Terms and Restrictions Apply

Physician on FIRE has partnered with CardRatings and other partners for our coverage of credit card products. Physician on FIRE and other partners may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. POF does not include all card companies or all available card offers. Credit Card Providers determine the underwriting criteria necessary for approval, you should review each Provider's terms and conditions to determine which card works for you and your personal financial situation.

Editorial Disclosure: Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Let’s begin by taking a look at what was written at this time last year.

“As another challenging year comes to a close, it’s time to put on your optimism hat and envision a better 2022 in which the pandemic transitions to an endemic. A year in which workplaces begin to resemble a steady state of the new normal and not a single NCAA bowl game is canceled.”

While the WHO hasn’t declared an official end to the pandemic, and there have been many media references to a “tripledemic,” some experts are saying we’ve entered the endemic phase.

No bowl games have been canceled, and most workplaces have settled on a “new normal” that may include some work from home.

Your job may not allow you to work from home, but if you make it your job to improve your personal finances, there’s quite a bit of work you can do right from the comfort of your lounge chair or home office. Choosing at least one of the following 14 ideas below will go a long way toward putting you in a better financial position by this time next year.

If you’ve already done everything on the list, congratulations! You probably don’t need to be here. Go out and enjoy the wealth you’ve built, and help others do the same!

If not, start with one item on the list, check it off, and move on to the next one. I’ve updated and expanded the list again for 2023, and I wish you nothing but success in this New Year.

#1. Calculate Your Net Worth

This is a great place to start. If you want to set financial goals for yourself, it helps to know where you’re at, first.

It’s not a complicated equation. You add up your assets, subtract your liabilities, and the result is your net worth.

People get hung up on what should and shouldn’t be included. Vehicles? Jewelry? Art? Football cards? You can get as specific as you want, but if it’s a depreciating asset and/or its value is < 1% of your net worth, I wouldn’t bother counting it.

I’ve got supposedly “valuable” football and baseball cards and other junk. Any jewelry my wife owns has more sentimental than monetary value, and that monetary value is a drop in the bucket compared to our invested assets. Our vehicles might be worth $40,000 combined, but they cost money to operate and will depreciate as we use them. I don’t count any of it when I calculate our net worth.

I do count the value of all our investment accounts and properties owned.

We’re debt-free, but if you’ve got mortgage debt, student loan debt, credit card debt, or any other debt, those go in the liabilities column.

I don’t have a pension coming, but I should receive Social Security eventually. I don’t include this in my calculation, but if you’re near retirement and your pension or Social Security appears to be a sure thing, you can find a calculator to estimate the value of that benefit as a lump sum in today’s dollars if you so choose.

I do count the value of my home and any money set aside for college (529 Plans) in my net worth, but not in my retirement assets. If you’re married with combined finances, you should be looking at your net worth as a family, as we do.

The fine details aren’t all that important. Just figure out where you stand today and monitor that number at least annually to ensure you’re headed in the right direction.

Passive Income MD asked, “Should You Track Your Net Worth?” My answer is yes.

#2. Track Your Portfolio

Again, we’re just wanting to determine where we’re at. What do we own? In which accounts? How are these investments performing?

You may have investments in a half-dozen places: IRA, 401(k) or 403(b), HSA, 457(b), 529 Plan, cash value life insurance, defined benefit plan, etc…

It’s helpful to look at everything at a glance in one place. I do this in two ways, and I suggest you do one or the other or both.

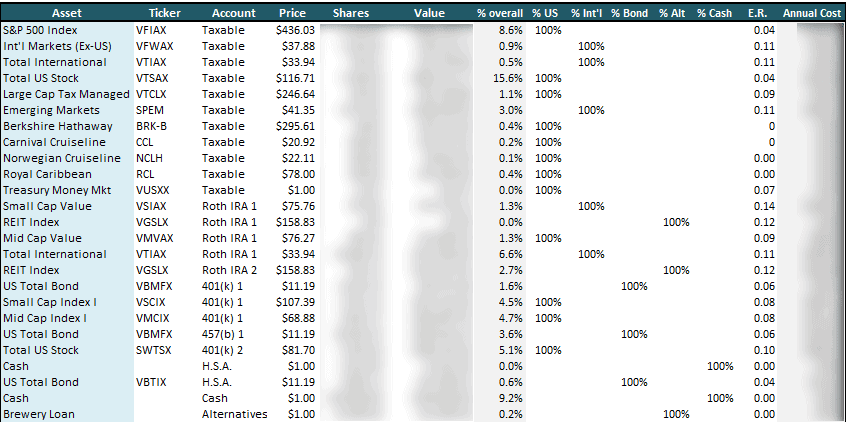

First, I use a spreadsheet I created that updates the value of publicly traded assets daily based on the ticker symbol. I’ve set it up to calculate the overall asset allocation across the board and tell me which classes are underweight or overweight compared to my desired asset allocation. It helps with rebalancing and looks pretty.

