2017 Q2 PoF Portfolio Update

I’ve described my portfolio and some rationale for what I own previously. The image below is a snapshot of the spreadsheet I use to track everything. About once a month or so, I log in to Empower which gathers the balances from every account for me, and I enter them into the spreadsheet.

Empower does a good (and in some ways better) job of tracking your balances and allocation, but I prefer to supplement with a spreadsheet, which aids in rebalancing and makes for easy sharing online with you all. If you sign up for the free service, this site may benefit, enhancing my charitable mission.

Although I just sold over $100,000 from the taxable account to pay for some property (to be detailed in a post next week), the account still has more than half of our retirement assets.

I like US and foreign stocks in the taxable account. While I could have only two funds there, I have tax-loss harvested, and I have trading partners now. I also own a little bit of Berkshire Hathaway. With no dividend come no tax drag, which is a beautiful thing.

You will notice that any fund owned in the taxable account does not appear anywhere else. This makes tax loss harvesting without an inadvertent wash sale simple. The NOSIX in the solo 401(k) is an S&P 500 fund, though, and could be considered substantially identical to VFIAX. I only contribute to this once a year, and the dividend amount is negligible, but I may look for a different low-cost, no-fee fund to replace it in the future as that balance grows.I have a similar potential issue with the HSA. There’s a good chance that when I leave my employer, I’ll transfer that money to a different provider like HSA bank, which offers lower cost funds than Wells Fargo.

In the Roth accounts, I have some of the more volatile investments, including emerging markets and REIT. One could make an argument for emerging markets in taxable (TLH opportunities, foreign tax credit), but it’s not the most tax-efficient class, either.

I like bonds in the 401(k) and will have a healthy dose of bonds in the 457(b) before I set that account up to be drawn down in early retirement.

2017 Q2 POF Asset Allocation

My targets have been adjusted slightly since I last gave you an update. I realized I was actually overweight on REIT based on Empower’s analysis, which takes into account the amount of REIT exposure in the US Stock mutual funds I own. I have also acquired additional physical real estate, so I feel comfortable reducing my REIT exposure.

My spreadsheet indicates I’m at 8.4% with REIT, but my non-REIT index funds apparently contribute another 2.5% in REIT to my overall portfolio. To account for this, I’ve lowered my goal (based on my spreadsheet) to 7.5% and have made a slight increase from 20% to 22.5% for my international stock allocation.

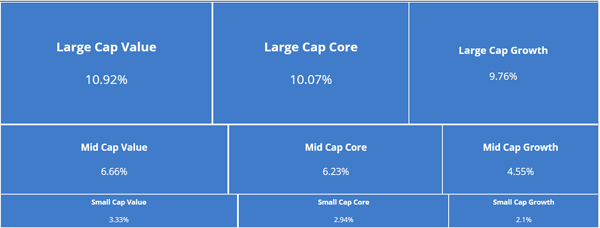

Let’s see how accurate my spreadsheet calculates my small cap and mid cap exposure. I don’t expect it to be all that accuarate, since there are some stocks considered mid caps in Vanguard’s small cap index. Here’s what Empower says in the 3×3 style box format:

As I suspected, I have more mid caps and fewer small caps than the spreadsheet predicts. I could fine tune the spreadsheet to reflect the percentage of mid caps in Vanguard’s small cap indices to get a more accurate picture, but I’m not rebalancing within US stocks so it’s not particularly important to be accurate. It’s more for informational purposes only, and I may very well drop the mid cap indices in favor of all small cap indices for simplicity’s sake.

2017 Q2 PoF Portfolio Performance

The market hummed along in the second quarter. Volatility remained low, and gains were slow, but steady. The S&P 500 (Empower’s standard benchmark) returned 2.57%, while my portfolio returned 2.78%.

Returns were boosted by the strong performance of international stocks. Developed markets outpaced emerging markets, making Vanguard’s Developed Markets Index my strongest performer at 6.38% for the quarter.

My bond fund did what bond funds tend to do. While they typically underperform in good times, they also can be expected to outperform when stocks are down. As JL Collins says, they “smooth the ride.” In the second quarter, Vanguard’s Total Bond Fund gained 0.84%.

2017 2Q Market Performance

Morningstar has a very complete list of market index performances, with returns in the last week, month, quarter, year-to-date, one-year, three-year, and five-year timeframes.

