, but only when you are older.

This is very pessimistic. If you conduct your business properly, you can run losses. You will just need to explain that.

I am not completely sure about the following. The money should not be for your kids at this point: it should be for your spouse (and vice versa). Then it does not have to be declared to the university/college as a asset available to the child. If it needs to be used, it could for example, be only shifted to the child later in the child’s studies and declared then.

Nothing morally wrong with doing that legally.

I would agree that having money in all three types of accounts (pre-tax, Roth, and post-tax/brokerage) is a great strategy because it allows you to pull money from the account(s) that allow you to optimize taxation, and especially before Medicare age, avoid excess taxable income so you qualify for subsidies.

I would love a one time review of my financial status with a professional who has expertise in tax management and retirement specific strategies……do you have a recommendation? Is the T-ball coach taking on clients? Other considerations when seeking a review?

Can you elaborate on “shrewd move to have 40-60% in a traditional account for many reasons”? Did you mean 40% of assets in Roth (after -tax) retirement accounts vs. 60% in tax-deferred retirement accounts?

Thank you,