The downside is that it took a lot of work to set up and I do need to update the number of shares of different stocks and mutual funds I own on a fairly regular basis. I do this about once per quarter.

I can save you the setup work by giving you a universal portfolio tracking spreadsheet. It’s up to you to enter your funds and the asset classes they’re holding, but the sheet will do the rest.

![]()

Enter your email, and I’ll send you a copy. I’ll also send you new emails alerting you to new posts, but you can opt out of those and into a weekly digest or opt out entirely as soon as you’ve got your sheet. No hard feelings.

Empower’s Free App & Software

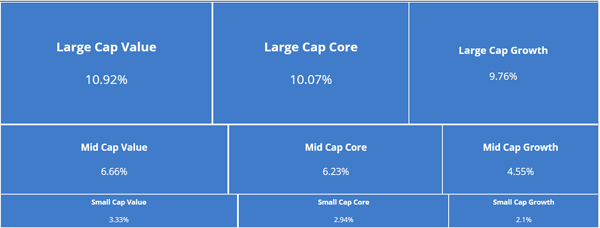

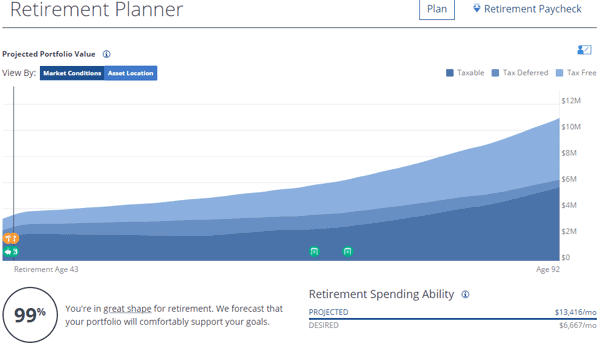

Second, I use Empower to see what’s happening across my accounts on a more regular basis. On any given day, I can log-in to see my current net worth, asset allocation in greater detail, overall performance among all accounts, within each account, or for each asset.

It’s got a fee analyzer to show what you’re paying in 401(k) fees and a retirement calculator to show if you’re on target to have a successful retirement (I am!).

Empower pairs very well with the spreadsheet because it will log in to all of you accounts and display all of the balances and shares owned on one screen, making updating my spreadsheet so much easier.

They do have an advisory service that costs money — I don’t use it or recommend it — and they will advertise that service to you if you sign up and use the free financial software. There’s a reason they can offer such a robust service “for free.” They do make good money off a small percentage of people who sign up and choose to use them as a financial advisor. I am not one of those people.

Nevertheless, I have been happy using the website and app for the last seven or so years. I was using it and recommending it long before I had a website of my own.

#3. Track Your Spending & Consider a Budget

Once again, if you want to know how you’re doing financially, you need to keep track somehow. Since spending is a key component of both your savings rate and your required nest egg to consider yourself financially independent, it’s important to know how much you spend on a monthly and yearly basis.

You can do this as loosely or accurately as you want. Before I had a blog, I knew what our credit card bills looked like and how much came out of our checking account for large expenses like property taxes.

Without actively tracking our spending, I knew that most months, we were spending $5,000 to $6,000.

Once I had a blog, I started tracking it more closely to prove to the world and myself that we were indeed financially independent. What I learned was confirmative. Using Mint.com initially and later Empower, I learned that our expenses were indeed in the range of $6,000 to $7,000 a month.

After about three years of tracking it, I could see that our spending was remarkably consistent and stopped keeping close track.

Now that we’re on the hook for health insurance, I anticipate spending to be closer at least $80,000 in a “normal” year. After the inflation we’ve seen in 2022, it may be closer to $90,000 a year or more.

When you pay closer attention to where the money goes, you can more easily identify areas in which you could potentially save money, and you can ensure that your spending is well aligned with your priorities.