A number of sites offer quarterly market reviews, and my tardiness means many are available. If you’d like to read about the quarter in great detail, see these market summaries:

- Fidelity

- T. Rowe Price

- JP Morgan

- Seeking Alpha

I have not read the reports in detail. I like to keep my investing relatively simple, and I don’t expect I’d learn anything particularly actionable in them. Still, if you’ve got the time, reviews such as these can give you some insight as to how the markets behave, or at least how the experts interpret their behavior.

2017 Q2 Spending

In the first quarter, we spent just under $14,000, putting us well under last year’s $62,000 pace. In the second quarter, the lower spending trend continues with less than $12,000 out the door, a figure I find quite interesting, given the fact that we haven’t intentionally tried to spend less.

I think the biggest difference is the realization that early retirement is going to be a reality in the relatively near future, and acquiring anything new or making additional home improvements doesn’t make a lot of sense right now. I suppose there is some intentionality there, but it’s not like we’re trying to see how low we can go in the spending department. Perhaps we’re closer to that sweet spot where frugality and minimalism converge.

I’ll detail where the money went, but first, it’s only fair to tell you where it didn’t go. One way we keep our expenses relatively modest is by cheating. How do we cheat?

- No mortgage or rent payments. We own our homes.

- No loan payments. Student loans have been paid off.

- No term life or disability insurance. We dropped them once we were FI.

- Health Insurance provided by employer. We will bear this cost when RE.

- Travel Rewards. Credit card points and CME travel reduce our travel costs.

- School-aged children. Both are enrolled in a quality public school.

- Donations. We give to and from donor advised funds, and track that separately.

Food & Dining remains our biggest spending category. We didn’t take any big trips, although I did visit friends in Colorado in April. Our family vacation to Paris & Reykjavik took place in the first quarter, so those expenses were already reported.

With about $26,000 in annual expenses in six months, I expect we’ll be well within the $60,000 spending budget I had anticipated. I do expect to make some bigger purchases in the next 12 to 24 months, which will include a new (to us) vehicle capable of pulling an RV, and, of course, an RV. I’m still budgeting $80,000 a year as our typical annual spending in early retirement to account for health care and “one time” expenses.

Over the same time frame, we may be building on our new property, but that will be funded by the sale of our current home(s). Also, even though we just dropped $168,000 on a chunk of land, I’m not including that as spending, as it is a real estate investment with real value and makes no sense to consider as money spent.2017 Q2 Blog Performance

E-mail subscribers have already seen the following figures from my 18-month e-mail update as of July 9th, 2017. They also saw the revenue data from this site, which I reserve only for e-mail subscribers. I am happy to report that the site brought in more money in the last quarter than it did in the entire first year.

If you’d like to join the nearly 1,600 over 3,000 strong (that’s more than 1,400 new subscribers in 4 months!), you can subscribe right here:

[optinform]

The site now has 243 posts and 33 pages, including the frequently updated Student Loan Resource Page, a Jobs page, and a recently updated Recommended page.

Numbers! I heart numbers:

- 1,097,000 all-time pageviews with 358,000 in the last quarter

- Viewed from 190 countries. Still none from Greenland or Madagascar, and somehow the number shrank by 5 countries. Were there mergers that I didn’t hear about?

More numbers:

- 2,544 e-mail subscribers (984 new in the last quarter)

- 681 Feedly subscribers

- 197 RSS Feedburner subscribers

- 4,445 Twitter followers

- 580 Facebook Page Likes & 96 Friends.

As you may know, my site is “the other site” in the White Coat Investor Network. We partnered four months ago in a synergistic relationship that has proven to be mutually beneficial, as anticipated.

The biggest news from WCI recently is the announcement of the (now sold out) first ever WCI Physician Wellness & Financial Literacy conference slated for March 1-3, 2018 in Park City, Utah.

I like to write Top 5 posts, so it seems appropriate to share the top 5 viewed posts of all-time. They are:

- Stealth Wealth: I’m Just an Ordinary Average Guy(15,857 views)

- He Has Read Over 250 Investing Books. He Recommends These Three Funds. (12,604 views)

- A Tale of 4 Physicians: The Impact of Lifestyle (11,885 views)

- Vanguard Backdoor Roth: A Step by Step Guide (11,237 views)

- 20 Steps to Effective DIY investing (10,882 views)

The fourth and fifth posts are not new posts, but are new to the Top 5, benefitting from sharing on social media and on forums.

Where is my traffic coming from? Top 5 referring sites:

- White Coat Investor (42,039 sessions)

- Twitter (20,617 sessions)

- Rockstar Finance (11,603sessions)

- Retireby40 (7,577 sessions)

- Facebook (6,593 sessions)

1500days.com remains at number 6. This list has not changed in content or order in the last quarter.