While I’ve never personally followed a budget — being a natural-born frugal weirdo has obviated the need — if you consistently spend more than you want to or more than you’ve planned, a budget may be what you need to get on track.

You Need a Budget is a popular budgeting and forecasting tool that many people swear by. You can also create your own spreadsheet, download someone else’s template, or even use an antiquated system of labeled envelopes with cash for different spending categories.

If you haven’t before, start tracking your spending in 2023.

#4. Write an Investor Policy Statement

It sounds fancy and complicated, but this is something you should be able to accomplish fairly quickly. It can be as simple as you’d like it to be.

Start with a desired asset allocation. List the accounts you’ll be investing in. You can build it out from there.

Being closer to retirement, I’ve included some basic elements of our drawdown strategy. While unnecessary if you’re decades from retiring, it’s a good idea to start thinking about how you’ll be accessing your hard-earned money when you do need it eventually.

If you’ve already written an IPS, an annual review is a good idea. The tax code changes; sometimes your job or income changes. If you haven’t looked at yours in over a year, it’s a good idea to review and perhaps revise the living document as needed.

If you need some guidance, I’ve written a few posts detailing my own IPS, why it says what it says, and how it has changed. And yes, it’s due for a review and possibly some revision.

If you want a more complete financial plan that includes not only investments, but also insurance, estate planning, asset protection, and more, consider investing in The White Coat Investor’s master course, Fire Your Financial Advisor, which will teach you what you need to know and leave you with a comprehensive financial plan.

Between now and January 4, 2023, WCI is offering a BOGO deal on his courses. Get the $699 Continuing Financial Education 2021 course FREE when enrolling in any of the following:

- No Hype Real Estate Investing (up to 17 CME)

- Financial Wellness & Burnout for the Medical Professional (up to 25 CME)

- Fire Your Financial Advisor (up to 17 CME)

- Continuing Financial Education 2022 (up to 34 CME)

#5. Increase Your Savings Rate

When physicians ask how much they should be saving annually, I generally recommend they try to live on half their takehome pay. In other words, save and invest as much as you spend. When it comes to student loan debt, I think of debt paydown as a form of saving and investing; you’re improving your net worth and getting a guaranteed return.

If you can do this, you’ll go from broke to a financially independent and work-optional state in about 15 years or so, depending on market conditions.

If you’ve tracked spending, you may be able to identify money being spent that’s poorly aligned with your long-term goals. There may be some subscriptions or services that aren’t really being used or really are not necessary.

The other side of your savings rate (calculate yours here) is income. Can you increase your income? Negotiate a raise? Do some locum tenens work on the side?

The White Coat Investor recommends a savings rate of 20% of your gross income, which works out to about a 30% to 35% net savings rate for most of us. If you can elevate your savings rate to the point where you’re paying off debt or investing a dollar for every dollar you spend, you’ll be in even better shape before you know it.

Make It happen in 2023.

#6. Max Out All Available Tax-Advantaged Accounts

If you haven’t done this in 2022 or before, perhaps 2023 is the year to take full advantage of the current and future tax savings that can result from contributing the maximum to every tax-advantaged account available to you.

In some of these accounts, you may have the option to choose traditional, tax-deferred contributions, Roth contributions, or a mix of the two. What you choose is up to you, and I’ve created a guide to aid you in that decision process.

The maximum contributions rise with inflation, and we’ve seen a lot of that lately, so you’ll be able to contribute more than ever before in 2023. Almost no one will have access to all of these acounts, but many people can utilize most of them.

401(k) / 403(b)

The maximum an employee can contribute to a 401(k) or 403(b) plan in 2023 is $22,500. Those 50 and over can add a catch-up contribution of $7,500 for a total of $30,000.

The total contribution max, including employer contributions for these plans, is $66,000 ($73,500 for the 50+ crowd).

457(b)

If you have a governmental 457(b), you definitely want to max out your 457(b) with $22,500 or $30,000 if you’re 50 or older. This account can be rolled over into an IRA if you wish when you separate from your employer.

If you have a non-governmental 457(b), make sure you understand your withdrawal options upon separation from your employer. If a lump sum payout is the only option, you may not want to build up a large balance. Also know that there’s a theoretical risk of losing some of this money if your employer goes bankrupt.