I frequently send readers away to different sites. Unfortunately, not every site registers, so while I know the White Coat Investor would top this list, my current setup with JetPack doesn’t track links to that particular site.

Here’s where people are clicking, mostly from The Sunday Best & Christopher Guest Posts:

- The Happy Philosopher (4,775 clicks)

- Bogleheads (4,212 clicks)

- ESI Money (3,923 clicks)

- Early Retirement Now (3,541 clicks)

- 1500 Days (3,225 clicks)

I hope you all had a good quarter, both from an investing perspective and from a life perspective. Summer is a great time to be alive, and I hope you’ve been able to enjoy it.

Expect another quarterly update in another couple months. I’ll do my best to be more timely. I’m particularly excited to write this next one, because I’ll be doing it as a part-timer. It just so happens that my new schedule begins with the advent of the fourth quarter.

45 thoughts on “2017 Q2 PoF Portfolio, Spending, and Blog Performance Update”

Sweet; our boys are the same ages as yours, and I have 3 day weekends now, mid 6 figure salary, and I live in the upper Midwest, so I use your site as a barometer for what we can do! I’ll raise a pint to that, thanks

No kidding? We’ve got a fair amount in common — my salary isn’t quite mid six-figures, and will be lower yet soon enough. On the other hand, I’ll only have one weekend off a month, but it will be a 15 to 30-day weekend. 🙂

Cheers!

-PoF

Impressive quarterly stats for your portfolio and for your blog! 190 countries, that’s amazing- perhaps a trip to Madagascar or Greenland shall be in order to promote your blog and get site visits from those countries? 😉

Congratulations on the ongoing growth of this blog and your email list. And congrats on the expected bump from the merger with WCI.

Great to see a physician blogger having so much success!

Holy crap, those are incredible blog numbers! I’m in complete awe!

We started our blogs at roughly the same time, and I’m just amazed at your progress PoF! Congrats!

Vanguard’s mega, large, mid, small, and total stock market funds track the CSRP index, which defines large cap as mega + mid cap. If you hold Vanguard large cap and mid cap funds, you will end up overweighting mid cap more than you think you are since they are duplicated in both funds, hence why your small and mid cap positions are not equal. Check page 40 of this guide from CSRP.

http://www.crsp.com/files/Equity-Indexes-Methodology-Guide_0.pdf

Another reqson as you mentioned has to do with the discrepancy between what Vanguard (or more accurately CSRP) considers small cap and what Morningstar regards as such – and Morningstar’s data is what, I think, that diagram is based on.

Would you be able to publish your spreadsheet you use for determining your asset allocation among your taxable account/Roth IRA/HSA/etc? I’ve wanted something to keep me honest about my asset allocation.

Thanks for the detailed quarterly update. What is your reasoning for having the index funds in your taxable account? Have you ever owned individual stocks other than Birkshire?

Also why is your Food and Dining category so high? Do you eat at restaurants a lot?

Wow! You really are on fire! Great post. Congratulations on all of the new followers. You truly provide a lot of great content.

I am one of your new email subscribers for this last quarter. To tell you the truth, I don’t even remember how or why I found your site, but I am glad that I did. It made me take a look at our retirement accounts and realize that we’ve done pretty well for not paying it much attention.

After getting everything put into Personal Capital, I found out that our NW is a little above 1.2M excluding our house and 529 plans (that would add another .5M at least). Then I started plugging numbers into your calculators and saw that I will be able to retire in another 8-10 years just as my youngest is heading off to college. I have also used the PC website to determine how I need to re-allocate my holdings.

So thank you for your writing and publishing this blog. I read it and have started branching out to read others as well.

Great post and congrats on your upcoming transition to part time. I would love to hear a post sometime from your wife about her views on personal finance, as she clearly does an excellent job of being a great home economist. I see too many doctors whose dreams of early financial independence go out the window due to their spouse’s spending habits. You definitely chose wisely!

I’ll see if I can convince her to write a guest post — she is definitely on board with our plans and a big reason we’re able to make them!

Best,

-PoF

I’ve found so many good new blogs and sites from your Sunday Best posts, so I’m glad to see that others do as well!

Nice work on the budget. You’re looking to beat us out this year! 🙂 Interested in learning more about the real estate and RV purchases. Thanks for posting your funds – I need to orchestrate mine better like that for ease of TLH.

I’m not looking to beat anyone with the budget, but I’m glad to see it slowly shrinking rather than vice versa. I wouldn’t say we do any real budgeting, we just spend intentionally and track where the money goes.

I’ll be writing about the new property for next Tuesday’s post, and the RV when the time comes.