Backdoor Roth IRA

Most attending physicians and other high-income households earn too much to contribute directly to a Roth IRA, but as long as you don’t have a tax-deferred IRA balance in your name, you can put $6,500 ($7,500 if 50+) in via what’s known as a backdoor Roth process in 2023.

For further information, check out our Backdoor Roth FAQ.

HSA

If your health insurance meets certain criteria, it can be paired with a Health Savings Account (HSA), and it should be high on your list for maxing out every year.

Money invested in an HSA gives you a tax deduction, grows tax-free, and when used for eligible healthcare expenses, can be withdrawn tax-free. There’s no other account type that can boast all three like that!

The maximum contribution for an individual in 2023 is $3,850. A family can contribute double that amount, which is $7,750, and the 50-and-up crowd can add $1,000 to those numbers.

529 Plans

The SECURE 2.0 Act has a stipulation that allows rollovers from 529 Plans to Roth IRA plans for the same beneficiary. There are numerous limitations, such as the account being at least 15 years old and you’re limited to the IRA contribution limit ($6,500 in 2023) for annual rollovers and a lifetime $35,000 max for rollovers, but it does make 529 Plan investments a touch more enticing.

Technically, the maximum for a single year is five years’ worth of gift tax exclusions ($17,000 per person per person in 2023). If you want to superfund a 529 Plan, a married couple could put $170,000 into each of their children’s 529 Plans without impacting their eventual estate tax exclusion, but then plan on making no contributions the next four years.

More commonly, you might consider “maxing out” a 529 plan to be giving the most that your state will give you a state tax deduction or credit for contributing. Some states do nothing, like California or the states that have no state income tax. Among states that make 529 contributions tax-advantaged, some have a dollar amount per beneficiary while others have a total contribution limit among all beneficiaries.

To learn a whole lot more about 529 Plans, see 529 Plans: What You Need to Know About College Savings Plans.

Individual 401(k) / SEP IRA

If you have a side gig or your sole gig is one in which you’re not employed (i.e. you’re an independent contractor), you may be able to contribute and even max out a “solo” a.k.a. individual 401(k) or SEP IRA.

In 2023, the maximum is $66,000, but you must have the income to support such a contribution. The calculations get a bit complicated, especially if you operate as an S Corporation, but if you have income at least four times that $66,000, there’s a good chance you can max this out.

If you have no W-2 income, you may be able to max out an individual 401(k) with less income than it takes to max out a SEP IRA because you can make employER and employEE contributions. Using a solo 401(k) can also allow you to keep the option of making backdoor Roth contributions, because that’s not IRA money (unlike the SEP IRA).

For a more detailed explanation of the differences between the two, see WCI’s article on the SEP IRA vs. Solo 401(k).

#7. Understand Your Taxes (and what you can do to lower them).

Do you understand the difference between your effective and marginal tax rates? Have you looked over your 1040 line by line? Do you understand the Section 199A 20% deduction for qualified business income?

When you understand how your taxes are calculated, you’ll be better equipped to pay less. Unfortunately, those of us who work for a living can only do so much to lower our taxes. Earned income will always be subject to taxation, especially when you have the earning power of a high-income professional.

However, you can impact your final tax bill. Here are a few of the ways I lower my taxes:

- Tax-deferred contributions to retirement accounts.

- Charitable Giving via a Donor Advised Fund.

- Working Less / Retiring from Medicine

- 20% QBI deduction (applies to blog income, but also available to many self-employed physicians depending on income)

- Have children. The child tax credit doesn’t begin to phase out until an income (MAGI) of $400,000 for those that are married and filing jointly.

There are strategies for everyone to keep tax bills in check (see my “Top 10 “Ways to Lower Your Taxes for more than a dozen ideas), but it’s particularly important for those not being paid as a W-2 employee to understand how the tax code works.

The best tool for tax planning I’ve found is CPA Kathryn Hannah’s Personal Finance Bundle), a tool I use to optimize my charitable giving and QBI deduction. For a detailed overview, see this article with screenshots and additional information.

You can also take a look at additional posts I’ve published devoted to the topic of taxes to further your financial education.

#8. Optimize your Debt Paydown Plans

If you’ve got debt, make plans to pay down those debts in a way that makes sense for you. Not all debt is all bad, of course, but debt-free is a good way to be, and if you’ve got high-interest debt, you’re going to want to focus on that first.

Credit Card Debt

Credit card debt is a big no-no, and It’s going to be among the highest interest debt around. If you have credit card debt, figure out what you can do to pay it off as quickly as possible.

This may involve selling high-dollar items you’ve purchased or changing expensive plans you’ve made, but credit card debt should be viewed as a financial emergency.

Once you’ve figured out how quickly you can eliminate that debt, consider picking up a 0% APR balance transfer card.

Don’t let that be an excuse to let the credit ride. Pay down the balance before the introductory rate rises. You don’t want to end up back in the same boat, which is more of a sinking ship than a boat that floats. And please, don’t ever allow yourself to rack up additional credit card debt ever again!

Student Loan Debt

Student Loan debt is another common debt among physicians and other professionals. The interest can be moderately high, and the balances are often well into the six figures.

The New Year is a great time to review your plan to eliminate student loan debt, whether it’s via a forgiveness program such as PSLF or via a rapid paydown plan.

You’ll find dozens of educational articles and calculators, as well as the latest refinancing rates and cash-back offers on my Student Loan Resource page.

Student Loan Refinancing Disclosures

I’ve offered to donate $100 to the charity of your choice if you refinance via my resource page. I’d love to see more people take me up on this offer.

If you’d like a professional consult, Travis Hornsby and his crew have consulted on over $750 Million in student loans for over 3,000 Student Loan Planner clients, and they frequently save their clients tens of thousands of dollars over the life of their loans. The average found savings has been over $50,000. That’s about a 100x ROI on the consult. Explore their options here.

Dr. Jim Dahle has added student loan consults to his list of services, co-founding Student Loan Advice, a White Coat Investor company, with Andrew Paulson, CSLP. Andrew and his team have consulted on over $250 Million in student debt and their average client saves $191,000. You can learn more about the costs and advantages of a consult with Student Loan Advice here.

Mortgage and Consumer Debt

Loans for automobiles, motorcycles, boats, RVs, etc… are not uncommon, either. Personally, I think a high-income professional ought to wait until they can afford to pay cash for these kind of things. A car payment does not need to be a line item on your budget. However, if you do take on debt for this stuff, make sure it’s low-interest and always pay on time.

Regarding mortgage debt, it’s not as “valuable” as it once was. With the increased standard deduction that went into effect in 2018, only about 10% of Americans will actually see a reduction in their taxes based on itemized deductions that include mortgage interest.

You don’t have to make any more than your minimum mortgage payments, but you might want to consider adding additional money to you monthly payments to pay down the principal faster, especially if interest rates rise and inflation subsides.

We were 100% debt-free by the time I turned 40, and it is a great feeling. Eliminating low-interest debt isn’t always the monetarily optimal choice, but I have no regrets.

#9. Earn Easy Travel Rewards

There are a number of websites and forums devoted entirely to the world of credit card travel rewards. The amount of information can be overwhelming, leading to analysis by paralysis.

However, I’ve discovered that the Pareto principle definitely applies here. You can get at least 80% of the results with 20% of the effort.

There are a number of great offers on both travel reward and cash back cards. If you’re new to the game, I recommend starting with a Chase card that has solid perks and points that can be used for cash or often more lucratively for travel with one of many partners. The Chase Sapphire Preferred is a good option, with a $95 annual fee and an offer of 60,000 points after meeting the minimum spend of $4,000 in three months. That’s worth $750 in travel when booking through the Chase portal and potentially more when transferring points to travel partners.

Chase Bank is a great place to start, because if you’ve picked up more than five cards in two years, Chase will typically reject your application for a new card, no matter how good your credit is.

While I generally prefer Chase cards for their best-in-class travel perks, the best card to come out in recent years is the Capital One Venture X. The statement credits can more than cover the annual fee, there’s a huge welcome bonus, and you get unlimited airport lounge access via the Priority Pass.

card_name

Annual fee

annual_feesIntro APR

intro_apr_rate,intro_apr_durationRegular APR

reg_apr,reg_apr_typeRecommended credit

credit_score_neededBonus Intro Rewards

bonus_miles_full read more

Finally, if you’ve got a small business, there’s a world of business cards available to you. I’ve recently updated my overviews of the top business card options for small business owners and the best cash back cards for everyone.

#10. Read a Personal Finance Book (or Five).

A frequent mid-career sentiment when it comes to money management is “I don’t know where to start.” I’ve written a two-part Investing Basics series, which is decent for a brief overview, but what you really need is a good book.