Cheers!

-PoF

Of course. Not trying to compete either. I like the idea of intentional spending rather than the exhaustive budgeting process. Unfortunately the budget for us is necessary as it does a good job of reconciling some philosophical differences. Looks like you use budgeting software linked to accounts – have you checked this for accuracy or are you ok with the ballpark figures (or do you actually track the spending afterwards yourself)? I’m finding it hard to detach myself from Excel and tracking each receipt which is both exhaustive but extremely accurate.

Gonna need to reduce fixed expenses, namely housing, over the next 15 years without plowing money into principal payments. Curious if you have seen any resources for house hacking in high cost of living areas. Only thing I can think to do (other than buy as little home as possible) is have a rental unit above a garage or something to that effect. Appreciate the input and writing!

I use Mint.com. I have to tweak the category on some purchases (maybe 5%), but it does a good enough job. We put the vast majority of our purchases on plastic, which makes automatic tracking much easier.

When I have read about house hacking, living in one part of a multi-family unit is frequently mentioned. It’s not for everyone, of course, but it can be an effective way to reduce your housing costs to zero if you find the right spot.

We are strongly considering having a portion of our next home as a separate, self-contained apartment that can be used by relatives, friends, and quite possibly paid AirBNB / VRBO guests. More on that next week!

Best,

-PoF

That level of spending for an attending physician with a family is inspiring. Definitely no large splurges and its nice to see what a budget looks like minus a mortgage or student loan repayment. I can’t wait till I’m there financially!

Thanks, ID. As our overhead gets smaller, the outflow of money shrinks accordingly. It’s a beautiful thing.

Cheers!

-PoF

Congrats on the third home! Jeez, those RE taxes will be killing you. Actually, I am pretty sure your combined total will be less than our primary home RE tax bill in Taxachusetts….! :>)

International equities are indeed on a serious upward swing this year. VEMAX and VTMGX in our taxable up by 20.4% and 16.9% respectively YTD. And VTPSX in my 401K up 17.8% YTD. Our decision to increase our international exposure late last year has worked out nicely. Better to be lucky than good, I guess. The 10yr returns on such funds are less than stellar so we’ll see what the next few years brings to international equities. ERN has commented that they may be cheap for a reason…..

Are your plans for purchasing an RV and truck part of a lengthy US states/Canada tour or to do shorter trips as you transition into your part-time work schedule?

International has been excellent this year. The necessity of owning international stocks is often questioned and debated, but I think the diversity is a good thing.

As for the RV, at one point, we thought me might take the better part of a year to explore the entire US (and parts of Canada), but the more we think about it, the more it makes sense to break that up into smaller chunks, using it for a few weeks at a time before retiring, and a few months at a time when retired. Our future plans are quite fluid.

Cheers!

-PoF

You had a great quarter. Your blog is definitely trending. You also do a masterful job with your household budget.

Nice work PoF. I am always amazed to see your exponential growth. It is pretty amazing. Keep up the good work. Congrats on the new property. Looking forward to hearing all about it.

Thanks, Triple D!

Details coming next Tuesday.

Cheers!

-PoF

Congrats on the upcoming transition to part-time! As I stare at the massive pile of paperwork that built up over vacation and two weeks on call, I can only dream of the day when I can go part-time.

Thankfully, that doesn’t really happen to me, but that does remind me I need to check my work e-mail, despite being on vacation. Part-time does sound like a dream, and it’s only six weeks away!

Best,

-PoF

Congrats on the solid month of spending and the blog growth! $3,700 a month for a family of 4 is pretty impressive.

Thanks, Donnie.

I’m surprised at how low that number has been, compared to when we first started tracking. Of course, as I outlined above, we do cheat a bit. Since it wasn’t in the text above when you read this post this morning, here’s how we “cheat.”

No mortgage or rent payments. We own our homes.

No loan payments. Student loans have been paid off.

No term life or disability insurance. We dropped them once we were FI.

Health Insurance provided by employer. We will bear this cost when RE.

Travel Hacks. Credit card points and CME travel reduce our travel costs.

School-aged children. Both are enrolled in a quality public school.

Donations. We give to and from donor advised funds, and track that separately.

Cheers!

-PoF

Haha, I don’t know if having no debt, self-insuring, and sending kids to public school is “cheating.” More like good financial planning. Donations may be a gray area, but I’ll give you a pass. Not including the travel points sure looks like cheating though ;). Congrats again on the quarter!