When I was in medical school, I read The Only Investment Guide You’ll Ever Need by Andrew Tobias. The paperback gave me good perspective and kept me from making expensive mistakes.

The best book available today for med students, residents and early-career physicians is The White Coat Investor. He’s got a great site, too, of course, but the book is well organized and can be read in a few short hours.

His followup, Financial Boot Camp is an excellent complement to the first book, and he released a third book aimed at professional students in 2021, The White Coat Investor’s Guide for Students: How Medical and Dental Students Can Secure Their Financial Future.

Dr. Cory S. Fawcett, a surgeon who retired in his mid-fifties, has written five financial books specifically for physicians, and I’ve reviewed most of them on this site.

- Book Report: The Doctors Guide to Starting Your Practice Right

- Book Report: The Doctors Guide to Eliminating Debt

- Smart Career Alternatives and Retirement for Physicians

- The Doctors Guide to Real Estate Investing for Busy Professionals

- The Doctors Guide to Navigating a Financial Crisis

Finally, a few other good, quick reads I highly recommend are Jonathan Clements’ How to Think About Money, John Bogle’s Little Book of Common Sense Investing, JL Collins’ Simple Path to Wealth, and Morgan Housel’s The Psychology of Money.

With the background knowledge from one or more of these books, you’ll be able to better understand many of the blog posts you read and the questions and answers you see in various online forums.

Bonus (#9.5?): Join a Q&A Forum

I’ve learned a ton from reading threads on various online forums and more recently, Facebook Groups. I strongly recommend the following:

- Physicians on FIRE Facebook group (Physicians only)

- fatFIRE Facebook group

- Dentists on FIRE Facebook group (Dentists only)

- Passive Income Docs Facebook group (Physicians only)

- White Coat Investors Facebook group

- Bogleheads Forum

- White Coat Investor Forum

Join me — I frequent all of the above — and I promise you’ll learn a ton, too.

#11. Complete a Legacy Binder

When a death occurs in the family, particularly when it’s unexpected, sorting out the finances can be a monumental challenge. Sadly, this was the reality for many unprepared Americans in 2020, and the pandemic didn’t magically disappear when the ball dropped at midnight.

A legacy binder, or “In Case of Emergency” Binder will not only have information on insurance policies, brokerage and retirement accounts, but also how to access them, who to call, and where to find important documents.

Usernames and passwords for emails, social media accounts, and more are a part of this.

I’ve got my own copy of Chelsea Brennan’s well-organized Legacy Binder, and you can get yours here.

#12. Make Your First Real Estate Investment

I’ve owned a number of homes over the years and I’ve invested in Vanguard’s REIT index for years, but in the last few years, I’ve expanded my real estate holdings significantly and without a whole lot of effort.

Crowdfunded real estate platforms have made it easier for people like you and me to access commercial real estate and other investments.

Those who qualify as accredited investors have the most options, but there are also options for everyone, regardless of income or net worth. Examples include eREITs from Fundrise, Diversyfund, and RealtyMogul, each of which you do not need to be an accredited investor to invest with them.

Accredited investors are individuals with a net worth of $1 Million (excluding primary home) or an income of $200,000 as an individual or $300,000 as a couple.

I’ve made the following investments as an accredited investor over the last several years:

- An investment in real estate funds with low minimums from Fundrise, Diversyfund, and RealtyMogul.

- An investment in 2 acres of farmland via AcreTrader (see my AcreTrader Review)

- A value-add multifamily investment via EquityMultiple (completed, 2.49% IRR)

- A value-add multifamily investment via Alpha Investing (completed, 50.5% IRR)

- A loan for a fix-and-flip property via PeerStreet (completed, 8.5% IRR)

- A loan for a fix-and-flip property via RealtyShares (completed, 7.0 IRR)

- An investment in a fix-and-flip property via Republic Real Estate (completed, 52.2% IRR)

- An investment in the DLP Lending Fund via CityVest (completed, 8.68% IRR)

- An investment in a student housing project and a ground-up townhome project via Crowdstreet

- An evergreen real estate fund via Origin Investments.

- A single family rental real estate fund via Republic Capital

*some of the above are referral links, and PoF may be compensated for certain actions you take with them.

I like these investments because people with more knowledge and time than me have done most of the due diligence. That doesn’t eliminate risk, obviously, and the investments are generally illiquid over the short term, but you are rewarded for those with increased returns.

For example, the forty-some completed investments with Crowdstreet have given investors an average internal rate of return of nearly 20% per year. I’ve found the same to be true with an IRR in the high teens for completed deals with RealtyMogul and EquityMultiple.

To see my ongoing returns and the final results my real estate investments that have gone full circle, see My Many Real Estate Investments.

#13 Shift to an Abundance Mindset with Charitable Giving

With your eyes on the prize of financial independence, it can be difficult to freely part with money you’ve worked hard to obtain. However, when you realize that your success is inevitable, you realize that you’re in a great position to help others who are less fortunate.

Since the pandemic started, more people than normal worried about how they would pay their utility bills and put food on the table. It has not a normal time, and many small businesses and individuals have suffered.

When you live with what some call a “scarcity mindset,” which I think is the default option and consistent with innate human nature, you see a limited amount of money and you want to keep as much of it as you can. It hurts to spend and it’s hard to give. You want the biggest pie slice, or better yet, the whole pie.

Transitioning to an “abundance mindset,” you realize that the pie can grow, your slice can grow right along with it, and you’ll have more to share. Starting a donor advised fund helped me make that transition. Sure, it stings a little when you make a large, lump sum contribution to your giving fund, but from that point on, you can give freely from it to dozens or hundreds of charities. It’s not your money anymore, so why not?

After almost six years of Physician on FIRE, we’ve donated over $500,000 of online income to charites and/or our donor advised fund(s).

In 2020, we made grants from our DAF of over $70,000 to a wide variety of charities, some chosen by you, and many in support of COVID relief. Since 2019, we’ve sponsored the salary of one of the employed surgeons at the One World Surgery facility in Honduras where we’ve volunteered as a family in the past.

I encourage you, as you get closer to being able to afford a comfortable retirement of your own, to consider donating generously to others, as well. I support you putting on your own oxygen mask first, but once you’re breathing easy, see what you can do to help those around you.

#14 Start Your First Side Hustle

I still think of side gigs as optional, but in a world where physician jobs and incomes are less stable than ever, some consider it mandatory to create additional income streams, even for doctors and other high-income professionals.

Yes, there are good reasons for doctors to have side hustles, and there’s no time like the present to start yours!

You can stick with what you know, picking up additional work as a locum tenens physician to start your first side gig.

Along those lines, you can use the knowledge and wisdom you’ve accumulated to earn money by completing paid medical surveys. A few options:

- All Global Circle (bonus of up to $50 for joining)

- Curizon (monthly drawing for $250 credit to new registrants referred by PoF)

- Incrowd

- ZoomRx

- GLG

Your side hustle doesn’t have to have anything to do with your primary job. If you want to tend bar, park cars, or work at an amusument park, have at it. A better option might be to start a small business in which you can eventually outsource most of the work, making it a semi-passive source of income.

That business can be a traditional retail or service company in a brick and mortar store or it could exist only online and over the airwaves. You can be a blogger, podcaster, or Youtuber and earn money for creating content people wish to consume.

If you’ve toyed with an idea for a business or project on the side, the best way to start is by starting. Make 2023 the year that your next chapter begins.

Best wishes on making and keeping all financial and other New Year’s Resolutions in 2023!

What Resolutions have you made for 2023? How have you fared with prior New Year’s Resolutions?

User-Generated Content Disclosure: Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

20 thoughts on “14 Financial New Year’s Resolutions for a Better 2023”

I started a side hustle in 2022. Created and launched my blog. I’m a blogger now. Haha…never thought I would be saying that a year ago. It’s been fun and exciting! Thank you, PoF!

I love it! Keep up the blogging, good sir.

Cheers!

-PoF

I like No. 1 and No. 2 the best. You have to know where you are and the delta.

Thanks for this post and Happy New Year. Since you spoke making your first real estate investment in Number 11, I thought I would ask you about this in terms of how it relates to your asset allocation strategy. Direct real estate investing is not for me, but I do own Vanguard Index REIT ETF and a similar REIT index Fund with Fidelity. I noticed that both Fidelity and Vanguard consider these equity allocations and not as a separate category as real estate. Do you consider your Vanguard REIT ETF as an equity or real estate allocation?