I continue to worry that it can misleading how so many in the FIRE crowd report their ‘spending’ while leaving out things like taxes (you admittedly include property but not income/FICA), health insurance (attributed to employer), etc. To your credit, you explain your math and rationale in the posts, but I think in your efforts to get to a really low headline number, you run the risk of setting irrational expectations for your readers. “POF only spent $5k/mo last year?!? We spent multiple times that last year honey; are we total hedonistic spenders?” Nah, it’s just we count our spending as non-investment money out the door, and recognize that our ’employer paid’ health premiums are part of our total comp which means those spending dollars are our spending (albeit pretax).

It just feels a little too much like Groupon using their new-fangled accounting lingo. While I understand your logic for doing so, basically, to get solid number for what your spending would be in retirement (although health insurance is again, conspicuously absent), but maybe it’d be helpful to have a ‘all money in and out spending, including employer paid benefits’ as well as ‘FIRE budget math spending’ to help your readers more fully appreciate how you spend your $$$. Your willingness to share what you do about your finances is fantastic, and greater transparency will only further your mission to educate by example.

I’m not familiar with the Groupon accounting, but I see your point and agree. I borrowed a section from my full spending post that explains the many ways we “cheat” to keep our spending that low, adding it to the text above.

In terms of taxes, I expect to pay next to nothing based on the way our portfolio is comprised of >80% post-tax dollars. A caveat that I don’t plan on abandoning this site the day I retire from clinical medicine, so I’ll have some income and FICA taxes, but only on income that is superfluous to the nest egg that could support us without the site and blog income.

I’m planning on spending up to $20,000 a year on health care, but may be able to cut that by about 2/3 with a healthcare sharing ministry or perhaps a more barebones catastrophic plan if the ACA is altered. Our anticipated budget after retiring from clinical medicine is up to $80,000 per year.

Best,

-PoF

Thanks for the update! Great blog numbers. I’ll put these on my proverbial wall as dream goals one day! Very curious to hear about your upcoming real estate transaction. A $100,000 down payment should mean you have something good coming!

Thanks, Boss.

I’ll elaborate in a week, but the $100k+ wasn’t a 20% down payment. That was to make up the difference between cash-on-hand and the purchase price. It is true that we have something good coming. And a lot of planning to do!

Best,

-PoF

Congrats on a successful quarter! I was so excited to see your blog report! I just listened to your podcast on Do You Even Blog a couple of days ago and thought it was great. I look forward to more updates on your incoming early retirement! ^.^

Thank you, Ms. FAF!

I enjoyed that podcast — as an anonymous blogger, there are very few people I actually talk about the blog with, and probably none as interested and enthusiastic as Pete.

Here is a link to that podcast and others I’ve appeared on, for those who may be interested.

Cheers!

-PoF

OMG you’ve been on other podcasts, and I didn’t know about it? Where have I been all this time? I’ll check all of them out. Thank you, Dr. PoF!

Appreciate you sending people my way! Doing my best to do the same for you. 🙂

Congrats on another great quarter.

Thanks, ESI!

I appreciate your efforts, as well.

Cheers!

-PoF

Great round up,PoF! Way to outperform the S&P 500 last quarter.

Can you expand a little more for me the tax loss harvesting concept and why that drives the differences in your taxable account compared to your Roth IRA?

That deserves a full post, but I’ll briefly summarize.

If you sell shares in taxable at a loss, and you have purchased “replacement shares” in any account within 30 days before or after, the government could disallow the portion of the loss equal to the value of the purchased shares, potentially wiping out some or all of your paper losses, and negating the benefit of your attempt to tax loss harvest.

Biweekly purchases (401(k)) or automatic reinvestment of dividends (Roth, others) could wreak havoc with your ability to TLH without worry of inadvertent wash sales. This was discussed recently on the WCI Forum in this thread.

Best,

-PoF

Understood – Thanks, PoF!

Awesome update! Congrats on getting another property, I’m sure it’ll help inch you closer to early retirement. I’m looking forward to hearing more about that. Another great month!

Great post. Very interesting. I too compare Vanguard to personal capital’s asset allocation. The only individual stock that I own is Apple and when Vanguard moved it from Large Cap Growth to core it really messed with my allocation. I guess this another argument to not own individual stocks. Congrats on the new property. My oldest brother retired early from IBM and bought a RV and visited 34 states and Canada.

I don’t know if that’s an argument against owning individual stocks or an argument against being overly concerned with the fine details of your 9-box asset allocation. In hindsight, Apple has turned out to be a great one to own.

I’ll bet your brother’s RV adventures were amazing. I look forward to doing something similar.

Cheers!

-PoF

He loved the Little Big Horn and Newfoundland.