Really good article here. I could not agree more with what was stated. I try and implement these into my life with some regularity. One thing I have found incredibly useful is having a financial goals tab in my wife and I’s shared budgeting tool (we use Google Sheets). This gives us the opportunity to share our budget in real time. The kicker here, much to your point, is that we have a Net Worth tab, a shared Student Loans tab, and a Financial Goals tab (amongst others). This helps us tackle many of your recommendations simultaneously. It gives a boost of motivation to see your net worth increase as you tackle your debt. I encourage everyone to follow much of what you have recommended. I have implemented much of this in my life and it has made quite a difference. Cheers to the new year!

Stay motivated!

TheMotivatedMD.com

I will reach out to Chelsea Brennan, the ICE Binder’s creator, to get you an answer.

Best,

-PoF

Did number 8 last week, I should my new Hilton Amex card this week. They were offering a $100 statement credit and 75,000 points with a $1000 spend no fee card. Plus it’s Amex who doesn’t require me to unfreeze my credit report in order to apply for a new card since I’ve had one with them since 2012. The unfreezing my report is what is keeping me from working on the Chase Cards right now, it’s on my list to grab it at some point.

Thanks for the list!

Would it be cool to reveal how much you/your blog makes from each of the links that people click through? It sounds like you really believe in all of these products, so I am hoping you will be comfortable sharing the $ also!

Thanks and happy New Year!

Believe it or not, Forrester, the blog doesn’t make a penny from clicks through to other sites. Some of the links are affiliate links / referral links, as mentioned, but generally it takes more than a click to generate what our affiliate partners call a conversion.

The definition of a conversion and the resulting referral fees vary widely. Most prohibit making the numbers public, as it’s common for the companies to negotiate different rates with different publishers.

Best,

-PoF

Oh, I didn’t know that you couldn’t reveal the numbers. That is interesting in itself!

I run into the same thing with comped travel sometimes. As a lecturer on cruise ships, people want to know if I am getting paid, traveling for free, and if my spouse travels for free. It is an awkward question, because the companies negotiate differently with different institutions, so it could be any of those situations or something different! I have tried to dodge the question in the past, but I like your answer – it isn’t public.

As always, thanks!

Oh, that sounds fun! I’ve attended some of those talks — seems like a great retirement side gig.

Cheers!

-PoF

Do you have a contact for groups looking for speaker on cruise ships?

I have had a side business in Travel Medicine for 25 years, preparing people for overseas travel. I’ve semi retired now and would have interest in speaking on travel related heath topics.

Michael Lucca,MD

I don’t, but when I’ve researched it briefly in the past, it sounded like most cruise lines use agencies to book speakers, and they don’t pay much more than a free cruise. But that’s worth something, which is better than nothing!

Cheers!

-PoF

Whats your thoughts on the Tiller App for budgeting vs Personal Capitol and Mint?

You’re thinking about buying a rental property? Wow. Didn’t see that coming. Should be an interesting experience as much as you guys travel.

A helpful article would be one about how to complete the backdoor ROTH using Turbotax. Each year it seems like I struggle through answering the questions right before I finally get it right. My guess is that many readers use Turbotax and have the same frustration.

It always amazes me how people actually know their net worth. Everyone knows their salary but few people in the real world seem to know their net worth. Net worth is what counts. Salary is how you get there.

Expense tracking is the only way to one day figure out if you can retire.

Stay out of debt.

Make personal finance a hobby.

I have never had a written IPS but I do have one in my head.

I hope to start doing my own taxes since they will be easier now.

Thank you for the tips! Your strategies have helped in our work.

Excellent rundown of everything you need to do to get back control of your finances. Luckily with the help of your blog and everyone else in the FI community, I’ve done nearly every one of these steps!

The two I haven’t yet are the policy statement and legacy binder but both are on my mind. I will definitely be focusing on those for 2020. The other one I want to focus on is travel rewards and cash back bonuses.

For example, I just learned about the Amex Blue Cash Preferred. It has awesome cash back on groceries, gas, and streaming services. I calculated it would have resulted in a cash back of $1400 for 2019 so I’m definitely looking at it for 2020. That’s in addition to another personal Chase and a new Business Chase card for us. We have a large trip planned for 2021 and I think starting now will be very beneficial!

Plus I plan to make some larger home maintenance purchases in the coming year so getting those bonuses might be a plus there, or cash back.

Thanks and keep it up for 2020!

Great tips. I’m definitely going to read more finance book this year. And its about time that I work on the legacy binder. Thanks for the reminder!